# macd_histo_colors_arrows_strat

#https://usethinkscript.com/threads/accessing-items-in-macd-diff.17075/

#Accessing items in MACD.Diff

#Peppermshrimp 11/2

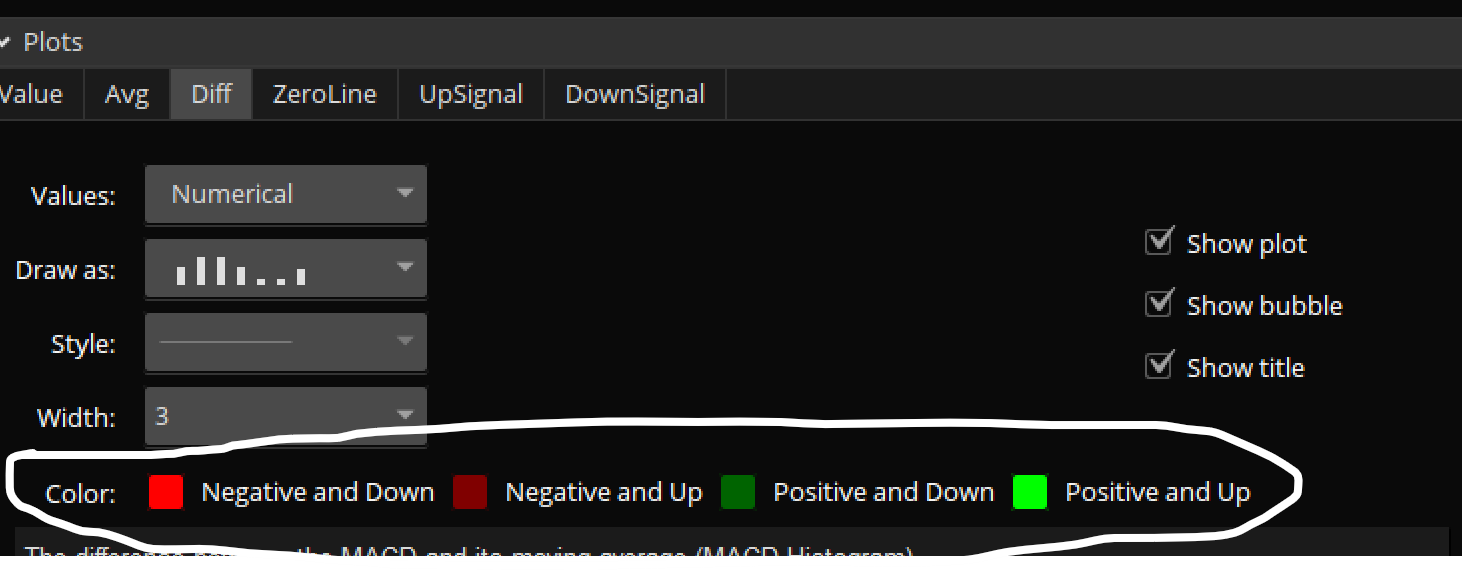

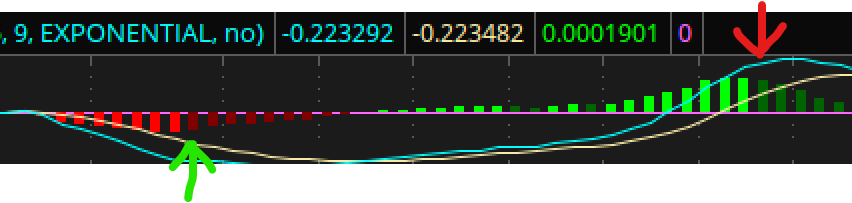

#Is there a way to reference 4 different ‘trends’ in MACD.Diff, other than just to change the colors? I am referring to ‘Negative and Down’, ‘Negative and Up’, ‘Positive and Down’, and ‘Positive and Up’. (see images below) I would like to set up a Strategy that puts an up arrow on the chart when these switch between ‘Negative and Down’ to ‘Negative and Up’, and puts a down arrow on the chart when they switch from ‘Positive and Down’ to ‘Positive and Up’. The only thinkscript I can find with respect to these 4 trends is when the color is being defined.

def na = double.nan;

def bn = barnumber();

def ref1 = if bn == 1 then close else ref1[1];

# macd

# TD Ameritrade IP Company, Inc. (c) 2007-2023

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input averageType = AverageType.EXPONENTIAL;

input showBreakoutSignals = no;

def Value = MovingAverage(averageType, close, fastLength) - MovingAverage(averageType, close, slowLength);

def Avg = MovingAverage(averageType, Value, MACDLength);

def Diff = Value - Avg;

# create # 's for diff colors , -2 to 2

# all color transistitions

#def Diff_color_num =

# if Diff > 0 and Diff > Diff[1] then 2

# else if Diff < 0 and Diff < Diff[1] then -2

# else if Diff > 0 and Diff < Diff[1] then -1

# else if Diff < 0 and Diff > Diff[1] then 1

# else 0;

# color changes, lowest and highest

def Diff_color_num =

if Diff > 0 and Diff < Diff[1] then -1

else if Diff < 0 and Diff > Diff[1] then 1

else 0;

# require x colors in a row to be considered a new color

input consecutive_bars = 2;

def qty = consecutive_bars;

def numsum = if Sum(Diff_color_num, qty) == (Diff_color_num * qty) then 1 else 0;

def new_color = if (numsum and getvalue(diff_color_num, qty) != diff_color_num) then 1 else 0;

#def new_color = if (numsum and getvalue(numsum, qty) and getvalue(diff_color_num, qty) != diff_color_num) then 1 else 0;

# create a trade signal , from the 1st of consequetive signals

def trade = if bn == 1 then 0

else if Diff_color_num == -1 and new_color then -1

else if Diff_color_num == 1 and new_color then 1

else trade[1];

def buy = (trade[0] == 1 and trade[1] == -1);

def sell = (trade[0] == -1 and trade[1] == 1);

input order_size = 1;

AddOrder(OrderType.BUY_TO_OPEN, buy, open[-1], order_size, Color.GREEN, Color.GREEN, name = "BUY");

AddOrder(OrderType.SELL_TO_CLOSE, sell, open[-1], order_size, Color.RED, Color.RED, name = "SELL");

# AddOrder ( type, condition, price, tradeSize, tickColor, arrowColor, name);

#------------------------------------------

input test1_bubbles = no;

AddChartBubble(test1_bubbles, low*0.996,

diff_color_num + "\n" +

new_color

, Color.YELLOW, no);

input test2_trade = no;

def y = 1;

plot z1 = if test2_trade then ref1 + (trade*y) else na;

input test3_signals = no;

plot up = if test3_signals and new_color and Diff_color_num > 0 then low*0.999 else na;

up.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

#up.SetDefaultColor(Color.green);

up.AssignValueColor(if Diff_color_num == 1 then color.green else if Diff_color_num == 2 then color.dark_green else color.black);

up.setlineweight(3);

up.hidebubble();

plot dwn = if test3_signals and new_color and Diff_color_num < 0 then high*1.001 else na;

dwn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

#dwn.SetDefaultColor(Color.red);

dwn.AssignValueColor(if Diff_color_num == -1 then color.red else if Diff_color_num == -2 then color.dark_red else color.black);

dwn.setlineweight(3);

dwn.hidebubble();

#plot zValue = value;

#plot zAvg = avg;

#plot zDiff = diff;

#plot ZeroLine = 0;

#plot UpSignal = if Diff crosses above ZeroLine then ZeroLine else Double.NaN;

#plot DownSignal = if Diff crosses below ZeroLine then ZeroLine else Double.NaN;

#UpSignal.SetHiding(!showBreakoutSignals);

#DownSignal.SetHiding(!showBreakoutSignals);

#Value.SetDefaultColor(GetColor(1));

#Avg.SetDefaultColor(GetColor(8));

#Diff.SetDefaultColor(GetColor(5));

#Diff.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

#Diff.SetLineWeight(3);

#Diff.DefineColor("Positive and Up", Color.GREEN);

#Diff.DefineColor("Positive and Down", Color.DARK_GREEN);

#Diff.DefineColor("Negative and Down", Color.RED);

#Diff.DefineColor("Negative and Up", Color.DARK_RED);

#Diff.AssignValueColor(if Diff >= 0 then if Diff > Diff[1] then Diff.Color("Positive and Up") else Diff.Color("Positive and Down") else if Diff < Diff[1] then Diff.Color("Negative and Down") else Diff.Color("Negative and Up"));

#ZeroLine.SetDefaultColor(GetColor(0));

#UpSignal.SetDefaultColor(Color.UPTICK);

#UpSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

#DownSignal.SetDefaultColor(Color.DOWNTICK);

#DownSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

#