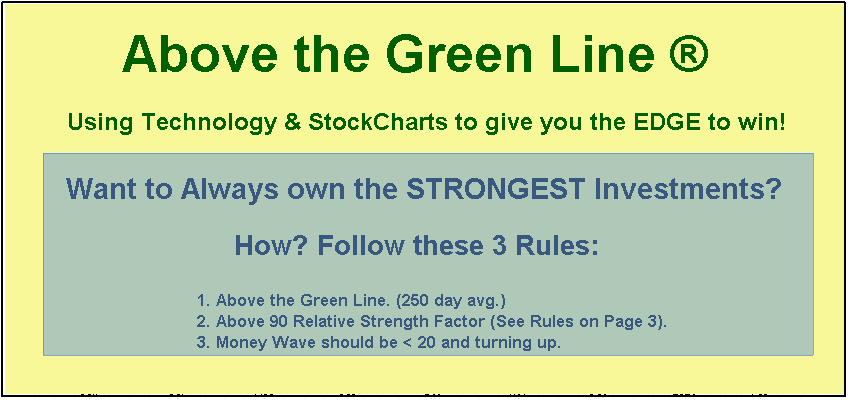

The Strategy is based on rotating into Investments that generally have more Buyers than Sellers (Above the Green Line), which is Above the 250-day moving average), and the highest Relative Strength (> 90 Relative Strength).

Above the Green Line system shared by Joanne Klein over at StockCharts.com was interesting, so I took some of the concepts and ported them over to ThinkorSwim.

As far as the Relative Strength line, you should be able to find it here. Money Wave is another name for StochasticSlow, which you can add to ThinkorSwim under the Studies section. Set your k period to 5 and d period to 1.

To scan for stocks trading above the green line: go to your TOS scan and add the following condition:

Set the aggregation period to D (daily).

Here are some examples

As you can see, the Money Wave line usually signals very early, sometimes too early, to even hold through the drawdown.

The system is there, apply however you want to your own trading. I see how this can be useful for swing trading (that's what I'm currently doing).

Above the Green Line system shared by Joanne Klein over at StockCharts.com was interesting, so I took some of the concepts and ported them over to ThinkorSwim.

How to use Above the Green Line chart

These are the 3 trading rules outlined by Joanne Klein in Above the Green Line system.- Stocks trading above the 250 days moving average

- Above 90 Relative Strength Factor

- Money Wave (Slow Stochastic) should be < 20 and turning up

Above the Green line indicator

Code:

# Above the Green line script

# Display 250 day moving average

# BenTen at UseThinkScript.com

input aggregationPeriod = AggregationPeriod.DAY;

def close = close(period = aggregationPeriod);

input length = 250;

input displace = 0;

plot greenline = Average(close[-displace], length);

greenline.AssignValueColor(color.light_green);As far as the Relative Strength line, you should be able to find it here. Money Wave is another name for StochasticSlow, which you can add to ThinkorSwim under the Studies section. Set your k period to 5 and d period to 1.

To scan for stocks trading above the green line: go to your TOS scan and add the following condition:

Code:

close is greater than SimpleMovingAvg("length" = 250)."SMA"Set the aggregation period to D (daily).

Improving the system

After doing some backtesting, I decided to switch the StochasticSlow indicator for our Buy the Dip indicator. The results improved tremendously.Here are some examples

As you can see, the Money Wave line usually signals very early, sometimes too early, to even hold through the drawdown.

The system is there, apply however you want to your own trading. I see how this can be useful for swing trading (that's what I'm currently doing).

Last edited by a moderator: