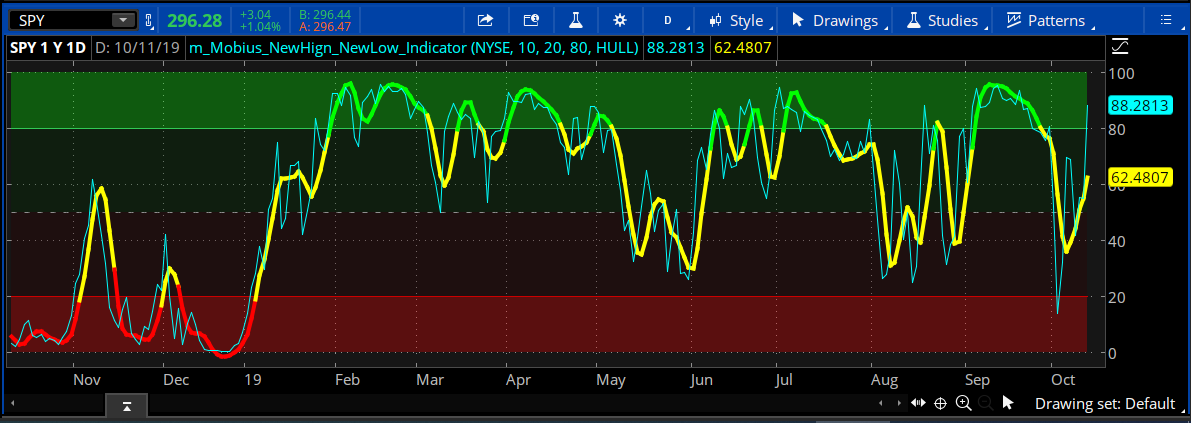

how do i use this indicator and put in my tos? i am a new tos userTry this chart out...

Code:# This indicator uses the Index New highs and Index New lows to help gauge overall Market sentiment. It's a leading indicator. # Index New High - New Low Indicator # Mobius 2015 declare lower; input Symb = {default "NYSE", "NASDQ", "AMEX", "ARCA", "ETF"}; input length = 10; input OverSold = 20; input OverBought = 80; Input AvgType = AverageType.Hull; def agg = AggregationPeriod.Day; def NYSEH = close(Symbol = "$NYHGH", period = agg); def NYSEL = close(Symbol = "$NYLOW", period = agg); def NASDQH = close(Symbol = "$NAHGH", period = agg); def NASDQL = close(Symbol = "$NALOW", period = agg); def AMEXH = close(Symbol = "$AMHGH", period = agg); def AMEXL = close(Symbol = "$AMLOW", period = agg); def ARCAH = close(Symbol = "$ARHGH", period = agg); def ARCAL = close(Symbol = "$ARLOW", period = agg); def ETFH = close(Symbol = "$ETFHGH", period = agg); def ETFL = close(Symbol = "$ETFLOW", period = agg); def P; Switch (Symb){ case "NYSE": P = NYSEH / (NYSEH + NYSEL) * 100; case "NASDQ": P = NASDQH / (NASDQH + NASDQL) * 100; case "AMEX": P = AMEXH / (AMEXH + AMEXL) * 100; case "ARCA": P = ARCAH / (ARCAH + ARCAL) * 100; case "ETF": P = ETFH / (ETFH + ETFL) * 100; } def price = if isNaN(P) then price[1] else P; plot data = if isNaN(close) then double.nan else price; data.EnableApproximation(); data.SetDefaultColor(Color.Cyan); plot avg = MovingAverage(AvgType, data, length); avg.EnableApproximation(); avg.AssignValueColor(if between(avg, OverSold, OverBought) then Color.yellow else if avg >= OverBought then Color.Green else Color.Red); avg.SetLineWeight(2); plot OB = if isNaN(close) then double.nan else OverBought; OB.SetDefaultColor(Color.Red); plot OS = if isNaN(close) then double.nan else OverSold; OS.SetDefaultColor(Color.Green); plot neutral = if isNaN(close) then double.nan else 50; neutral.SetdefaultColor(Color.Dark_Gray); addCloud(0, OS, CreateColor(250,0,0), CreateColor(250,0,0)); addCloud(OS, neutral, createColor(50,0,0), createColor(50,0,0)); addCloud(neutral, OB, createColor(0,50,0), createColor(0,50,0)); addCloud(OB, 100, CreateColor(0,250,0), createColor(0,250,0)); # End High - Low Index

Those are built in columns already in both the scanner and the watchlist.

i can use this code for tradingview too

Last edited by a moderator: