This scanner allows you to scan for potential stocks with momentum gathering to the downside and upside in ThinkorSwim. I also turned these scanners into an indicator that plot up and down arrows on your chart.

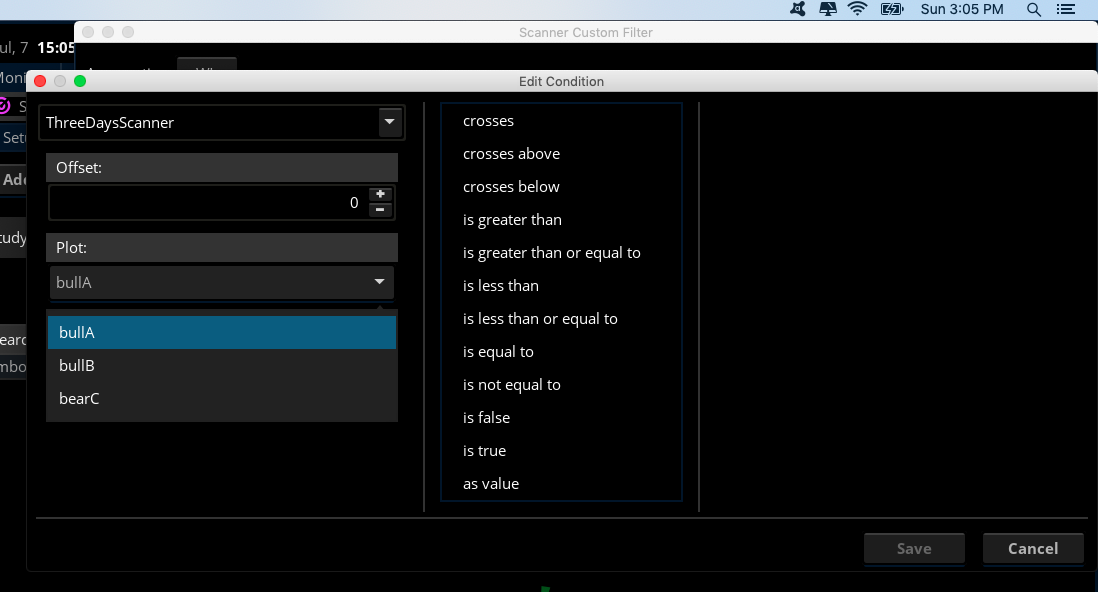

Import the code below as a Study. Switch over to the StockHacker tab and look up its name. Scan for bullA, bullB, and/or bearC.

- Bullish signal = 3 days up in price and volume

- Bullish reversal = 3 days down in price, 3 days down in volume

- Bearish reversal = 3 days down in price, 3 days up in volume

Import the code below as a Study. Switch over to the StockHacker tab and look up its name. Scan for bullA, bullB, and/or bearC.

thinkScript Code

Code:

# Original code found at https://github.com/hwrdprkns/ThinkOrSwim/blob/master/StockHackerSCAN.ts

# Modified by BenTen to plot arrows on chart

# A. 3 DAYS UP, PRICE AND VOLUME (BULLISH)

def bullishA = (CLOSE > CLOSE[1] AND

CLOSE [1] > CLOSE [2] AND VOLUMEAVG(LENGTH = 20) > VOLUMEAVG(LENGTH = 20)[1] AND VOLUMEAVG(LENGTH = 20)[1] > VOLUMEAVG(LENGTH = 20)[2]);

plot bullA = bullishA;

bullA.AssignValueColor(Color.WHITE);

bullA.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

# B. 3 DAYS DOWN IN PRICE, 3 DAYS DOWN IN VOLUME (BULLISH REVERSAL)

def bullishB = (CLOSE < CLOSE[1] AND

CLOSE [1] < CLOSE [2] AND

VOLUMEAVG(LENGTH = 20) > VOLUMEAVG(LENGTH = 20)[1] AND

VOLUMEAVG(LENGTH = 20)[1] > VOLUMEAVG(LENGTH = 20)[2]);

plot bullB = bullishB;

bullB.AssignValueColor(Color.CYAN);

bullB.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

# C. 3 DAYS DOWN IN PRICE, 3 DAYS UP IN VOLUME (BEARISH REVERSAL)

def bearishC = (CLOSE < CLOSE[1] AND

CLOSE [1] < CLOSE [2] AND

VOLUMEAVG(LENGTH = 20) > VOLUMEAVG(LENGTH = 20)[1] AND

VOLUMEAVG(LENGTH = 20)[1] > VOLUMEAVG(LENGTH = 20)[2]);

plot bearC = bearishC;

bearC.AssignValueColor(Color.YELLOW);

bearC.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);