Razor_Morozumi

New member

Hi,

With Administrative MerryDay's kind suggestion, I try to re-post my question with images.

Hope this time I may get some advise or answer from community.

Thank you, MerryDay.

- Goal:

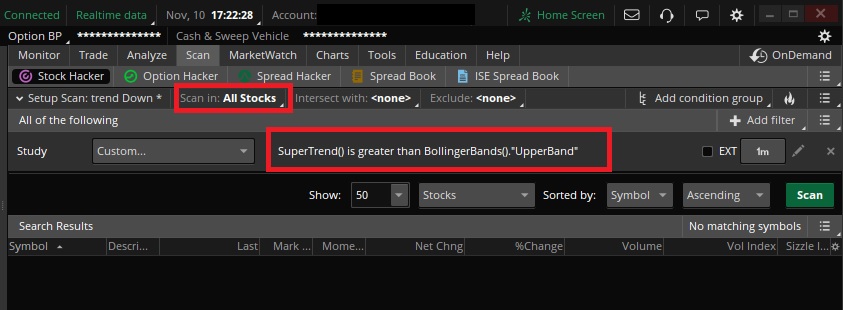

In order for scanning possible entry point (for down trend), I would like to set SCAN with conditions between SuperTrend() and BollingerBands() parameters to see if SuperTrend() exceeds BollingerBands() UpperBand at the time scanned. (see below chart 1)

- What I noticed

I created below SCAN setting, but it seems not working at all (at least TSLA should be listed as part of SCAN result as you see above chart) met the condition (means SuperTrend() exceeded BollingerBands() UpperBand at the end of the day.

I also tried to use "cross above" or "is greater than or equal to" instead of using "is greater than", but result was same as not triggered by met SCAN condition.

SCAN parameter setting (see below chart 2):

--> SuperTrend() is greater than BollingerBands(). "UpperBand"

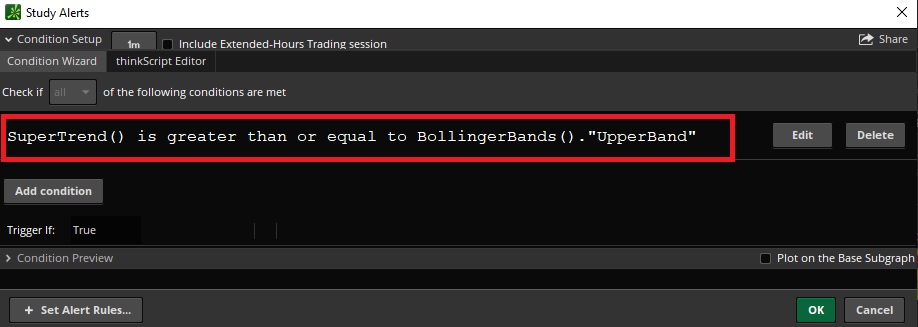

But interesting enough, when I set Alert under TSLA chart with the same condition as Alert condition, it worked perfectly and properly triggered for action based on met condition. As for Alert setting, it is slightly different as what I set as SCAN.

Alert parameter setting (see below chart 3):

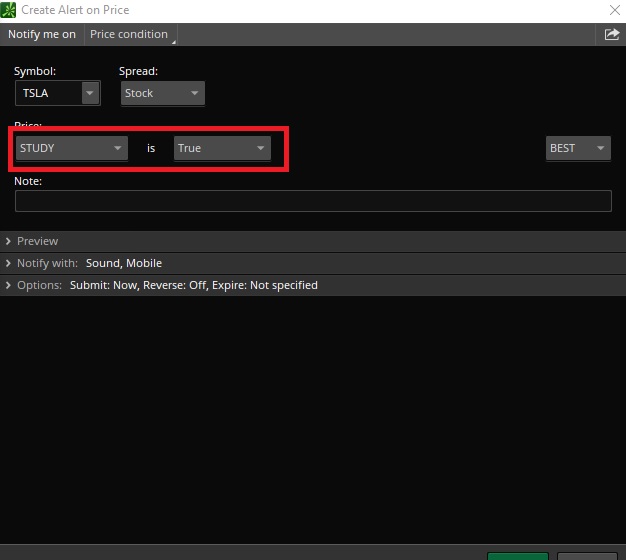

Alert parameter setting with Study is True (see below chart 4):

--> Study is True

(under "Creating Alert on Price", select Study under Price: pull down menu, and specify the exact same condition of SuperTrend() is greater than BollingerBands(). "UpperBand" under "Condition Wizard". Once set conditions, select "True")

QUESTION:

How I can make SCAN setting work properly for catching/scanning the condition as SuperTrend() exceeds BollingerBands() UpperBand under SCAN?

The differences between SCAN and Alert setting is TRUE/FOLSE "Study is TRUE" as trigger under Alert instead of directly compared value on both SuperTrend() and BollingerBands() UpperBand under SCAN setting.

Please help me how I can properly create SCAN to make it work as above.

Thank you very much for your input.

With Administrative MerryDay's kind suggestion, I try to re-post my question with images.

Hope this time I may get some advise or answer from community.

Thank you, MerryDay.

- Goal:

In order for scanning possible entry point (for down trend), I would like to set SCAN with conditions between SuperTrend() and BollingerBands() parameters to see if SuperTrend() exceeds BollingerBands() UpperBand at the time scanned. (see below chart 1)

- What I noticed

I created below SCAN setting, but it seems not working at all (at least TSLA should be listed as part of SCAN result as you see above chart) met the condition (means SuperTrend() exceeded BollingerBands() UpperBand at the end of the day.

I also tried to use "cross above" or "is greater than or equal to" instead of using "is greater than", but result was same as not triggered by met SCAN condition.

SCAN parameter setting (see below chart 2):

--> SuperTrend() is greater than BollingerBands(). "UpperBand"

But interesting enough, when I set Alert under TSLA chart with the same condition as Alert condition, it worked perfectly and properly triggered for action based on met condition. As for Alert setting, it is slightly different as what I set as SCAN.

Alert parameter setting (see below chart 3):

Alert parameter setting with Study is True (see below chart 4):

--> Study is True

(under "Creating Alert on Price", select Study under Price: pull down menu, and specify the exact same condition of SuperTrend() is greater than BollingerBands(). "UpperBand" under "Condition Wizard". Once set conditions, select "True")

QUESTION:

How I can make SCAN setting work properly for catching/scanning the condition as SuperTrend() exceeds BollingerBands() UpperBand under SCAN?

The differences between SCAN and Alert setting is TRUE/FOLSE "Study is TRUE" as trigger under Alert instead of directly compared value on both SuperTrend() and BollingerBands() UpperBand under SCAN setting.

Please help me how I can properly create SCAN to make it work as above.

Thank you very much for your input.