GetRichOrDieTrying

Member

Hi everybody,

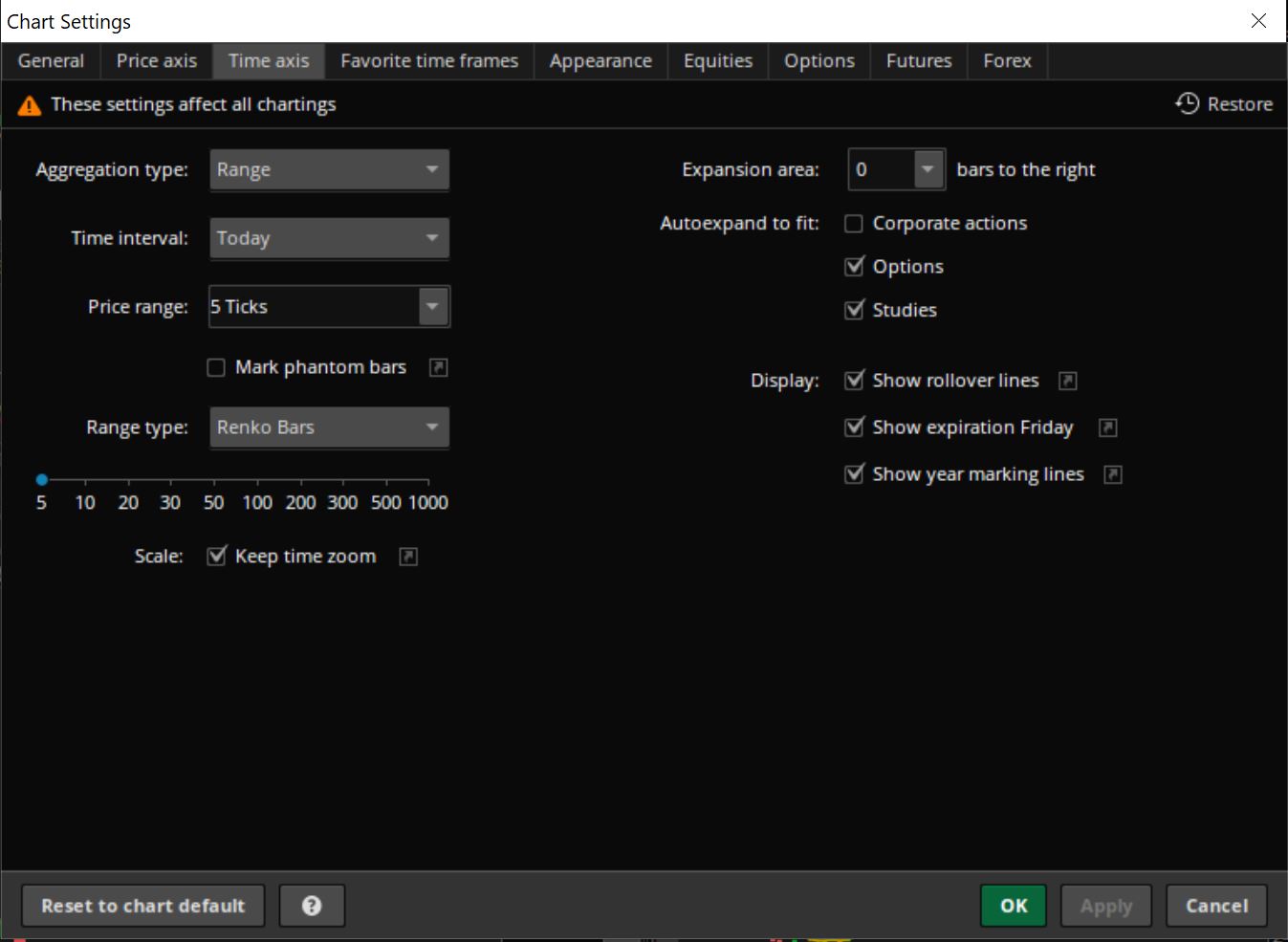

I'm always asking questions here and getting great answers. Today, I thought I'd give something back to the community. I've recently started using Renko Bricks as opposed to Candlesticks for trading. If you're not familiar with Renko bricks, they are a trend following aggregation method for monitoring price action, that helps eliminate the "noise" from traditional candlesticks. Unlike candlestick charts, Renko charts are time-independent, meaning that bricks (as opposed to candles) are only printed when price moves above or below your set tick value. The time stamps that you see in the screenshot below represent the times that new Bricks have formed. Since bricks are only printed when price moves, you could see huge gaps of time missing on the X-Axis. This is normal and it is incredibly helpful, because it gives you a sense of how much momentum there truly is in an underlying asset. If you see that an asset hasn't printed a Renko brick in awhile, it's safe to say that volume, momentum and liquidity is low. In Thinkorswim, your Tick Value represents the dollar value of each brick. As an example, a 10 Tick setting would print a new brick everytime price moves above or below $.10.

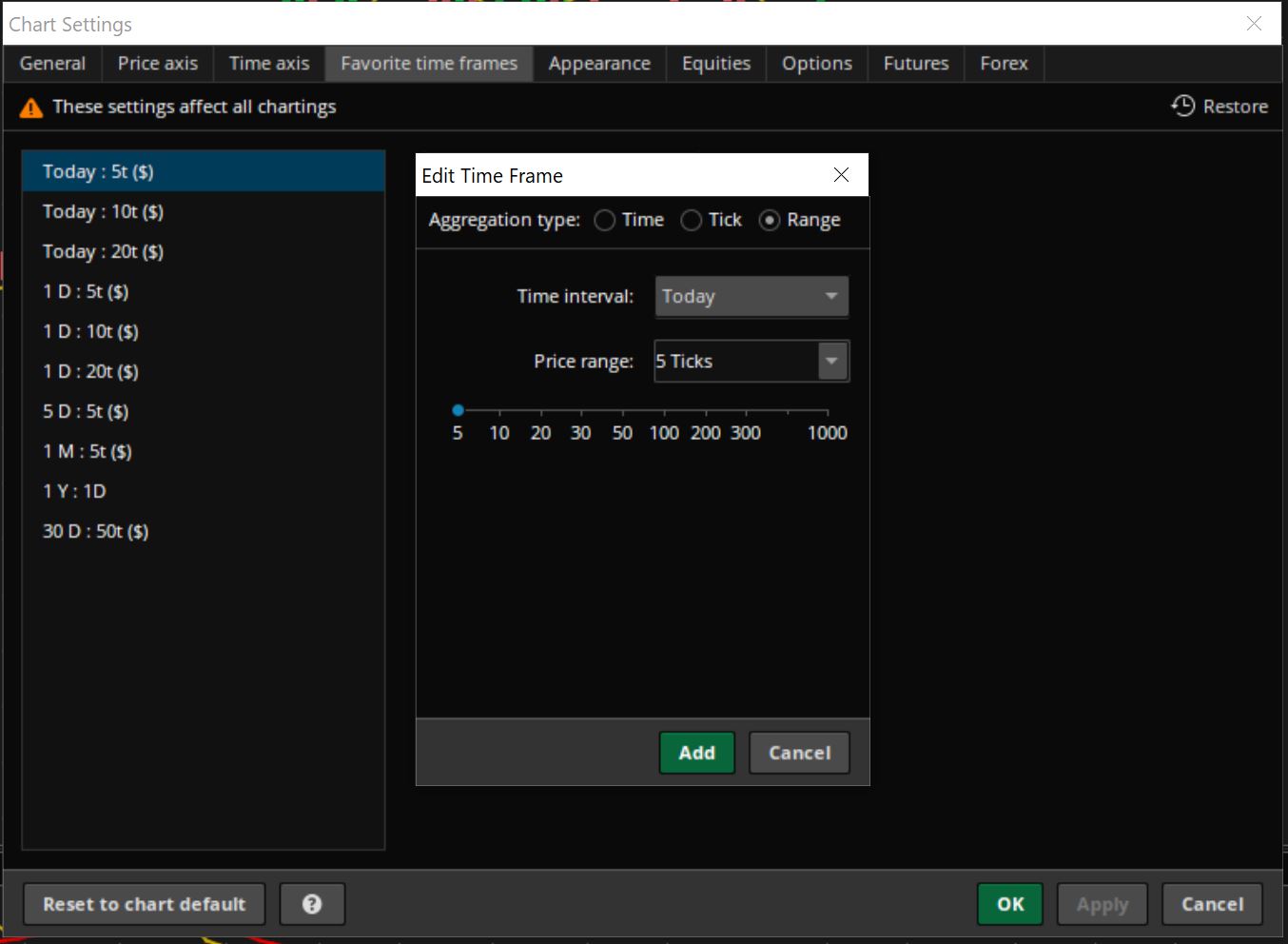

One of the things I've recently begun testing is multi-frame analysis with Renko Charts. Technically this is impossible, because as I mentioned earlier, Renko charts are time-independent and only print when price action changes. Multi-time frame analysis is incredibly helpful for providing confirmation based on short, mid-term and long-term time frames. If price action has a good setup on a mid or longer-term timeframe, it's likely a safe bet that you could enter on the smaller time-frame and capture a larger profit. As a workaround for traditional MTFA with Renko, I've tested multiple tick ranges.

In the screenshot below I have a 5 Tick ($.05) and a 10 Tick ($.10) chart. Here's how the entry and exit works:

Enter on the 5 Tick chart when:

Also, in case you're wondering, Renko Charts are effective for intraday trading as well as swing trading. You'll have to play around with the Tick values to suit your trading style. You do not have to use 5 and 10 Tick values, especially if you're a swing trader.

I'm always asking questions here and getting great answers. Today, I thought I'd give something back to the community. I've recently started using Renko Bricks as opposed to Candlesticks for trading. If you're not familiar with Renko bricks, they are a trend following aggregation method for monitoring price action, that helps eliminate the "noise" from traditional candlesticks. Unlike candlestick charts, Renko charts are time-independent, meaning that bricks (as opposed to candles) are only printed when price moves above or below your set tick value. The time stamps that you see in the screenshot below represent the times that new Bricks have formed. Since bricks are only printed when price moves, you could see huge gaps of time missing on the X-Axis. This is normal and it is incredibly helpful, because it gives you a sense of how much momentum there truly is in an underlying asset. If you see that an asset hasn't printed a Renko brick in awhile, it's safe to say that volume, momentum and liquidity is low. In Thinkorswim, your Tick Value represents the dollar value of each brick. As an example, a 10 Tick setting would print a new brick everytime price moves above or below $.10.

One of the things I've recently begun testing is multi-frame analysis with Renko Charts. Technically this is impossible, because as I mentioned earlier, Renko charts are time-independent and only print when price action changes. Multi-time frame analysis is incredibly helpful for providing confirmation based on short, mid-term and long-term time frames. If price action has a good setup on a mid or longer-term timeframe, it's likely a safe bet that you could enter on the smaller time-frame and capture a larger profit. As a workaround for traditional MTFA with Renko, I've tested multiple tick ranges.

In the screenshot below I have a 5 Tick ($.05) and a 10 Tick ($.10) chart. Here's how the entry and exit works:

Enter on the 5 Tick chart when:

- The 10 Tick chart is in an uptrend (Higher Swing Lows)

- A10 Tick brick closes Green above the 10 EMA line

- The 5 Tick chart is also in an uptrend (Higher Swing Lows)

- The 5 Tick MACD is in an uptrend

- A Red brick closes below the 10 EMA on the 10 Tick chart

Also, in case you're wondering, Renko Charts are effective for intraday trading as well as swing trading. You'll have to play around with the Tick values to suit your trading style. You do not have to use 5 and 10 Tick values, especially if you're a swing trader.