ApeX Predator

Well-known member

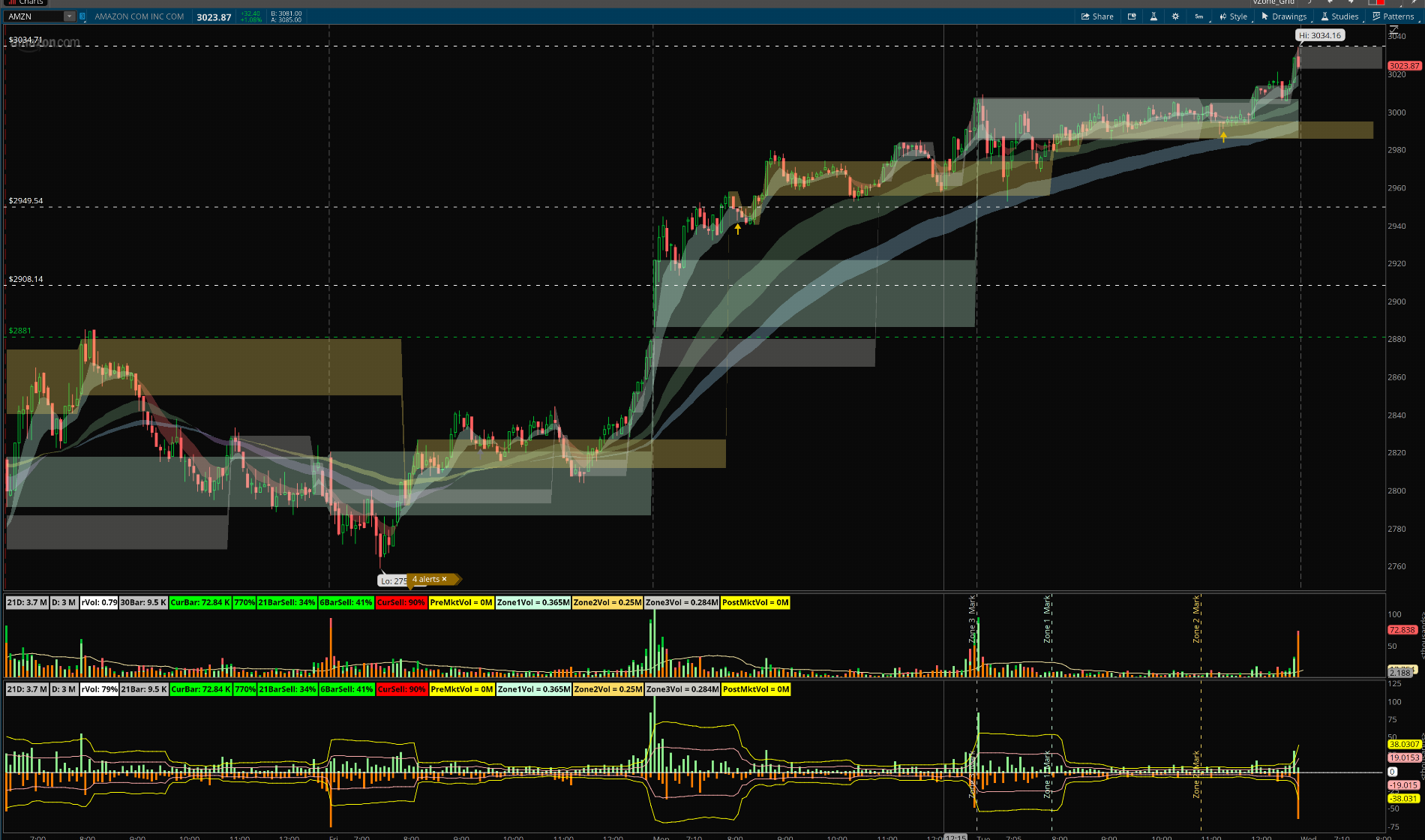

Yet another Support/Resistance Indicator for DayTrading, but with a twist, We use high/low of High Volume Bar, in three different Zones of the Day.

With out further delay, Uploading the code here, will come back and edit this line with more appropriate description.

huge thanks to @cos251 for helping me with Coding this, Reviewing and Testing it.

Link to Video: https://www.screencast.com/users/Ma...10/media/f1702bb2-2090-463a-8ad2-59639c1166cd

** For those of you curious what it looks like here is the image. Also the extream bottom Volume Indicator is still work in progress, I am using Standard deviation, instead of AVG volumes, any suggestion would be welcome. Note: the Standard deviation Volumes Study is not posted yet.

vZone Extend On/Off

Shared Study Link: https://tos.mx/ke0f6ny Click here for --> Easiest way to load shared links

vZone_Labels

Shared Study Link: https://tos.mx/kribwZB Click here for --> Easiest way to load shared links

With out further delay, Uploading the code here, will come back and edit this line with more appropriate description.

huge thanks to @cos251 for helping me with Coding this, Reviewing and Testing it.

Link to Video: https://www.screencast.com/users/Ma...10/media/f1702bb2-2090-463a-8ad2-59639c1166cd

** For those of you curious what it looks like here is the image. Also the extream bottom Volume Indicator is still work in progress, I am using Standard deviation, instead of AVG volumes, any suggestion would be welcome. Note: the Standard deviation Volumes Study is not posted yet.

vZone Extend On/Off

Shared Study Link: https://tos.mx/ke0f6ny Click here for --> Easiest way to load shared links

Ruby:

## vZoneSTUDY.ts

## This Indicator is based on the Following concept and, I suggest watch the video before you start to use this.

## Created on 07/13/21

## Created by: SuryaKiranC #

##

## https://www.screencast.com/users/MarketGauge/folders/DATE1010/media/f1702bb2-2090-463a-8ad2-59639c1166cd

## This is to Plot Support/Resistance based on High Volume Candle in three different time zones for the day.

##

## Removing the header Credit credits and description is not permitted, any modification needs to be shared.

## A big thanks to @COS251 for helping me with Coding this, Reviewing and Testing it.

## V 1.3 : Switched to highest Volume per Zone, so there are not only a sigle volume box per zone.

## V 1.2 : No changes to the logic But just hints and header updates, also added a tiny URL for the video.

## V 1.1 : Just added the ability to disable the vZones, automatically, extending from previous in to current session.

## Note : It is available as an option, should somebody prefer the extension. Set "Extend" to your needs accordingly.

## V 1.0 : Split Day in to three Zones and Find the highest Volume Candle for each zone and plot Support/Resistance.

## : Zone 1 : 09:30 - 11:00

## : Zone 2 : 11:00 - 14:00

## : Zone 3 : 14:00 - 16:00

## : vZones are Plotted on 15m and lower charts.

## : Plots EMA Cloud to assist with identifying reversals, Keeping EMA Clouds for all Timeframes

#hint: <b>vZoneStudy for Upper Chart.</b> \n <li> Suggestion, See the following Video</li> https://tinyurl.com/yzaxrf7e <li>Volume Based Support/Resistance for Intraday.</li>

#hint showEMACloud: <b>Helps find Reversal </b> <li>Select "No" if it is too loud on your charts.</li>

#hint audibleAlerts: <b>TOS Sounds for Condition </b> <li>Select "No" if it is too loud for you.</li>

#hint Extend: <b>Extend vZone Clouds from past session</b> <li>Select "No" if it is too loud for you.</li>

declare once_per_bar;

def Future = if GetSymbolPart(1) == "/YM:XCBT" or # Reserved for any further work, not used at the moment other than display the label.

GetSymbolPart(1) == "/ES:XCME" or

GetSymbolPart(1) == "/NQ:XCME" or

GetSymbolPart(1) == "/RTY:XCME" or

GetSymbolPart(1) == "/EMD:XCME" or

GetSymbolPart(1) == "/NKD:XCME" or

GetSymbolPart(1) == “/DX:XICE" or

GetSymbolPart(1) == "/6E:XCME" or

GetSymbolPart(1) == "/6A:XCME" or

GetSymbolPart(1) == "/ZB:XCBT" or

GetSymbolPart(1) == "/ZN:XCBT" or

GetSymbolPart(1) == "/CL:XNYM" or

GetSymbolPart(1) == "/NG:XNYM" or

GetSymbolPart(1) == "/GC:XCEC" or

GetSymbolPart(1) == "/SI:XCEC" or

GetSymbolPart(1) == "/HG:XCEC” or

GetSymbolPart(1) == "/6B:XCME" or

GetSymbolPart(1) == "/ZC:XCBT" or

GetSymbolPart(1) == "/ZS:XCBT" or

GetSymbolPart(1) == "/CC:XICE" or

GetSymbolPart(1) == "/KC:XICE" or

GetSymbolPart(1) == ”/CT:XICE" or

GetSymbolPart(1) == "/ZW:XCBT" or

GetSymbolPart(1) == "/SB:XICE" or

GetSymbolPart(1) == "/LE:XCME" or

GetSymbolPart(1) == "/HO:XNYM" or

GetSymbolPart(1) == "/HE:XCME" or

GetSymbolPart(1) == "/OJ:XICE" or

GetSymbolPart(1) == "/VX:XCBF" then yes else no;

AddLabel(if Future then yes else no, "Future", Color.YELLOW);

input showEMACloud = No;

input audibleAlerts = Yes;

input Extend = {default "No", "Yes"};

def Today = GetYYYYMMDD();

def StartTime = 0930;

def Update1 = 1100;

def Update2 = 1400;

def EndTime = 1600;

def Zone1 = SecondsFromTime(StartTime) >= 0 and SecondsTillTime(Update1) >= 0;

def Zone2 = SecondsFromTime(Update1) >= 0 and SecondsTillTime(Update2) >= 0;

def Zone3 = SecondsFromTime(Update2) >= 0 and SecondsTillTime(EndTime) >= 0;

DefineGlobalColor("Zone1", CreateColor(204, 255, 225));

DefineGlobalColor("Zone2", CreateColor(252, 220, 101));

DefineGlobalColor("Zone3", CreateColor(204, 204, 198));

DefineGlobalColor("EMA1+", CreateColor(201, 255, 234));

DefineGlobalColor("EMA1-", CreateColor(255, 105, 105));

DefineGlobalColor("EMA2+", CreateColor(125, 176, 130));

DefineGlobalColor("EMA2-", CreateColor(194, 152, 227));

DefineGlobalColor("EMA3+", CreateColor(161, 217, 247));

DefineGlobalColor("EMA3-", CreateColor(255, 255, 112));

def ema1low = 5;

def ema1high = 13;

def ema2low = 34;

def ema2high = 51;

def ema3low = 72;

def ema3high = 89;

def ema5 = if showEMACloud then ExpAverage(close, ema1low) else Double.NaN;

def ema13 = if showEMACloud then ExpAverage(close, ema1high) else Double.NaN;

def ema34 = if showEMACloud then ExpAverage(close, ema2low) else Double.NaN;

def ema51 = if showEMACloud then ExpAverage(close, ema2high) else Double.NaN;

def ema72 = if showEMACloud then ExpAverage(close, ema3low) else Double.NaN;

def ema89 = if showEMACloud then ExpAverage(close, ema3high) else Double.NaN;

AddCloud( ema5, ema13, GlobalColor("EMA1+"), GlobalColor("EMA1-"));

AddCloud(ema34, ema51, GlobalColor("EMA2+"), GlobalColor("EMA2-"));

AddCloud(ema72, ema89, GlobalColor("EMA3+"), GlobalColor("EMA3-"));

def CrossAbove = if showEMACloud and ema5 > ema89 and ema5[1] <= ema89[1] then 1 else 0;

def CrossBelow = if showEMACloud and ema5 < ema13 and ema5[1] >= ema13[1] then 1 else 0;

Alert(showEMACloud and audibleAlerts and CrossAbove, "Buy", Alert.BAR, Sound.Ding);

Alert(showEMACloud and audibleAlerts and CrossBelow, "Sell", Alert.BAR, Sound.Ring);

################################################################

########## Booleans Set for Plot Use #########

################################################################

def afterStart;

def beforeEnd;

def openPrice;

if GetAggregationPeriod() <= AggregationPeriod.FIFTEEN_MIN {

afterStart = GetTime() > RegularTradingStart(GetYYYYMMDD());

beforeEnd = GetTime() < RegularTradingEnd(GetYYYYMMDD());

openPrice = DailyOpen();

} else {

afterStart = Double.NaN;

beforeEnd = Double.NaN;

openPrice = Double.NaN;

}

script Zone {

def H ;

def L ;

input CountIn = 0930;

input CountOut = 1100;

def TF = SecondsFromTime(CountIn) >= 0 and SecondsTillTime(CountOut) >= 0;

if TF and !TF[1] and highest(volume) {

H = high;

L = low;

} else {

H = H[1];

L = L[1];

}

plot VZH = H;

plot VZL = L;

VZH.Hide();

VZL.Hide();

}

def Z1H;

def Z1L;

def Z2H;

def Z2L;

def Z3H;

def Z3L;

switch (Extend){

Case "Yes":

Z1H = Zone(CountIn = StartTime, CountOut = Update1).VZH;

Z2H = Zone(CountIn = Update1, CountOut = Update2).VZH;

Z3H = Zone(CountIn = Update2, CountOut = EndTime).VZH;

Z1L = Zone(CountIn = StartTime, CountOut = Update1).VZL;

Z2L = Zone(CountIn = Update1, CountOut = Update2).VZL;

Z3L = Zone(CountIn = Update2, CountOut = EndTime).VZL;

Case "No":

Z1H = if today != today[1] then Double.NaN else Zone(CountIn = StartTime, CountOut = Update1).VZH;

Z2H = if today and !Zone2 then Double.NaN else Zone(CountIn = Update1, CountOut = Update2).VZH;

Z3H = if today and !Zone3 then Double.NaN else Zone(CountIn = Update2, CountOut = EndTime).VZH;

Z1L = if today != today[1] then Double.NaN else Zone(CountIn = StartTime, CountOut = Update1).VZL;

Z2L = if today and !Zone2 then Double.NaN else Zone(CountIn = Update1, CountOut = Update2).VZL;

Z3L = if today and !Zone3 then Double.NaN else Zone(CountIn = Update2, CountOut = EndTime).VZL;

}

def BelowVZ = if Zone1 and close < Z1L or Zone2 and close < Z2L or Zone3 and close < Z3L then 1 else 0;

def AboveVZ = if Zone1 and close > Z1H or Zone2 and close > Z2H or Zone3 and close > Z3H then 1 else 0;

AddLabel(if (GetAggregationPeriod() > AggregationPeriod.FIFTEEN_MIN) then yes else no, "vBox Zones on 5/10/15M Charts Only ", Color.RED);

AddCloud(if afterStart and beforeEnd then Z1H else Double.NaN, if afterStart and beforeEnd then Z1L else Double.NaN, GlobalColor("Zone1"), GlobalColor("Zone1"));

AddCloud(if Update1 and beforeEnd then Z2H else Double.NaN, if Update1 and beforeEnd then Z2L else Double.NaN, GlobalColor("Zone2"), GlobalColor("Zone2"));

AddCloud(if Update2 and beforeEnd then Z3H else Double.NaN, if Update2 and beforeEnd then Z3L else Double.NaN, GlobalColor("Zone3"), GlobalColor("Zone3"));

Alert(audibleAlerts and AboveVZ, "Above High VolumeBar Caution Long", Alert.BAR, Sound.Ding);

Alert(audibleAlerts and BelowVZ, "Below High VolumeBar Look for Reversal", Alert.BAR, Sound.Ring);vZone_Labels

Shared Study Link: https://tos.mx/kribwZB Click here for --> Easiest way to load shared links

Ruby:

##vZone_Labels

##This is Companian Indicator for vZone, which is based on the Following concept and, I suggest watch the video before you start to use this.

##

## https://www.screencast.com/users/MarketGauge/folders/DATE1010/media/f1702bb2-2090-463a-8ad2-59639c1166cd

## This is to Plot Support/Resistance based on High Volume Candle in three different time zones for the day.

##

## Removing the header Credit credits and description is not permitted, any modification needs to be shared.

## A big thanks to @COS251 for helping me with Coding this, Reviewing and Testing it.

##

# Version 1.0.2

#

# Created on 01/08/21

# Created by: SuryaKiranC ## Included rVolume label and Changed length as input.

#hint: <b>vZone_Labels Lower Study</b> \n Setup inputs as per your preferences \n <li>Replacement for Standard TOS Volume Bars, Disable VolumeSubgraph.</li>

#hint Length: <b>No of Bars for Average Calculation.</b> <li>Adjust as per your preference.</li>

#hint Barlength: <b>Near term No of Bars for Average Calculations.</b> <li>Adjust as per your preference.</li>

#hint ShowVolAvg: <b>Plot Vol Average across Volume Bars.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowPreMktVol: <b>Enable/Disable PreMkt Volume.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowZoneVol: <b>Enable/Disable Per Zone Volume.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowPostMktVol: <b>Enable/Disable PostMkt Volume.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowDayAvg: <b>Enable/Disable Average Volume of Days set in the Length above.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowTodayVolume: <b>Enable/Disable Today's Volume</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowRvol: <b>Enable/Disable Relative Volume to Length Days</b> <li>Set "No" if this is not needed for you.</li>

#hint UnusualVolumePercent: <b>Define your own UnusualVolume, Typical Liquid Stock 110% and above.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowBarAvg: <b>Enable/Disable Average Bar volume, On Daily This is same as ShowDayAvg.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowCurrentBar: <b>Enable/Disable Current Bar Volume.</b> <li>Set "No" if this is not needed for you.</li>

#hint ShowPercentOfBarAvg: <b>Enable/Disable % if Volume, Compared to Days/Bar of Length </b> <li>Set "No" if this is not needed for you.</li>

#hint ShowBarsSell: <b>Enable/Disable Sell Volume for length </b> <li>Set "No" if this is not needed for you.</li>

#hint Show6BarSell: <b>Enable/Disable Sell Volume for Last 6 Bar </b> <li>Set "No" if this is not needed for you.</li>

#hint ShowSellVolume:<b>Enable/Disable Current Volume Sell Compared to length Bars </b> <li>Set "No" if this is not needed for you.</li>

#declare lower; # If you disable Volume subgraph and using as lower study uncomment this and comment the next one.

declare on_volume; #If you need to use only labels as a top study comment "Selling Volume" & "Buying Volume", along with this line with a "#" in-front of the line

DefineGlobalColor("Zone1", CreateColor(204, 255, 225));

DefineGlobalColor("Zone2", CreateColor(252, 220, 101));

DefineGlobalColor("Zone3", CreateColor(204, 204, 198));

input Length = 21;

input Barlength = 6;

input ShowVolAvg = Yes;

input ShowPreMktVol = Yes;

input ShowZoneVol = Yes;

input ShowPostMktVol = Yes;

def Zone1 = gettime() >= RegularTradingStart(GetYYYYMMDD()) and gettime() <= RegularTradingStart(GetYYYYMMDD()) + 90*60*1000;

def Zone2 = gettime() > RegularTradingStart(GetYYYYMMDD()) + 90*60*1000 and gettime() <= RegularTradingEnd(GetYYYYMMDD())-120*60*1000;

def Zone3 = gettime() > RegularTradingEnd(GetYYYYMMDD()) - 120*60*1000 and gettime() <= RegularTradingEnd(GetYYYYMMDD());

def startTime = 0930;

def update1 = 1100;

def update2 = 1400;

def endTime = 1600;

def isNewDay = GetDay() == GetLastDay();

def yyyymmdd = GetYYYYMMDD();

def period = yyyymmdd;

def isPeriodRolled = CompoundValue(1, period != period[1], 1);

def sumVol = if isPeriodRolled then volume else CompoundValue(1, sumVol[1] + volume, volume);

######################### Current BAR ########################

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

def Buying = V*(C-L)/(H-L);

def Selling = V*(H-C)/(H-L);

######################## 6BAR ################################

def HH6 = Average(high[1], Barlength);

def HC6 = Average(close[1], Barlength);

def HL6 = Average(low[1], Barlength);

def HV6 = Average(volume[1], Barlength);

def Buy6 = HV6 * (HC6 - HL6) / (HH6 - HL6);

def Sell6 = HV6 * (HH6 - HC6) / (HH6 - HL6);

###################### 30BAR #################################

def HH30 = Average(high[1], Length);

def HC30 = Average(close[1], Length);

def HL30 = Average(low[1], Length);

def HV30 = Average(volume[1], Length);

def Buy30 = HV30 * (HC30 - HL30) / (HH30 - HL30);

def Sell30 = HV30 * (HH30 - HC30) / (HH30 - HL30);

###################### 6Bar Volume % #########################

def H6Vol = Round(Buy6, 0) + Round(Sell6, 0) ;

def H6buyPercent = ( Round(Buy6, 0) / H6Vol ) * 100;

def H6sellPercent = ( Round(Sell6, 0) / H6Vol ) * 100;

###################### 30Bar Volume % ######################

def H30Vol = Round(Buy30, 0) + Round(Sell30, 0) ;

def H30buyPercent = (Round(Buy30, 0) / H30Vol) * 100;

def H30sellPercent = (Round(Sell30, 0) / H30Vol) * 100;

####################### Volume Stats #########################

def volDayAvg = Average(volume (Period = "DAY")[1],Length);

def DayVol = volume(period = "DAY");

def rVol = Round((DayVol / volDayAvg), 2);

def avgBars = Average(volume[1],Length);

def curVolume = volume;

def percentOfBars = Round((curVolume / avgBars) * 100, 0);

def SellVolPercent = Round((Selling / Volume) * 100, 0);

######################### Labels ##############################

input ShowDayAvg = yes;

input ShowTodayVolume = yes;

input ShowRvol = yes;

input UnusualVolumePercent = 110;

input ShowBarAvg = yes;

input ShowCurrentBar = yes;

input ShowPercentOfBarAvg = yes;

AddLabel(ShowDayAvg, Length+"D: " + Round(volDayAvg * .000001, 1) + " M ", Color.LIGHT_GRAY);

AddLabel(ShowTodayVolume, "D: " + Round(DayVol * .000001, 1) + " M ", (if rVol >= UnusualVolumePercent then Color.GREEN else if rVol >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowRvol,"rVol: " + rVol,(if rVol >= UnusualVolumePercent then Color.GREEN else if rVol >= 100 then Color.ORANGE else Color.WHITE));

AddLabel(ShowBarAvg, "30Bar: " + Round(avgBars * .001, 1) + " K ", Color.LIGHT_GRAY);

AddLabel(ShowCurrentBar, "CurBar: " + Round(curVolume * .001, 2) + " K ", (if percentOfBars >= UnusualVolumePercent then Color.GREEN else if percentOfBars >= 100 then Color.ORANGE else Color.LIGHT_GRAY));

AddLabel(ShowPercentOfBarAvg, percentOfBars + "%", (if percentOfBars >= UnusualVolumePercent then Color.GREEN else if percentOfBars >= 100 then Color.ORANGE else Color.WHITE) );

############################################ 30 Bar Stats ############################################

input ShowBarsSell = yes;

AddLabel(ShowBarsSell, length + "BarSell: " + Round(H30sellPercent, 0) + "% ", (if H30sellPercent > 55 then Color.RED else if H30sellPercent < 45 then Color.GREEN else Color.ORANGE));

############################################ 6 Bar Stats #############################################

input Show6BarSell = yes;

AddLabel(Show6BarSell, Barlength +"BarSell: " + Round(H6sellPercent, 0) + "% ", (if H6sellPercent > 55 then Color.RED else if H6sellPercent < 45 then Color.GREEN else Color.ORANGE));

############################################ Current Bar Stats ########################################

input ShowSellVolume = yes;

AddLabel(ShowSellVolume, "CurSell: " + Round(SellVolPercent, 0) + "% ", (if SellVolPercent > 51 then Color.RED else if SellVolPercent < 49 then Color.GREEN else Color.ORANGE));

##################### Selling Volume #####################

plot SVol = Selling;

SVol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

SVol.SetDefaultColor(Color.DARK_ORANGE);

SVol.HideTitle();

SVol.HideBubble();

SVol.SetLineWeight(3);

##################### Buying Volume ######################

plot BVol = Buying;

BVol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

BVol.SetDefaultColor(Color.LIGHT_GREEN);

BVol.HideTitle();

BVol.HideBubble();

BVol.SetLineWeight(3);

##################### Plots and Style ###################

plot Vol = volume;

plot VolAvg = Average(volume[1], Length);

VolAvg.SetHiding(!ShowVolAvg);

Vol.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Vol.SetLineWeight(3);

Vol.DefineColor("Up", Color.UPTICK);

Vol.DefineColor("Down", Color.DOWNTICK);

Vol.AssignValueColor(if close > close[1] then Vol.color("Up") else if close < close[1] then Vol.color("Down") else GetColor(1));

VolAvg.SetDefaultColor(GetColor(8));

def PreMkt = RegularTradingStart (GetYYYYMMDD()) > GetTime();

def PreVol = if PreMkt and !PreMkt[1] then volume else if PreMkt then PreVol[1] + volume else PreVol[1];

AddLabel(if GetAggregationPeriod() > AggregationPeriod.THIRTY_MIN or !ShowPreMktVol then 0 else 1, "PreMktVol = " + Round(PreVol * .000001, 3) + "M ", Color.YELLOW);

def RTH1Zone = SecondsFromTime(startTime) >= 0 and SecondsTillTime(update1) > 0;

def RTH1ZoneVol = if RTH1Zone and !RTH1Zone[1] then volume else if RTH1Zone[1] then RTH1ZoneVol[1] + volume else RTH1ZoneVol[1];

AddLabel(if GetAggregationPeriod() > AggregationPeriod.THIRTY_MIN or !ShowZoneVol then 0 else 1, "Zone1Vol = " + Round(RTH1ZoneVol * .000001, 3) + "M ", GlobalColor("Zone1"));

def RTH2Zone = SecondsFromTime(update1) >= 0 and SecondsTillTime(update2) > 0;

def RTH2ZoneVol = if RTH2Zone and !RTH2Zone[1] then volume else if RTH2Zone[1] then RTH2ZoneVol[1] + volume else RTH2ZoneVol[1];

AddLabel(if GetAggregationPeriod() > AggregationPeriod.THIRTY_MIN or !ShowZoneVol then 0 else 1, "Zone2Vol = " + Round(RTH2ZoneVol * .000001, 3) + "M ", GlobalColor("Zone2"));

def RTH3Zone = SecondsFromTime(update2) >= 0 and SecondsTillTime(endTime) > 0;

def RTH3ZoneVol = if RTH3Zone and !RTH3Zone[1] then volume else if RTH3Zone[1] then RTH3ZoneVol[1] + volume else RTH3ZoneVol[1];

AddLabel(if GetAggregationPeriod() > AggregationPeriod.THIRTY_MIN or !ShowZoneVol then 0 else 1, "Zone3Vol = " + Round(RTH3ZoneVol * .000001, 3) + "M ", GlobalColor("Zone3"));

AddVerticalLine(if isNewDay and RTH1Zone == 0 and RTH1Zone[1] == 1 then yes else no, " Zone 1 Mark", color = GlobalColor("Zone1"));

AddVerticalLine(if isNewDay and RTH2Zone == 0 and RTH2Zone[1] == 1 then yes else no, " Zone 2 Mark", color = GlobalColor("Zone2"));

AddVerticalLine(if isNewDay and RTH3Zone == 0 and RTH3Zone[1] == 1 then yes else no, " Zone 3 Mark", color = GlobalColor("Zone3"));

def PostMkt = RegularTradingEnd (GetYYYYMMDD()) < GetTime();

def PostVol = if PostMkt and !PostMkt[1] then volume else if PostMkt then PostVol[1] + volume else PostVol[1];

AddLabel(if GetAggregationPeriod() > AggregationPeriod.THIRTY_MIN or !ShowPostMktVol then 0 else 1, "PostMktVol = " + Round(PostVol * .000001, 3) + "M ", Color.YELLOW);

#End Volume RTH First 60 Mins

Last edited by a moderator: