Scan For Price Within A Percentage Of Moving Average

Copy the above code

In Studies, click Create

Paste the above study

Name the study: Pct_From_MA

Save

Click on the scanner.

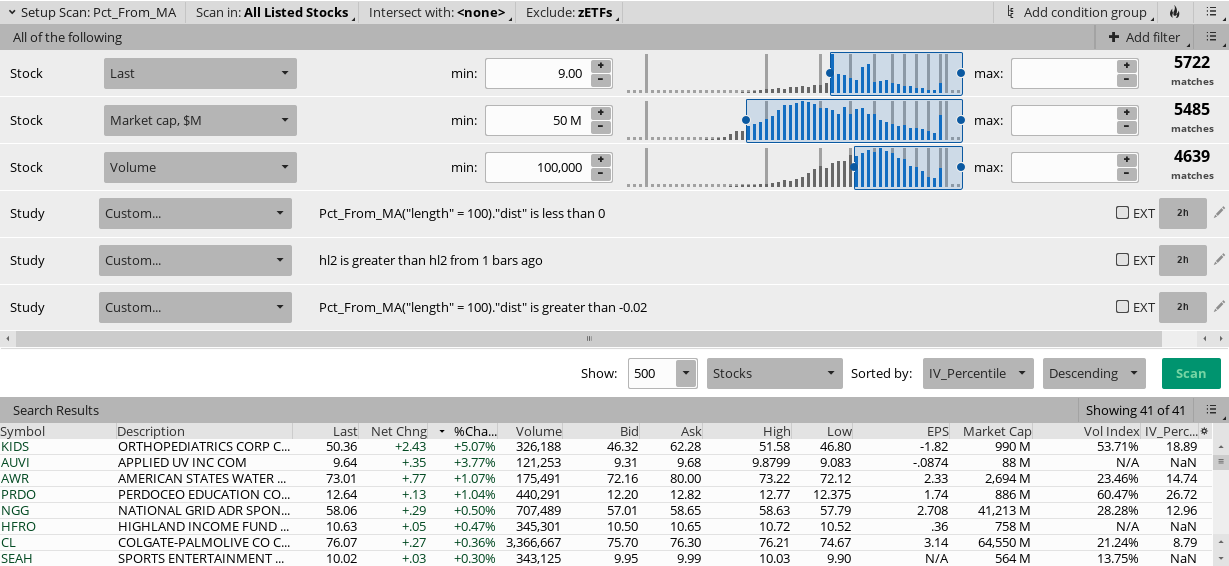

Where price is below ma

Where price is rising (hl2 is greater than hl2 from 1 bars ago)

Where price is within -2% of the ma

Remember: Change the aggregation of each filter to what you want

Here is a Shared Link: http://tos.mx/kXoe4Db

The shared link will only work if you copy and pasted the above study and named it: Pct_From_MA

A poster was having difficulty scanning for within a percentage of ma so I wrote this brief tutorial. I don't use moving average studies so I can not assist w/ how people are utilizing this in their strategies.

- Where price is below 100 ma

- Where price is rising (hl2 is greater than hl2 from 1 bars ago)

- Where price is within -2% of the 100 ma

Ruby:

# MA Distance Percentage

# Paris

# 4.13.2018

# Computes percentage the current close is above/below the 200 DSMA

# Displays on a lower chart

declare lower;

input length = 200;

def data = close;

def avg = Average(data, length);

def pct = (data/avg) - 1;

plot dist = pct;

plot zero = 0;

zero.SetDefaultColor(Color.WHITE);

zero.SetLineWeight(2);

AddLabel(1, "Percentage from " + length + " MA: " + AsPercent(pct), if pct > 0 then Color.GREEN else Color.PINK);In Studies, click Create

Paste the above study

Name the study: Pct_From_MA

Save

Click on the scanner.

Where price is below ma

- Click on +Add filter

- Click on the pencil icon next to the filter you just added

- Click edit

- In the left column, click on the 1st pull-down window, click study

- Type in Pct_From_MA

- Under Plot, click on the pull-down window, choose dist

- In length change the 200 ma length to 100 ma length .... (or whatever moving average length that you want)

- In the middle column, choose Less than or equal to .... (if scanning for above ma change this to Greater than)

- In the right column, click on the pull-down window, click value

- Change 100 in the next box to 0

- Save

Where price is rising (hl2 is greater than hl2 from 1 bars ago)

- Click on +Add filter

- Click on the pencil icon next to the filter you just added

- Click edit

- In the left column, click on the 1st pull-down window, click price

- Click hl2 .... (or what ever representation of price that floats your boat)

- In the middle column, choose greater than or equal to

- In the right column, click on the pull-down window, click price

- Click hl2 .... (or what ever representation of price that floats your boat)

- In the box under hl2, change the 0 to 1 offset

- Save

Where price is within -2% of the ma

- Click on +Add filter

- Click on the pencil icon next to the filter you just added

- Click edit

- In the left column, click on the 1st pull-down window, click study

- Type in Pct_From_MA

- Under Plot, click on the pull-down window, choose dist

- In length change the 200 ma length to 100 ma length .... (or whatever moving average length that you want)

- In the middle column, choose greater than or equal to .... (or Less than if scanning for above ma)

- In the right column, click on the pull-down window, click value

- In the box under value, change the value from 100 to -0.02 .... (negative values represent under ma; positive values for above ma)

- Save .... (change the percentage to anything you want)

Remember: Change the aggregation of each filter to what you want

Here is a Shared Link: http://tos.mx/kXoe4Db

The shared link will only work if you copy and pasted the above study and named it: Pct_From_MA

A poster was having difficulty scanning for within a percentage of ma so I wrote this brief tutorial. I don't use moving average studies so I can not assist w/ how people are utilizing this in their strategies.

Last edited: