You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

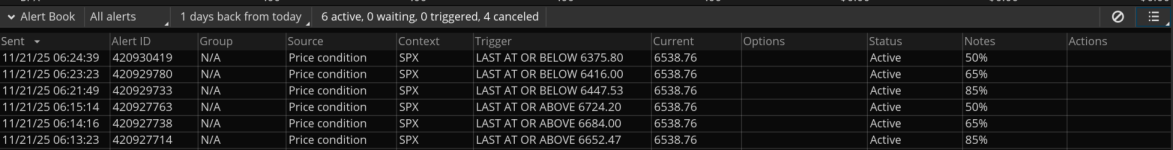

SPX Alerts for certain prices during the day

- Thread starter Imaginativeone

- Start date

Solution

So, essentially, you're going for percentage of cushion remaining? Something like...

100 - 100 * AbsValue(CurrentPrice - ShortStrike) / AbsValue(EntryPrice - ShortStrike)

(with "price" being of the underlying)

Does that look somewhat correct? If so, then yeah, you would only need to input the price of the underlying at the time of entry, and the strike price. The alerts could be auto/dynamic, plus we could easily do all sorts of other things like active labels to track it on screen.

If not, then give me the correct formula in somewhat similar format to what I provided.

100 - 100 * AbsValue(CurrentPrice - ShortStrike) / AbsValue(EntryPrice - ShortStrike)

(with "price" being of the underlying)

Does that look somewhat correct? If so, then yeah, you would only need to input the price of the underlying at the time of entry, and the strike price. The alerts could be auto/dynamic, plus we could easily do all sorts of other things like active labels to track it on screen.

If not, then give me the correct formula in somewhat similar format to what I provided.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Yeah, easily, you can hard-code the price levels, or use inputs. Then you can check for Close being above or below them, or crossing them, respectively. Then you plug those into ThinkScript's Alert() function.

Before bothering with that, I noticed that the image has "notes" with percentages. These percentages are of what exactly? If I knew what those are, there is a possibility that it could be fully automatic, and you wouldn't need to type anything in.

Alternatively, you could also leave the real alerts on the screen and arm the reversing alert. You can drag them visually on the screen to adjust prices with the Show Alerts option, if you prefer that over typing.

It depends... Describe what the alerts are for, and how you're coming up with the numbers.

Before bothering with that, I noticed that the image has "notes" with percentages. These percentages are of what exactly? If I knew what those are, there is a possibility that it could be fully automatic, and you wouldn't need to type anything in.

Alternatively, you could also leave the real alerts on the screen and arm the reversing alert. You can drag them visually on the screen to adjust prices with the Show Alerts option, if you prefer that over typing.

It depends... Describe what the alerts are for, and how you're coming up with the numbers.

Yeah, easily, you can hard-code the price levels, or use inputs. Then you can check for Close being above or below them, or crossing them, respectively. Then you plug those into ThinkScript's Alert() function.

Before bothering with that, I noticed that the image has "notes" with percentages. These percentages are of what exactly? If I knew what those are, there is a possibility that it could be fully automatic, and you wouldn't need to type anything in.

Alternatively, you could also leave the real alerts on the screen and arm the reversing alert. You can drag them visually on the screen to adjust prices with the Show Alerts option, if you prefer that over typing.

It depends... Describe what the alerts are for, and how you're coming up with the numbers.

This is really interesting . Super interested on how you could automate the notes portion and will wait for the OP’s response since I would implement something similar based on levels drawn from the open.

Last edited:

First, thank you all for responding to my post.

I'm setting up Verticals at 3, 2, or 1 Deltas (my favorite distance from The Money). I don't mind risking a lot for that comfortable distance, and often enough, my small profit comes in just fine. On no-profit days, the price of the underlying breaches my Vertical no matter how far-away/safe I think I might be.

The alerts let me know things are going South. I'm setting the alerts as percentages of the Short Strike Price: 85% - Category A responses, 65% - Category B responses, 50% - Category C responses (the price might be on its way to a breach!). The Notes make it clear which price-level has been reached.

I'm doing all this prep at 4:30 am to 6:00 am. While it "only takes 40 minutes", that's a lot of prime-early-morning-time working on alerts. I'd like to trim that time down by being able to set up the alerts on my live account and on paper by clicking a button in the respective environments.

Postscript: If I could automatically restore the alert, that would be a giant bonus.

I'm setting up Verticals at 3, 2, or 1 Deltas (my favorite distance from The Money). I don't mind risking a lot for that comfortable distance, and often enough, my small profit comes in just fine. On no-profit days, the price of the underlying breaches my Vertical no matter how far-away/safe I think I might be.

The alerts let me know things are going South. I'm setting the alerts as percentages of the Short Strike Price: 85% - Category A responses, 65% - Category B responses, 50% - Category C responses (the price might be on its way to a breach!). The Notes make it clear which price-level has been reached.

I'm doing all this prep at 4:30 am to 6:00 am. While it "only takes 40 minutes", that's a lot of prime-early-morning-time working on alerts. I'd like to trim that time down by being able to set up the alerts on my live account and on paper by clicking a button in the respective environments.

Postscript: If I could automatically restore the alert, that would be a giant bonus.

Last edited:

First, thank you all for responding to my post.

I'm setting up Verticals at 3, 2, or 1 Deltas (my favorite distance from The Money). I don't mind risking a lot for that comfortable distance, and often enough, my small profit comes in just fine. On no-profit days, the price of the underlying breaches my Vertical no matter how far-away/safe I think I might be.

The alerts let me know things are going South. I'm setting the alerts as percentages of the Short Strike Price: 85% - Category A responses, 65% - Category B responses, 50% - Category C responses (the price might be on its way to a breach!). The Notes make it clear which price-level has been reached.

I'm doing all this prep at 4:30 am to 6:00 am. While it "only takes 40 minutes", that's a lot of prime-early-morning-time working on alerts. I'd like to trim that time down by being able to set up the alerts on my live account and on paper by clicking a button in the respective environments.

Postscript: If I could automatically restore the alert, that would be a giant bonus.

Will you be on your TOS all the time? If you are, using @Joshua's suggested method could work.

But from the sound of it, you won't be able to monitor and have TOS running in the background. In that case, setting up price level alerts would work better.

You mean manually? Please point me in the direction of making a script for this.

Claude.ai took me quite far. Turns out that I just needed my price lines with accurate price levels. Creating alerts from those just takes a few seconds. Automating the alerts is next, but a lower priority than before.You mean manually? Please point me in the direction of making a script for this.

So, essentially, you're going for percentage of cushion remaining? Something like...

100 - 100 * AbsValue(CurrentPrice - ShortStrike) / AbsValue(EntryPrice - ShortStrike)

(with "price" being of the underlying)

Does that look somewhat correct? If so, then yeah, you would only need to input the price of the underlying at the time of entry, and the strike price. The alerts could be auto/dynamic, plus we could easily do all sorts of other things like active labels to track it on screen.

If not, then give me the correct formula in somewhat similar format to what I provided.

100 - 100 * AbsValue(CurrentPrice - ShortStrike) / AbsValue(EntryPrice - ShortStrike)

(with "price" being of the underlying)

Does that look somewhat correct? If so, then yeah, you would only need to input the price of the underlying at the time of entry, and the strike price. The alerts could be auto/dynamic, plus we could easily do all sorts of other things like active labels to track it on screen.

If not, then give me the correct formula in somewhat similar format to what I provided.

Are you open to sharing what the chart looks like with what you came up with ? Curious what this looks like on a chart. Thanks!Claude.ai took me quite far. Turns out that I just needed my price lines with accurate price levels. Creating alerts from those just takes a few seconds. Automating the alerts is next, but a lower priority than before.

Similar threads

-

Script for How many days in 2005 did SPX open higher than the previous day

- Started by bluegolden

- Replies: 1

-

-

-

-

looking to plot ES price levels to be converted to SPX levels based Closing Price

- Started by tosalerts6247

- Replies: 1

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1825

Online

Similar threads

-

Script for How many days in 2005 did SPX open higher than the previous day

- Started by bluegolden

- Replies: 1

-

-

-

-

looking to plot ES price levels to be converted to SPX levels based Closing Price

- Started by tosalerts6247

- Replies: 1

Similar threads

-

Script for How many days in 2005 did SPX open higher than the previous day

- Started by bluegolden

- Replies: 1

-

-

-

-

looking to plot ES price levels to be converted to SPX levels based Closing Price

- Started by tosalerts6247

- Replies: 1

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.