Author Message:

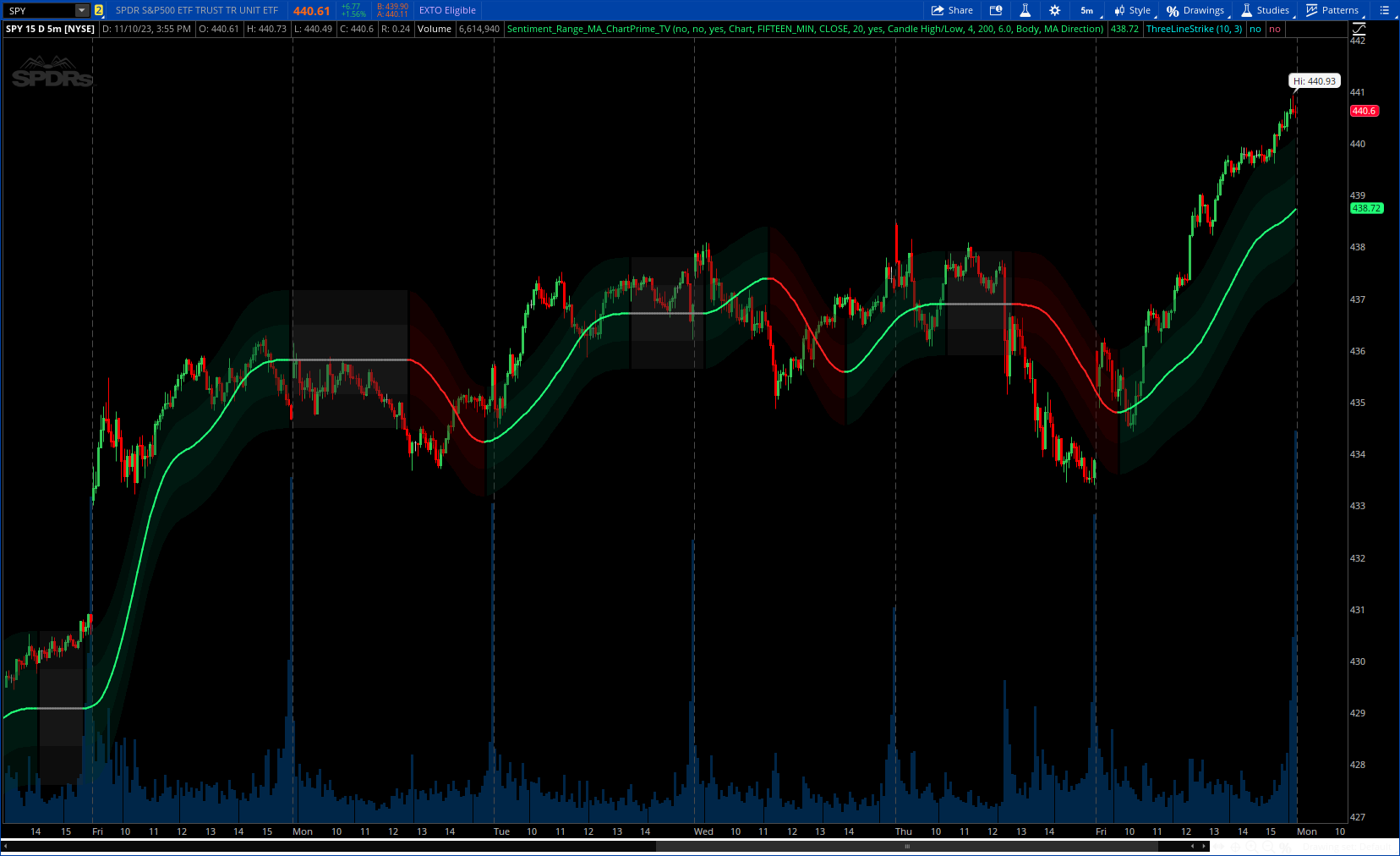

The "Sentiment Range MA" provides traders with a dynamic perspective on market activity, emphasizing both stability in chop zones and quick adaptability outside of them.

Key Features:

- Chop Zone Stability: In choppy markets, this indicator remains consistent, filtering out the noise to provide a clear view.

- Quick Adaptability: Should the price break out of these zones, the indicator recalibrates promptly.

- Dynamic Support and Resistance: Adapts based on the latest price action, serving as an evolving reference point.

- Emphasis on Recent Levels: The tool factors in the latest notable market levels to stay relevant and timely.

CODE:

CSS:

# https://www.tradingview.com/v/LVsNPKBe/

#/ This source code is subject to the terms of the Mozilla Public License 2.0 at https://moz

#// © ChartPrime

#indicator("Sentiment Range MA [ChartPrime]", overlay = true, timeframe = "", timeframe_gaps = false)

# Converted and Mod by Sam4Cok@Samer800 - 11/2023

input showSignals = no;

input colorBars = no;

input showBand = yes;

input timeframe = {Default "Chart", "Custom"};

input customTimeframe = AggregationPeriod.DAY;

input source = FundamentalType.CLOSE; # "Source"

input Length = 20; # "Length"

input DoubleFilter = yes; # "Double Filter"

input trueRangeType = {Default "Candle High/Low", "Volatility Adjustment"};

input CandleSmoothing = 4; # "Trigger Smoothing"

input atrLength = 200; # "ATR Length"

input RangeMultiplier = 6.00; # "Range Multiplier"

input RangeStyle = {default "Body", "Wick"}; # "Range Style"

input LineColorStyle = {default "MA Direction", "MA Cross", "Solid"}; # "Color Style"

def na = Double.NaN;

def last = isNaN(close);

def useAtr = trueRangeType == trueRangeType."Volatility Adjustment";

def mtf = timeframe == timeframe."Custom";

def dir = LineColorStyle == LineColorStyle."MA Direction";

def cross = LineColorStyle == LineColorStyle."MA Cross";

def len = Length + 1;

def smoothing = CandleSmoothing + 1;

def multi = RangeMultiplier;

#-- Color

DefineGlobalColor("bull", CreateColor(33, 255, 120)); # "Bullish Color"

DefineGlobalColor("bear", CreateColor(255, 33, 33)); # "Bearish Color"

DefineGlobalColor("neut", CreateColor(137, 137, 137)); # "Neutral Color"

DefineGlobalColor("dbull", CreateColor(1, 50, 32)); # "Bullish Color"

DefineGlobalColor("dbear", CreateColor(63, 0, 0)); # "Bearish Color"

DefineGlobalColor("dneut", CreateColor(42, 42, 42)); # "Neutral Color"

#- MTF

def tfS = Fundamental(FundamentalType = source);

def tfO = Fundamental(FundamentalType = FundamentalType.OPEN);

def tfC = Fundamental(FundamentalType = FundamentalType.CLOSE);

def tfH = Fundamental(FundamentalType = FundamentalType.HIGH);

def tfL = Fundamental(FundamentalType = FundamentalType.LOW);

def mtfS = Fundamental(FundamentalType = source, Period = customTimeframe);

def mtfO = Fundamental(FundamentalType = FundamentalType.OPEN, Period = customTimeframe);

def mtfC = Fundamental(FundamentalType = FundamentalType.CLOSE, Period = customTimeframe);

def mtfH = Fundamental(FundamentalType = FundamentalType.HIGH, Period = customTimeframe);

def mtfL = Fundamental(FundamentalType = FundamentalType.LOW, Period = customTimeframe);

def s = if mtf then mtfS else tfC;

def o = if mtf then mtfO else tfO;

def c = if mtf then mtfC else tfC;

def h = if mtf then mtfH else tfH;

def l = if mtf then mtfL else tfL;

#sr_ma(float source, output_smoothing, trigger_smoothing, atr_length = 50, multiplier, string

script sr_ma {

input source = close;

input output_smoothing = 3;

input smoothing = 1;

input atr_length = 50;

input multiplier = 1;

input range_switch = "Body";

input duel_filter = no;

input useAtr = no;

input o = open;

input c = close;

input h = high;

input l = low;

def ntr = TrueRange(h, c, l);

def nATR = WildersAverage(ntr, atr_length);

def minVol = Min(nATR * 0.5, c * (0.3 / 100));

def volAdj = minVol[20];

def max = Max(o, c);

def min = Min(o, c);

def candle_top = if range_switch != "Body" then h else max;

def candle_bot = if range_switch != "Body" then l else min;

def smooth_top = Average(candle_top, smoothing);

def smooth_bot = Average(candle_bot, smoothing);

def tr = candle_top - candle_bot;

def avgTr = Average(tr, atr_length);

def atr = if useAtr then volAdj else avgTr;

def sr_ma;

def cur_range;

def top_range;

def bot_range;

def flag = smooth_top > top_range[1] or smooth_bot < bot_range[1] or !cur_range[1];

if flag {

sr_ma = source;

cur_range = atr * multiplier;

top_range = sr_ma + cur_range;

bot_range = sr_ma - cur_range;

} else {

sr_ma = if sr_ma[1] then sr_ma[1] else source;

cur_range = if cur_range[1] then cur_range[1] else atr * multiplier;

top_range = if top_range[1] then top_range[1] else sr_ma + cur_range;

bot_range = if bot_range[1] then bot_range[1] else sr_ma - cur_range;

}

def AvgMa = Average(sr_ma, output_smoothing);

def AvgTop = Average(top_range, output_smoothing);

def AvgBot = Average(bot_range, output_smoothing);

def sr_WMA = WMA(sr_ma, output_smoothing);

def sr_dWMA = WMA(AvgMa, output_smoothing);

def top_WMA = WMA(top_range, output_smoothing);

def top_dWMA = WMA(AvgTop, output_smoothing);

def bot_WMA = WMA(bot_range, output_smoothing);

def bot_dWMA = WMA(AvgBot, output_smoothing);

def smooth_cur_range = if duel_filter then sr_dWMA else sr_WMA;

def smooth_top_range = if duel_filter then top_dWMA else top_WMA;

def smooth_bot_range = if duel_filter then bot_dWMA else bot_WMA;

plot srm = if smooth_cur_range then smooth_cur_range else Double.NaN;

plot top = if smooth_top_range then smooth_top_range else Double.NaN;

plot bot = if smooth_bot_range then smooth_bot_range else Double.NaN;

}

def sr_ma = sr_ma(s, len, smoothing, atrLength, multi, RangeStyle, DoubleFilter, useAtr, o, c, h, l).srm;

def top_range = sr_ma(s, len, smoothing, atrLength, multi, RangeStyle, DoubleFilter, useAtr, o, c, h, l).top;

def bot_range = sr_ma(s, len, smoothing, atrLength, multi, RangeStyle, DoubleFilter, useAtr, o, c, h, l).bot;

def ma_delta;

def ma_cross;

def plot_neutral = h > sr_ma and l < sr_ma;

def plot_bullish = l > sr_ma;

def plot_bearish = h < sr_ma;

if plot_bullish {

ma_cross = 1;

} else

if plot_bearish {

ma_cross = -1;

} else

if plot_neutral {

ma_cross = 0;

} else {

ma_cross = if isNaN(ma_cross[1]) then 0 else ma_cross[1];

}

def nzSr_ma = if isNaN(sr_ma[1]) then 0 else sr_ma[1];

def ma_delta_neutral = (sr_ma - nzSr_ma) == 0;

def ma_delta_bullish = (sr_ma - nzSr_ma) > 0;

def ma_delta_bearish = (sr_ma - nzSr_ma) < 0;

if ma_delta_bullish {

ma_delta = 1;

} else

if ma_delta_bearish {

ma_delta = -1;

} else

if ma_delta_neutral {

ma_delta = 0;

} else {

ma_delta = if isNaN(ma_delta[1]) then 0 else ma_delta[1];

}

def ma_col = if cross then ma_cross else

if Dir then ma_delta else 0;

plot ma = if last then na else sr_ma; # "SR MA"

def top = if last or !showBand then na else top_range; # "Top Range"

def bot = if last or !showBand then na else bot_range; # "Bottom Range"

ma.SetLineWeight(2);

ma.AssignValueColor(if ma_col > 0 then GlobalColor("bull") else

if ma_col < 0 then GlobalColor("bear") else GlobalColor("neut"));

def halfTop = top - (top - ma) / 2;

def halfBot = bot + (ma - bot) / 2;

AddCloud(if ma_col > 0 then halfTop else na, halfBot, GlobalColor("dbull"));

AddCloud(if ma_col < 0 then halfTop else na, halfBot, GlobalColor("dbear"));

AddCloud(if !ma_col then halfTop else na, halfBot, GlobalColor("dneut"));

AddCloud(if ma_col > 0 then Top else na, Bot, GlobalColor("dbull"));

AddCloud(if ma_col < 0 then Top else na, Bot, GlobalColor("dbear"));

AddCloud(if !ma_col then Top else na, Bot, GlobalColor("dneut"));

#-- BarColor

def barColor = if ma_cross>0 and ma_delta > 0 then 2 else

if ma_cross>0 or ma_delta > 0 then 1 else

if ma_cross<0 and ma_delta < 0 then -2 else

if ma_cross<0 or ma_delta < 0 then -1 else 0;

AssignPriceColor(if !colorBars then Color.CURRENT else

if barColor == 2 then Color.GREEN else

if barColor == 1 then Color.DARK_GREEN else

if barColor ==-2 then Color.RED else

if barColor ==-1 then Color.DARK_RED else Color.GRAY);

#-- Signals

def Bull = if barColor== 2 then Bull[1] + 1 else 0;

def Bear = if barColor==-2 then Bear[1] + 1 else 0;

AddChartBubble(showSignals and Bull==2, low, "B", Color.GREEN, no);

AddChartBubble(showSignals and Bear==2, high, "S", Color.RED);

#-- END of CODE

Last edited by a moderator: