#horz_lines_4hour_00

#https://usethinkscript.com/forums/questions.6/

#draw a horizontal line indicator request.

#METAL 1/12

#1

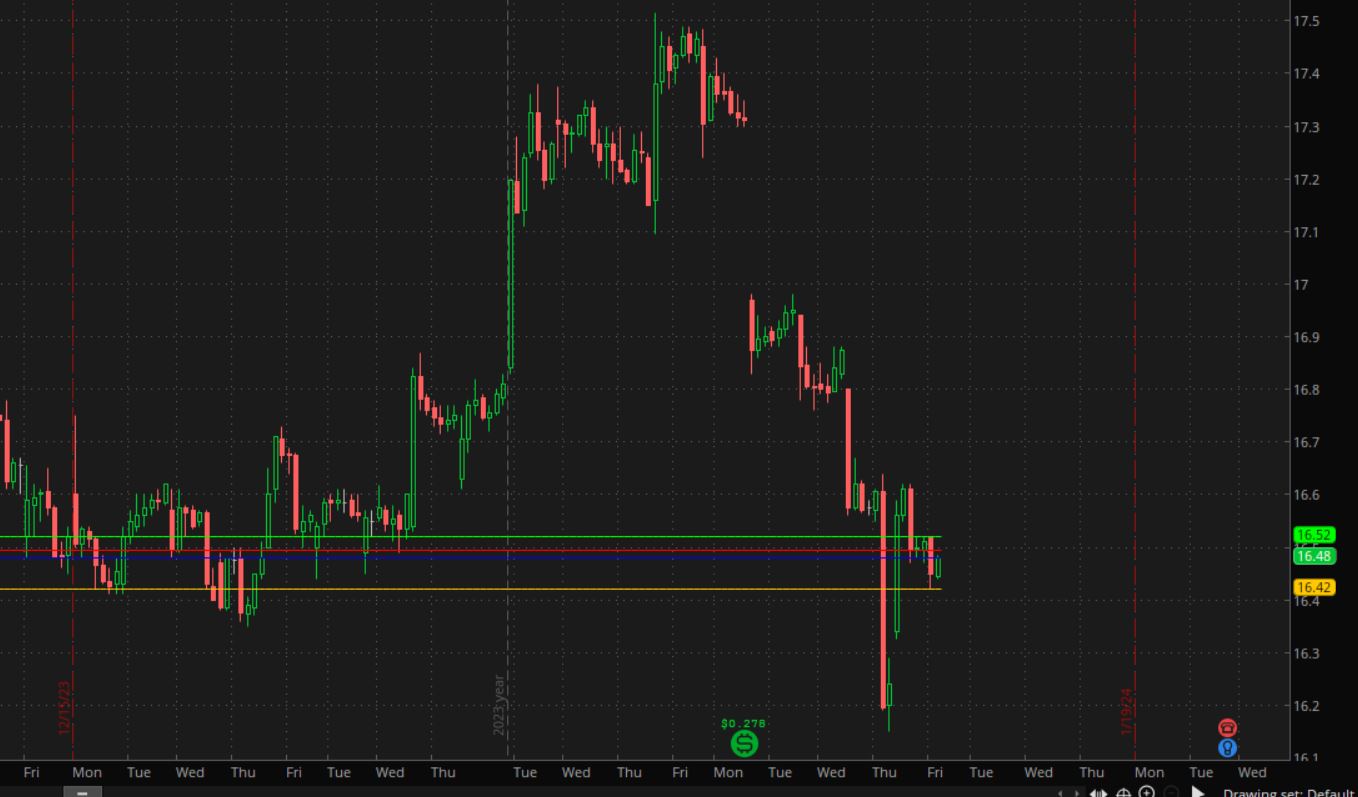

#Is there a way to draw a horizontal line from the top of wick, bottom of wick, top of body, and low of body on a specific TF for a specific length.

#For example: on a 4H TF, I would like a line drawn from the mentioned areas across the current days chart. I would like to be able to specify the length back for it to draw the lines from. Thanks in advance.

#METAL

#2

#Maybe someone can help. I have been trying to get this to work and cannot figure out what is wrong. I decided to use the Wolf Wave Trend by Mobius/ @BenTen as a base for the line plots. I do not get any errors but I also do not get any plots.

#I am wanting line plots from High, Open, Close, and Low of each 4 hour candle as far back as I need for current trading day. I have been using the "RV strategy" for scalping. I am simply looking for a way to speed up the lines needed for possible reversals with this strategy. It will plot a lot of lines and look crazy, but it does work so far.

#I would like to be able to change the aggregation to maybe a day or whatever.

#Here is what I have so far. Chat GPT was also used.

# User Inputs

input length = 10;

# Internal Script Reference

script LinePlot {

input BarID = 0;

input Value = 0;

input BarOrigin = 0;

# def ThisBar = HighestAll(BarOrigin);

def ThisBar = HighestAll(if isnan(close) then 0 else BarOrigin);

# def ValueLine = if BarOrigin == ThisBar

# then Value

# else Double.NaN;

# plot P = if ThisBar - BarID <= BarOrigin

# then HighestAll(ValueLine)

# else Double.NaN;

plot P = if ThisBar - BarID <= BarOrigin

then HighestAll(if BarOrigin == ThisBar then Value else 0)

else Double.NaN;

}

# Define Aggregation Period

def agg = AggregationPeriod.FOUR_HOURS;

# Calculate High, Open, Close, Low for each 4-hour bar

def high_4H = high(period = agg);

def open_4H = open(period = agg);

def close_4H = close(period = agg);

def low_4H = low(period = agg);

def x = BarNumber();

# Plots

plot HighLine = LinePlot(BarID = x - HighestAll(x),

Value = high_4H,

BarOrigin = x);

HighLine.SetDefaultColor(Color.GREEN);

highline.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

plot OpenLine = LinePlot(BarID = x - HighestAll(x),

Value = open_4H,

BarOrigin = x);

OpenLine.SetDefaultColor(Color.RED);

#x.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

plot CloseLine = LinePlot(BarID = x - HighestAll(x),

Value = close_4H,

BarOrigin = x);

CloseLine.SetDefaultColor(Color.BLUE);

#x.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

plot LowLine = LinePlot(BarID = x - HighestAll(x),

Value = low_4H,

BarOrigin = x);

LowLine.SetDefaultColor(Color.ORANGE);

#x.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

addchartbubble(0, low,

open_4h + "\n" +

high_4h + "\n" +

low_4h + "\n" +

close_4h + "\n" +

highline + "\n"

, color.yellow, no);

#