New TOS user here and this community has been immensly helpful, big THANK YOU.

I'm currently using the TOS standard StochasticSlow indicator with arrows plotted when SlowD crossing the overbought & oversold. However I'd like arrows plotted both on the lower study and the chart, under the following conditions:

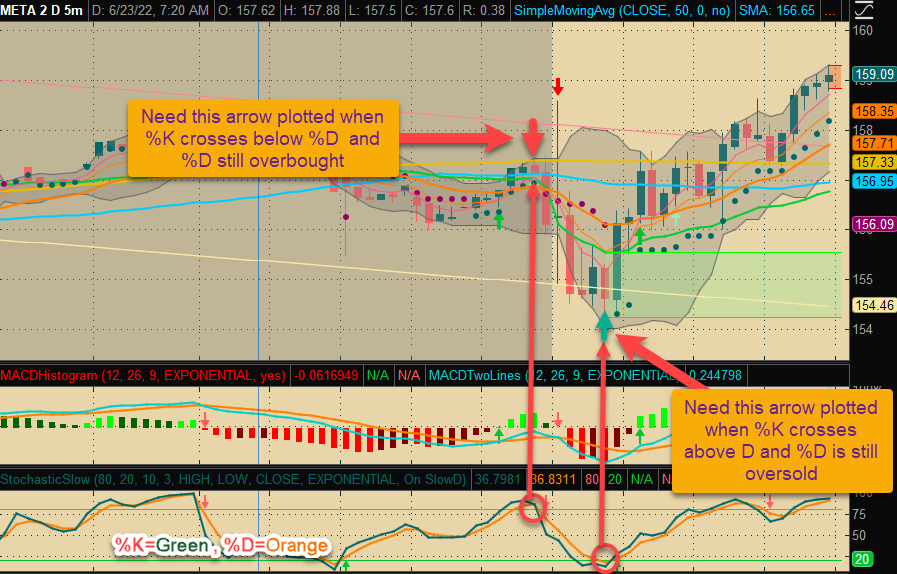

i) Up arrow(customizable color) when SlowK crosses above SlowD and SlowD is still within customizable oversold area(ie SlowD < Oversold). I'd like to specify the Oversold threshold(eg 20,25 etc)

ii) Down arrow(customizable color) when SlowK crosses below SlowD and SlowD is still within customizable overbought area(ie SlowD > Overbought). I'd like to specify the Overbought threshold(eg 80,75 etc)

Hoping this is possible. My searches for a similar ask/solution wasnt fruitful on this forum but apologize in advance if I didnt look carefully enough. I'm not familar with thinkscript coding.

Seems like this is providing very useful buy/sell signals and would like to add this study to scan/watchlist also,if possible.

Can you please help with this or point me to custom study if it already exists.

Thank you so much

Perhaps a picture will inspire someone to help me with the code:

Thanks!

I'm currently using the TOS standard StochasticSlow indicator with arrows plotted when SlowD crossing the overbought & oversold. However I'd like arrows plotted both on the lower study and the chart, under the following conditions:

i) Up arrow(customizable color) when SlowK crosses above SlowD and SlowD is still within customizable oversold area(ie SlowD < Oversold). I'd like to specify the Oversold threshold(eg 20,25 etc)

ii) Down arrow(customizable color) when SlowK crosses below SlowD and SlowD is still within customizable overbought area(ie SlowD > Overbought). I'd like to specify the Overbought threshold(eg 80,75 etc)

Hoping this is possible. My searches for a similar ask/solution wasnt fruitful on this forum but apologize in advance if I didnt look carefully enough. I'm not familar with thinkscript coding.

Seems like this is providing very useful buy/sell signals and would like to add this study to scan/watchlist also,if possible.

Can you please help with this or point me to custom study if it already exists.

Thank you so much

Perhaps a picture will inspire someone to help me with the code:

Thanks!

Last edited by a moderator: