You should upgrade or use an alternative browser.

Weekend Trend Trader by Nick Radge Strategy for ThinkorSwim

- Thread starter gamgoum

- Start date

-

- Tags

- trading strategy

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

@Jacque the 10% above 200EMA is available on stock hacker (screenshot below). Below is the script you need to add as a study filter for the ROC. Give that a shot. Good luck! @cabe1332I’m looking for a weekly scan.

# RateOfChange > 10% Weekly AG

# cabe1332

# code start

def price = close(period = AggregationPeriod.week);

def change = round((price - price[5]) / price[5] * 100,0);

def rc = change > 10;

plot scan = rc;

# code end

See my post below. Just change the ROC from 10 to 30. Good luck! @cabe1332Yeah, I'm pretty new to TOS and looking for the same scanner. Can someone point me in the right direction please? Thanks!

EvilSurgeon

Member

Hi mc01439 and Zachc, I have a similar backtest excel sheet, it may have come from one of you. Is there an automated way of doing this and across many stocks? I had to do one stock at a time and combine the data. A quick search of the forum did not yield anything, so apologies if already asked and answered, but is so, pls provide a like to the thread. Thanks! Awesome work.Tested with a 20 week trailing ATR 3 stop.

Did not make money with the stops out-lined in the original post using trailing stops of 40% and 10% .

This was tested on the S&P 100 from 1992 using 5% of equity per trade. The totals below do not include dividends received of $131,223.00 for the test period.

All Trades Long Trades Short Trades Benchmark Buy & Hold (SPX) Starting Capital Ending Capital Net Profit Net Profit % Annualized Gain % Exposure Total Commission Return on Cash Margin Interest Paid Dividends Received Number of Trades Average Profit Average Profit % Average Bars Held Winning Trades Win Rate Gross Profit Average Profit Average Profit % Average Bars Held Max Consecutive Winners Losing Trades Loss Rate Gross Loss Average Loss Average Loss % Average Bars Held Max Consecutive Losses Maximum Drawdown Maximum Drawdown Date Maximum Drawdown % Maximum Drawdown % Date Sharpe Ratio Profit Factor ∞ Recovery Factor Payoff Ratio Profit / Total Bars

Period Starting Return Return % Max DD % Exposure % Entries Exits

charlie2598

Member

You can download ToS data or manually input it into excel@Zachc you made that in excel file or you have other software for backtesting the strategy or TOS.

how we can link data in excel.as I am not that good with strategy backtest thing.

EvilSurgeon

Member

In post #1 above @gamgoum (not seen in awhile), he states

Looking at the original weekend trend trader code from post #1 above (https://usethinkscript.com/threads/weekend-trend-trader-by-nick-radge-strategy-for-thinkorswim.669/) we see the following:Ideas for scanning for potential stocks:

I tried to combine 20 weeks high with Rate of change > 30% but the output of such a scan was very limited (perhaps due to current volatility in the markets. A more reliable scanner I found was to scan for ROC >10% over last 20 weeks and for stocks at least 10% above their 200 DMA.

You can use other momentum scanners and let me know if you find something relevant.

input roc = 10;

## Confirmation rate of change

def rate = RateOfChange(roc);

plot buySignal = Twentyweekhigh and rate > roc and marClose > RF;Similar to the LTBB Breakout, shouldn't the code be:

input roc = 20;

## Confirmation rate of change

def rate = RateOfChange(roc);

plot buySignal = Twentyweekhigh and rate > 10 and marClose > RF;Assuming roc is time of lookback for RateofChange?

Thanks!

EvilSurgeon

Member

Looking at the original code in post #1 https://usethinkscript.com/threads/weekend-trend-trader-by-nick-radge-strategy-for-thinkorswim.669/

@gamgoum (not seen in awhile) suggest an ROC of 10% over 20weeks.

Comparing to the LTBBBreakout, the code in post #1 states:

input roc = 10;Later the code in post #1 states

## Confirmation rate of change

def rate = RateOfChange(roc);plot buySignal = Twentyweekhigh and rate > roc and marClose > RF;What I am suggesting is more in line with the LTBBreakout code, and I believe roc is the time period for the rate of change.

I don't use it. Make the changes, observe, create a spreadsheet of the differences. Come back and teach us what you learn.Hi @BenTen or @MerryDay or anyone else. I just posted a similar, but slightly different question in the Long Term BB Breakout thread.

Looking at the original code in post #1 https://usethinkscript.com/threads/weekend-trend-trader-by-nick-radge-strategy-for-thinkorswim.669/

@gamgoum (not seen in awhile) suggest an ROC of 10% over 20weeks.

Comparing to the LTBBBreakout, the code in post #1 states:

, shouldn't this be 20?Code:input roc = 10;

Later the code in post #1 states

thenCode:## Confirmation rate of change def rate = RateOfChange(roc);Shouldn't this be rate > 10?Code:plot buySignal = Twentyweekhigh and rate > roc and marClose > RF;

What I am suggesting is more in line with the LTBBreakout code, and I believe roc is the time period for the rate of change.

Interesting ideas!

guest

Guest

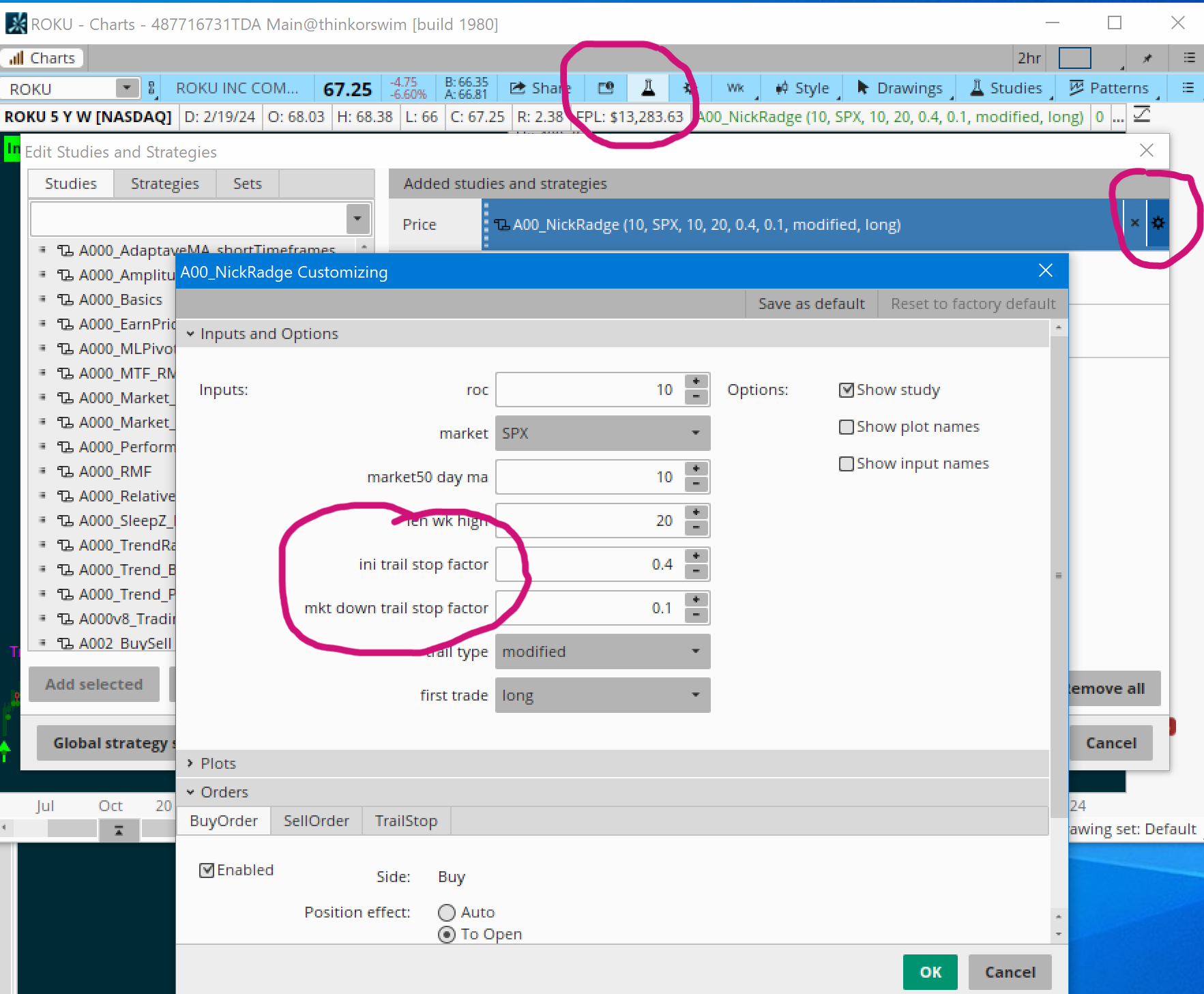

You change input settings in the settings window:I'm using a trail stop factor of 3.

1. click on the flask at the top of your chart

2. click on the gear to the right of the indicator

3. change whatever settings you want

How would I be able to scan for a BuyOrder or SellOrder?

To create scan:

1. Remove these lines of code from the script:

2. Then copy & paste the code into the study tabAddOrder(condition = buySignal, type = OrderType.BUY_TO_OPEN, price = open[-1], name = "BuyOrder");

AddOrder(condition = sellSignal, type = OrderType.SELL_TO_CLOSE, price = open[-1], name = "SellOrder");

AddOrder(condition = cross, type = OrderType.SELL_TO_CLOSE, price = open[-1], name = "TrailStop");

3. The scan filter is:

If you need assistance in setting up your scan filter:buysignal is true

https://usethinkscript.com/threads/how-to-use-thinkorswim-stock-hacker-scans.284/

what did you attribute the 50% drawdown to - market dynamics, economy, news, sales...etc...I ran the strat through my backtest as well. My parameters were as such

20 Random SP100 stocks

35 Years of data

Roc 20 for the first test (I had completed a test at ROC10 but the file corrupted so I will need to redo it later tonight)

Full Stats of the backtest for ROC20

View attachment 5494

P/L Distribution Graph

View attachment 5496

Equity Return

View attachment 5498

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

Wave Trend Oscillator with Fractal Energy & Divergences For ThinkOrSwim

- Started by DeeBee

- Replies: 0

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

Wave Trend Oscillator with Fractal Energy & Divergences For ThinkOrSwim

- Started by DeeBee

- Replies: 0

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

Similar threads

-

Trend Follow with Noise Reduction For ThinkOrSwim

- Started by rip78

- Replies: 0

-

-

-

Wave Trend Oscillator with Fractal Energy & Divergences For ThinkOrSwim

- Started by DeeBee

- Replies: 0

-

Volume Confirmation for a Trend System For ThinkOrSwim

- Started by GLENNOHULL

- Replies: 4

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/