Author Message :

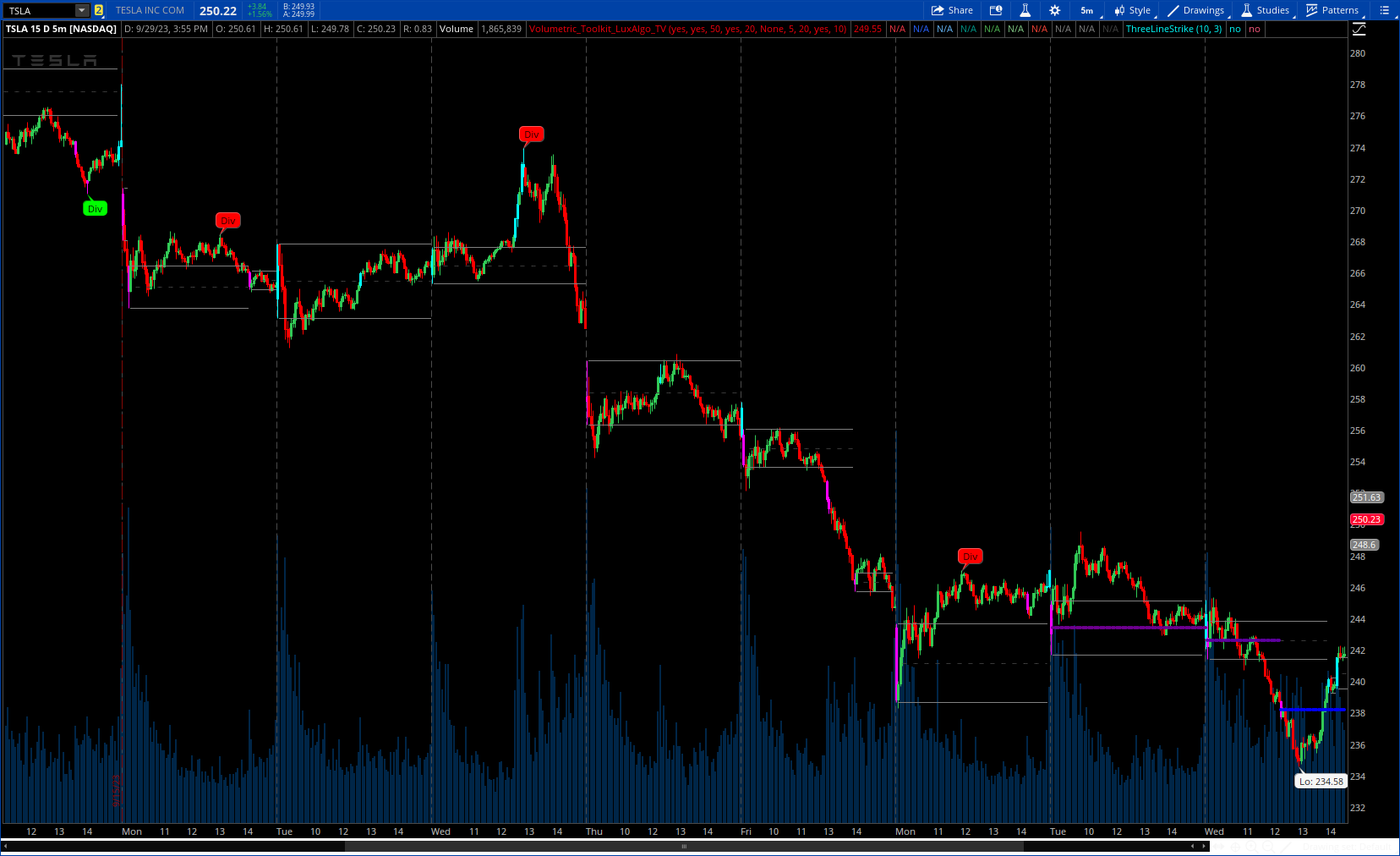

The Volumetric Toolkit is a complete and comprehensive set of tools that display price action-related analysis methods from volume data.

A total of 4 features are included within the toolkit. Symbols that do not include volume data will not be supported by the script.

More Details : https://www.tradingview.com/v/iSs4eqFJ/

CODE:

CSS:

# https://www.tradingview.com/v/iSs4eqFJ/

#// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International

#// © LuxAlgo

#indicator("Volumetric Toolkit [LuxAlgo]", "LuxAlgo - Volumetric Toolkit",

# Converted and mod by Sam4Cok@Samer800 - 09/2023

input ShowVolumetricInterestLine = yes;

input ShowRangesOfInterest = yes; # 'Show Ranges Of Interest'

input roiLength = 50; # 'ROI Length'

input showImpulseCandles = yes; # 'Show Impulses'

input ImpulsesLength = 20; # 'Impulses Length'

input LevelOfInterestDisplay = {"Highest And Lowest", "Fibonacci Levels",

"Both",Default "None"};

input NoOfLevelsToShow = 5; # 'No Of Levels To Show'

input loiLength = 20; # 'Levels Of Interest Length'

input showDivergences = yes; # 'Show Divergences'

input DivergenceLength = 10; # 'Divergence Length'

def na = Double.NaN;

def last = IsNaN(close);

#//Main Variables

def n = AbsValue(BarNumber());

def v = volume;

def HiLo; Def Fibo;

Switch (LevelOfInterestDisplay) {

Case "Highest And Lowest" :

HiLo = yes;

Fibo = no;

Case "Fibonacci Levels" :

HiLo = no;

Fibo = yes;

Case "Both" :

HiLo = yes;

Fibo = yes;

Default:

HiLo = no;

Fibo = no;

}

DefineGlobalColor("up", CreateColor(41, 98, 255));

DefineGlobalColor("dn", CreateColor(242, 54, 69));

DefineGlobalColor("md", CreateColor(118, 28, 202));

DefineGlobalColor("786", CreateColor(244, 67, 54));

DefineGlobalColor("618", CreateColor(129, 199, 132));

DefineGlobalColor("500", CreateColor(76, 175, 80));

DefineGlobalColor("382", CreateColor(0, 150, 136));

DefineGlobalColor("236", CreateColor(100, 181, 246));

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

def _pivotRange;

##############

_BN = BarNumber();

_nan = Double.NaN;

_pivotRange = lbL + lbL;

_VStop = if !IsNaN(dat[_pivotRange]) and lbR > 0 and lbL > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat, -a) else dat < GetValue(dat, -a) else _nan;

if (HL > 0) {

_V = if _BN > lbL and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

#minimax(ds, p, min, max) => // normalize to price

script minimax {

input ds = hl2;

input hiVal = high;

input LoVal = low;

input min = 0;

input max = 100;

def hi = hiVal;

def lo = LoVal;

def minimax = (max - min) * (ds - lo) / (hi - lo) + min;

plot out = minimax;

}

def loiPhv = findpivots(v, 1, loiLength, loiLength);

def loi_phv = !IsNaN(loiPhv);

def avg = if loi_phv then hl2 else avg[1];

def avgCnt = if avg - avg[1] then avgCnt[1] + 1 else avgCnt[1];

def hiAvgCnt = HighestAll(avgCnt);

def Avgcond0 = avgCnt == (hiAvgCnt - NoOfLevelsToShow);

def plotCond = (Avgcond0 and !Avgcond0[1]);

def avgBar0 = if plotCond then n else avgBar0[1];

def barCond0 = n > HighestAll(avgBar0) and !last;

def avgLine0 = if barCond0 then avg else na;

def avgHi0 = HighestAll(if avgLine0 then avgLine0 else 0);

def avgLo0 = LowestAll(if avgLine0 then avgLine0 else 1000000);

def col0 = minimax(avg, avgHi0, avgLo0, 0, 100);

def colVal0 = (if col0 > 100 then 100 else if col0 < 0 then 0 else col0) * 2.55;

def rngDif = if Fibo then (avgHi0 - avgLo0) else na;

def fibUp = if plotCond and colVal0 > 50 then 1 else 0;

def fib1;

def fib2;

def fib3;

def fib4;

def fib5;

if fibUp {

fib1 = avgHi0 - rngDif * 0.236;

fib2 = avgHi0 - rngDif * 0.382;

fib3 = avgHi0 - rngDif * 0.500;

fib4 = avgHi0 - rngDif * 0.618;

fib5 = avgHi0 - rngDif * 0.786;

} else {

fib1 = avgLo0 + rngDif * 0.236;

fib2 = avgLo0 + rngDif * 0.382;

fib3 = avgLo0 + rngDif * 0.500;

fib4 = avgLo0 + rngDif * 0.618;

fib5 = avgLo0 + rngDif * 0.786;

}

plot plotAvgLine = if ShowVolumetricInterestLine and avgLine0 then avgLine0 else na;

plot avgUp = if !HiLo then na else if barCond0 then avgHi0 else na;

plot AvgDn = if !HiLo then na else if barCond0 then avgLo0 else na;

plot AvgMd1 = if barCond0 then fib1 else na;

plot AvgMd2 = if barCond0 then fib2 else na;

plot AvgMd3 = if barCond0 then fib3 else na;

plot AvgMd4 = if barCond0 then fib4 else na;

plot AvgMd5 = if barCond0 then fib5 else na;

plotAvgLine.AssignValueColor(CreateColor(colVal0, 0, 255 - colVal0));

plotAvgLine.SetStyle(Curve.POINTS);

avgUp.SetDefaultColor(GlobalColor("dn"));

AvgDn.SetDefaultColor(GlobalColor("up"));

AvgMd1.SetDefaultColor(GlobalColor("236"));

AvgMd2.SetDefaultColor(GlobalColor("382"));

AvgMd3.SetDefaultColor(GlobalColor("500"));

AvgMd4.SetDefaultColor(GlobalColor("618"));

AvgMd5.SetDefaultColor(GlobalColor("786"));

AvgMd1.SetPaintingStrategy(PaintingStrategy.DASHES);

AvgMd2.SetPaintingStrategy(PaintingStrategy.DASHES);

AvgMd3.SetPaintingStrategy(PaintingStrategy.DASHES);

AvgMd4.SetPaintingStrategy(PaintingStrategy.DASHES);

AvgMd5.SetPaintingStrategy(PaintingStrategy.DASHES);

#GlobalColor("up"

#//Ranges Of Interest

def rhv = Highest(v, roiLength);

def rhvCon = rhv == v;

def roi_avg = if ShowRangesOfInterest and rhvCon then hl2 else roi_avg[1];

def roi_upper = if ShowRangesOfInterest and rhvCon then high else roi_upper[1];

def roi_lower = if ShowRangesOfInterest and rhvCon then low else roi_lower[1];

#//Impulses

def imp_upv = Highest(v, ImpulsesLength);

def imp_up = Highest(high, ImpulsesLength);

def imp_dn = Lowest(low, ImpulsesLength);

def bull_imp = imp_upv > imp_upv[1] and imp_up > imp_up[1] and showImpulseCandles;

def bear_imp = imp_upv > imp_upv[1] and imp_dn < imp_dn[1] and showImpulseCandles;

#/Volume Divergences

def ph = FindPivots(high, 1, DivergenceLength, DivergenceLength);

def pl = FindPivots(low, -1, DivergenceLength, DivergenceLength);

def phv = FindPivots(v, 1, DivergenceLength, DivergenceLength);

def phvCond = !IsNaN(phv) and showDivergences;

def phv_y1;

def ph_y1;

def pl_y1;

#def x1;

def BearD;

def BullD;

if phvCond {

BearD = if phv < phv_y1[1] and high > ph_y1[1] and !IsNaN(ph) then ph_y1[1] else na;

BullD = if phv < phv_y1[1] and low < pl_y1[1] and !IsNaN(pl) then pl_y1[1] else na;

phv_y1 = phv;

ph_y1 = high;

pl_y1 = low;

# x1 = n - divLength;

} else {

BearD = na;

BullD = na;

phv_y1 = phv_y1[1];

ph_y1 = ph_y1[1];

pl_y1 = pl_y1[1];

# x1 = x1[1];

}

#/Plots

#//ROI

AddChartBubble(BearD, high, "Div", Color.RED);

AddChartBubble(BullD, low, "Div", Color.GREEN, no);

plot Upper = if roi_upper and !rhvCon then roi_upper else na;#, 'Upper'

plot Lower = if roi_lower and !rhvCon then roi_lower else na;#, 'Lower'

plot UpLo2 = if roi_avg and !rhvCon then roi_avg else na;

Upper.SetDefaultColor(Color.GRAY);

Lower.SetDefaultColor(Color.GRAY);

UpLo2.SetDefaultColor(Color.DARK_GRAY);

UpLo2.SetStyle(Curve.SHORT_DASH);

AssignPriceColor(if bull_imp then Color.CYAN else

if bear_imp then Color.MAGENTA else Color.CURRENT);

#-- END of CODE