jngy2k

Member

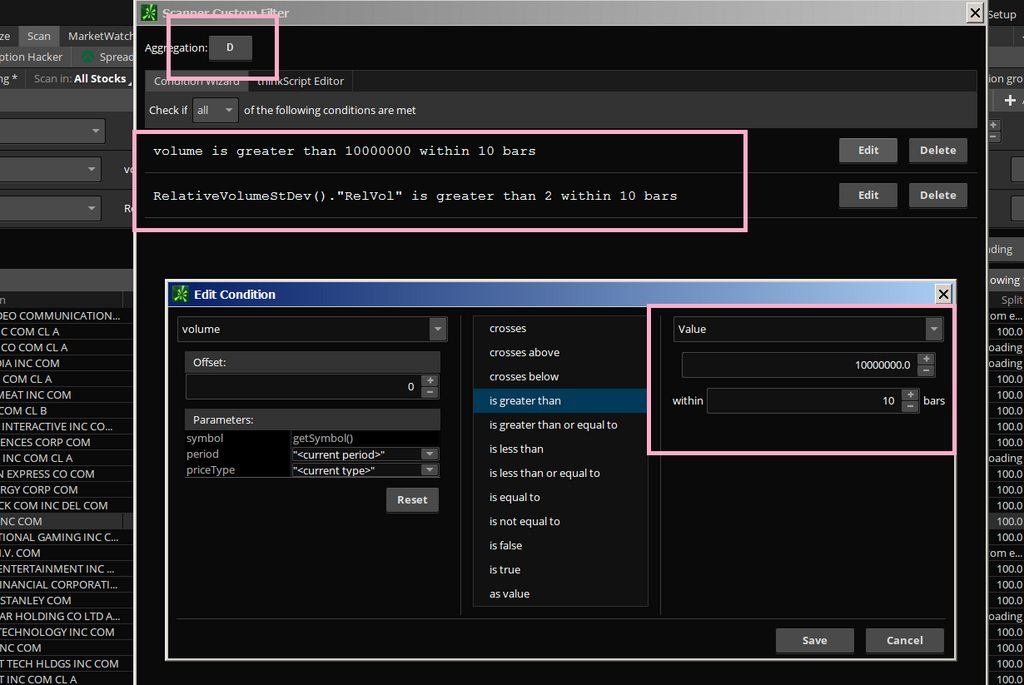

The scan is going to help me find momentum stocks based on volume stocks that traded above 10 million volume in one day with a higher relative volume on that day usually start trending. I'm looking for stocks that traded 10million volume IN ONE DAY within the past 10 days and not 10 million volume overall within 10 days.

The custom scan I come up with on TOS is below but not sure if it is operating correctly then I would like to scan those stocks that traded 10M volume in one of the Days out of 10 days to have had above relative volume st dv. > 2. for the day it traded above 10 million volume.

thoughts + suggestions ???

The custom scan I come up with on TOS is below but not sure if it is operating correctly then I would like to scan those stocks that traded 10M volume in one of the Days out of 10 days to have had above relative volume st dv. > 2. for the day it traded above 10 million volume.

thoughts + suggestions ???

Last edited: