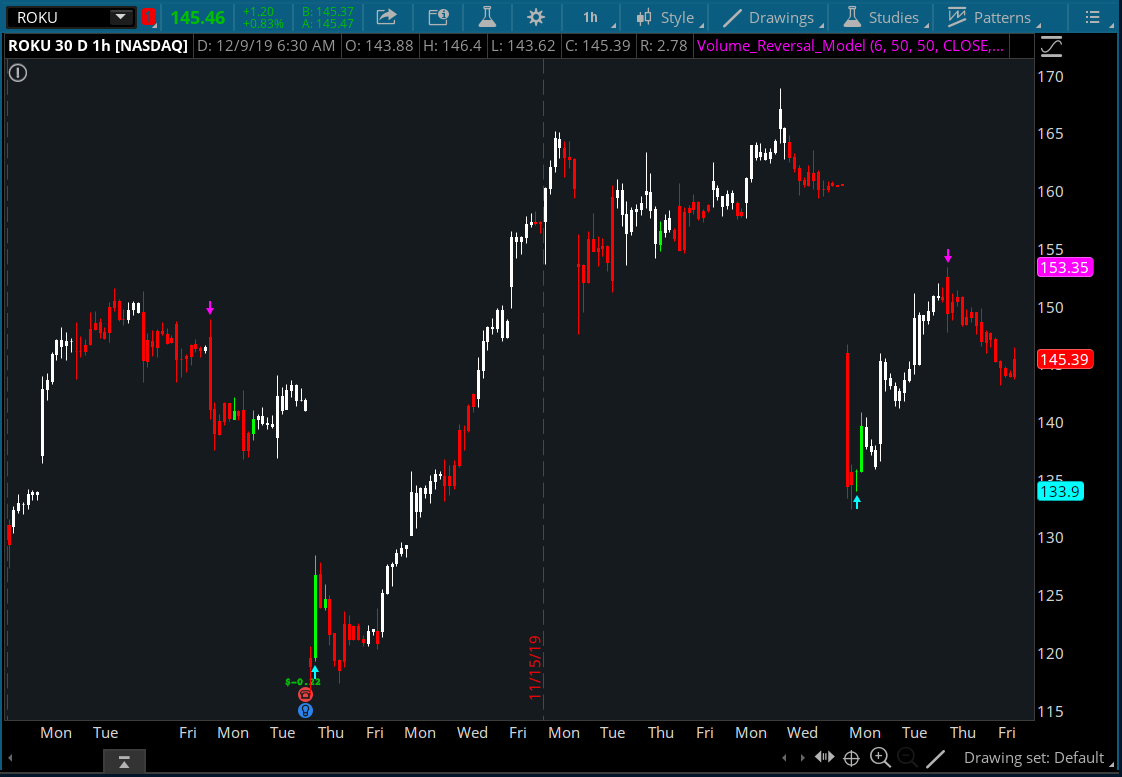

Here's a "nice model of volume" with reversal signals in arrows and current trend painted as color candles.

Brought to you by @diazlaz

Brought to you by @diazlaz

thinkScript Code

Code:

#Volume Game (vg) by RafaelZioni

#Original Port from https://www.tradingview.com/script/55gajSsI-volume-game/

#

# 2019.11.23 1.0 @diazlaz - Original Port

# https://usethinkscript.com/threads/volume-reversal-model-for-thinkorswim.1248/

#declare zerobase;

input RSIlength = 6; #RSI Period Length

input RSIoverSold = 50;

input RSIoverBought = 50;

input price = close;

#///////////// RSI

def vrsi = RSI(RSIlength, RSIoverBought, RSIoverSold, price);

#///////////// Bollinger Bands

input BBlength = 200; #Bollinger Period Length

input BBmult = 2; #Bollinger Bands Standard Deviation

def BBbasis = Average(price, BBlength);

def BBdev = BBmult * StDev(price, BBlength);

def BBupper = BBbasis + BBdev;

def BBlower = BBbasis - BBdev;

def source = close;

def buyEntry = Crosses(source, BBlower, CrossingDirection.ABOVE);

def sellEntry = Crosses(source, BBupper, CrossingDirection.BELOW);

input window1 = 8; #lookback window 1

input window2 = 21; #lookback window 2

def top1 = If(high >= Highest(high, window1), high, 0);

def bot1 = If(low <= Lowest(low, window1), low, 0);

def top2 = If(high >= Highest(high, window2), high, 0);

def bot2 = If(low <= Lowest(low, window2), low, 0);

input length = 9; #length

def avrg = Average(volume,length);

def vold1 = volume >= avrg * 1.5 and close < open;

def vold2 = volume >= avrg * 0.5 and volume <= avrg * 1.5 and close < open;

def vold3 = volume < avrg * 0.5 and close < open and volume >= avrg * 1.4;

def volu1 = volume >= avrg * 1.5 and close > open;

def volu2 = volume >= avrg * 0.6 and close > open;

def volu3 = volume < avrg * 0.5 and close > open;

def src = close;

#net volume of positive and negative volume

def nv = if (src - src[1]) > 0 then volume else

if (src - src[1]) < 0 then -volume else 0 * volume;

def cnv = TotalSum(nv); #cumulative net volume

def cnv_tb = cnv - Average(cnv,15); #normalized 15 bars moving average

input window_len = 28; #Window length

input v_len = 14; #V smooth length

def price_spread = stdev(high-low, window_len);

def v = cnv - Average(cnv,15);

def smooth = Average(v, v_len);

def v_spread = stdev(v - smooth, window_len);

def shadow = (v - smooth) / v_spread * price_spread;

def out = if shadow > 0 then high + shadow else low + shadow;

def down = out < close and Crosses(out, top1, CrossingDirection.BELOW) and vold1;

def up1 = out > close and volu2 and vrsi < RSIoverSold;

def down1= out < close and vold1;

def down2= out < close;

def up = out > close and Crosses(out, bot2, CrossingDirection.ABOVE);

plot pDown = if down then high else Double.NaN;

pDown.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

pDown.SetLineWeight(1);

pDown.AssignValueColor(COLOR.MAGENTA);

#plot pDown1 = if down2 then high else Double.NaN;

#pDown1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

#pDown1.SetLineWeight(1);

#pDown1.AssignValueColor(COLOR.ORANGE);

plot pUp = if up then low else Double.NaN;

pUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

pUp.SetLineWeight(1);

pUp.AssignValueColor(COLOR.CYAN);

#plot pUp1 = if up1 then low else Double.NaN;

#pUp1.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

#pUp1.SetLineWeight(1);

#pUp1.AssignValueColor(COLOR.BLUE);

assignPriceColor(if down2 then color.red else if Up1 then color.green else color.white);