germanburrito

Active member

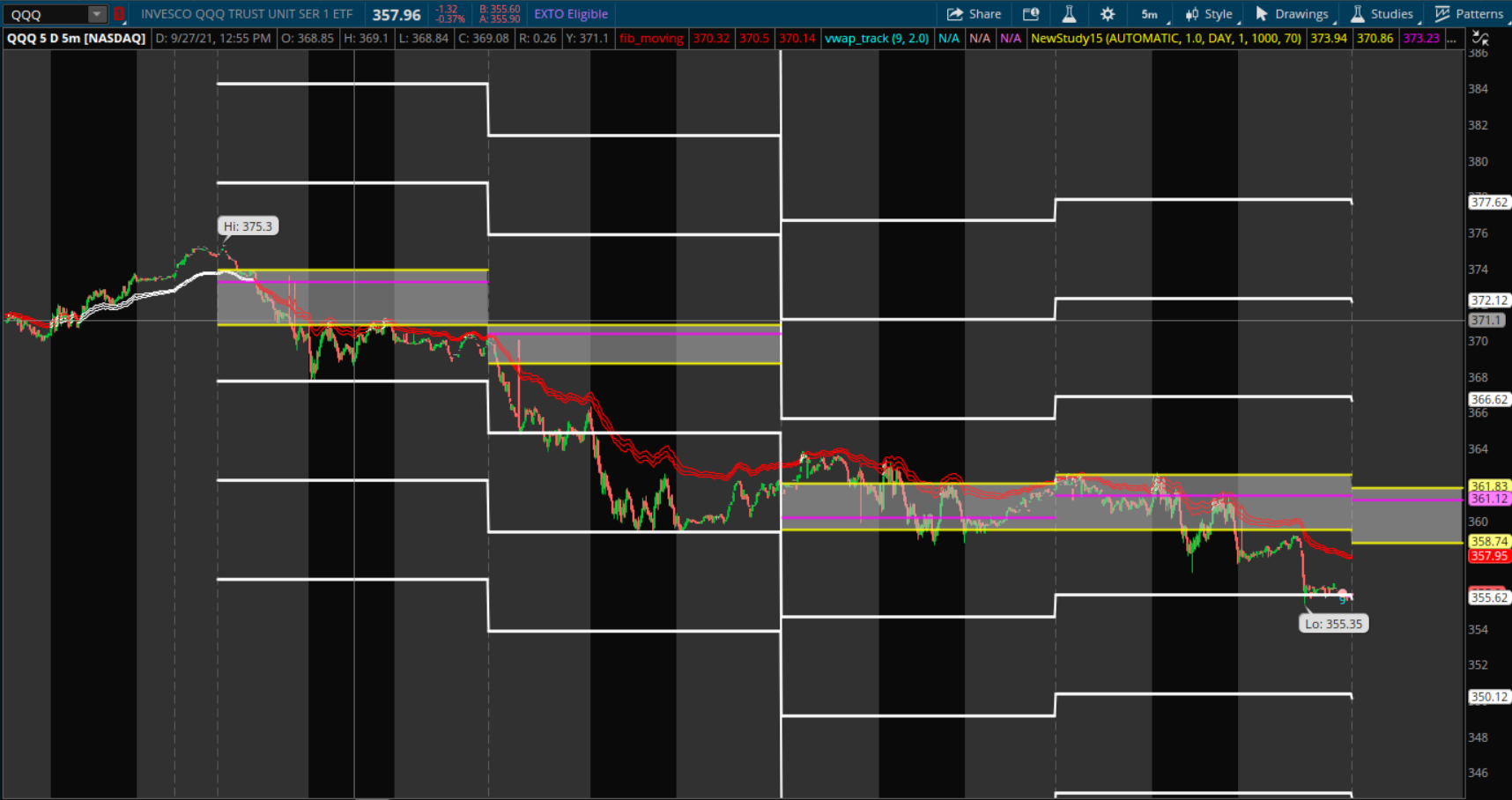

Volume Profile POC Plotted Forward ThinkOrSwim

I like this idea so here is this, I took a code I found in house and I added standard deviations to it, the problem is that is using the deviation from the whole chart not just the previous day, which I think might work better from experience. usually I would look at a weekly chart, for intraday movement, for weekly movement I would look at maybe a 20 day or 30 day that way you have a better idea of how much it has "deviated" thru out the month. let me know if you like this.

I like this idea so here is this, I took a code I found in house and I added standard deviations to it, the problem is that is using the deviation from the whole chart not just the previous day, which I think might work better from experience. usually I would look at a weekly chart, for intraday movement, for weekly movement I would look at maybe a 20 day or 30 day that way you have a better idea of how much it has "deviated" thru out the month. let me know if you like this.

Code:

#VolumeProfile_PreviousDay_displayed_NextDay

#20190426 Sleepyz

#20210712 Sleepyz - revised to add option for pricePerRowHeightMode rather than just automatic

input pricePerRowHeightMode = {default AUTOMATIC, TICKSIZE, CUSTOM};

input customRowHeight = 1.0;

def height;

switch (pricePerRowHeightMode) {

case AUTOMATIC:

height = PricePerRow.AUTOMATIC;

case TICKSIZE:

height = PricePerRow.TICKSIZE;

case CUSTOM:

height = customRowHeight;

}

input timePerProfile = {CHART, MINUTE, HOUR, default DAY, WEEK, MONTH, "OPT EXP", BAR};

input multiplier = 1;

input profiles = 1000;

input valueAreaPercent = 70;

def period;

def yyyymmdd = GetYYYYMMDD();

def seconds = SecondsFromTime(0);

def month = GetYear() * 12 + GetMonth();

def day_number = DaysFromDate(First(yyyymmdd)) + GetDayOfWeek(First(yyyymmdd));

def dom = GetDayOfMonth(yyyymmdd);

def dow = GetDayOfWeek(yyyymmdd - dom + 1);

def expthismonth = (if dow > 5 then 27 else 20) - dow;

def exp_opt = month + (dom > expthismonth);

switch (timePerProfile) {

case CHART:

period = 0;

case MINUTE:

period = Floor(seconds / 60 + day_number * 24 * 60);

case HOUR:

period = Floor(seconds / 3600 + day_number * 24);

case DAY:

period = CountTradingDays(Min(First(yyyymmdd), yyyymmdd), yyyymmdd) - 1;

case WEEK:

period = Floor(day_number / 7);

case MONTH:

period = Floor(month - First(month));

case "OPT EXP":

period = exp_opt - First(exp_opt);

case BAR:

period = BarNumber() - 1;

}

def count = CompoundValue(1, if period != period[1] then (count[1] + period - period[1]) % multiplier else count[1], 0);

def cond = count < count[1] + period - period[1];

profile vol = VolumeProfile("startNewProfile" = cond, "numberOfProfiles" = profiles, "pricePerRow" = height, "value area percent" = valueAreaPercent, onExpansion = no);

#Prior Day High/Low ValueAreas

def HVA = if IsNaN(vol.GetHighestValueArea()) then HVA[1] else vol.GetHighestValueArea();

def pHVA = CompoundValue(1, if cond then HVA[1] else pHVA[1], Double.NaN);

def LVA = if IsNaN(vol.GetLowestValueArea()) then LVA[1] else vol.GetLowestValueArea();

def pLVA = CompoundValue(1, if cond then LVA[1] else pLVA[1], Double.NaN);

plot PrevHVA = pHVA;

plot PrevLVA = pLVA;

PrevHVA.SetDefaultColor(Color.YELLOW);

PrevLVA.SetDefaultColor(Color.YELLOW);

PrevHVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevLVA.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

#Prior Day POC Calculated

def POC = if IsNaN(vol.GetPointOfControl()) and cond then POC[1] else vol.GetPointOfControl();

def pPOC = CompoundValue (1, if cond then POC[1] else pPOC[1], Double.NaN);

plot PrevPOC = pPOC;

PrevPOC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PrevPOC.SetDefaultColor(Color.MAGENTA);

def dev = StDevall(close);

plot dev1 = pPOC + dev * 1;

plot dev2 = pPOC - (dev * 1);

plot dev3 = pPOC + (dev * 2);

plot devN1 = pPOC - dev * 2;

plot devN2 = pPOC + (dev * 3);

plot devN3 = pPOC - (dev * 3);

dev1.SetDefaultColor(Color.WHITE);

dev2.SetDefaultColor(Color.WHITE);

dev3.SetDefaultColor(Color.WHITE);

devN1.SetDefaultColor(Color.WHITE);

devN2.SetDefaultColor(Color.WHITE);

devN3.SetDefaultColor(Color.WHITE);

addcloud(PrevHVA , PrevlVA , color.LIGHT_GRAY);

Last edited by a moderator: