Volatility Ratio Indicator & Scan

Provides a quick and easy way to gauge the relative strength of the current price compared to the recent trend, allowing traders to identify potential entry and exit points based on whether the price is significantly above or below the moving average, indicating potential overbought or oversold conditions and possible trend reversals.

A higher ratio (price significantly above the moving average) suggests a strong uptrend, while a lower ratio (price significantly below the moving average) indicates a downtrend.

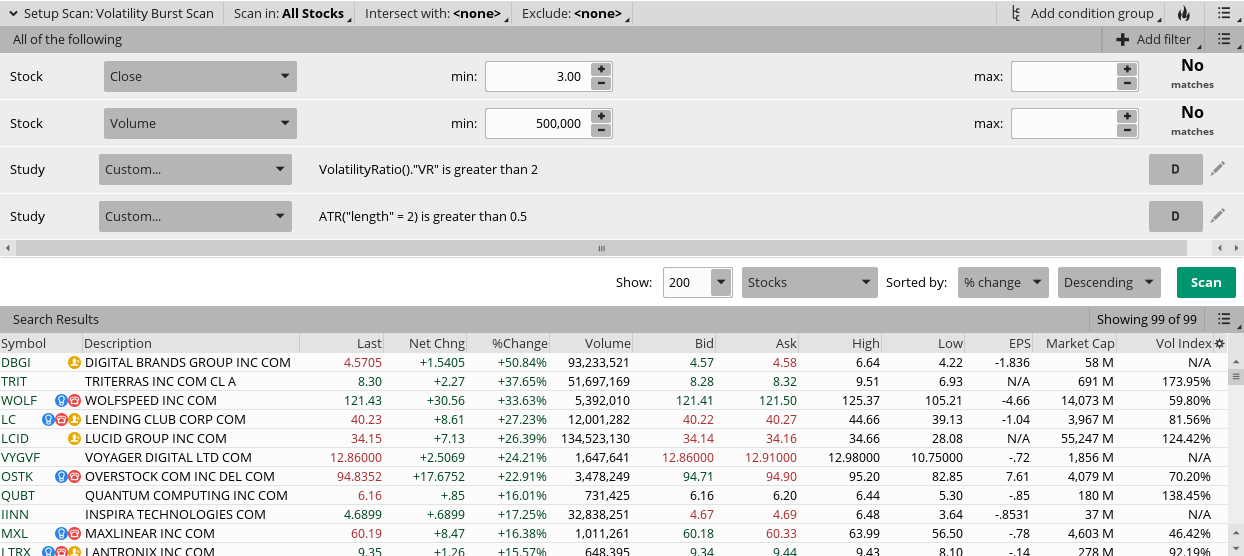

Here's a good scan I made:

http://tos.mx/IuRFsgv

To use the above scan, first load this script into your library. Name it: Volatility Ratio

http://tos.mx/nvDXYsK

Provides a quick and easy way to gauge the relative strength of the current price compared to the recent trend, allowing traders to identify potential entry and exit points based on whether the price is significantly above or below the moving average, indicating potential overbought or oversold conditions and possible trend reversals.

A higher ratio (price significantly above the moving average) suggests a strong uptrend, while a lower ratio (price significantly below the moving average) indicates a downtrend.

Here's a good scan I made:

http://tos.mx/IuRFsgv

To use the above scan, first load this script into your library. Name it: Volatility Ratio

http://tos.mx/nvDXYsK

Ruby:

declare lower;

input length = 14;

input signal = .6;

def truehigh = Max(high, close[1]);

def truelow = Min(low, close[1]);

def TTR = truehigh - truelow;

def ATR = MovingAverage(averagetype.WILDERS, TTR, length);

plot VR = TTR / ATR;

VR.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

VR.AssignValueColor(if VR >= signal then Color.GREEN else Color.LIGHT_RED);

plot zeroline = 0;

zeroline.SetDefaultColor(Color.GRAY);

plot sigline = signal;

sigline.SetDefaultColor(Color.LIME);

plot widerangeline = 2;

widerangeline.SetDefaultColor(Color.CYAN);

Last edited by a moderator: