netarchitech

Well-known member

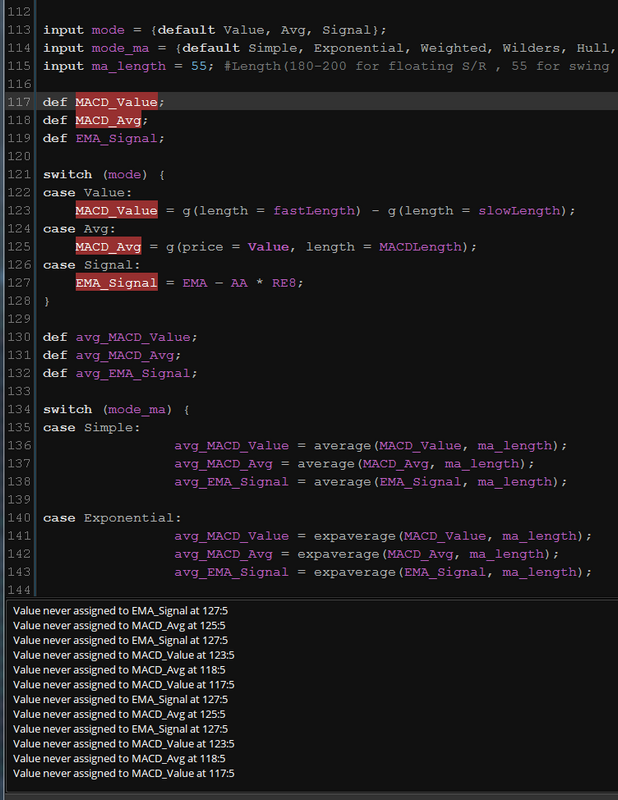

Given the following:

Below is the previous code I was trying...The compiler didn't complain, but the code didn't interact with the studies either:

I've tried everything I can think of, searched here and across the internet, but I can't find the answer...Any help/pointers in the right direction would be greatly appreciated

Thanks in advance...

Code:

input mode = {default Value, Avg, Signal};

input mode_ma = {default Simple, Exponential, Weighted, Wilders, Hull, EHMA, THMA};

input ma_length = 55; #Length(180-200 for floating S/R , 55 for swing entry)

def MACD_Value;

def MACD_Avg;

def EMA_Signal;

switch (mode) {

case Value:

MACD_Value = g(length = fastLength) - g(length = slowLength);

case Avg:

MACD_Avg = g(price = Value, length = MACDLength);

case Signal:

EMA_Signal = EMA – AA * RE8;

}

def avg_MACD_Value;

def avg_MACD_Avg;

def avg_EMA_Signal;

switch (mode_ma) {

case Simple:

avg_MACD_Value = average(MACD_Value, ma_length);

avg_MACD_Avg = average(MACD_Avg, ma_length);

avg_EMA_Signal = average(EMA_Signal, ma_length);

case Exponential:

avg_MACD_Value = expaverage(MACD_Value, ma_length);

avg_MACD_Avg = expaverage(MACD_Avg, ma_length);

avg_EMA_Signal = expaverage(EMA_Signal, ma_length);

case Weighted:

avg_MACD_Value = wma(MACD_Value, ma_length);

avg_MACD_Avg = wma(MACD_Avg, ma_length);

avg_EMA_Signal = wma(EMA_Signal, ma_length);

case Wilders:

avg_MACD_Value = wildersaverage(MACD_Value, ma_length);

avg_MACD_Avg = wildersaverage(MACD_Avg, ma_length);

avg_EMA_Signal = wildersaverage(EMA_Signal, ma_length);

case Hull:

avg_MACD_Value = wma(2 * wma(MACD_Value, ma_length / 2) - wma(MACD_Value, ma_length), round(sqrt(ma_length)));

avg_MACD_Avg = wma(2 * wma(MACD_Avg, ma_length / 2) - wma(MACD_Avg, ma_length), round(sqrt(ma_length)));

avg_EMA_Signal = wma(2 * wma(EMA_Signal, ma_length / 2) - wma(EMA_Signal, ma_length), round(sqrt(ma_length)));

case EHMA:

avg_MACD_Value = expaverage(2 * expaverage(MACD_Value, ma_length / 2) - expaverage(MACD_Value, ma_length), round(sqrt(ma_length)));

avg_MACD_Avg = expaverage(2 * expaverage(MACD_Avg, ma_length / 2) - expaverage(MACD_Avg, ma_length), round(sqrt(ma_length)));

avg_EMA_Signal = expaverage(2 * expaverage(EMA_Signal, ma_length / 2) - expaverage(EMA_Signal, ma_length), round(sqrt(ma_length)));

case THMA:

avg_MACD_Value = wma(wma(MACD_Value,(ma_length/2) / 3) * 3 - wma(MACD_Value, (ma_length/2) / 2) - wma(MACD_Value, (ma_length/2)), (ma_length/2));

avg_MACD_Avg = wma(wma(MACD_Avg,(ma_length/2) / 3) * 3 - wma(MACD_Avg, (ma_length/2) / 2) - wma(MACD_Avg, (ma_length/2)), (ma_length/2));

avg_EMA_Signal = wma(wma(EMA_Signal,(ma_length/2) / 3) * 3 - wma(EMA_Signal, (ma_length/2) / 2) - wma(EMA_Signal, (ma_length/2)), (ma_length/2));

}

;Below is the previous code I was trying...The compiler didn't complain, but the code didn't interact with the studies either:

Code:

input modeswitch = {default "Value", "Avg", "Diff", "Signal", "EMA"};

input modeSwitch_ma = {default "Simple", "Exponential", "Weighted", "Wilders", "Hull", "EHMA", "THMA"};

input ma_length = 55; #Length(180-200 for floating S/R , 55 for swing entry)

def ma_calc;

switch (modeSwitch) {

case "Value":

ma_calc = g(length = fastLength) - g(length = slowLength);

case "Avg":

ma_calc = g(price = Value, length = MACDLength);

case "Diff":

ma_calc = Value - Avg;

case "Signal":

ma_calc = EMA – AA * RE8;

case "EMA":

ma_calc = AA * Close + CC * EMA[1];

}

;

def multi_ma;

switch (modeSwitch_ma) {

case "Simple":

multi_ma = average(ma_calc, ma_length);

case "Exponential":

multi_ma = expaverage(ma_calc, ma_length);

case "Weighted":

multi_ma = wma(ma_calc, ma_length);

case "Wilders":

multi_ma = wildersaverage(ma_calc, ma_length);

case "Hull":

multi_ma = wma(2 * wma(ma_calc, ma_length / 2) - wma(ma_calc, ma_length), round(sqrt(ma_length)));

case "EHMA":

multi_ma = expaverage(2 * expaverage(ma_calc, ma_length / 2) - expaverage(ma_calc, ma_length), round(sqrt(ma_length)));

case "THMA":

multi_ma = wma(wma(ma_calc,(ma_length/2) / 3) * 3 - wma(ma_calc, (ma_length/2) / 2) - wma(ma_calc, (ma_length/2)), (ma_length/2));

}

;I've tried everything I can think of, searched here and across the internet, but I can't find the answer...Any help/pointers in the right direction would be greatly appreciated

Thanks in advance...

Last edited by a moderator: