confluence905

New member

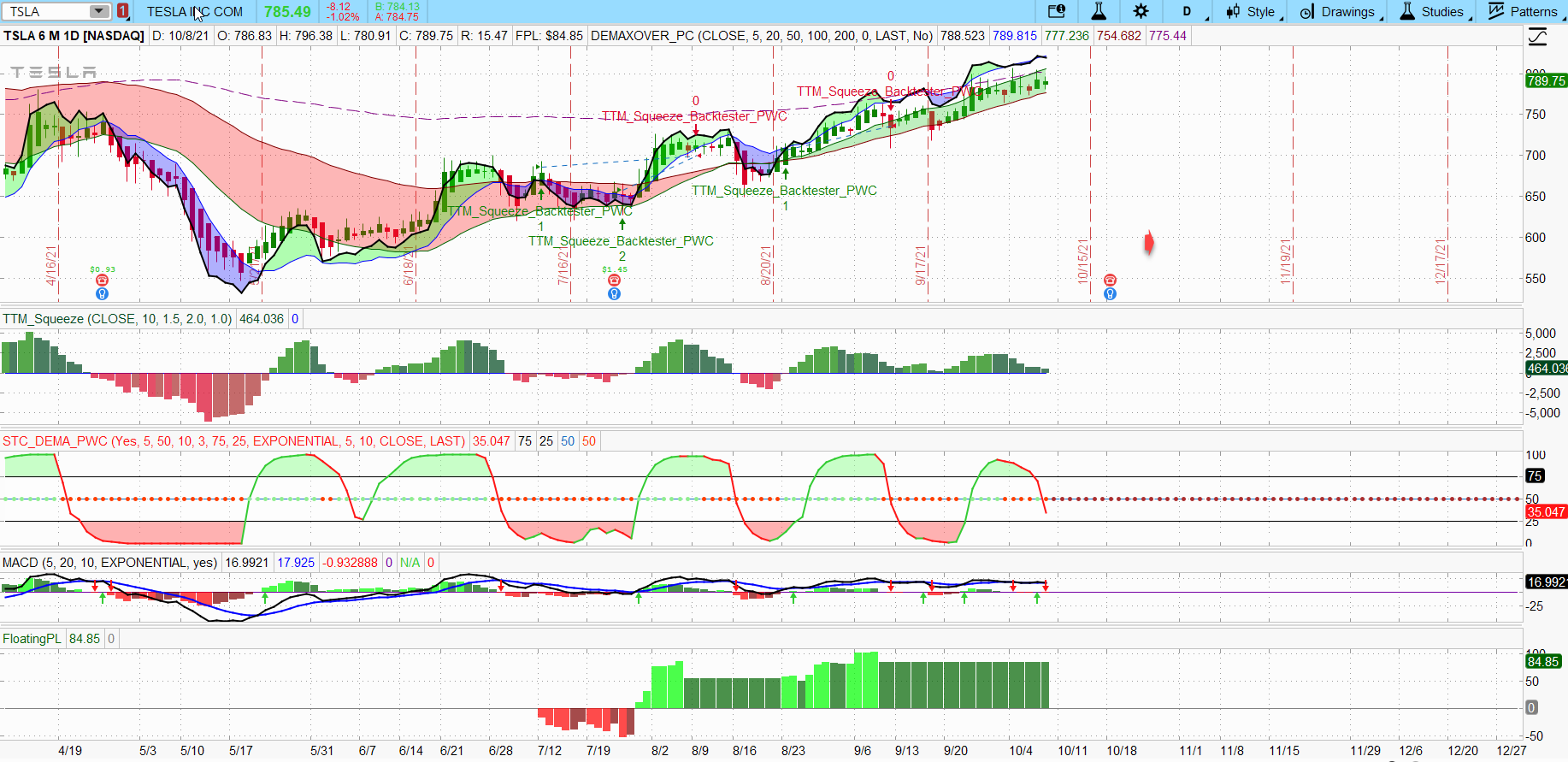

I trying to combine the TTM Squeeze and Schaff Trend Cycle (STC) as a trading strategy in TOS but having some trouble getting the bullish signal to align with the TTM squeeze and STC.

Ruby:

#Position

input Shares = 5;

input Gain = 0.03;

#TTM Squeeze parameters

input length = 10;

input nk = 1.5;

input nBB = 2.0;

#MACD, TTM, STC Parameters

input fastLength = 5;

input medLength = 20;

input slowLength = 50;

#STC Parameters

input KPeriod = 10;

input DPeriod = 3;

#Studies

def TTM = TTM_Squeeze(close, length, nk, nBB).histogram;

def squeeze = TTM_Squeeze(close, length, nk, nBB).SqueezeAlert;

def STC = schaffTrendCycle(fastLength, slowLength, KPeriod, DPeriod);

#def MAC = MACD(fastLength, medLength, length);

#Bullish Signals

#def MACBullish = if MAC > MAC[1] and MAC[1] < MAC[2] then 1 else 0;

def STCBullish = if STC < 25 and STC > STC[1] and STC[1] < STC[2] then 1 else 0;

def TTMBullish = if TTM < Squeeze and TTM > TTM[1] and TTM[1] < TTM[2] then 1 else 0;

def Bullish = if STCBullish == 1 and TTMBullish ==1 then 1 else 0;

#Bearish Signals

#def MACBearish = if MAC < MAC[1] and MAC[1] > MAC[2] then 1 else 0;

def STCBearish = if STC > 75 and STC < STC[1] and STC[1] > STC[2] then 1 else 0;

def TTMBearish = if TTM > squeeze and TTM < TTM[1] and TTM[1] >= TTM[2] then 1 else 0;

def Bearish = if STCBearish == 1 then 1 else 0;

#Combined

def BullishSignal = Bullish == 1;

def BearishSignal = Bearish == 1;

#Exit Trade

def exitBullishTrade = if Bearish == 1 then 1 else 0;

def exitBearishTrade = if Bullish == 1 then 1 else 0;

#Execute Bullish Buy and Sell

AddOrder(OrderType.BUY_TO_OPEN, BullishSignal, close, Shares);

AddOrder(OrderType.SELL_TO_CLOSE, high >= EntryPrice() + EntryPrice() * Gain, EntryPrice() + EntryPrice() * Gain, Shares);

AddOrder(OrderType.SELL_TO_CLOSE, exitBullishTrade, close, Shares);

#Execute Bearish Buy and Sell

#AddOrder(OrderType.SELL_TO_OPEN, BearishSignal, close, Shares);

#AddOrder(OrderType.BUY_TO_CLOSE, low <= EntryPrice() - (EntryPrice() * Gain), EntryPrice() - (EntryPrice() * Gain), Shares);

#AddOrder(OrderType.BUY_TO_CLOSE, exitBearishTrade, close, Shares);

Last edited by a moderator: