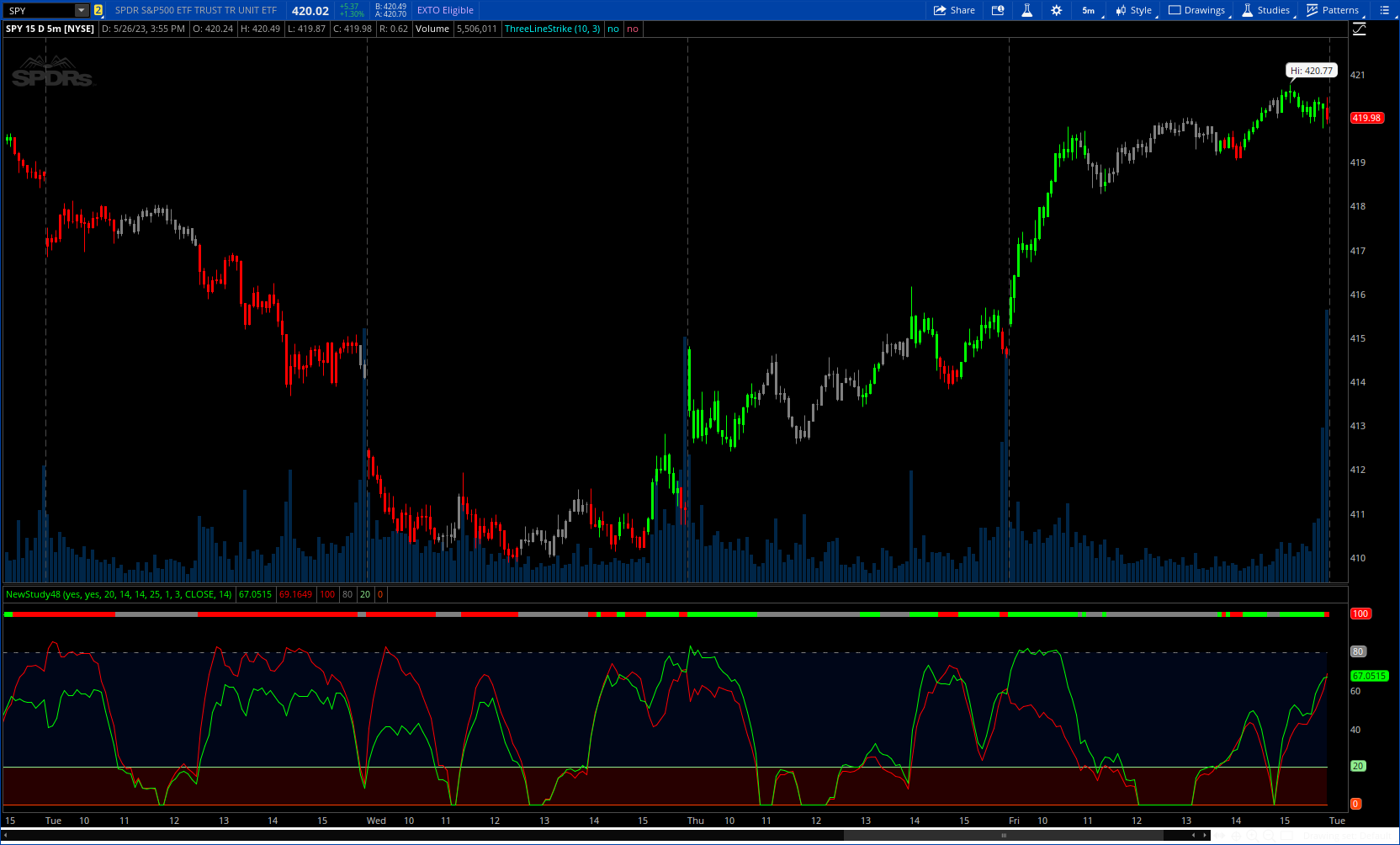

The True Trend oscillator identifies trending or ranging markets with a stochastic ATR and RSI.

CODE:

CSS:

#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © wbburgin

#indicator("True Trend Oscillator [wbburgin]",overlay=false)

# converted and mod by Sam2Cok@Samer800 - 05/2023

declare lower;

input colorBars = yes;

input ShowTrendLinw = yes;

input RangeThreshold = 20; # "A higher threshold will identify more ranges but will be slower at catching the trend"

input atrLength = 14; # "ATR Length"

input lengthStoch = 14; # "Stochastic Length"

input Lookback = 25; # "The number of bars used for the estimation of the rational quadratic kernel"

input RelativeWeighting = 1; # "Relative Weighting"

input StochasticSmoothing = 3; # "Stochastic Smoothing"

input rsiSource = close; # "RSI Source"

input rsiLength = 14; # "RSI Length"

def na = Double.NaN;

def last = isNaN(close);

def threshold = min(max(RangeThreshold, 0), 100);

#stochatr(src,smoothK,lookback,weighting,lengthStoch)=>

script stochatr {

input atrSrc = 1;

input smoothK = 3;

input lookback = 25;

input weighting = 1;

input lengthStoch = 14;

def lowest_k = Lowest(atrSrc, lengthStoch);

def c1 = atrSrc - lowest_k;

def c2 = Highest(atrSrc, lengthStoch) - lowest_k;

def fastK = if c2 != 0 then c1 / c2 * 100 else 0;

def _src = fastK;

def size = smoothK-1;

def currentWeight = fold i = 0 to size + smoothK with p do

p + _src[i] * Power(1 + (Power(i, 2) / ((Power(lookback, 2) * 2 * weighting))), - weighting);

def cumulativeWeight = fold j = 0 to size + smoothK with q do

q + Power(1 + (Power(j, 2) / ((Power(lookback, 2) * 2 * weighting))), - weighting);

def yhat = currentWeight / cumulativeWeight;

plot out = yhat;

}

def tr = TrueRange(high, close, low);

def atrSrc = WildersAverage(tr, atrLength);

def k = stochatr(atrSrc, StochasticSmoothing, Lookback, RelativeWeighting, lengthStoch);

def nRSI = RSI(Price = rsiSource, Length = rsiLength);

def bull = Sqrt(nRSI * k);

def bear = Sqrt((100 - nRSI) * k);

def dir = min(bull,bear);

def col = if (bull > bear and dir > threshold) then 1 else

if (bear > bull and dir > threshold) then -1 else 0;

plot bullTrend = bull; # "Bull Trend"

plot bearTrend = bear; # "Bear Trend"

bullTrend.SetDefaultColor(Color.GREEN);

bearTrend.SetDefaultColor(Color.RED);

plot trend = if last or !ShowTrendLinw then na else 100;

plot top = if last then na else 80;#

plot bottom = if last then na else threshold;

plot base = if last then na else 0;

trend.AssignValueColor(if col>0 then Color.GREEN else if col<0 then Color.RED else Color.GRAY);

trend.SetPaintingStrategy(PaintingStrategy.LINE_VS_SQUARES);

bottom.SetDefaultColor(Color.LIGHT_GREEN);

base.SetDefaultColor(Color.LIGHT_RED);

top.SetStyle(Curve.SHORT_DASH);

top.SetDefaultColor(Color.GRAY);

#-- cloud and BarColor

AddCloud(top, bottom, CreateColor(0, 21, 80), CreateColor(0, 21, 80));

AddCloud(bottom, base, Color.DARK_RED, Color.DARK_RED);

AssignPriceColor(if !colorBars then Color.CURRENT else

if col>0 then Color.GREEN else if col<0 then Color.RED else Color.GRAY);

#-- END of CODE