germanburrito

Active member

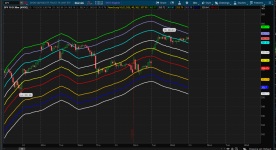

This is my version of the true center band indicator. you guys have been great to me. Improvements are encouraged and welcome.

Code:

input price = close;

input length = 40;

def displacement = (length);

def dPrice = price[displacement];

def tmp = if !IsNaN(dPrice) then Average(dPrice, AbsValue(length)) else tmp[1] + (tmp[1] - tmp

[2]);

def tmp1 = if !IsNaN(price) then tmp else Double.NaN;

plot Data = tmp1;

Data.SetDefaultColor(color.yellow );

def pct=100;

input width=50;

def d=width/pct;

def d1=2*d;

def d25=1.07*d;

def d2=1.15*d;

def d3=1.618*d;

def d4=.47*d;

def stdDeviation = Highestall("data" = AbsValue(tmp1 - price));

plot UpperLine = tmp1 + stdDeviation*d1;

plot LowerLine = tmp1 - stdDeviation*d1;

plot UpperLine1 = tmp1 + stdDeviation*d25;

plot LowerLine1 = tmp1 - stdDeviation*d2;

plot UpperLine2 = tmp1 + stdDeviation*d3;

plot LowerLine2 = tmp1 - stdDeviation*d3;

plot UpperLine4 = tmp1 + stdDeviation*d4;

plot LowerLine4 = tmp1 - stdDeviation*d4;

UpperLine.SetDefaultColor(color.Green);

UpperLine1.SetDefaultColor(color.cyan);

UpperLine2.SetDefaultColor(color.violet);

LowerLine.SetDefaultColor(color.white );

LowerLine1.SetDefaultColor(color.orange );

LowerLine2.SetDefaultColor(color.blue );

LowerLine4.SetDefaultColor(color.light_RED );

LowerLine4.SetDefaultColor(color.red );

data.setDefaultColor(color.YEllow);

upperline.SetLineWeight(2);

upperline1.SetLineWeight(2);

upperline2.SetLineWeight(2);

upperline4.SetLineWeight(2);

upperline.SetLineWeight(2);

lowerLine.setlineweight(2);

lowerLine1.setlineweight(2);

lowerLine2.setlineweight(2);

lowerLine4.setlineweight(2);

Data.setlineweight(2);Attachments

Last edited by a moderator: