Author Message:

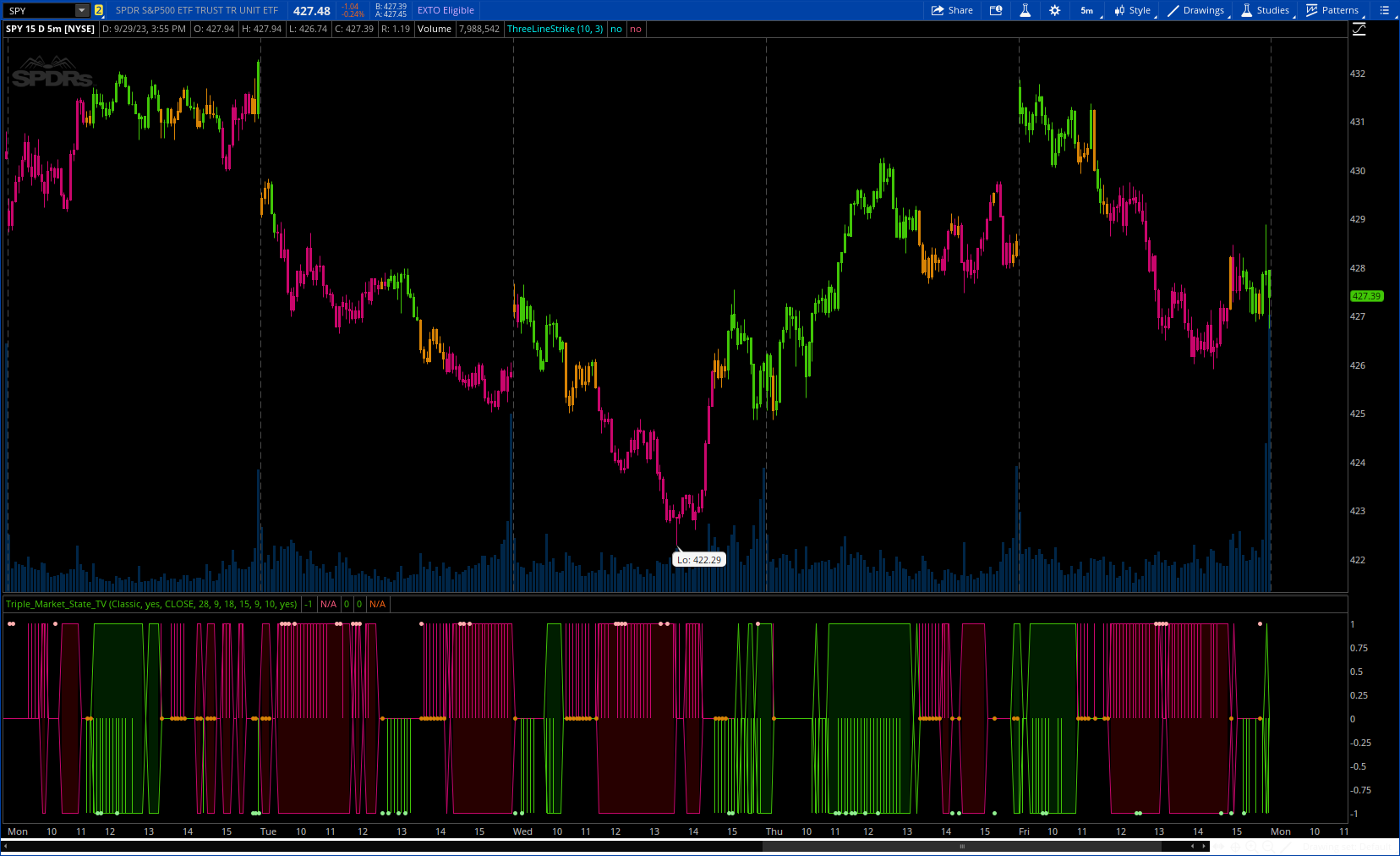

Clear trend identification is an important aspect of finding the right side to trade, another is getting the best buying/selling price on a pullback, retracement or reversal. Triple Ehlers Market State can do both.

More Info : https://www.tradingview.com/v/6vcvpsLs/

CODE:

CSS:

# https://www.tradingview.com/v/6vcvpsLs/

#// This source code is subject to the terms of the Mozilla Public License 2.0 at

#//@Woody_Bearbash

#indicator('Triple Market State', 'Triple MS', false, format.price, 2)

# Converted by Sam4Cok@Samer800 - 09/2023

declare lower;

input Theme = {default "Classic", "Night", "Mono"};

input BarColoring = yes; # 'Bar coloring'

input source = close; # 'Source'

input SlowPeriod = 28; # 'Slow Period'

input SlowThreshold = 9;

input MediumPeriod = 18; # 'Medium Period'

input MediumThreshold = 15;

input FastPeriod = 9; # 'Fast Period'

input FastThreshold = 10;

input RecentTrendWeighting = yes; # "Shows on bars ONLY"

def na = Double.NaN;

def last = isNaN(close);

def M1 = Theme == Theme."Classic";

def M2 = Theme == Theme."Night";

def M3 = Theme == Theme."Mono";

def up_ = if M1 then 1 else if M2 then 2 else 3;

def dn_ = if M1 then -1 else if M2 then -2 else -3;

def md_ = if M1 then 11 else if M2 then 22 else 33;

DefineGlobalColor("bullc", CreateColor(65, 198, 7));

DefineGlobalColor("bearc", CreateColor(202, 6, 108));

DefineGlobalColor("consc", CreateColor(216, 131, 5));

DefineGlobalColor("dbullc", Color.DARK_GREEN);

DefineGlobalColor("dbearc", Color.DARK_RED);

DefineGlobalColor("bulla", CreateColor(205, 177, 78));

DefineGlobalColor("beara", CreateColor(192, 104, 227));

DefineGlobalColor("consa", CreateColor(46, 109, 128));

DefineGlobalColor("bullo", CreateColor(194, 189, 189));

DefineGlobalColor("bearo", CreateColor(49, 121, 245));

DefineGlobalColor("conso", CreateColor(216, 131, 5));

#// Functions ? ?

#cc(Series, Period) => // Correlation Cycle Function

script cc {

input Series = close;

input Perd = 14;

def PIx2 = 4.0 * ASin(1.0);

def len = Max(2, Perd);

def period = len;

def Rx = fold i = 0 to period with p do

p + Series[i];

def Ix = Rx;

def Rxx = fold i1 = 0 to period with p1 do

p1 + (Series[i1] * Series[i1]);

def Ixx = Rxx;

def Rxy = fold i2 = 0 to period with p2 do

p2 + (Series[i2] * Cos(PIx2 * i2 / period));

def Ixy = fold i3 = 0 to period with p3 do

p3 + (Series[i3] * -Sin(PIx2 * i3 / period));

def Ryy = fold i4 = 0 to period with p4 do

p4 + (Cos(PIx2 * i4 / period) * Cos(PIx2 * i4 / period));

def Iyy = fold i5 = 0 to period with p5 do

p5 + (-Sin(PIx2 * i5 / period) * -Sin(PIx2 * i5 / period));

def Ry = fold i6 = 0 to period with p6 do

p6 + (Cos(PIx2 * i6 / period));

def Iy = fold i7 = 0 to period with p7 do

p7 + (-Sin(PIx2 * i7 / period));

def real_1 = period * Rxx - Rx * Rx;

def real_2 = period * Ryy - Ry * Ry;

def real_3 = period * Rxy - Rx * Ry;

def realPart = if real_1 > 0.0 and real_2 > 0.0 then

(real_3) / Sqrt(real_1 * real_2) else realPart[1];

def imag_1 = period * Ixx - Ix * Ix;

def imag_2 = period * Iyy - Iy * Iy;

def imag_3 = period * Ixy - Ix * Iy;

def imagPart = if imag_1 > 0.0 and imag_2 > 0.0 then

(imag_3) / Sqrt(imag_1 * imag_2) else imagPart[1];

plot real = realPart;

plot imag = imagPart;

}

#cap(RealPart, ImaginaryPart) => // Correlation Angle Phasor Function

script cap {

input RealPart = 0;

input ImaginaryPart = 0;

def HALF_OF_PI = ASin(1.0);

def Rad = ATan(RealPart / ImaginaryPart) + HALF_OF_PI;

def DEG_IN_1_RADIAN = 90.0 / HALF_OF_PI;

def tempAngle = Rad * DEG_IN_1_RADIAN;

def angle;

def angle0 = if ImaginaryPart == 0.0 then 0.0 else tempAngle;

def angle1;

if ImaginaryPart > 0.0 {

angle1 = angle0 - 180.0;

} else {

angle1 = angle0;

}

angle = if angle1[1] > angle1 and angle1[1] - angle1 < 270.0 then

angle1[1] else angle1;

plot out = angle;

}

#mstate(Angle, Degrees) => // Market State Function

script mstate {

input Angle = close;

input Degrees = 45;

def thresholdInDegrees = Degrees;

def temp = AbsValue(Angle - Angle[1]) < thresholdInDegrees;

def state;

if Angle >= 0.0 and temp {

state = 1;

} else

if Angle < 0.0 and temp {

state = -1;

} else {

state = 0;#state[1];

}

plot out = state;

}

#// Correlation Cycle ? ?

def real1 = cc(source, SlowPeriod).real;

def imaginary1 = cc(source, SlowPeriod).imag;

def real2 = cc(source, MediumPeriod).real;

def imaginary2 = cc(source, MediumPeriod).imag;

def real3 = cc(source, FastPeriod).real;

def imaginary3 = cc(source, FastPeriod).imag;

#// Correlation Angle/Phasor ?

def angle1 = cap(real1, imaginary1);

def angle2 = cap(real2, imaginary2);

def angle3 = cap(real3, imaginary3);

#// Market State ?

def state1 = mstate(angle1, SlowThreshold);

def state2 = mstate(angle2, MediumThreshold);

def state3 = mstate(angle3, FastThreshold);

def colorMS1 = if state1 > 0.5 then up_ else

if state1 < -0.5 then dn_ else na;

def colorMS2 = if state2 > 0.5 then up_ else

if state2 < -0.5 then dn_ else na;

def colorMS3 = if state3 > 0.5 then up_ else

if state3 < -0.5 then dn_ else na;

def color1 = if state1 > 0.5 then up_ else

if state1 < -0.5 then dn_ else color1[1];

def color2 = if state2 > 0.5 then up_ else

if state2 < -0.5 then dn_ else color2[1];

def color3 = if state3 > 0.5 then up_ else

if state3 < -0.5 then dn_ else color3[1];

AddCloud(if colorMS1==1 then state1 else na, -state1,

GlobalColor("dbullc"), GlobalColor("dbullc"));

AddCloud(if colorMS1==2 then state1 else na, -state1,

GlobalColor("bulla"), GlobalColor("bulla"));

AddCloud(if colorMS1==3 then state1 else na, -state1,

GlobalColor("bullo"), GlobalColor("bullo"));

AddCloud(if colorMS1==-1 then state1 else na, -state1,

GlobalColor("dbearc"), GlobalColor("dbearc"));

AddCloud(if colorMS1==-2 then state1 else na, -state1,

GlobalColor("beara"), GlobalColor("beara"));

AddCloud(if colorMS1==-3 then state1 else na, -state1,

GlobalColor("bearo"), GlobalColor("bearo"));

plot Medium = if !last then -state2 else na; # 'State Medium'

plot Fast = if !last and state3 then -state3 else na; # 'State Fast'

Fast.SetLineWeight(2);

Medium.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Fast.SetPaintingStrategy(PaintingStrategy.POINTS);

Medium.AssignValueColor(if color2==1 then GlobalColor("bullc") else

if color2==2 then GlobalColor("bulla") else

if color2==3 then GlobalColor("bullo") else

if color2==-1 then GlobalColor("bearc") else

if color2==-2 then GlobalColor("beara") else

if color2==-3 then GlobalColor("bearo") else Color.GRAY);

Fast.AssignValueColor(if color3==1 then Color.LIGHT_GREEN else

if color3==2 then GlobalColor("bulla") else

if color3==3 then GlobalColor("bullo") else

if color3==-1 then Color.PINK else

if color3==-2 then GlobalColor("beara") else

if color3==-3 then GlobalColor("bearo") else Color.GRAY);

plot SlowUp = if !last then state1 else na; # 'State Slow'

plot SlowDn = if !last then -state1 else na; # 'State Slow'

SlowUp.AssignValueColor(if color1==1 then GlobalColor("bullc") else

if color1==2 then GlobalColor("bulla") else

if color1==3 then GlobalColor("bullo") else

if color1==-1 then GlobalColor("bearc") else

if color1==-2 then GlobalColor("beara") else

if color1==-3 then GlobalColor("bearo") else Color.GRAY);

SlowDn.AssignValueColor(if color1==1 then GlobalColor("bullc") else

if color1==2 then GlobalColor("bulla") else

if color1==3 then GlobalColor("bullo") else

if color1==-1 then GlobalColor("bearc") else

if color1==-2 then GlobalColor("beara") else

if color1==-3 then GlobalColor("bearo") else Color.GRAY);

#// Bar Gates ?

def trend_slo = if state1 > 0.5 then 1 else

if state1 < -0.5 then -1 else

if state1 < 0.5 and state1 > -0.5 then 2 else trend_slo[1];

def trend_med = if state2 > 0.5 then 1 else

if state2 < -0.5 then -1 else

if state2 < 0.5 and state2 > -0.5 then 2 else trend_med[1];

def trend_fas = if state3 > 0.5 then 1 else

if state3 < -0.5 then -1 else

if state3 < 0.5 and state3 > -0.5 then 2 else trend_fas[1];

def trend_double = if trend_slo == 1 and trend_med == 1 or

trend_slo == 1 and trend_fas == 1 or

trend_med == 1 and trend_fas == 1 then 1 else

if trend_slo == -1 and trend_med == -1 or

trend_slo == -1 and trend_fas == -1 or

trend_med == -1 and trend_fas == -1 then -1 else trend_double[1];

#/ Parliament arrays ?

def sig_up = (if trend_slo == 1 then 1 else 0) +

(if trend_med == 1 then 1 else 0) +

(if trend_fas == 1 then 1 else 0) +

(if trend_double == 1 and RecentTrendWeighting then 1 else 0);

def sigSum_up = sig_up;

def sig_dn = (if trend_slo == -1 then 1 else 0) +

(if trend_med == -1 then 1 else 0) +

(if trend_fas == -1 then 1 else 0) +

(if trend_double == -1 and RecentTrendWeighting then 1 else 0);

def sigSum_dn = sig_dn;

def mid_signal = sigSum_up == sigSum_dn;

plot Retracement = if mid_signal then 0 else na; # 'Retracement'

Retracement.SetLineWeight(2);

Retracement.SetPaintingStrategy(PaintingStrategy.POINTS);

Retracement.AssignValueColor(if md_==11 then GlobalColor("consc") else

if md_==22 then GlobalColor("consa") else

if md_==33 then GlobalColor("conso") else Color.GRAY);

def bar_col = if sigSum_up > sigSum_dn then up_ else

if sigSum_up < sigSum_dn then dn_ else md_;

AssignPriceColor(if !BarColoring then Color.CURRENT else

if bar_col==11 then GlobalColor("consc") else

if bar_col==22 then GlobalColor("consa") else

if bar_col==33 then GlobalColor("conso") else

if bar_col==1 then GlobalColor("bullc") else

if bar_col==2 then GlobalColor("bulla") else

if bar_col==3 then GlobalColor("bullo") else

if bar_col==-1 then GlobalColor("bearc") else

if bar_col==-2 then GlobalColor("beara") else

if bar_col==-3 then GlobalColor("bearo") else Color.GRAY);

#-- END of CODE