#CummulativeTick

#hint: The CumulativeTick indicator is designed to be run on a 20 day 5 minute chart of the /ES, /NQ, /TF, or /YM. Running the chart on other instruments may result in the loss of the average lines.

declare lower;

declare once_per_bar;

def openTime = 0930;

def pivot1 = 1030;

def pivot2 = 1200;

def pivot3 = 1330;

def pivot4 = 1500;

input closeTime = 1600;

def tickData = hlc3("$TICK");

rec CT = if GetDay() != GetDay()[1] then 0 else if SecondsTillTime(openTime) <= 0 and SecondsTillTime(closeTime) >= 0 then CT[1] + tickData else 0;

plot cumulativeTick = if !IsNaN(tickData) then CT else Double.NaN;

cumulativeTick.SetStyle(curve.POINTS);

plot zero = 0;

zero.SetDefaultColor(Color.WHITE);

zero.HideBubble();

zero.HideTitle();

cumulativeTick.AssignValueColor(if cumulativeTick < cumulativeTick [1] then Color.MAGENTA

else Color.CYAN);

cumulativeTick.SetLineWeight(1);

rec ticksAtPivot1 = if SecondsTillTime(pivot1) <= 0 and SecondsTillTime(pivot1)[1] > 0 then cumulativeTick else ticksAtPivot1[1];

rec ticksAtPivot2 = if SecondsTillTime(pivot2) <= 0 and SecondsTillTime(pivot2)[1] > 0 then cumulativeTick else ticksAtPivot2[1];

rec ticksAtPivot3 = if SecondsTillTime(pivot3) <= 0 and SecondsTillTime(pivot3)[1] > 0 then cumulativeTick else ticksAtPivot3[1];

rec ticksAtPivot4 = if SecondsTillTime(pivot4) <= 0 and SecondsTillTime(pivot4)[1] > 0 then cumulativeTick else ticksAtPivot4[1];

rec ticksAtClose = if SecondsTillTime(closeTime) <= 0 and SecondsTillTime(closeTime)[1] > 0 then cumulativeTick else ticksAtClose[1];

def positiveDay = if (SecondsTillTime(closeTime) <= 0 and SecondsTillTime(closeTime)[1] > 0) and cumulativeTick > 0 then 1 else 0;

def negativeDay = if SecondsTillTime(closeTime) <= 0 and SecondsTillTime(closeTime)[1] > 0 and cumulativeTick < 0 then 1 else 0;

def positiveDayTicksAtPivot1 = if positiveDay then ticksAtPivot1 else 0;

def positiveDayTicksAtPivot2 = if positiveDay then ticksAtPivot2 else 0;

def positiveDayTicksAtPivot3 = if positiveDay then ticksAtPivot3 else 0;

def positiveDayTicksAtPivot4 = if positiveDay then ticksAtPivot4 else 0;

def negativeDayTicksAtPivot1 = if negativeDay then ticksAtPivot1 else 0;

def negativeDayTicksAtPivot2 = if negativeDay then ticksAtPivot2 else 0;

def negativeDayTicksAtPivot3 = if negativeDay then ticksAtPivot3 else 0;

def negativeDayTicksAtPivot4 = if negativeDay then ticksAtPivot4 else 0;

rec totalPDTAP1 = if !IsNaN(cumulativeTick) then if positiveDay then totalPDTAP1[1] + positiveDayTicksAtPivot1 else totalPDTAP1[1] else totalPDTAP1[1];

rec totalPDTAP2 = if !IsNaN(cumulativeTick) then if positiveDay then totalPDTAP2[1] + positiveDayTicksAtPivot2 else totalPDTAP2[1] else totalPDTAP2[1];

rec totalPDTAP3 = if !IsNaN(cumulativeTick) then if positiveDay then totalPDTAP3[1] + positiveDayTicksAtPivot3 else totalPDTAP3[1] else totalPDTAP3[1];

rec totalPDTAP4 = if !IsNaN(cumulativeTick) then if positiveDay then totalPDTAP4[1] + positiveDayTicksAtPivot4 else totalPDTAP4[1] else totalPDTAP4[1];

rec totalNDTAP1 = if !IsNaN(cumulativeTick) then if negativeDay then totalNDTAP1[1] + negativeDayTicksAtPivot1 else totalNDTAP1[1] else totalNDTAP1[1];

rec totalNDTAP2 = if !IsNaN(cumulativeTick) then if negativeDay then totalNDTAP2[1] + negativeDayTicksAtPivot2 else totalNDTAP2[1] else totalNDTAP2[1];

rec totalNDTAP3 = if !IsNaN(cumulativeTick) then if negativeDay then totalNDTAP3[1] + negativeDayTicksAtPivot3 else totalNDTAP3[1] else totalNDTAP3[1];

rec totalNDTAP4 = if !IsNaN(cumulativeTick) then if negativeDay then totalNDTAP4[1] + negativeDayTicksAtPivot4 else totalNDTAP4[1] else totalNDTAP4[1];

rec positiveDays = if !IsNaN(cumulativeTick) then if positiveDay then positiveDays[1] + 1 else positiveDays[1] else positiveDays[1];

rec negativeDays = if !IsNaN(cumulativeTick) then if negativeDay then negativeDays[1] + 1 else negativeDays[1] else negativeDays[1];

plot avePosTickAtPivot1 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalPDTAP1 / positiveDays else Double.NaN);

plot avePosTickAtPivot2 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalPDTAP2 / positiveDays else Double.NaN);

plot avePosTickAtPivot3 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalPDTAP3 / positiveDays else Double.NaN);

plot avePosTickAtPivot4 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalPDTAP4 / positiveDays else Double.NaN);

plot aveNegTickAtPivot1 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalNDTAP1 / negativeDays else Double.NaN);

plot aveNegTickAtPivot2 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalNDTAP2 / negativeDays else Double.NaN);

plot aveNegTickAtPivot3 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalNDTAP3 / negativeDays else Double.NaN);

plot aveNegTickAtPivot4 = HighestAll(if IsNaN(close[-1]) and !IsNaN(close) then totalNDTAP4 / negativeDays else Double.NaN);

avePosTickAtPivot1.SetDefaultColor(Color.DARK_GRAY);

avePosTickAtPivot2.SetDefaultColor(Color.DARK_GRAY);

avePosTickAtPivot3.SetDefaultColor(Color.DARK_GRAY);

avePosTickAtPivot4.SetDefaultColor(Color.DARK_GRAY);

aveNegTickAtPivot1.SetDefaultColor(Color.DARK_GRAY);

aveNegTickAtPivot2.SetDefaultColor(Color.DARK_GRAY);

aveNegTickAtPivot3.SetDefaultColor(Color.DARK_GRAY);

aveNegTickAtPivot4.SetDefaultColor(Color.DARK_GRAY);

avePosTickAtPivot1.SetStyle(Curve.FIRM);

avePosTickAtPivot2.SetStyle(Curve.FIRM);

avePosTickAtPivot3.SetStyle(Curve.FIRM);

avePosTickAtPivot4.SetStyle(Curve.FIRM);

aveNegTickAtPivot1.SetStyle(Curve.FIRM);

aveNegTickAtPivot2.SetStyle(Curve.FIRM);

aveNegTickAtPivot3.SetStyle(Curve.FIRM);

aveNegTickAtPivot4.SetStyle(Curve.FIRM);

avePosTickAtPivot1.HideBubble();

avePosTickAtPivot2.HideBubble();

avePosTickAtPivot3.HideBubble();

avePosTickAtPivot4.HideBubble();

aveNegTickAtPivot1.HideBubble();

aveNegTickAtPivot2.HideBubble();

aveNegTickAtPivot3.HideBubble();

aveNegTickAtPivot4.HideBubble();

avePosTickAtPivot1.HideTitle();

avePosTickAtPivot2.HideTitle();

avePosTickAtPivot3.HideTitle();

avePosTickAtPivot4.HideTitle();

aveNegTickAtPivot1.HideTitle();

aveNegTickAtPivot2.HideTitle();

aveNegTickAtPivot3.HideTitle();

aveNegTickAtPivot4.HideTitle();

#AddChartBubble( SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), avePosTickAtPivot1, "+10:30", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), avePosTickAtPivot2, "+12:00", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), avePosTickAtPivot3, "+13:30", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), avePosTickAtPivot4, "+15:00", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), aveNegTickAtPivot1, "-10:30", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), aveNegTickAtPivot2, "-12:00", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), aveNegTickAtPivot3, "-13:30", Color.DARK_GRAY, yes);

#AddChartBubble(SecondsTillTime(openTime) == 0 and GetDay() == GetLastDay(), aveNegTickAtPivot4, "-15:00", Color.DARK_GRAY, yes);

AddVerticalLine(SecondsTillTime(openTime) == 0 or (GetDay() != GetDay()[1] and (SecondsTillTime(0000) > 0)), "", Color.GRAY, 1);

# AI Adds

def lastHP = if x == highestAll(xh)

then xh else lastHP[1];

def lastHP1 = if x == highestAll(xh1)

then xh1 else lastHP[1];

def lastLP = if x == highestAll(xl)

then xl else lastLP[1];

def lastLP1 = if x == highestAll(xl1)

then xl1 else lastLP1[1];

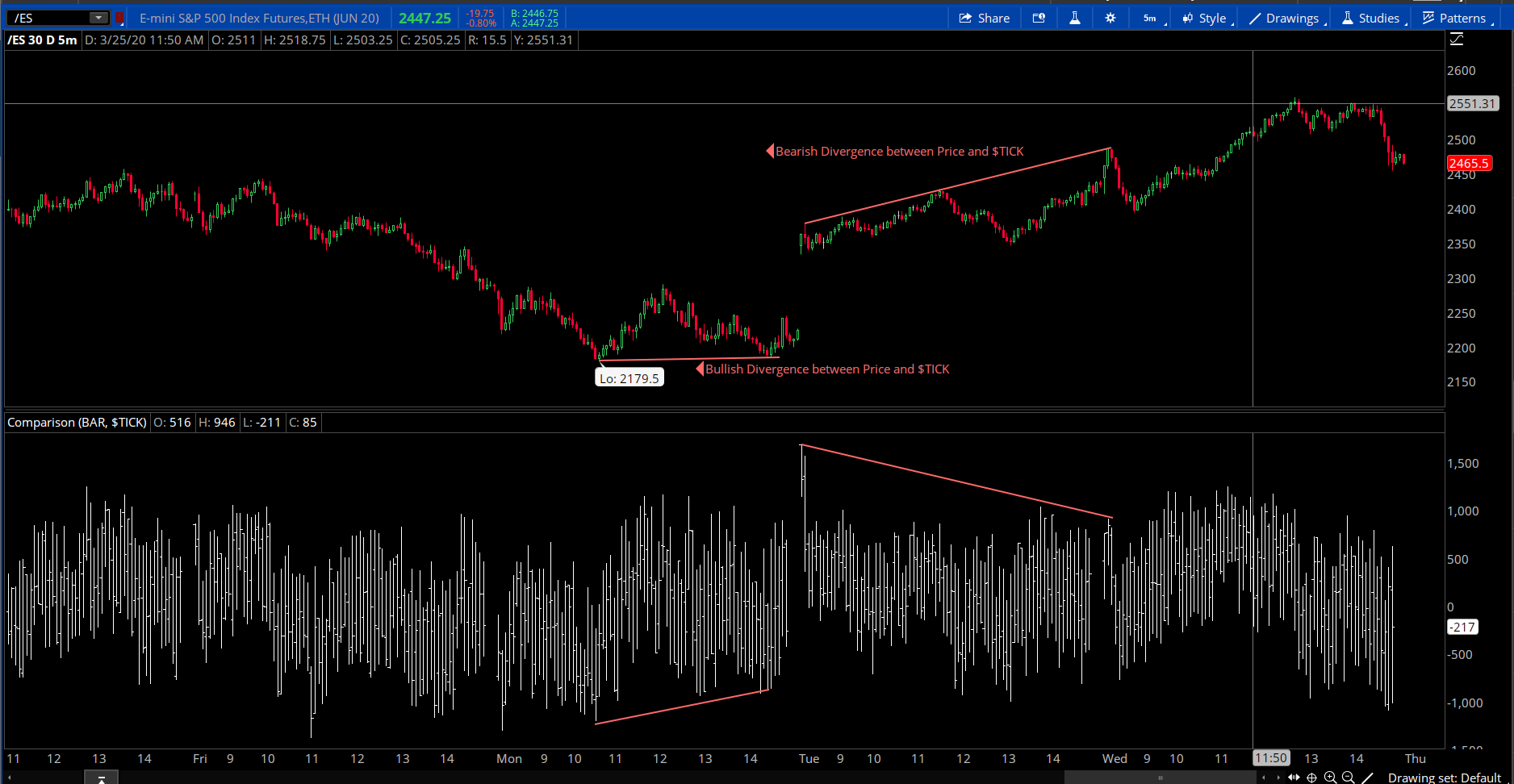

Addlabel(lastHP1<lastHP,"Divergent",color.red);

Addlabel(lastLP1>lastLP,"Divergent",color.green);