OGOptionSlayer

Well-known member

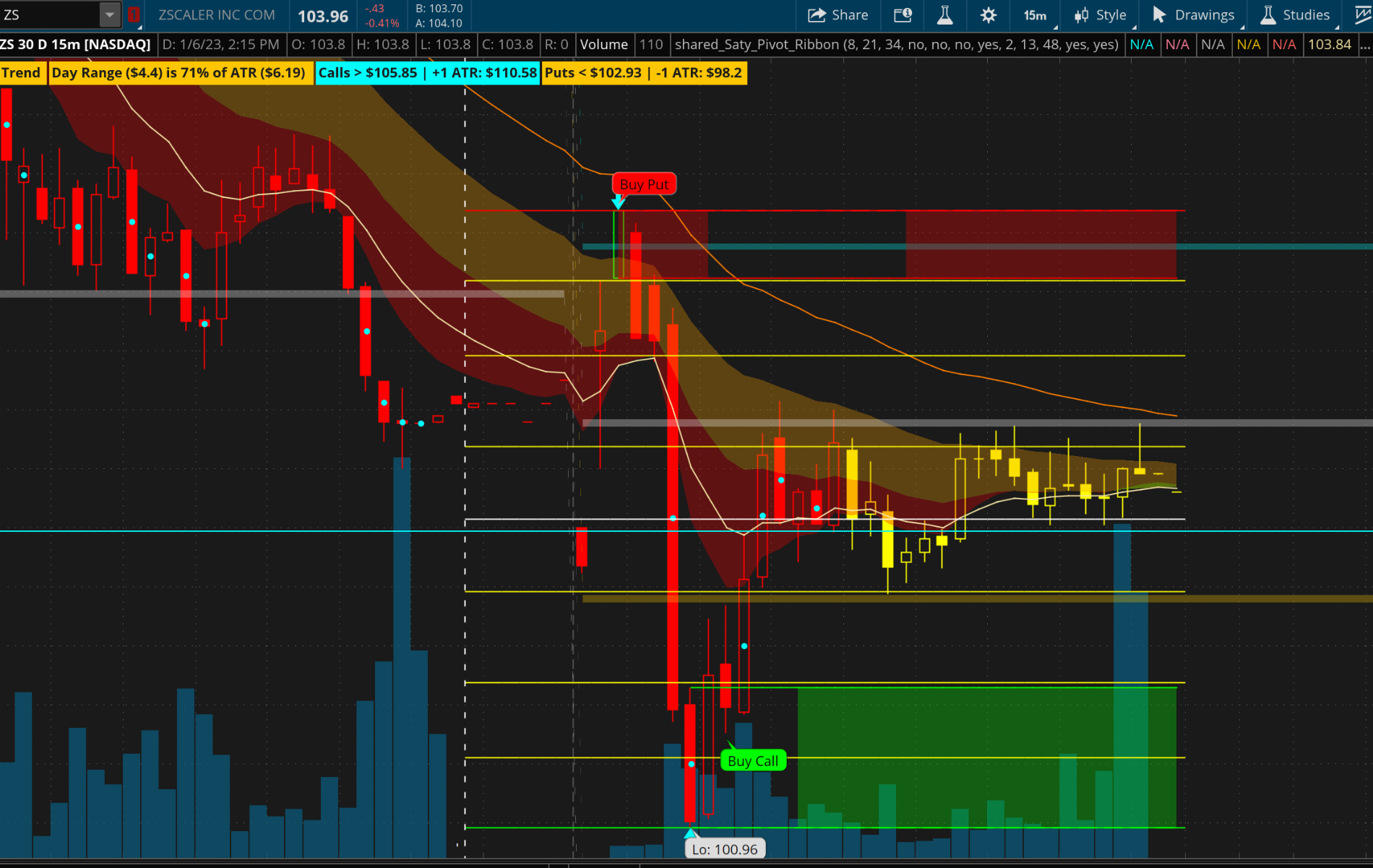

Hi @alexsmith3546, to be honest, these charts are both charts I would play and this is how:@OGOptionSlayer was wondering if i can pick your brains on something like this , so you can see in the first 15 minutes that was a very strong sell but the stock recovered (this is set using the 40 candle at 15 minutes)

How do you handle sudden changes in direction like this, this has been a real problem for me. If you saw this chart, would you just consider this as a no trade since the targets have been hit for the day and the price is just going to chop around ? Also when the price has entered the green zone or the red zone (depending on the sell down or buy up), do you just wait for it to break out of the zone ?

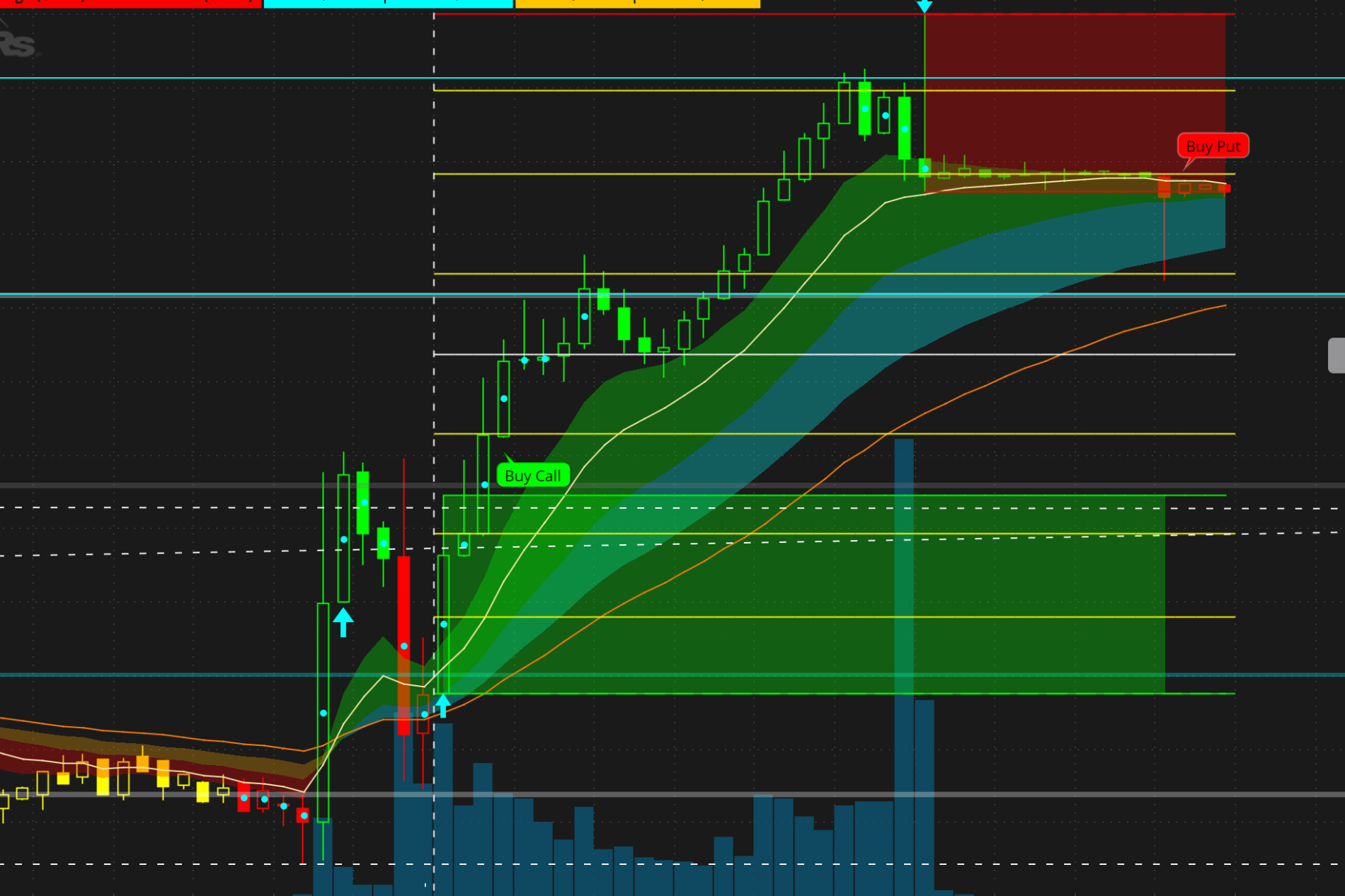

Like life would be lovely if we get something as nice as this all the time but it doesnt happen

Chart #1 Choppy Chart: I would have taken my full position out at the bottom of the last candle or as near to it as soon as I saw price action reverse. This is just a choppy day. I would have also gotten in the calls going back up. This is a 15m chart and you have plenty of time to react. As you can see you go through several Fib levels all the way up to what I think is 28.6%. I would have looked to take profit there for at least half of my position setting my new stop loss at the low of the highest candle up, which would be SATY's fib level. You would have been stopped out but still with significant profit.

Many times you will see your runners come in for even more gain and you should set your next TP at the fib level of the next SATY ATR level for either the remaining runners or just leave two. At this point, you would be riding profit and there was nothing signifying a real trend change. Don't fight the trend.

Chart #2: I would take some profit at SATY ATR call line (blue line), half position. Three more at two fib levels higher since that call line is so close to the next one. And then leave runners but set stops to the previous fib levels or the low of the highest candle, whichever you prefer. You typically aren't going to get a better run for this unless it's one of those crazy trend days so I would consider closing completely out at that level. This is at least a 200-300% play which is consistent for this indicator if used properly.

Final Thoughts on the Indicator vs Personal Risk Management Strategy:

The thing with the indicator is that you know your risk management better than I do and you should be able to easily adapt it to this signal and especially combined with SATY's ATRs or the built-in fib levels. Now that @Chemmy has added the 10 SMA and 50 SMA, you can see that cross occurring and that will really tell you if the trend is reversing.

As we all grow this indicator as a community, I believe it will be one of the best on the market. It consistently produces results if you don't try to diamond hand and realize that 20% profits compounding daily are better than waiting for those 200%-1000% gainers that come occasionally. It comes down to risk tolerance and discipline which I highlight in one of my first posts as being the most important traits when trading with this indicator or any indicator in this crazy consolidation market.

Finally, it's important to use my TTM Squeeze strategy in combination with this to sniff out the trend change or to know when to jump in because the reversal is coming in. I have now combined BBs and MACD as well so I can see if the trend is strong as it pushes up against the BBs or if it's starting to falter and move away from the edges of the BBs. I look for the MACD cross (12 ema and 26 ema is standard) and this is a further area of confluence for a trend change.

Sorry for the long reply but I hope it helps.