How to calculate the expected move in thinkscript using the below extract?

https://www.tastylive.com/definitions/calculating-expected-move

Calculating Expected Move

Expected move is the amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events.

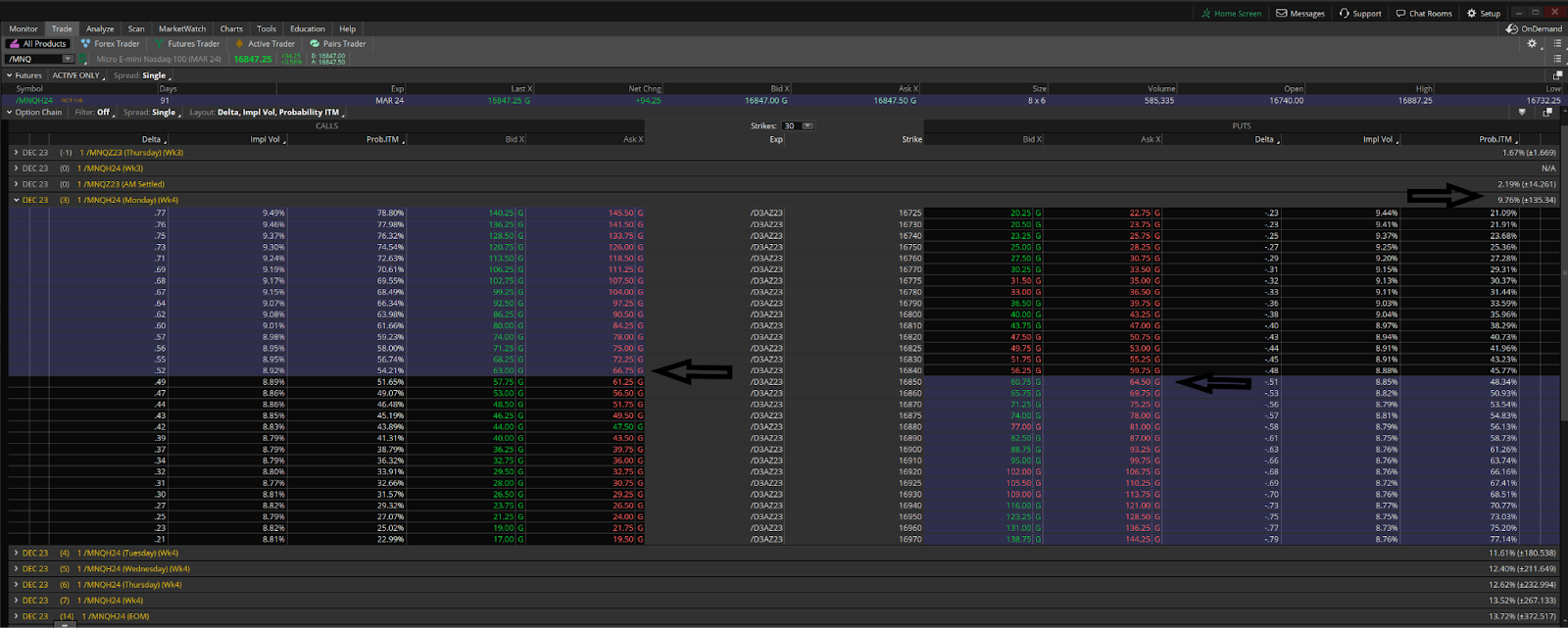

We use this calculation on the day before the binary event or very close to the expiration date. The expected move of a stock for a binary event can be found by calculating 85% of the value of the front month at the money (ATM) straddle. Add the price of the front month ATM call and the price of the front month ATM put, then multiply this value by 85%. Another easy way to calculate the expected move for a binary event is to take the ATM straddle, plus the 1st OTM strangle and then divide the sum by 2.

We only use this for a binary event because the accuracy of premium decay and all of the variables associated with implied volatility are too rich to accurately reflect expected move for a longer time period.

Instead of using the implied volatility to derive the expected move, can we obtain these values with the arrows for a calculated future date in thinkscript?

https://www.tastylive.com/definitions/calculating-expected-move

Calculating Expected Move

Expected move is the amount that a stock is predicted to increase or decrease from its current price, based on the current level of implied volatility for binary events.

We use this calculation on the day before the binary event or very close to the expiration date. The expected move of a stock for a binary event can be found by calculating 85% of the value of the front month at the money (ATM) straddle. Add the price of the front month ATM call and the price of the front month ATM put, then multiply this value by 85%. Another easy way to calculate the expected move for a binary event is to take the ATM straddle, plus the 1st OTM strangle and then divide the sum by 2.

We only use this for a binary event because the accuracy of premium decay and all of the variables associated with implied volatility are too rich to accurately reflect expected move for a longer time period.

Instead of using the implied volatility to derive the expected move, can we obtain these values with the arrows for a calculated future date in thinkscript?

Last edited by a moderator: