You should upgrade or use an alternative browser.

Support Resistance Levels script testing

- Thread starter Svanoy

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

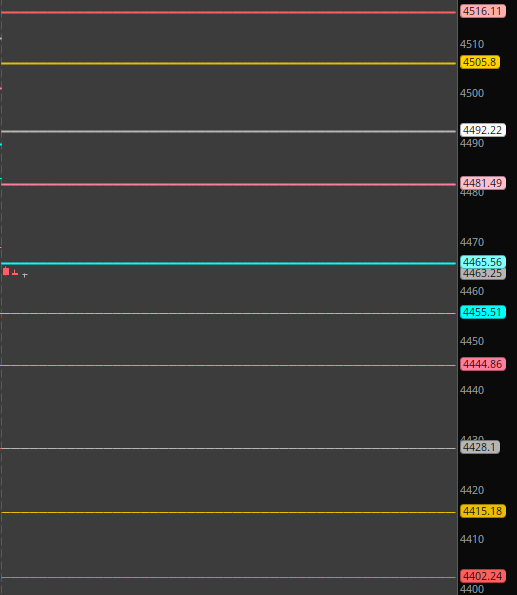

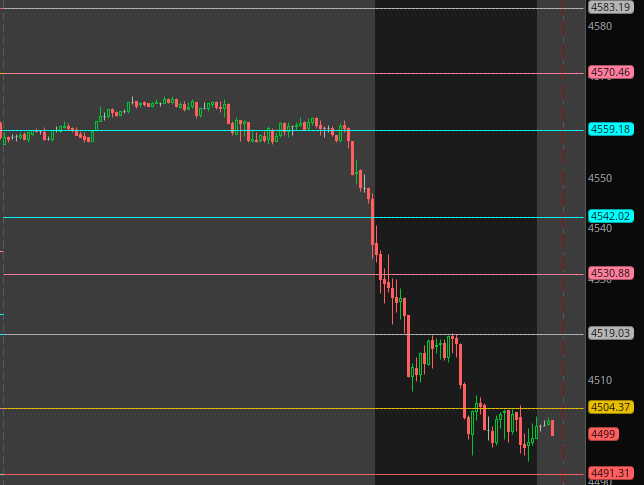

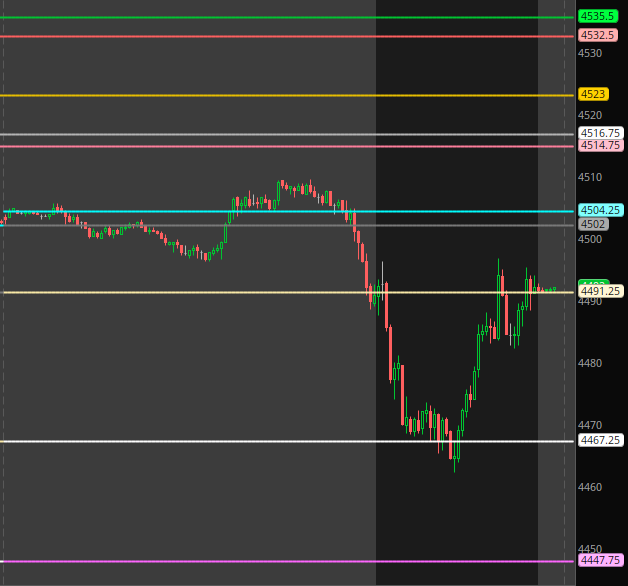

Looks good, is there a script available to test?ESU23 9/11/23 17:00

Two studies plotting past moving average crosses above and below the open at 6:00p.m. EST for the following night and day.

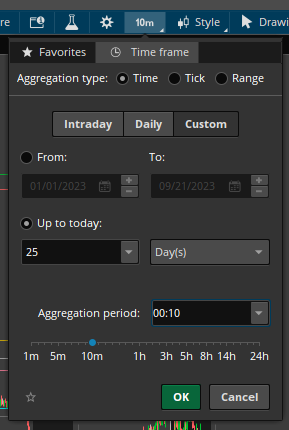

Using a 30 day 10 min chart.

It has its limitations, but very interesting results.

Working on a improved version now.

#Support/Resistance Above

declare once_per_bar;

input Time_Of_First_Bar_Of_Day = 1800;

input spacing = 10;

def ADOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then open else ADOpen[1], 0);

def BarOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then AbsValue(BarNumber()) else BarOpen[1], 0);

def SMA100 = reference SimpleMovingAvg(close, 100);

def SMA200 = reference SimpleMovingAvg(close, 200);

def SMA500 = reference SimpleMovingAvg(close, 500);

def a = (SMA100+ SMA200+ SMA500) / 3;

def Cross = if Crosses(SMA100, SMA200, CrossingDirection.ANY) then SMA200 else if Crosses(SMA100, SMA500, CrossingDirection.ANY) then SMA500 else if Crosses(SMA200, SMA500, CrossingDirection.ANY) then SMA500 else if Crosses(SMA100, a, CrossingDirection.ANY) then a else if Crosses(SMA200, a, CrossingDirection.ANY) then a else if Crosses(SMA500, a, CrossingDirection.ANY) then a else Cross[1];

#######################################################################################

#Define/Plot Levels..##################################################################

#######################################################################################

script Targets {

input Time_Of_First_Bar_Of_Day = 0;

input BarOpen = 0;

input Cross = 0;

input ADOpen = 0;

input Spacing = 0;

def TA = if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 and !isnan(close) then

fold a = 0 to BarOpen

with inta = Double.POSITIVE_INFINITY

do if IsNaN(GetValue(Cross,a)) then inta

else if GetValue(Cross,a) < ADOpen then inta

else if GetValue(Cross,a) > inta then inta

else if GetValue(Cross,a) < inta and GetValue(Cross,a) > ADOpen + Spacing

then GetValue(Cross,a)

else inta

else TA[1];

plot Targets = TA;

}

################################

plot PAC1 = Targets(Time_Of_First_Bar_Of_Day,BarOpen,Cross,ADOpen,0);

PAC1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC1.SetLineWeight(1);

plot PAC2 = Targets(Time_Of_First_Bar_Of_Day,BarOpen,Cross,PAC1,Spacing);

PAC2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC2.SetLineWeight(1);

plot PAC3 = Targets(Time_Of_First_Bar_Of_Day,BarOpen,Cross,PAC2,Spacing);

PAC3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC3.SetLineWeight(1);

plot PAC4 = Targets(Time_Of_First_Bar_Of_Day,BarOpen,Cross,PAC3,Spacing);

PAC4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC4.SetLineWeight(1);

plot PAC5 = Targets(Time_Of_First_Bar_Of_Day,BarOpen,Cross,PAC4,Spacing);

PAC5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC5.SetLineWeight(1);#Support/Resistance Below

declare once_per_bar;

input Time_Of_First_Bar_Of_Day = 1800;

input spacing = 10;

def ADOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then open else ADOpen[1], 0);

def BarOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then AbsValue(BarNumber()) else BarOpen[1], 0);

def SMA100 = reference SimpleMovingAvg(close, 100);

def SMA200 = reference SimpleMovingAvg(close, 200);

def SMA500 = reference SimpleMovingAvg(close, 500);

def a = (SMA100 + SMA200 + SMA500) / 3;

def Cross = if Crosses(SMA100, SMA200, CrossingDirection.ANY) then SMA200 else if Crosses(SMA100, SMA500, CrossingDirection.ANY) then SMA500 else if Crosses(SMA200, SMA500, CrossingDirection.ANY) then SMA500 else if Crosses(SMA100, a, CrossingDirection.ANY) then a else if Crosses(SMA200, a, CrossingDirection.ANY) then a else if Crosses(SMA500, a, CrossingDirection.ANY) then a else Cross[1];

#######################################################################################

#Define/Plot Levels..##################################################################

#######################################################################################

script Targets {

input Time_Of_First_Bar_Of_Day = 0;

input BarOpen = 0;

input Cross = 0;

input ADOpen = 0;

input Spacing = 0;

def TA = if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 and !IsNaN(close) then

fold a = 0 to BarOpen

with inta = Double.NEGATIVE_INFINITY

do if IsNaN(GetValue(Cross,a)) then inta

else if GetValue(Cross, a) > ADOpen then inta

else if GetValue(Cross, a) < inta then inta

else if GetValue(Cross, a) > inta and GetValue(Cross, a) < ADOpen - Spacing

then GetValue(Cross, a)

else inta

else TA[1];

plot Targets = if !TA then Double.NEGATIVE_INFINITY else TA;

}

################################

plot PBC1 = Targets(Time_Of_First_Bar_Of_Day, BarOpen, Cross, ADOpen, 0);

PBC1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC1.SetLineWeight(1);

plot PBC2 = Targets(Time_Of_First_Bar_Of_Day, BarOpen, Cross, PBC1, Spacing);

PBC2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC2.SetLineWeight(1);

plot PBC3 = Targets(Time_Of_First_Bar_Of_Day, BarOpen, Cross, PBC2, Spacing);

PBC3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC3.SetLineWeight(1);

plot PBC4 = Targets(Time_Of_First_Bar_Of_Day, BarOpen, Cross, PBC3, Spacing);

PBC4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC4.SetLineWeight(1);

plot PBC5 = Targets(Time_Of_First_Bar_Of_Day, BarOpen, Cross, PBC4, Spacing);

PBC5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

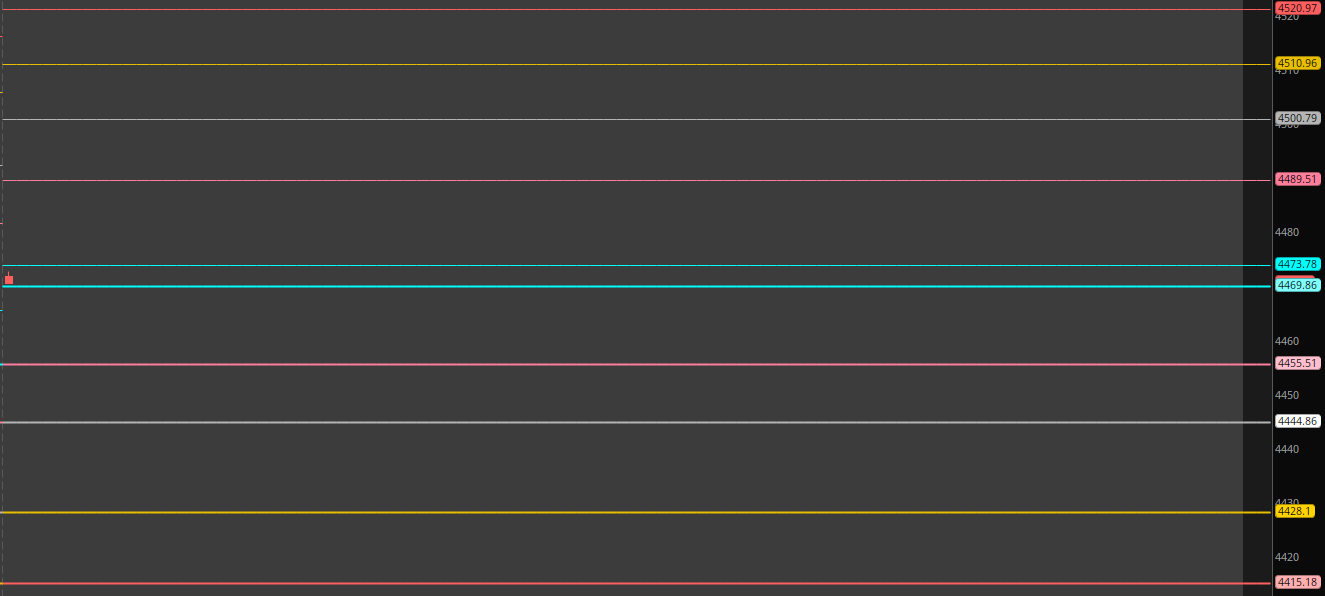

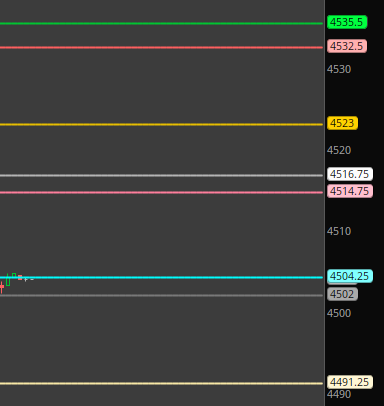

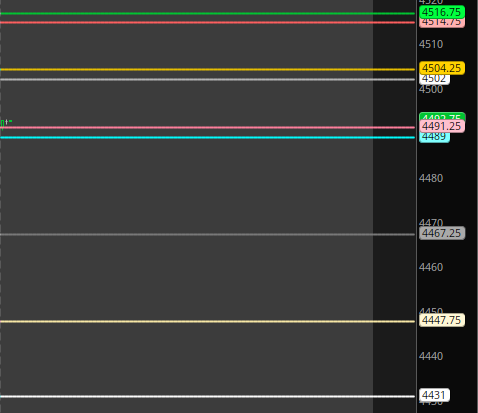

PBC5.SetLineWeight(1);Can only look back a max of 25 days on a 10 min chart due to fold limitations.

Removed the spacing between plots.

Seems to do a fairly good job overall.

Believe this is about as far I'll go with it.

declare once_per_bar;

input Time_Of_First_Bar_Of_Day = 1800;

def ADOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then open else ADOpen[1], 0);

def BarOpen = CompoundValue(1, if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then AbsValue(BarNumber()) else BarOpen[1], 0);

def SMA100 = reference SimpleMovingAvg(close, 100);

def SMA200 = reference SimpleMovingAvg(close, 200);

def SMA500 = reference SimpleMovingAvg(close, 500);

def a = (SMA100 + SMA200 + SMA500) / 3;

def Cross = if Crosses(SMA100, SMA200, CrossingDirection.ANY) then Round(Round(SMA200 / TickSize(), 0) * TickSize(),2) else if Crosses(SMA100, SMA500, CrossingDirection.ANY) then Round(Round(SMA500 / TickSize(), 0) * TickSize(),2) else if Crosses(SMA200, SMA500, CrossingDirection.ANY) then Round(Round(SMA500 / TickSize(), 0) * TickSize(),2) else if Crosses(SMA100, a, CrossingDirection.ANY) then Round(Round(a / TickSize(), 0) * TickSize(),2) else if Crosses(SMA200, a, CrossingDirection.ANY) then Round(Round(a / TickSize(), 0) * TickSize(),2) else if Crosses(SMA500, a, CrossingDirection.ANY) then Round(Round(a / TickSize(), 0) * TickSize(),2) else Cross[1];

#######################################################################################

#Define/Plot Levels..##################################################################

#######################################################################################

script TargetsA {

input Time_Of_First_Bar_Of_Day = 0;

input BarOpen = 0;

input Cross = 0;

input ADOpen = 0;

def TA = if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 and !isnan(close) then

fold a = 0 to BarOpen

with inta = Double.POSITIVE_INFINITY

do if IsNaN(GetValue(Cross,a)) then inta

else if GetValue(Cross,a) < ADOpen then inta

else if GetValue(Cross,a) > inta then inta

else if GetValue(Cross,a) < inta and GetValue(Cross,a) > ADOpen

then GetValue(Cross,a)

else inta

else TA[1];

plot Targets = TA;

}

#######################################################################################

script TargetsB {

input Time_Of_First_Bar_Of_Day = 0;

input BarOpen = 0;

input Cross = 0;

input ADOpen = 0;

def TA = if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 and !IsNaN(close) then

fold a = 0 to BarOpen

with inta = Double.NEGATIVE_INFINITY

do if IsNaN(GetValue(Cross,a)) then inta

else if GetValue(Cross, a) > ADOpen then inta

else if GetValue(Cross, a) < inta then inta

else if GetValue(Cross, a) > inta and GetValue(Cross, a) < ADOpen

then GetValue(Cross, a)

else inta

else TA[1];

plot Targets = if !TA then Double.NEGATIVE_INFINITY else TA;

}

def CAC = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,Cross,ADOpen);

def CBC = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, Cross, ADOpen);

def C = CompoundValue(1,if SecondsFromTime(Time_Of_First_Bar_Of_Day) == 0 then if AbsValue(ADOpen - CAC) >= AbsValue(ADOpen - CBC) then ADOpen - AbsValue(ADOpen - CBC) else ADOpen + AbsValue(ADOpen - CAC) else C[1],ADOpen);#TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, Cross, Cross, 0);

plot PC = C;

PC.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PC.SetLineWeight(1);

################################

plot PAC1 = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,PC,PC);

PAC1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC1.SetLineWeight(1);

plot PAC2 = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,PC,PAC1);

PAC2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC2.SetLineWeight(1);

plot PAC3 = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,PC,PAC2);

PAC3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC3.SetLineWeight(1);

plot PAC4 = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,PC,PAC3);

PAC4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC4.SetLineWeight(1);

plot PAC5 = TargetsA(Time_Of_First_Bar_Of_Day,BarOpen,PC,PAC4);

PAC5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PAC5.SetLineWeight(1);

################################

plot PBC1 = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, PC, PC);

PBC1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC1.SetLineWeight(1);

plot PBC2 = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, PC, PBC1);

PBC2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC2.SetLineWeight(1);

plot PBC3 = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, PC, PBC2);

PBC3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC3.SetLineWeight(1);

plot PBC4 = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, PC, PBC3);

PBC4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

PBC4.SetLineWeight(1);

plot PBC5 = TargetsB(Time_Of_First_Bar_Of_Day, BarOpen, PC, PBC4);

PBC5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

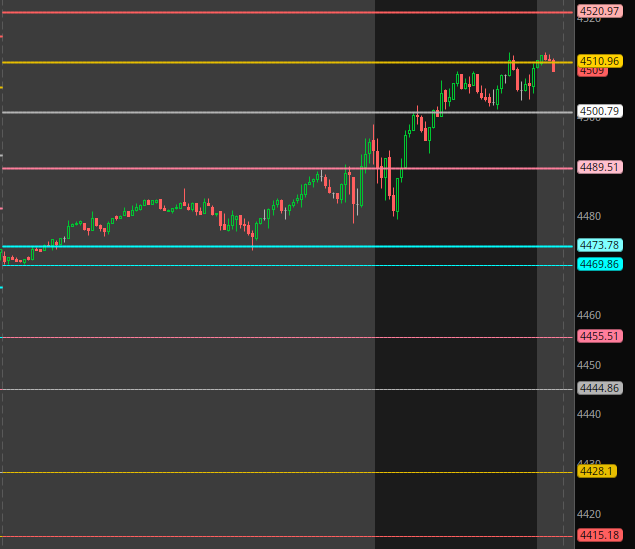

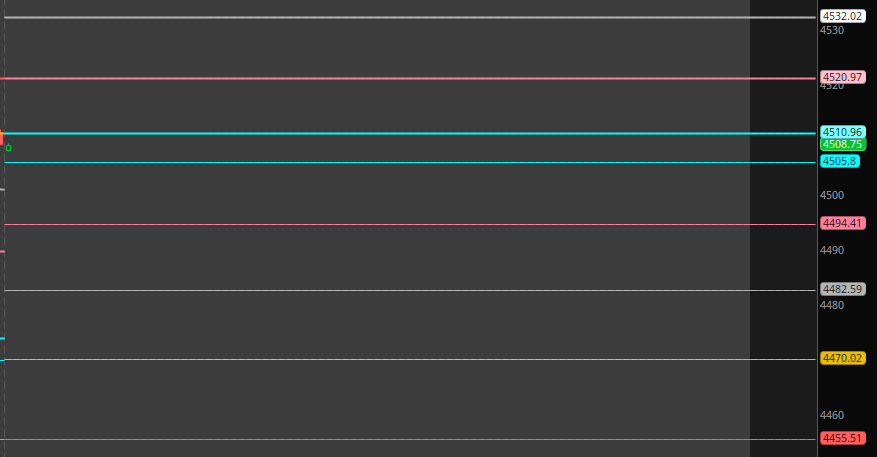

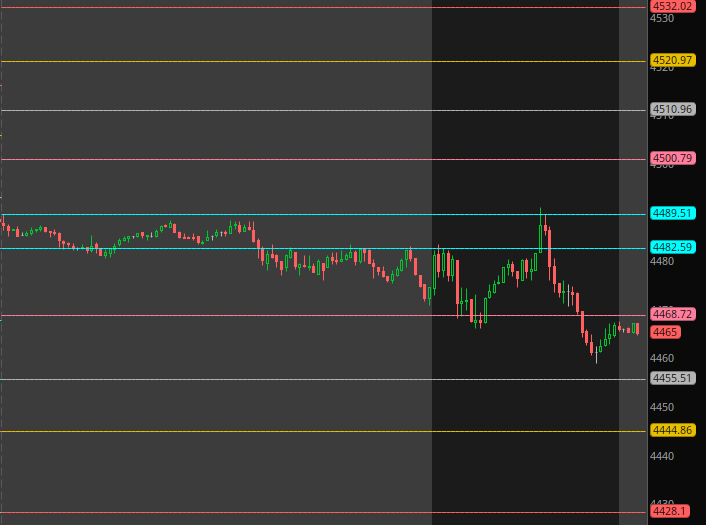

PBC5.SetLineWeight(1);I'm using /ESZ23 not /ES.

Custom time frame to utilize as many days as possible without error.

was looking over my old watches threads and I forgot about this ! I used to check this everydayESZ23 9/19/23 17:00

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| K | Recent Changes on TOS Tools?: Trend Lines/Levels on Different Time Frames | Playground | 2 | |

| C | Futures Trading Around Key SPX Options Levels | Playground | 0 |

Similar threads

-

Recent Changes on TOS Tools?: Trend Lines/Levels on Different Time Frames

- Started by Kbone

- Replies: 2

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Recent Changes on TOS Tools?: Trend Lines/Levels on Different Time Frames

- Started by Kbone

- Replies: 2

-

Similar threads

-

Recent Changes on TOS Tools?: Trend Lines/Levels on Different Time Frames

- Started by Kbone

- Replies: 2

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/