You should upgrade or use an alternative browser.

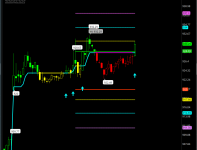

SuperTrend CCI ATR Trend for ThinkorSwim

- Thread starter tomsk

- Start date

No, Supertrends are not "repainters"should not 'repaints' be appended to the title of this one?

For prior candles, the calculations used in Supertrends are set and final and do not repaint.

However, this study, like the majority of indicators on this forum, will continually update the current bar until it is closed.

Think about it, we can not know as a candle is forming what the final close, high, low, of the current bar is going to be, so of course, it updates with the most recent tick.

Find out more about Supertrends:

https://usethinkscript.com/threads/...ius-for-thinkorswim.12346/page-16#post-106205

TapthatAsk

Member

What needs to be smoother to adjust the buy sell arrows to be more restrictive?Supertrend CCI ATR Trend Enchanced

This is the script from post#1 to which I added Mobius's Supertrend Cycle Statistics Labels (many thanks to @sunnybabu, who found these on TOS OneNote). I haven't had time to see how having these statistics will affect my trading, yet. But I find them interesting.

Ruby:# SuperTrend CCI ATR Trend # tomsk # 11.18.2019 # V1.0 - 08.10.2019 - dtek - Initial release of SuperTrend CCI ATR Trend # V2.0 - 11.18.2019 - tomsk - Modified the logic, cleaned up code for consistency # SUPERTREND BY MOBIUS AND CCI ATR TREND COMBINED INTO ONE CHART INDICATOR, # BOTH IN AGREEMENT IS A VERY POWERFUL SIGNAL IF TRENDING. VERY GOOD AT CATCHING # REVERSALS. WORKS WELL ON 1 AND 5 MIN CHARTS. PLOT IS THE COMBINATION LOWEST # FOR UPTREND AND HIGHEST OF THE DOWNTREND. DOTS COLORED IF BOTH IN AGREEMENT # OR GREY IF NOT - 08/10/2019 DTEK # Supertrend, extracted from Mobius original code input ST_Atr_Mult = 1.0; # was .70 input ST_nATR = 4; input ST_AvgType = AverageType.HULL; input ShowLabel = yes; def c = close; def v = volume; def ATR = MovingAverage(ST_AvgType, TrueRange(high, close, low), ST_nATR); def UP = HL2 + (ST_Atr_Mult* ATR); def DN = HL2 + (-ST_Atr_Mult * ATR); def ST = if close < ST[1] then UP else DN; # CCI_ATR measures distance from the mean. Calculates a trend # line based on that distance using ATR as the locator for the line. # Credit goes to Mobius for the underlying logic input lengthCCI = 50; # Was 20 input lengthATR = 21; # Was 4 input AtrFactor = 1.0; # Was 0.7 def ATRCCI = Average(TrueRange(high, close, low), lengthATR) * AtrFactor; def price = close + low + high; def linDev = LinDev(price, lengthCCI); def CCI = if linDev == 0 then 0 else (price - Average(price, lengthCCI)) / linDev / 0.015; def MT1 = if CCI > 0 then Max(MT1[1], HL2 - ATRCCI) else Min(MT1[1], HL2 + ATRCCI); # Alignment of Supertrend and CCI ATR indicators def Pos_State = close > ST and close > MT1; def Neg_State = close < ST and close < MT1; # Combined Signal Approach - Supertrend and ATR CCI plot CSA = MT1; CSA.AssignValueColor(if Pos_State then Color.CYAN else if Neg_State then Color.MAGENTA else Color.YELLOW); # Buy/Sell Signals using state transitions def BuySignal = (!Pos_State[1] and Pos_State); def SellSignal = !Neg_State[1] and Neg_State; # Buy/Sell Arrows plot BuySignalArrow = if BuySignal then 0.995 * MT1 else Double.NaN; BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP); BuySignalArrow.SetDefaultColor(Color.CYAN); BuySignalArrow.SetLineWeight(5); plot SellSignalArrow = if SellSignal then 1.005 * MT1 else Double.NaN; SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); SellSignalArrow.SetDefaultColor(Color.PINK); SellSignalArrow.SetLineWeight(5); # Candle Colors AssignPriceColor(if Pos_State then Color.GREEN else if Neg_State then Color.RED else Color.YELLOW); # End SuperTrend CCI ATR Trend def upBars = if c < ST then upBars[1] + 1 else upBars[1]; def upCycles = if c < ST and c[1] > ST[1] then upCycles[1] + 1 else upCycles[1]; def dnBars = if c > ST then dnBars[1] + 1 else dnBars[1]; def dnCycles = if c > ST and c[1] < ST[1] then dnCycles[1] + 1 else dnCycles[1]; def upCycleCount = upBars / upCycles; def dnCycleCount = dnBars / dnCycles; def thisCycle = if c < ST and c[1] > ST[1] then 1 else if c < ST then thisCycle[1] + 1 else if c > ST and c[1] < ST[1] then 1 else if c > ST then thisCycle[1] + 1 else thisCycle[1]; def Volup = (fold i = 0 to thisCycle do if i > 0 then Volup[1] + v else Volup[1]) / thisCycle; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; AddLabel(ShowLabel, "Up Bars = " + upBars + "; " + " Up Cycles = " + upCycles + "; " + " Dn Bars = " + dnBars + "; " + " Dn Cycles = " + dnCycles + "; " , if c < ST then GlobalColor("LabelRed") else GlobalColor("LabelGreen") ); #.... This portion of code modofies by jhf AddLabel(ShowLabel, " Avg Up Cycle Count = " + Round(upCycleCount, 0) + " Avg Dn Cycle Count = " + Round(dnCycleCount, 0) + " This Cycle = " + thisCycle, if c < ST then GlobalColor("LabelRed") else GlobalColor("LabelGreen") ); #.... This portion of code modofies by jhf # End Code SuperTrend

What needs to be smoother to adjust the buy sell arrows to be more restrictive?

It is recommended that you use 3 non-collinear indicators to confirm signal.

Read more:

https://usethinkscript.com/threads/...nt-to-successful-trading-in-thinkorswim.6114/

Across your three timeframes:

https://usethinkscript.com/threads/best-time-frame-for-trading-for-thinkorswim.12209/

Resiliencetrader

Member

HI ! Do you have this indicator without the color on the candle ?Thank you in advance

The easiest way to prevent this indicator from painting the candles would be to take out the AssignPriceColor statement.

In this case, it would be deleting this code from the bottom of the script:

# Candle Colors

AssignPriceColor(if Pos_State then Color.GREEN

else if Neg_State then Color.RED

else Color.YELLOW);If you want to preserve the option of painting the candles, you can replace the above code with:

# Candle Colors

input PaintCandles = no ;

AssignPriceColor(if !PaintCandles then color.current else

if Pos_State then Color.GREEN

else if Neg_State then Color.RED

else Color.YELLOW);input agg = AggregationPeriod.FIFTEEN_MIN;

def c = close(period = agg);

def h = high(period = agg);

def l = low(period = agg);

def pricedata = hl2(period = agg);

input ShowTodayOnly={"No", default "Yes"};

def Today = if GetLastDay() == GetDay() then 1 else 0;

input afterbegin = 0900;

input afterend = 1600;

def aftermarket = SecondsFromTime(afterbegin) >= 0 and SecondsTillTime(afterend) >= 0;

DefineGlobalColor("TrendUp", CreateColor(0, 254, 30));

DefineGlobalColor("TrendDown", CreateColor(255, 3, 2));

input lengthCCI = 50;

input lengthATR = 5;

input AtrFactor = 0.7;

def ATRcci = Average(TrueRange(h, c, l), lengthATR) * AtrFactor;

def price = c + l + h;

def linDev = LinDev(price, lengthCCI);

def CCI = if linDev == 0

then 0

else (price - Average(price, lengthCCI)) / linDev / 0.015;

def MT1 = if CCI > 0 and showtodayonly and today and aftermarket then Max(MT1[1], pricedata - ATRcci)

else Min(MT1[1], pricedata + ATRcci);

plot data = MT1;

data.AssignValueColor(if c < MT1 then Color.RED else Color.GREEN);

Can someone post the code to add an audible alarm when the buy or sell signal is plotted, Thanks

Add this code snippet to the bottom of your study:

Alert(!Pos_State[1] and Pos_State, "BuySignal", Alert.Bar, Sound.ding);

Alert(!Neg_State[1] and Neg_State, "SellSignal", Alert.Bar, Sound.ring);

These are alerts written into studies. They alert ONLY for charts / grids currently populating your workspace.

They cannot be sent to phone/email. They cannot have custom sounds.

https://usethinkscript.com/resources/how-to-add-alert-script-to-thinkorswim-indicators.9/

https://tlc.thinkorswim.com/center/howToTos/thinkManual/MarketWatch/Alerts/studyalerts

However, stuffing an abbreviated script into the scanner yielded results.

To scan for buy signals, the last two lines should look like this:

plot BuySignal = (!Pos_State[1] and Pos_State);

#plot SellSignal = !Neg_State[1] and Neg_State;

To scan for sell signals, change the last two lines to this:

#plot BuySignal = (!Pos_State[1] and Pos_State);

plot SellSignal = !Neg_State[1] and Neg_State;

shared chart link: http://tos.mx/!qCB5CMLA MUST follow these instructions for loading shared links.

How do I set the buy and sell signals directly on the candle instead of scattered across the chart?

Thanks,

To place the arrows directly below the candles replace this portion of the code:

# Buy/Sell Arrows

plot BuySignalArrow = if BuySignal then 0.995 * MT1 else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(Color.CYAN);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if SellSignal then 1.005 * MT1 else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(Color.PINK);

SellSignalArrow.SetLineWeight(5);with this boolean code:

# Buy/Sell Arrows

plot BuySignalArrow = BuySignal ;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BuySignalArrow.SetDefaultColor(Color.CYAN);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = SellSignal;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SellSignalArrow.SetDefaultColor(Color.PINK);

SellSignalArrow.SetLineWeight(5);The one posted earlier doesn't work for this version. Thanks

Here is the code for v2.1:You need to post the script that you want the alerts added to.

# SuperTrend CCI ATR Trend

# tomsk

# 1.17.2020

# V1.0 - 08.10.2019 - dtek - Initial release of SuperTrend CCI ATR Trend

# V2.0 - 11.18.2019 - tomsk - Modified the logic, cleaned up code for consistency

# V2.1 - 01.17.2020 - tomsk - Enhanced state transition engine to only display latest trend

# SUPERTREND BY MOBIUS AND CCI ATR TREND COMBINED INTO ONE CHART INDICATOR,

# BOTH IN AGREEMENT IS A VERY POWERFUL SIGNAL IF TRENDING. VERY GOOD AT CATCHING

# REVERSALS. WORKS WELL ON 1 AND 5 MIN CHARTS. PLOT IS THE COMBINATION LOWEST

# FOR UPTREND AND HIGHEST OF THE DOWNTREND. DOTS COLORED IF BOTH IN AGREEMENT

# OR GREY IF NOT - 08/10/2019 DTEK

# Supertrend, extracted from Mobius original code

input ST_Atr_Mult = 1.0; # was .70

input ST_nATR = 4;

input ST_AvgType = AverageType.HULL;

def ATR = MovingAverage(ST_AvgType, TrueRange(high, close, low), ST_nATR);

def UP = HL2 + (ST_Atr_Mult* ATR);

def DN = HL2 + (-ST_Atr_Mult * ATR);

def ST = if close < ST[1] then UP else DN;

# CCI_ATR measures distance from the mean. Calculates a trend

# line based on that distance using ATR as the locator for the line.

# Credit goes to Mobius for the underlying logic

input lengthCCI = 50; # Was 20

input lengthATR = 21; # Was 4

input AtrFactor = 1.0; # Was 0.7

def bar = barNumber();

def StateUp = 1;

def StateDn = 2;

def ATRCCI = Average(TrueRange(high, close, low), lengthATR) * AtrFactor;

def price = close + low + high;

def linDev = LinDev(price, lengthCCI);

def CCI = if linDev == 0

then 0

else (price - Average(price, lengthCCI)) / linDev / 0.015;

def MT1 = if CCI > 0

then Max(MT1[1], HL2 - ATRCCI)

else Min(MT1[1], HL2 + ATRCCI);

# Alignment of Supertrend and CCI ATR indicators

def State = if close > ST and close > MT1 then StateUp

else if close < ST and close < MT1 then StateDn

else State[1];

def newState = HighestAll(if State <> State[1] then bar else 0);

# Combined Signal Approach - Supertrend and ATR CCI

plot CSA = if bar >= newState then MT1 else Double.NaN;

CSA.AssignValueColor(if bar >= newState

then if State == StateUp then Color.CYAN

else if State == StateDn then Color.YELLOW

else Color.CURRENT

else Color.CURRENT);

# Buy/Sell Arrows

plot BuySignalArrow = if bar >= newState and State == StateUp and State[1] <> StateUp then 0.995 * MT1 else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(Color.CYAN);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if bar >= newState and State == StateDn and State[1] <> StateDn then 1.005 * MT1 else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(Color.YELLOW);

SellSignalArrow.SetLineWeight(5);

# Candle Colors

AssignPriceColor(if bar >= newState

then if State == StateUp then Color.GREEN

else if State == StateDn then Color.RED

else Color.YELLOW

else Color.CURRENT);

# End SuperTrend CCI ATR Trend#//Fibonacci Trading

# Converted by Sam4Cok@Samer800 - 10/2023

https://usethinkscript.com/threads/fibonacci-trading-for-thinkorswim.16825/

What is the purpose of the candle recoloring? Is that the candle you should execute on?The easiest way to prevent this indicator from painting the candles would be to take out the AssignPriceColor statement.

In this case, it would be deleting this code from the bottom of the script:

Ruby:# Candle Colors AssignPriceColor(if Pos_State then Color.GREEN else if Neg_State then Color.RED else Color.YELLOW);

If you want to preserve the option of painting the candles, you can replace the above code with:

Ruby:# Candle Colors input PaintCandles = no ; AssignPriceColor(if !PaintCandles then color.current else if Pos_State then Color.GREEN else if Neg_State then Color.RED else Color.YELLOW);

The purpose of the candle recoloring is to provide a visual depiction of trend:What is the purpose of the candle recoloring?

This study provides buy and sell arrows for your review.Is that the candle you should execute on?

But remember, you should never execute on a signal from a single indicator.

Indicator signals must be verified with your overall strategy.

read more

https://usethinkscript.com/threads/basics-for-developing-a-good-strategy.8058/

Is there a way to make chart labels for time frames to place at the top of chart? I got this off a different thread you had with SMA850. It would be great if this could be done. I can't find that original thread unless this it.Supertrend CCI ATR Trend Enchanced

This is the script from post#1 to which I added Mobius's Supertrend Cycle Statistics Labels (many thanks to @sunnybabu, who found these on TOS OneNote). I haven't had time to see how having these statistics will affect my trading, yet. But I find them interesting.

Ruby:# SuperTrend CCI ATR Trend # tomsk # 11.18.2019 # V1.0 - 08.10.2019 - dtek - Initial release of SuperTrend CCI ATR Trend # V2.0 - 11.18.2019 - tomsk - Modified the logic, cleaned up code for consistency # SUPERTREND BY MOBIUS AND CCI ATR TREND COMBINED INTO ONE CHART INDICATOR, # BOTH IN AGREEMENT IS A VERY POWERFUL SIGNAL IF TRENDING. VERY GOOD AT CATCHING # REVERSALS. WORKS WELL ON 1 AND 5 MIN CHARTS. PLOT IS THE COMBINATION LOWEST # FOR UPTREND AND HIGHEST OF THE DOWNTREND. DOTS COLORED IF BOTH IN AGREEMENT # OR GREY IF NOT - 08/10/2019 DTEK # Supertrend, extracted from Mobius original code input ST_Atr_Mult = 1.0; # was .70 input ST_nATR = 4; input ST_AvgType = AverageType.HULL; input ShowLabel = yes; def c = close; def v = volume; def ATR = MovingAverage(ST_AvgType, TrueRange(high, close, low), ST_nATR); def UP = HL2 + (ST_Atr_Mult* ATR); def DN = HL2 + (-ST_Atr_Mult * ATR); def ST = if close < ST[1] then UP else DN; # CCI_ATR measures distance from the mean. Calculates a trend # line based on that distance using ATR as the locator for the line. # Credit goes to Mobius for the underlying logic input lengthCCI = 50; # Was 20 input lengthATR = 21; # Was 4 input AtrFactor = 1.0; # Was 0.7 def ATRCCI = Average(TrueRange(high, close, low), lengthATR) * AtrFactor; def price = close + low + high; def linDev = LinDev(price, lengthCCI); def CCI = if linDev == 0 then 0 else (price - Average(price, lengthCCI)) / linDev / 0.015; def MT1 = if CCI > 0 then Max(MT1[1], HL2 - ATRCCI) else Min(MT1[1], HL2 + ATRCCI); # Alignment of Supertrend and CCI ATR indicators def Pos_State = close > ST and close > MT1; def Neg_State = close < ST and close < MT1; # Combined Signal Approach - Supertrend and ATR CCI plot CSA = MT1; CSA.AssignValueColor(if Pos_State then Color.CYAN else if Neg_State then Color.MAGENTA else Color.YELLOW); # Buy/Sell Signals using state transitions def BuySignal = (!Pos_State[1] and Pos_State); def SellSignal = !Neg_State[1] and Neg_State; # Buy/Sell Arrows plot BuySignalArrow = if BuySignal then 0.995 * MT1 else Double.NaN; BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP); BuySignalArrow.SetDefaultColor(Color.CYAN); BuySignalArrow.SetLineWeight(5); plot SellSignalArrow = if SellSignal then 1.005 * MT1 else Double.NaN; SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN); SellSignalArrow.SetDefaultColor(Color.PINK); SellSignalArrow.SetLineWeight(5); # Candle Colors AssignPriceColor(if Pos_State then Color.GREEN else if Neg_State then Color.RED else Color.YELLOW); # End SuperTrend CCI ATR Trend def upBars = if c < ST then upBars[1] + 1 else upBars[1]; def upCycles = if c < ST and c[1] > ST[1] then upCycles[1] + 1 else upCycles[1]; def dnBars = if c > ST then dnBars[1] + 1 else dnBars[1]; def dnCycles = if c > ST and c[1] < ST[1] then dnCycles[1] + 1 else dnCycles[1]; def upCycleCount = upBars / upCycles; def dnCycleCount = dnBars / dnCycles; def thisCycle = if c < ST and c[1] > ST[1] then 1 else if c < ST then thisCycle[1] + 1 else if c > ST and c[1] < ST[1] then 1 else if c > ST then thisCycle[1] + 1 else thisCycle[1]; def Volup = (fold i = 0 to thisCycle do if i > 0 then Volup[1] + v else Volup[1]) / thisCycle; DefineGlobalColor("LabelRed", CreateColor(225, 0, 0)) ; DefineGlobalColor("LabelGreen", CreateColor(0, 165, 0)) ; AddLabel(ShowLabel, "Up Bars = " + upBars + "; " + " Up Cycles = " + upCycles + "; " + " Dn Bars = " + dnBars + "; " + " Dn Cycles = " + dnCycles + "; " , if c < ST then GlobalColor("LabelRed") else GlobalColor("LabelGreen") ); #.... This portion of code modofies by jhf AddLabel(ShowLabel, " Avg Up Cycle Count = " + Round(upCycleCount, 0) + " Avg Dn Cycle Count = " + Round(dnCycleCount, 0) + " This Cycle = " + thisCycle, if c < ST then GlobalColor("LabelRed") else GlobalColor("LabelGreen") ); #.... This portion of code modofies by jhf # End Code SuperTrend

Is there a way to make chart labels for time frames to place at the top of chart? I got this off a different thread you had with SMA850. It would be great if this could be done. I can't find that original thread unless this it.

I do not know of a SuperTrend that has chart labels for the various timeframes.

JOSHTHEBANKER

Member

has anyone tried this for larger time frames?GOOD MORNING,is there a possible scan for this strategy?

# SuperTrend CCI ATR Trend

# tomsk

# 1.17.2020

# V1.0 - 08.10.2019 - dtek - Initial release of SuperTrend CCI ATR Trend

# V2.0 - 11.18.2019 - tomsk - Modified the logic, cleaned up code for consistency

# V2.1 - 01.17.2020 - tomsk - Enhanced state transition engine to only display latest trend

# SUPERTREND BY MOBIUS AND CCI ATR TREND COMBINED INTO ONE CHART INDICATOR,

# BOTH IN AGREEMENT IS A VERY POWERFUL SIGNAL IF TRENDING. VERY GOOD AT CATCHING

# REVERSALS. WORKS WELL ON 1 AND 5 MIN CHARTS. PLOT IS THE COMBINATION LOWEST

# FOR UPTREND AND HIGHEST OF THE DOWNTREND. DOTS COLORED IF BOTH IN AGREEMENT

# OR GREY IF NOT - 08/10/2019 DTEK

# Supertrend, extracted from Mobius original code

input ST_Atr_Mult = 1.0; # was .70

input ST_nATR = 4;

input ST_AvgType = AverageType.HULL;

def ATR = MovingAverage(ST_AvgType, TrueRange(high, close, low), ST_nATR);

def UP = HL2 + (ST_Atr_Mult* ATR);

def DN = HL2 + (-ST_Atr_Mult * ATR);

def ST = if close < ST[1] then UP else DN;

# CCI_ATR measures distance from the mean. Calculates a trend

# line based on that distance using ATR as the locator for the line.

# Credit goes to Mobius for the underlying logic

input lengthCCI = 50; # Was 20

input lengthATR = 21; # Was 4

input AtrFactor = 1.0; # Was 0.7

def bar = barNumber();

def StateUp = 1;

def StateDn = 2;

def ATRCCI = Average(TrueRange(high, close, low), lengthATR) * AtrFactor;

def price = close + low + high;

def linDev = LinDev(price, lengthCCI);

def CCI = if linDev == 0

then 0

else (price - Average(price, lengthCCI)) / linDev / 0.015;

def MT1 = if CCI > 0

then Max(MT1[1], HL2 - ATRCCI)

else Min(MT1[1], HL2 + ATRCCI);

# Alignment of Supertrend and CCI ATR indicators

def State = if close > ST and close > MT1 then StateUp

else if close < ST and close < MT1 then StateDn

else State[1];

def newState = HighestAll(if State <> State[1] then bar else 0);

# Combined Signal Approach - Supertrend and ATR CCI

plot CSA = if bar >= newState then MT1 else Double.NaN;

CSA.AssignValueColor(if bar >= newState

then if State == StateUp then Color.CYAN

else if State == StateDn then Color.YELLOW

else Color.CURRENT

else Color.CURRENT);

# Buy/Sell Arrows

plot BuySignalArrow = if bar >= newState and State == StateUp and State[1] <> StateUp then 0.995 * MT1 else Double.NaN;

BuySignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

BuySignalArrow.SetDefaultColor(Color.CYAN);

BuySignalArrow.SetLineWeight(5);

plot SellSignalArrow = if bar >= newState and State == StateDn and State[1] <> StateDn then 1.005 * MT1 else Double.NaN;

SellSignalArrow.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

SellSignalArrow.SetDefaultColor(Color.YELLOW);

SellSignalArrow.SetLineWeight(5);

# Candle Colors

AssignPriceColor(if bar >= newState

then if State == StateUp then Color.GREEN

else if State == StateDn then Color.RED

else Color.YELLOW

else Color.CURRENT);

# End SuperTrend CCI ATR Trend

has anyone tried this for larger time frames?

Everything you ever wanted to know about SuperTrends (including which timeframes):

https://usethinkscript.com/threads/supertrend-indicator-by-mobius-for-thinkorswim.7/#post-77876

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| L | Supertrend CCI ATR in 1 Plot For Mobile For ThinkOrSwim | Indicators | 82 | |

|

|

Q-Trend, QQE, SuperTrend strategy for ThinkOrSwim | Indicators | 24 | |

|

|

Smart Supertrend For ThinkOrSwim | Indicators | 13 | |

| M | SuperTrend Oscillator [LUX] For ThinkOrSwim | Indicators | 6 | |

| B | SuperTrend TradingView Look-A-Like For ThinkOrSwim | Indicators | 69 |

Similar threads

-

Supertrend CCI ATR in 1 Plot For Mobile For ThinkOrSwim

- Started by leakywaders

- Replies: 82

-

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

Supertrend CCI ATR in 1 Plot For Mobile For ThinkOrSwim

- Started by leakywaders

- Replies: 82

-

-

-

-

Similar threads

-

Supertrend CCI ATR in 1 Plot For Mobile For ThinkOrSwim

- Started by leakywaders

- Replies: 82

-

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/