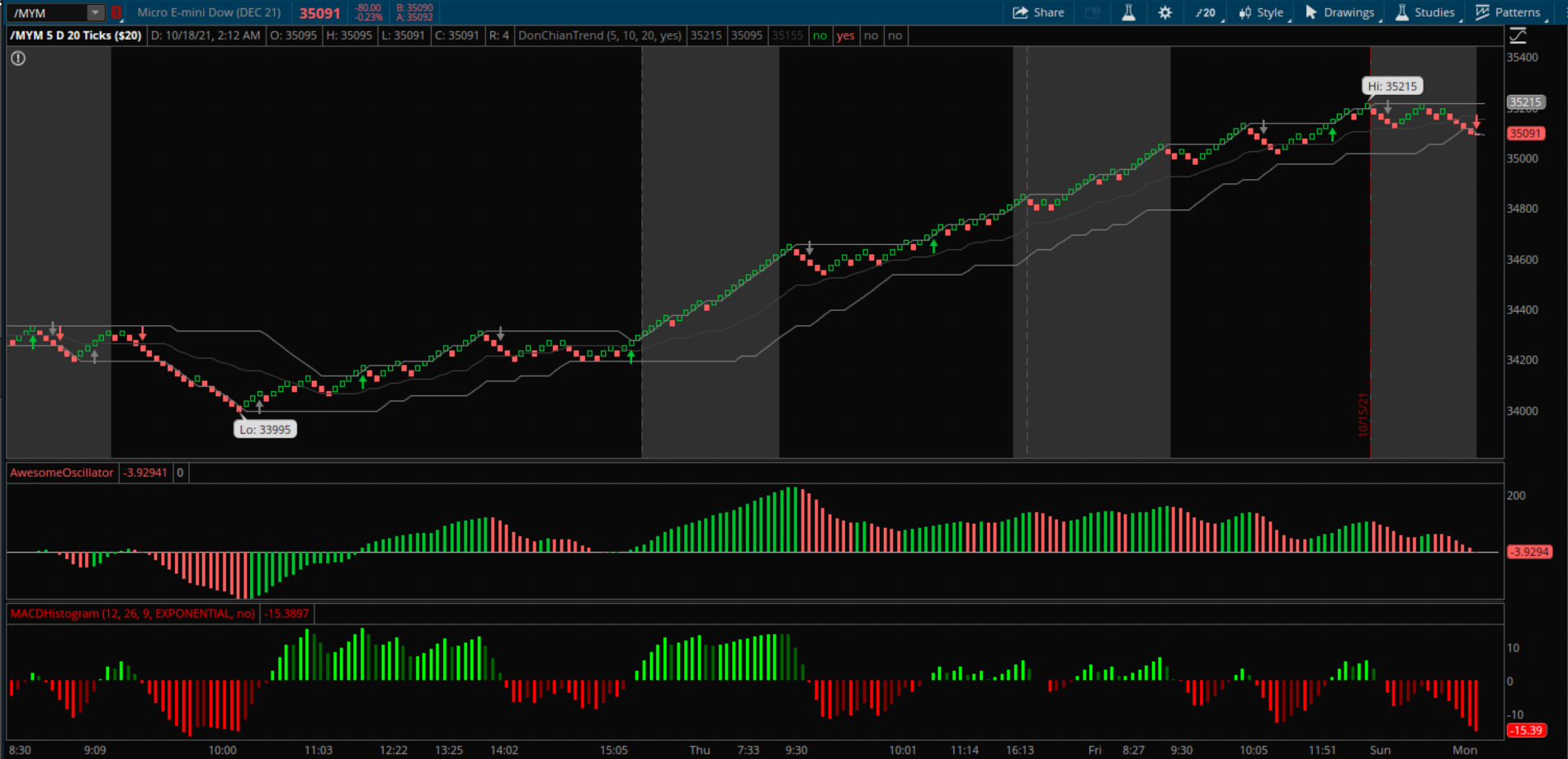

This is my first post, love this forum as I've tried to learn how to use ThinkScript. Looking for suggestions from some of you more senior scripters as to how I might improve this script I wrote (borrowing from various threads here and there) to come up with a Renko+Donchian strategy that I try to use on futures. Back testing is decent enough using my settings, but I put little to no faith in that.

Code:

##################################################

## Donchian setup for use with Renko Charts ##

## Using AwesomeOsc and MACD for validation ##

##################################################

input BandLength = 20;

input ShowSignals = yes;

def Awesome = AwesomeOscillator().AO;

def MACDVal = MACDHistogram().diff;

#### Create Donchian ####

plot upperBand = Highest(high[1], BandLength);

plot lowerBand = Lowest(low[1], BandLength);

plot middleBand = (upperBand + lowerBand) / 2;

upperBand.SetDefaultColor(Color.gray);

lowerBand.SetDefaultColor(Color.gray);

middleBand.SetDefaultColor(Color.dark_gray);

#### Signals ####

def SingleUp = high > high[1];

def SingleDn = high < high[1];

def DoubleUp = (high[1] > high[2]) and (high > high[1]);

def DoubleDn = (high[1] < high[2]) and (high < high[1]);

def TripleUp = (high[2] > high[3]) and(high[1] > high[2]) and (high > high[1]);

def TripleDn = (high[2] < high[3]) and(high[1] < high[2]) and (high < high[1]);

def BelowMD = high < middleBand;

def AboveMD = low > middleBand;

def BelowLB = high < lowerBand;

def AboveHB = low > upperBand;

def AwesomeUp = Awesome > Awesome[1];

def AwesomeDn = Awesome < Awesome[1];

def AwesomePos = Awesome > 0;

def AwesomeNeg = Awesome < 0;

def MACDPos = MACDVal > 0;

def MACDNeg = MACDVal < 0;

#### Variable to hold our position (Long/Short/Flat) ####

def CurrPos;

#### BuySignals ####

def BuySignal = (DoubleUp or AboveHB) and AwesomePos and MACDPos;

#### BuyStop Signals ####

def BuyStop = TripleDn or (high crosses below BelowMD) or (SingleDn and (high[1]==middleBand[1]));

#### SellSignals ####

def SellSignal = (DoubleDn or BelowLB) and AwesomeNeg and MACDNeg;

#### SellStop Signals ####

def SellStop = TripleUp or (low crosses above AboveMD) or (SingleUp and (low[1]==middleBand[1]));

if (BarNumber()==1) {

CurrPos = 0;

}else{

if CurrPos[1] == 0 { #### IF we're FLAT ####

If BuySignal {

CurrPos = 1;

} else if SellSignal {

CurrPos = -1;

} else {

CurrPos = CurrPos[1];

}

} else if CurrPos[1] == 1 { #### IF we're LONG ####

If SellSignal {

CurrPos = -1;

} else if BuyStop {

CurrPos = 0;

} else {

CurrPos = CurrPos[1];

}

} else if CurrPos[1] == -1 { #### IF we're SHORT ####

If BuySignal {

CurrPos = 1;

} else if SellStop {

CurrPos = 0;

} else {

CurrPos = CurrPos[1];

}

} else {

CurrPos = CurrPos[1];

}

}

#### Show signals and alert if Show Signals is turned on

plot BS = BuySignal and (CurrPos[1] <> 1) and ShowSignals; #### Buy and we're not already long

BS.SetDefaultColor(Color.UPTICK);

BS.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

alert(BuySignal and (CurrPos[1] <> 1 and ShowSignals),”Renko BUY Alert”,alert.BAR);

plot SS = SellSignal and (CurrPos[1] <> -1) and ShowSignals; #### Sell and we're not already short

SS.SetDefaultColor(Color.DOWNTICK);

SS.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

alert( SellSignal and (CurrPos[1] <> -1) and ShowSignals,”Renko SELL Alert”,alert.BAR);

plot StopBuy = BuyStop and CurrPOs[1]==1 and ShowSignals; #### Long and receive a stop

StopBuy.SetDefaultColor(Color.gray);

StopBuy.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

alert( BuyStop and CurrPOs[1]==1 and ShowSignals,”Renko Buy Stop Alert”,alert.BAR);

plot StopSell = SellStop and CurrPOs[1]==-1 and ShowSignals; #### Short and we receive a stop

StopSell.SetDefaultColor(Color.gray);

StopSell.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

alert( SellStop and CurrPOs[1]==-1 and ShowSignals,”Renko Sell Stop Alert”,alert.BAR);