Hi All,

I have a strategy that I want to implement on TOS, but it rely's on indicators being set up the same way on another charting platform called TC2000. TC2000 allows you to overlay indicators and then has a feature to allow you take each indicator and scale it with another indicator you have overlayed. I do not see any scaling features on TOS so I am thinking unfortunately the code for the indicator would have to modified to provide the scaling.

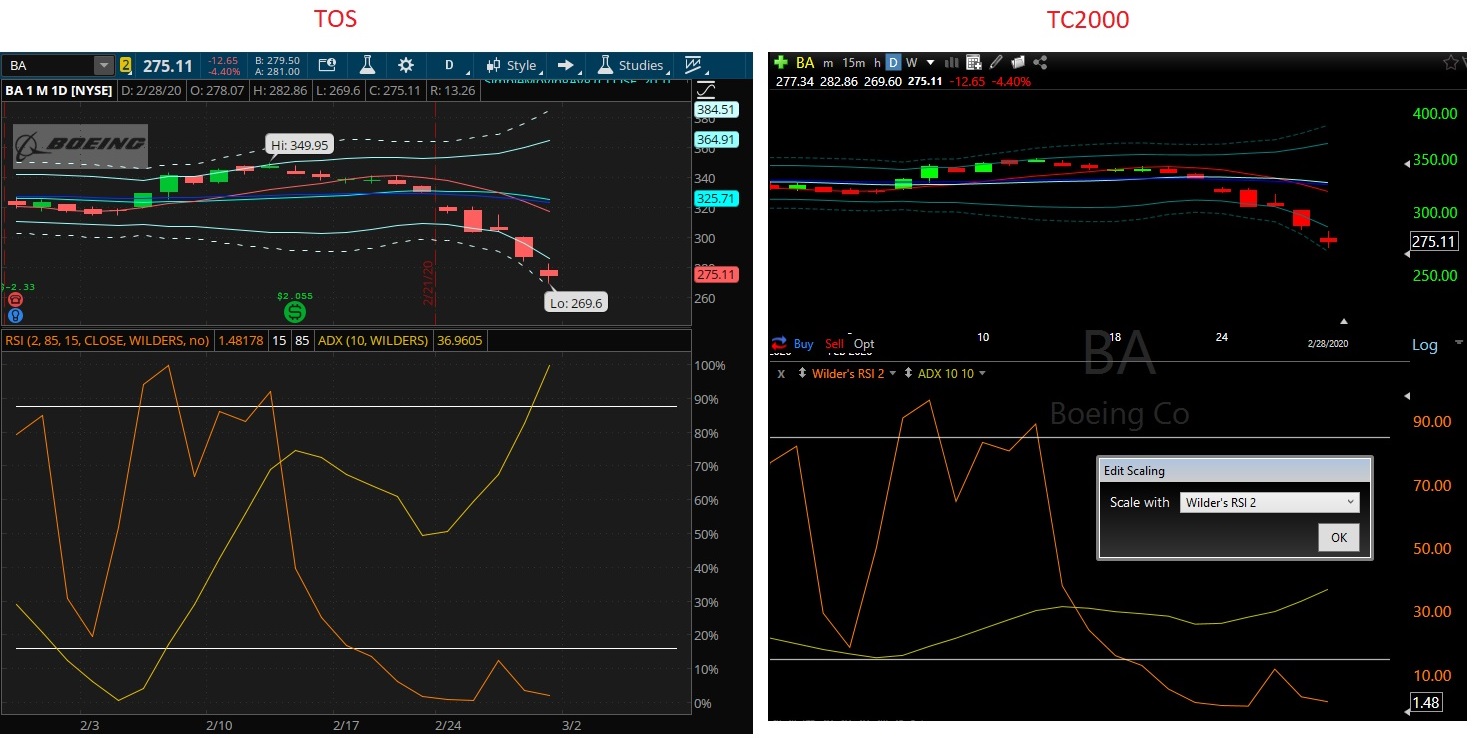

Below shows an identical chart and setup for both TOS and TC2000 so you can see the visual difference that scaling creates in TC2000.

On the left is the TOS version; right is TC2000. The 2 indicators are at the bottom; the RSI 2 and the ADX 10. In the TC2000 picture the ADX indicator has been "Scaled with the RSI 2 indicator". TOS does not allow you to do this and you can see from the 2 pictures how different the ADX indicator looks on both.

Question:

1) Am I missing something on TOS that would allow this scaling to be done?

2) If there is nothing in TOS that would allow this scaling feature, does anyone understand exactly what the scaling might be doing to be able to say if the TOS ADX indicator could be changed to mimic this scaling feature in TC2000?

Really appreciate any help at all. My only other alternative is to subscribe to a monthly data plan with TC2000 which I really do not want to do as I do all of my trading / charting with TOS and have real time data there.

I have a strategy that I want to implement on TOS, but it rely's on indicators being set up the same way on another charting platform called TC2000. TC2000 allows you to overlay indicators and then has a feature to allow you take each indicator and scale it with another indicator you have overlayed. I do not see any scaling features on TOS so I am thinking unfortunately the code for the indicator would have to modified to provide the scaling.

Below shows an identical chart and setup for both TOS and TC2000 so you can see the visual difference that scaling creates in TC2000.

On the left is the TOS version; right is TC2000. The 2 indicators are at the bottom; the RSI 2 and the ADX 10. In the TC2000 picture the ADX indicator has been "Scaled with the RSI 2 indicator". TOS does not allow you to do this and you can see from the 2 pictures how different the ADX indicator looks on both.

Question:

1) Am I missing something on TOS that would allow this scaling to be done?

2) If there is nothing in TOS that would allow this scaling feature, does anyone understand exactly what the scaling might be doing to be able to say if the TOS ADX indicator could be changed to mimic this scaling feature in TC2000?

Really appreciate any help at all. My only other alternative is to subscribe to a monthly data plan with TC2000 which I really do not want to do as I do all of my trading / charting with TOS and have real time data there.