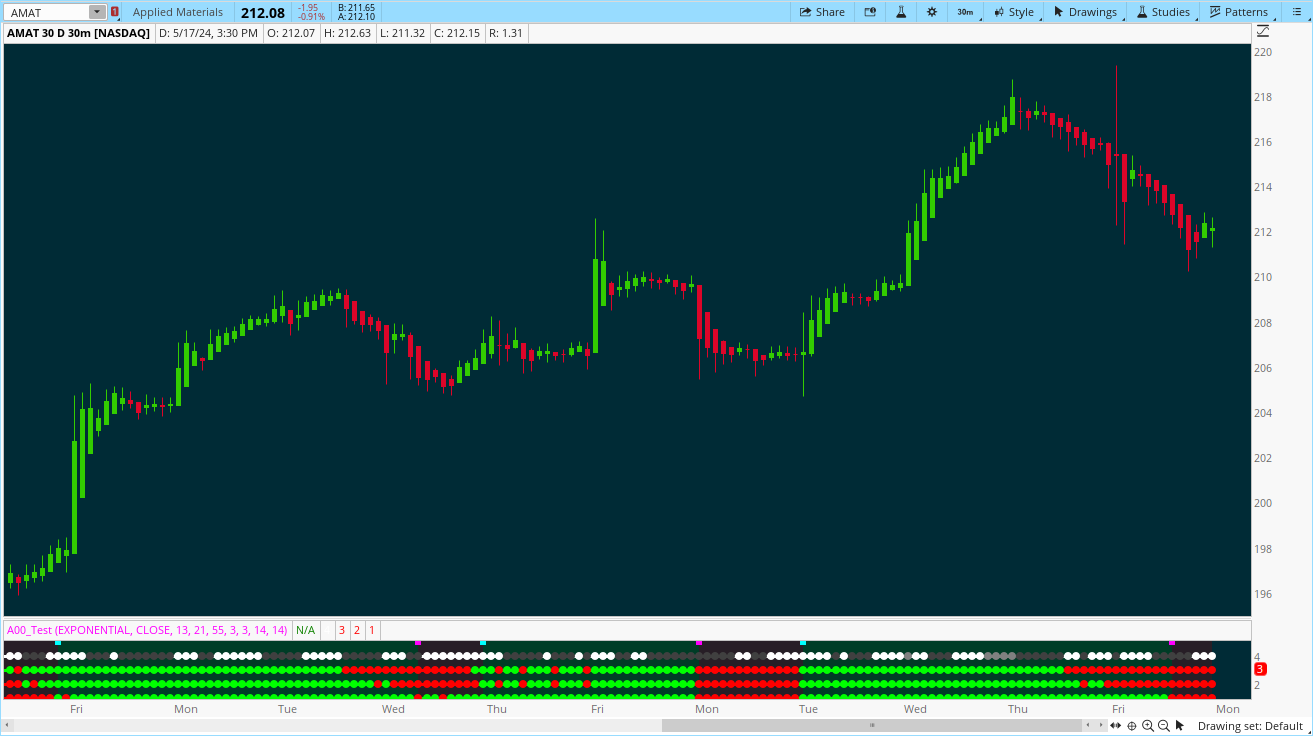

This stochRSI 3 EMA Dashboard is labeled Trend Meter on Tradingview

The author states:

This is a useful trend analysis tool.

The script consists of 3 EMAs, all weighted against the same baseline moving average to give you an overview of the trend. My meter shows the status of each EMA; either up (green) or down (red). When you see two of the same colour vertically aligned then the trade will most likely go in that direction. When all three are the same colour then it's a certainty.

The top row represents the stochastic RSI direction to further validate the EMA signals.

Please if possible, convert EMA Trend Meter

https://www.tradingview.com/script/KFLuglJc-EMA-Trend-Meter/

code is down in the comments section

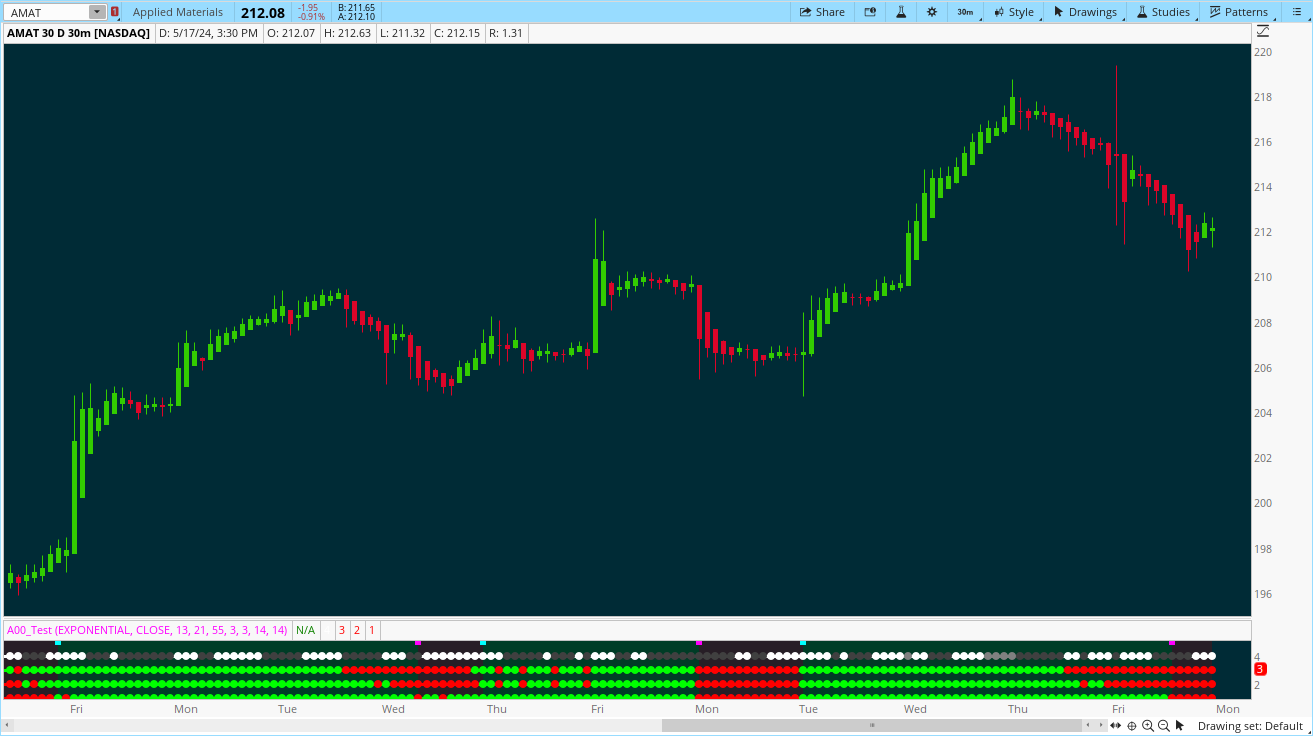

The author states:

This is a useful trend analysis tool.

The script consists of 3 EMAs, all weighted against the same baseline moving average to give you an overview of the trend. My meter shows the status of each EMA; either up (green) or down (red). When you see two of the same colour vertically aligned then the trade will most likely go in that direction. When all three are the same colour then it's a certainty.

The top row represents the stochastic RSI direction to further validate the EMA signals.

Please if possible, convert EMA Trend Meter

https://www.tradingview.com/script/KFLuglJc-EMA-Trend-Meter/

code is down in the comments section

Last edited by a moderator: