As stated in the OP, this system utilizes both regular divergence and hidden divergence. Hidden divergence is the inverse of regular divergence- this is why you are seeing "backward" divergences in the images. They are called hidden divergence.I'm a long time believer in Stochastics Divergence but I've never been able to set up a scan to capture them real time. Can anyone share an idea for how to scan for them? I doesn't sound like it would be that difficult however coding isn't my specialty.

To be clear a divergence occurs when;

1) Bullish Entry: Price makes a new low however the stochastics indicator does not make a new low. The stoch indicator makes a higher low.

2) Bearish Entry: Price makes a new high however the stochastics indicator does not make a new high. The stoch indicator makes a lower high.

Some of the screenshots above have this backward.

Thanks - I'm a first time poster.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Repaints Stochastics Divergence System For ThinkOrSwim

- Thread starter Chence27

- Start date

Repaints

Thanks @Chence27 ! Appreciate all your efforts. Will this work for SPX on multiple tf's? When I change the tf from anything greater than 1m, there seems to be a conflicting note on the upper left of the price chart. Is this normal or are there further settings that I'm missing? Thanks again! Great work!!As stated in the OP, this system utilizes both regular divergence and hidden divergence. Hidden divergence is the inverse of regular divergence- this is why you are seeing "backward" divergences in the images. They are called hidden divergence.

Yeah it works with every symbol. I'm not sure what this "conflicting note" is. Maybe attach a screenshot of it.Thanks @Chence27 ! Appreciate all your efforts. Will this work for SPX on multiple tf's? When I change the tf from anything greater than 1m, there seems to be a conflicting note on the upper left of the price chart. Is this normal or are there further settings that I'm missing? Thanks again! Great work!!

Thanks for the reply. When I change time frames other than 1m, here is what I see:Yeah it works with every symbol. I'm not sure what this "conflicting note" is. Maybe attach a screenshot of it.

@rfb You have AggregationPeriod discrepancies... For a more in-depth explanation, read about Referencing Secondary Aggregation

Last edited by a moderator:

Go through the indicator settings and make sure any settings regarding time frames match the chart time frame. I no longer use this system nor Thinkorswim and I can't recall the name of the culprit indicator but it should be easy to find.Thanks for the reply. When I change time frames other than 1m, here is what I see:

Thanks. After @rad14733 pointed me in the right direction, I've already changed the settings to match the time frames I'm looking at in addition to making minor adjustments to your existing code (back-testing purposes only)Go through the indicator settings and make sure any settings regarding time frames match the chart time frame. I no longer use this system nor Thinkorswim and I can't recall the name of the culprit indicator but it should be easy to find.

If you don't mind me asking, why are you not using this indicator or ToS any more? Your past posts here seemed it was working well for you. Just curious. Thank you.

TOS is a sub par platform for any serious trader in several aspects, and I've begun trading based on orderflow and market structure rather than lagging indicators.Thanks. After @rad14733 pointed me in the right direction, I've already changed the settings to match the time frames I'm looking at in addition to making minor adjustments to your existing code (back-testing purposes only)

If you don't mind me asking, why are you not using this indicator or ToS any more? Your past posts here seemed it was working well for you. Just curious. Thank you.

Imagine that there was an 80 percent probability that price would make an average 20 point move at a certain level simply by knowing how many buyers and sellers transacted at that level. I don't know of any lagging indicator that is that reliable. Sadly TOS lacks the capability of providing that kind of information.

Thank you.. Interesting info and perspective. As we all know there is no "holy grail" system, but 80% probability is a healthy statistic! Would you mind sharing what platform and or brokerage you are using? Thanks again!TOS is a sub par platform for any serious trader in several aspects, and I've begun trading based on orderflow and market structure rather than lagging indicators.

Imagine that there was an 80 percent probability that price would make an average 20 point move at a certain level simply by knowing how many buyers and sellers transacted at that level. I don't know of any lagging indicator that is that reliable. Sadly TOS lacks the capability of providing that kind of information.

Absolutely. I use Sierra Chart with Stage 5 broker. Check out ES Spy King on twitter to learn more about the method.Thank you.. Interesting info and perspective. As we all know there is no "holy grail" system, but 80% probability is a healthy statistic! Would you mind sharing what platform and or brokerage you are using? Thanks again!

Thanks!Absolutely. I use Sierra Chart with Stage 5 broker. Check out ES Spy King on twitter to learn more about the method.

A member posted a comment here and then apparently deleted it, but I'd like to address what was said.

"Be wary of orderflow. It's marketed as a revolutionary concept but prop traders only have a 50% win rate. Risk management makes them money. No one can achieve an 80% win rate. You'll spend money on orderflow software and then find out it's not helpful."

Most of what was said here is verifiably false. I personally know traders who are 50% profitable on their worst day and 100% on their best. It sounds like this person didn't learn or understand orderflow sufficiently. Orderflow literally allows you to see the most important aspect of market activity and I know from experience that it can give you an edge unlike anything else. I am not lying, the system I mentioned that has an 80% win rate has been documented in real time in our discord group, and can be verified by anyone with a twitter account. Simply find ES Spy King on twitter and check all of his past buy and sell levels. Go back in the charts and see the performance for yourself. Unfortunately we have to deal with ignorance in all walks of life, the trading community included.

"Be wary of orderflow. It's marketed as a revolutionary concept but prop traders only have a 50% win rate. Risk management makes them money. No one can achieve an 80% win rate. You'll spend money on orderflow software and then find out it's not helpful."

Most of what was said here is verifiably false. I personally know traders who are 50% profitable on their worst day and 100% on their best. It sounds like this person didn't learn or understand orderflow sufficiently. Orderflow literally allows you to see the most important aspect of market activity and I know from experience that it can give you an edge unlike anything else. I am not lying, the system I mentioned that has an 80% win rate has been documented in real time in our discord group, and can be verified by anyone with a twitter account. Simply find ES Spy King on twitter and check all of his past buy and sell levels. Go back in the charts and see the performance for yourself. Unfortunately we have to deal with ignorance in all walks of life, the trading community included.

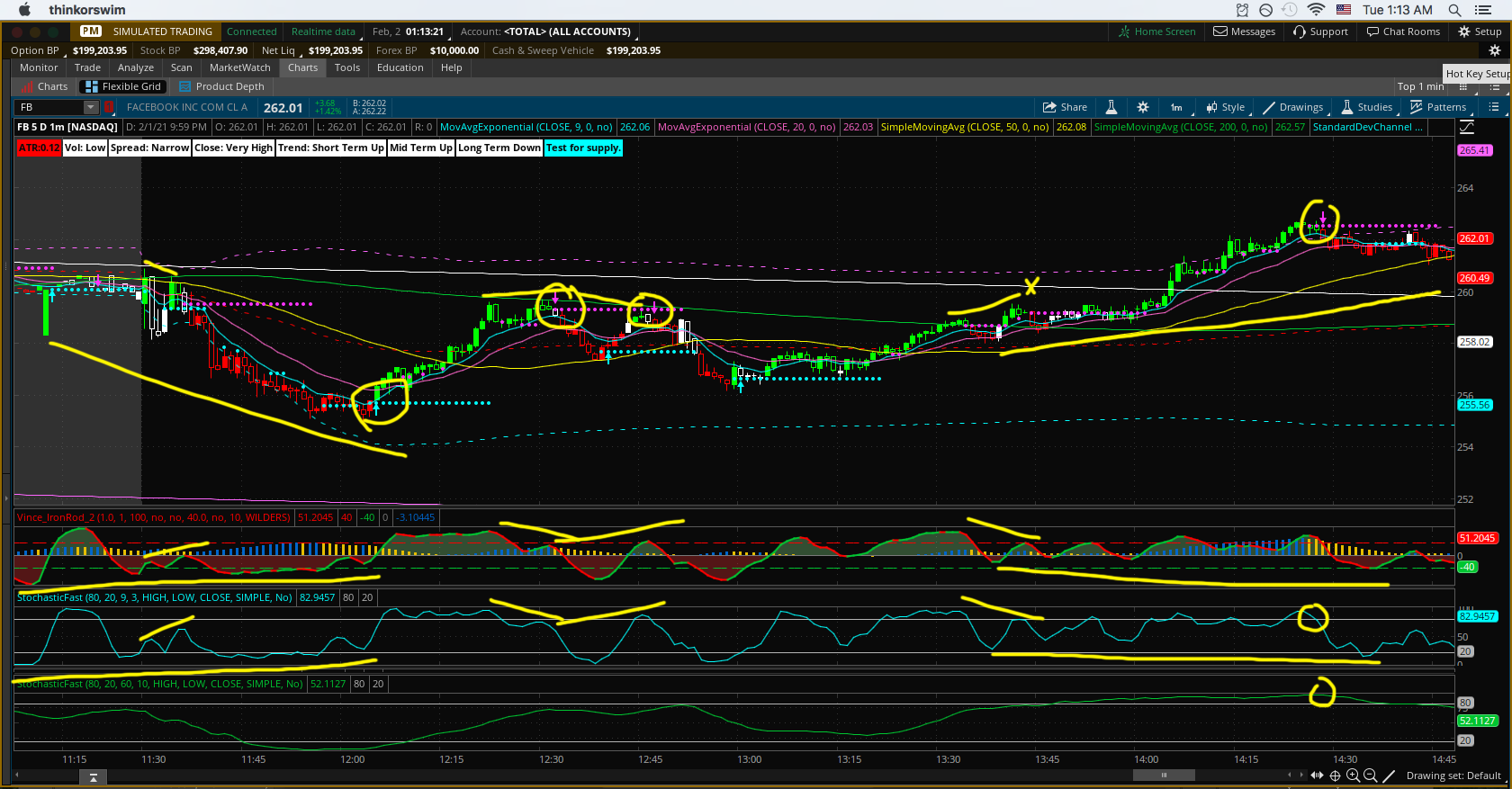

Chence, very interesting. trying to learn more about this. What does "Ironrod SMI" measure?This strategy is based on stochastics divergence and overbought/oversold levels, with a few other indicators for confirmation. The signals have a high accuracy rate. I trade this on a one minute chart.

The indicators:

The main play is to trade divergences, both regular and hidden. Short term divergences are found on the Stoch(9,3) and should be confirmed with a divergence on Ironrod SMI, although a divergence on the stoch is almost guaranteed to be on the Ironrod SMI. On the other hand, many times the Ironrod SMI picks up divergences more clearly than the stoch and sometimes it picks up divergences when there are none on the stoch, and these can be traded too, but the accuracy rate is higher with both indicators picking up the divergence. Longer divergences are found on the stoch(60,10) and don't need confirmation from any other lower indicator.

- Stochastics Fast (9,3) (available in ToS)

- Stochastics Fast (60,10) (available in ToS)

- Ironrod SMI

- Top Breakout Indicator

- Supertrend CCI ATR

- Trend Reversal indicator

EDIT: On stochastics (60,10) I am now using the faster k line (10) for divergences rather than the slower d line (60) because the d line lags way too much and the k line picks up way more divergences. The accuracy of the k line divergences is scary! At least on es.

The highest probability divergence on stoch is when the higher high is above the overbought level and the lower high is below the overbought level, or when the lower low is below the oversold level and the higher low is above the oversold level. The greater the distance between the highs or lows, the higher the probability of the reversal (regular divergence) or continuation (hidden divergence).

Another thing to look out for is when price is in a tight range, not able to make higher highs or lower lows (the swing highs or lows bounce at the same price), but stochastics or Ironrod is making higher highs or lower lows. This has a lower probability of resulting in a reversal or continuation than the regular and hidden divergences, but can still be valid.

Plays can be made with overbought and oversold levels on the stochastics as well. If there isn't a strong trend and price action is in more of a range, matching overbought or oversold levels on both stochastics can be a high probability reversal trade. Pullback plays can be found when stoch(60,10) is at overbought or oversold for a while (more than 30 minutes perhaps) and stoch(9,3) quickly dips to the opposite oversold/bought level.

Confirmation for all of these trades should include a signal from Top Breakout indicator, a change in color (green to red or red to green) of the SMI line on the Ironrod indicator, an arrow from the trend reversal indicator, and a change in color of the Supertrend which paints the candles.

I also draw trendlines and support and resistance lines as part of my strategy and use standard deviation channels to help spot potential reversal areas.

Using the same system on a five minute chart will help spot higher probability and longer lasting moves.

This seems to work particularly well on futures, perhaps because they move more than most stocks.

S

SMI is stochastic momentum indicatorChence, very interesting. trying to learn more about this. What does "Ironrod SMI" measure?

I don't see why not.Can we create alerts for arrows up & arrows down?

Order flow is real time data of buyer and seller transactions. There are various ways to visualize this, although TOS is severely limited in this area and the only order flow tools it provides, the DOM and time and sales, are garbage.@Chence27 congrats on your success!

Are you still trading based off divergences?

And can you elaborate more on the order flow concept you mentioned(I don't have or use twitter).

Tidan

Member

What do you use in Sierra charts for visualizing order flow?Order flow is real time data of buyer and seller transactions. There are various ways to visualize this, although TOS is severely limited in this area and the only order flow tools it provides, the DOM and time and sales, are garbage.

And are you still trading divergences?

I use custom order flow studies which visualize the strength of the buyers and sellers in various ways and on various time frames. And yes I use divergences in my trading system. I don't use this stochastic divergence system anymore nor do I use time-based charts for my trigger charts.What do you use in Sierra charts for visualizing order flow?

And are you still trading divergences?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

-

ATR and Exponential Moving Average Divergence Strategy (Ideal for Options)

- Started by YungTraderFromMontana

- Replies: 3

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

752

Online

Similar threads

-

ATR and Exponential Moving Average Divergence Strategy (Ideal for Options)

- Started by YungTraderFromMontana

- Replies: 3

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

Similar threads

-

ATR and Exponential Moving Average Divergence Strategy (Ideal for Options)

- Started by YungTraderFromMontana

- Replies: 3

-

Percent From High Dynamic Channel + Breakout System For ThinkOrSwim

- Started by uplink

- Replies: 3

-

Momentum Conviction Scoring System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 18

-

3 Trigger Pillar System For ThinkOrSwim

- Started by justAnotherTrader

- Replies: 17

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.