I get asked for my strategy a TON! so I'm going to just share it here to have a place to direct people.

So when I started trading, I use to always "buy the bottom" and "Sell the top". This was always the rule that I heard. So I figured when I was searching for stocks, I would try to find stocks that have had big fall backs, then I would try to find some type of resistance and buy when it bounces off. But we all know the notorious "bounce then keep falling" routine lol.

So after years and years of trying to accomplish this and master it, I only ended up losing money in the end. Yes I had some really good trades that made me a lot of money, but at the end of the year I could never keep a winning balance. So I decided that I was going to buy into stocks that were already going up, but had a retracement that I could buy off of. Eventually I settled on the 21 length EMA (Exponential Moving Average), I noticed that on almost all timeframes the 21EMA had a huge impact as a support and resistance line on price action. The 21EMA also offered to show when a stock was trending well.

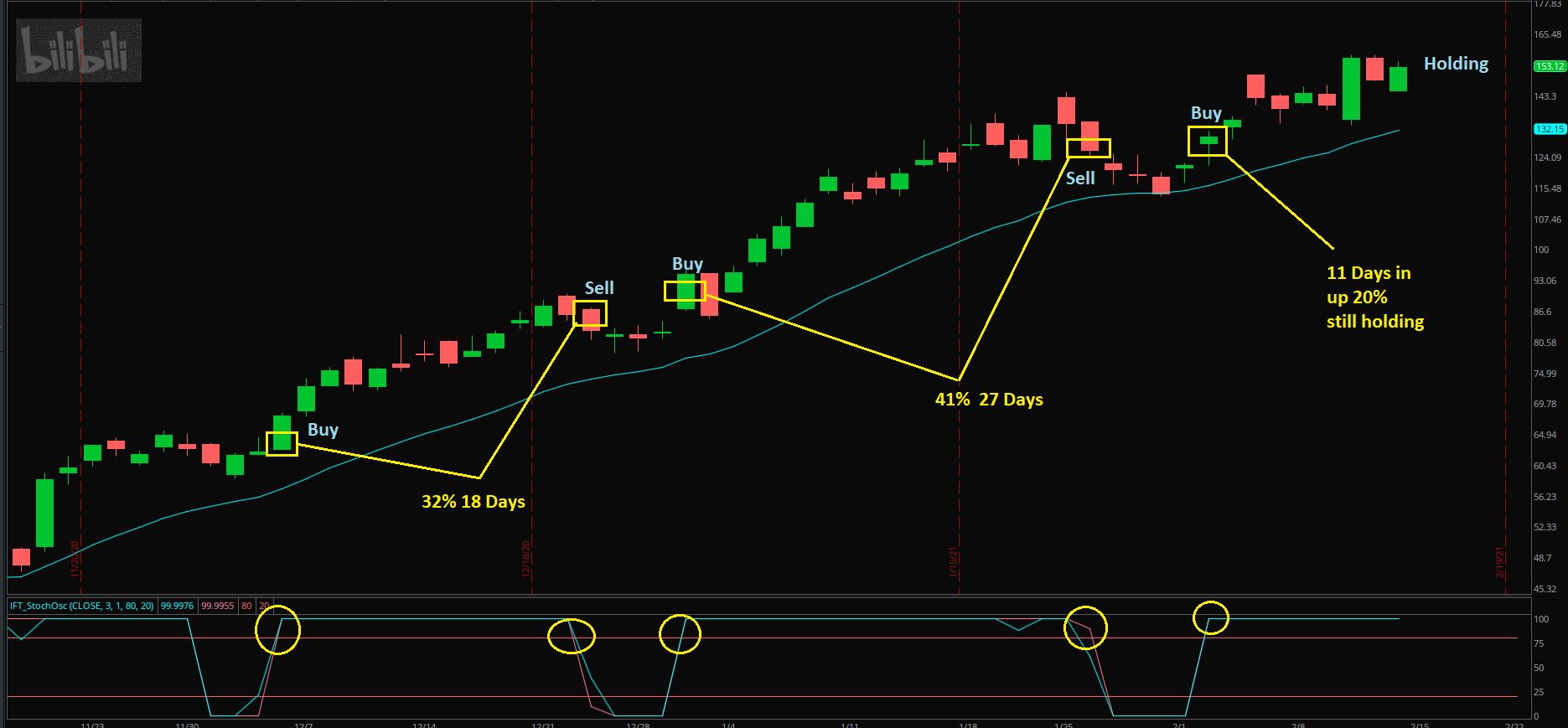

So then I needed a reason to enter, So I mixed in a few stochastics to figure out which one I like the best for this method. I ended up landing on the IFT_StochOsc indicator (Shout out to @Tradervic for showing me this one). So the new plan was when price would fall down to the 21EMA, the price starts to turn around back upwards and the stochastic would jump up. BUY and then hold until the stochastic would fall back down.

So in this example Above, it shows you that price is staying above the 21EMA and trending well. Price will drop down near EMA and bounce, once you get a confirmed bounce the IFT stochastic will jump to 100. This is where you buy. You want the IFT to be zero'd out before the bounce up and you don't want too much of a gap between the price and the EMA, these like to cause false signals. I have the IFT stochastic indicator set to 3 Length and 1 Slowing Length. You can use whatever you like, but this is what i have fell on liking the most.

So above there are 3 beautiful trades there, of course this is the kind of setups you see on YouTube or google. You always see the perfect charts, of course this doesn't always work.

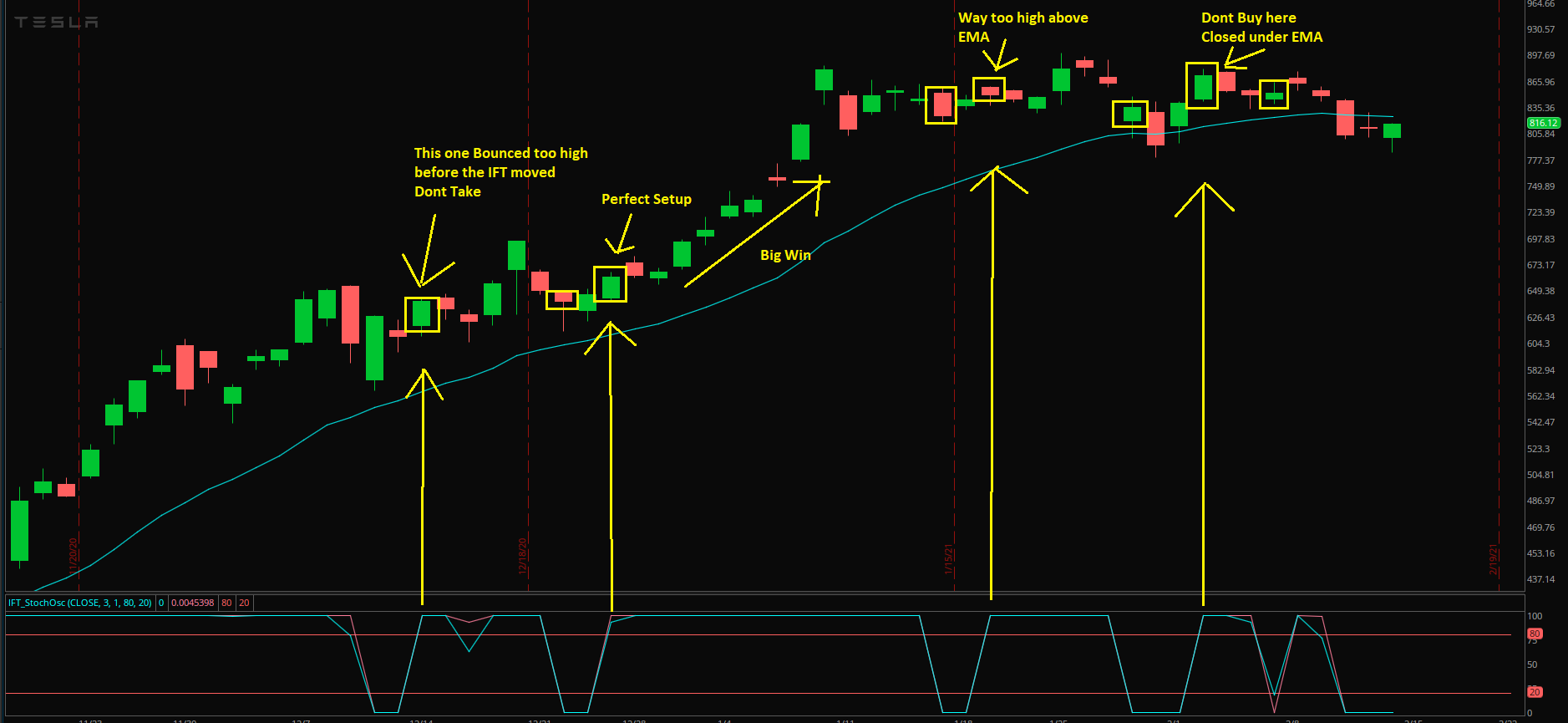

So here is TSLA:

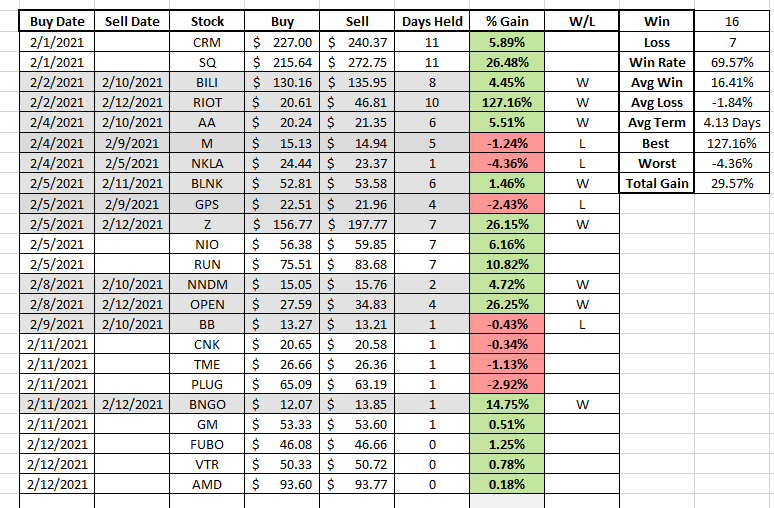

Okay so this Strategy of mine, I have landed on this and have done nothing but trade with this. This is due to the fact that I have realized that no matter what I will get losses. So with this strategy, the stock will either take off and start surging, or its going to start falling slowly. So Since I have started trading with this strategy my average profit on winning trades is around +13.8% and my average loss on losing trades is -2.4% with a total win rate of about 59%. So this is actually huge. Yes you get a lot of losses, but those losses are kept minimal and it lets profits run.

So this next picture is my trades of February and we just finished the 2nd week of the month. It has been a very good month for me. Everyone has their own methods of executing n such. But I prefer stocks that are 5% APTR or higher (Meaning it on average moves 5% on the daily), and I also want the stock to be above the 200SMA (Simple Moving Average) as well.

I also use both Daily and Weekly timeframes with this method. I have also tried this on the 4hr timeframe before, but sometimes price moves so quickly on the open on a trade your suppose to be in, I miss out on them a lot. So I prefer to sit on my trades for days (unless it goes south)

Every indicator in this Strategy is provided on the TOS application by default.

Using my BTD_Percentile indicator (VIP Indicator) with the strategy above is also very very nice for a confirmation of a bounce. I personally like to use a 5 length on that.

I like to keep my methods simple, no need for always having 21.5 indicators on your screen blocking all the price action. Out of all the fancy indicators out there, and ones that I've made, I still personally only use basic indicators

So when I started trading, I use to always "buy the bottom" and "Sell the top". This was always the rule that I heard. So I figured when I was searching for stocks, I would try to find stocks that have had big fall backs, then I would try to find some type of resistance and buy when it bounces off. But we all know the notorious "bounce then keep falling" routine lol.

So after years and years of trying to accomplish this and master it, I only ended up losing money in the end. Yes I had some really good trades that made me a lot of money, but at the end of the year I could never keep a winning balance. So I decided that I was going to buy into stocks that were already going up, but had a retracement that I could buy off of. Eventually I settled on the 21 length EMA (Exponential Moving Average), I noticed that on almost all timeframes the 21EMA had a huge impact as a support and resistance line on price action. The 21EMA also offered to show when a stock was trending well.

So then I needed a reason to enter, So I mixed in a few stochastics to figure out which one I like the best for this method. I ended up landing on the IFT_StochOsc indicator (Shout out to @Tradervic for showing me this one). So the new plan was when price would fall down to the 21EMA, the price starts to turn around back upwards and the stochastic would jump up. BUY and then hold until the stochastic would fall back down.

So in this example Above, it shows you that price is staying above the 21EMA and trending well. Price will drop down near EMA and bounce, once you get a confirmed bounce the IFT stochastic will jump to 100. This is where you buy. You want the IFT to be zero'd out before the bounce up and you don't want too much of a gap between the price and the EMA, these like to cause false signals. I have the IFT stochastic indicator set to 3 Length and 1 Slowing Length. You can use whatever you like, but this is what i have fell on liking the most.

So above there are 3 beautiful trades there, of course this is the kind of setups you see on YouTube or google. You always see the perfect charts, of course this doesn't always work.

So here is TSLA:

- On the 1st buy signal, the price was already well on its way up before the Stochastic moved up. I try to avoid these. Sometimes they work out, but I see a lot of failed trys when this happens.

- On the 2nd buy signal, it looks good. I might of preferred the price to be a little closer to the EMA, but this works.

- On the 3rd buy signal, it is so insanely high above the EMA, stay out of these. These do also have good potential, but I avoid them because Price likes to fall down the the EMA right after a lot.

- On the 4th signal, 2 bars before the IFTW entry signal the stock closed below the EMA. This is something I also avoid, I want to see the stock bounce off the EMA and not just go back n forth through it no problem.

Okay so this Strategy of mine, I have landed on this and have done nothing but trade with this. This is due to the fact that I have realized that no matter what I will get losses. So with this strategy, the stock will either take off and start surging, or its going to start falling slowly. So Since I have started trading with this strategy my average profit on winning trades is around +13.8% and my average loss on losing trades is -2.4% with a total win rate of about 59%. So this is actually huge. Yes you get a lot of losses, but those losses are kept minimal and it lets profits run.

So this next picture is my trades of February and we just finished the 2nd week of the month. It has been a very good month for me. Everyone has their own methods of executing n such. But I prefer stocks that are 5% APTR or higher (Meaning it on average moves 5% on the daily), and I also want the stock to be above the 200SMA (Simple Moving Average) as well.

I also use both Daily and Weekly timeframes with this method. I have also tried this on the 4hr timeframe before, but sometimes price moves so quickly on the open on a trade your suppose to be in, I miss out on them a lot. So I prefer to sit on my trades for days (unless it goes south)

Every indicator in this Strategy is provided on the TOS application by default.

Using my BTD_Percentile indicator (VIP Indicator) with the strategy above is also very very nice for a confirmation of a bounce. I personally like to use a 5 length on that.

I like to keep my methods simple, no need for always having 21.5 indicators on your screen blocking all the price action. Out of all the fancy indicators out there, and ones that I've made, I still personally only use basic indicators

Last edited: