Is there any way we can get a Stepped Heiken Ashi Moving Average MTF/T3 study converted from TradingView?

https://www.tradingview.com/script/...n-Ashi-Moving-Average-w-Jurik-Filtering-Loxx/

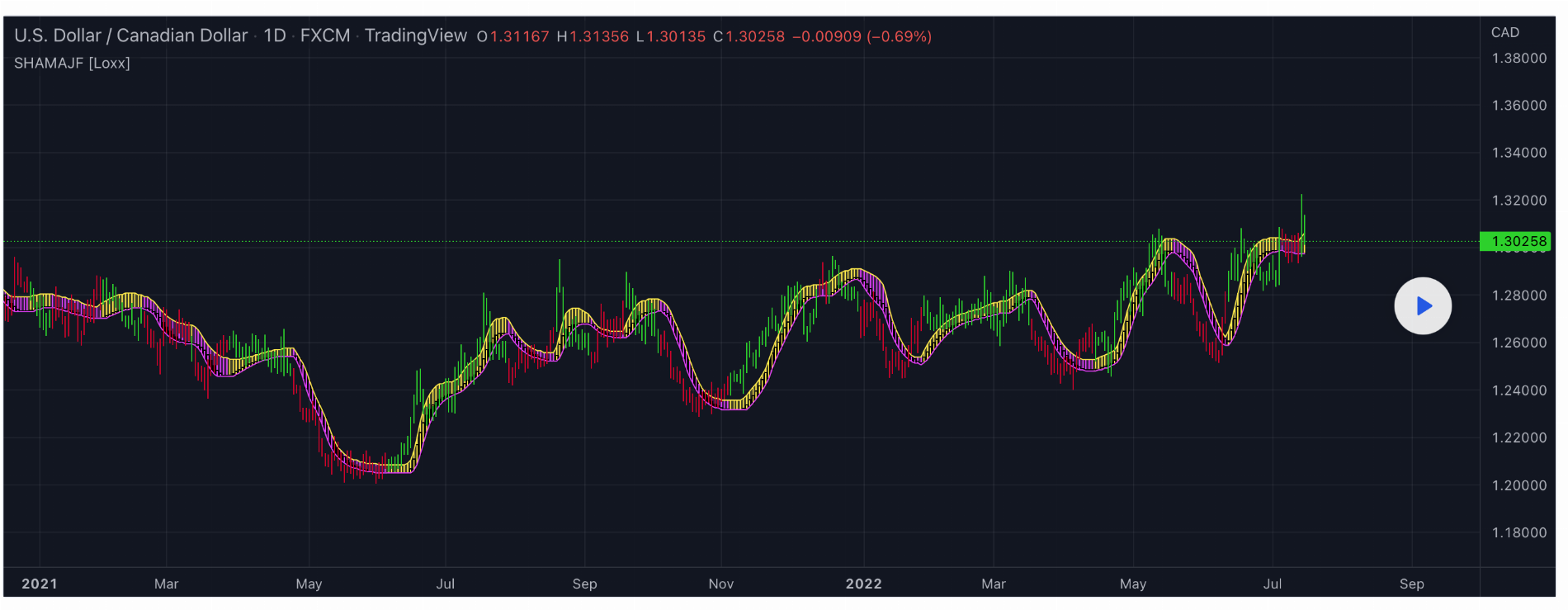

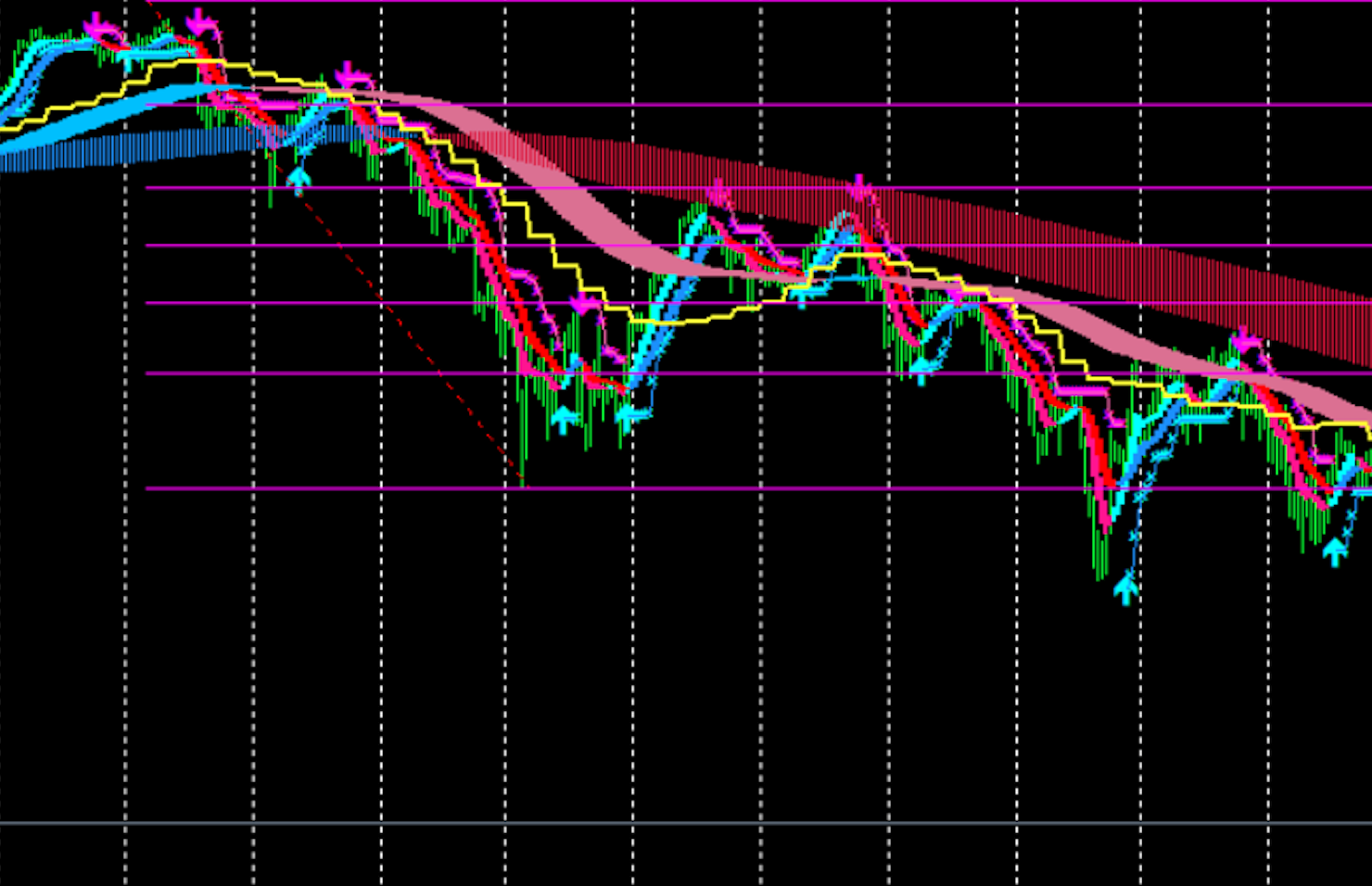

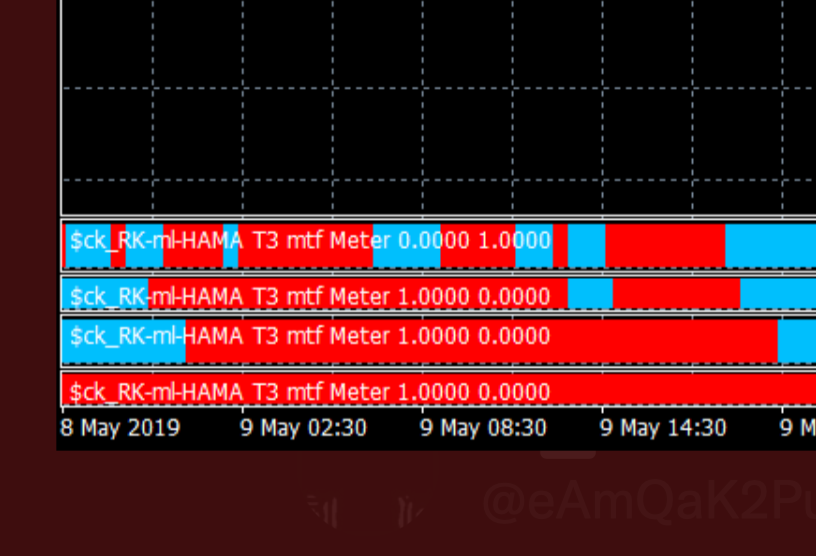

I provided the code below that I found. The 1st attached image shows the general application as shown on TradingView. The 2nd image is from an MT4 chart that shows the different size in the 'ribbons' based upon the different time frames (I wasn't able to find an example of the multiple ribbons on TradingView for the study) - the chart looks a little busy, but it's only the red/blue ribbons that I'm referencing. The last and 3rd image is the lower study to show buy/sell alignments w/ the upper ribbons/study.

// This source code is subject to the terms of the Mozilla Public License 2.0 at

https://mozilla.org/MPL/2.0/

// © loxx

//@version=5

indicator("Stepped Heiken Ashi Moving Average w/ Jurik Filtering [Loxx]",

shorttitle = "SHAMAJF [Loxx]",

overlay = true,

timeframe="",

timeframe_gaps = true)

import loxx/loxxexpandedsourcetypes/3

import loxx/loxxjuriktools/1

calcBaseUnit() =>

bool isForexSymbol = syminfo.type == "forex"

bool isYenPair = syminfo.currency == "JPY"

float result = isForexSymbol ? isYenPair ? 0.01 : 0.0001 : syminfo.mintick

_declen()=>

mtckstr = str.tostring(syminfo.mintick)

da = str.split(mtckstr, ".")

temp = array.size(da)

dlen = 0.

if syminfo.mintick < 1

dstr = array.get(da, 1)

dlen := str.length(dstr)

dlen

greencolor = #2DD204

redcolor = #D2042D

per= input.int(13, "Period", group = "Basic Settings")

step = input.int(1, "Step", group = "Basic Settings", minval = 1)

better = input.bool(false, "Better HA?", group = "Basic Settings")

jurik = input.bool(true, "Juirk Filtered?", group = "Basic Settings")

jper= input.int(34, "Juirk Length", group = "Basic Settings")

jphs= input.int(0, "Juirk Phase", group = "Basic Settings")

colorbars = input.bool(false, "Color bars?", group= "UI Options")

showcandles = input.bool(false, "Show candles?", group= "UI Options")

showfill = input.bool(false, "Show fill?", group= "UI Options")

maOpen = 0.

maClose = 0.

maLow = 0.

maHigh =0.

if jurik

maOpen := loxxjuriktools.jurik_filt(open, jper, jphs)

maClose := loxxjuriktools.jurik_filt(close, jper, jphs)

maLow := loxxjuriktools.jurik_filt(low, jper, jphs)

maHigh := loxxjuriktools.jurik_filt(high, jper, jphs)

else

maOpen := ta.sma(open, per)

maClose := ta.sma(close, per)

maHigh := ta.sma(high, per)

maLow := ta.sma(low, per)

haClose = 0.

if better

if (maHigh != maLow)

haClose := (maOpen + maClose) / 2 + (((maClose - maOpen) / (maHigh - maLow)) * math.abs((maClose - maOpen) / 2))

else

haClose := (maOpen + maClose) / 2

else

haClose := (maOpen + maHigh + maLow + maClose) / 4

haOpen = 0.

haOpen := (nz(haOpen[1]) + nz(haClose[1]))/2

haHigh = math.max(maHigh, math.max(haOpen, haClose))

haLow = math.min(maOpen, math.min(haOpen, haClose))

color colorhigh = na

color colorlow = na

if (haOpen < haClose)

colorlow := color.fuchsia

colorhigh := color.yellow

else

colorlow := color.fuchsia

colorhigh := color.yellow

outLow = haLow

outHigh = haHigh

outOpen = haOpen

outClose = haClose

if (math.abs(outLow - nz(outLow[1])) < step * _declen() * calcBaseUnit())

outLow := nz(outLow[1])

if (math.abs(outHigh - nz(outHigh[1])) < step * _declen() * calcBaseUnit())

outHigh := nz(outHigh[1])

if (math.abs(outOpen - nz(outOpen[1])) < step * _declen() * calcBaseUnit())

outOpen := nz(outOpen[1])

if (math.abs(outClose - nz(outClose[1])) < step * _declen() * calcBaseUnit())

outClose := nz(outClose[1])

colorout = outClose > outOpen ? greencolor : redcolor

coloroutf = outClose > outOpen ? color.yellow : color.fuchsia

plotcandle(outOpen, outHigh, outLow, outClose, color = showcandles ? coloroutf : na, wickcolor = showcandles ? coloroutf : na)

l = plot(outLow, color = colorlow)

h = plot(outHigh, color = colorhigh)

fill(h, l, color = showfill ? color.new(coloroutf, 80) : na)

barcolor(colorbars ? colorout : na)