I am interested in learning About his trading methodology, but not much info available as far as I can find.

The concepts are Gamma Exposure (GEX): a combo of Gamma Flip, Gamma P&L, and Gamma Volatility as relating to Static or Dynamic Delta Hedging (and highest open interest on the option chains). This is where the DarkPools ALL swim and eat.

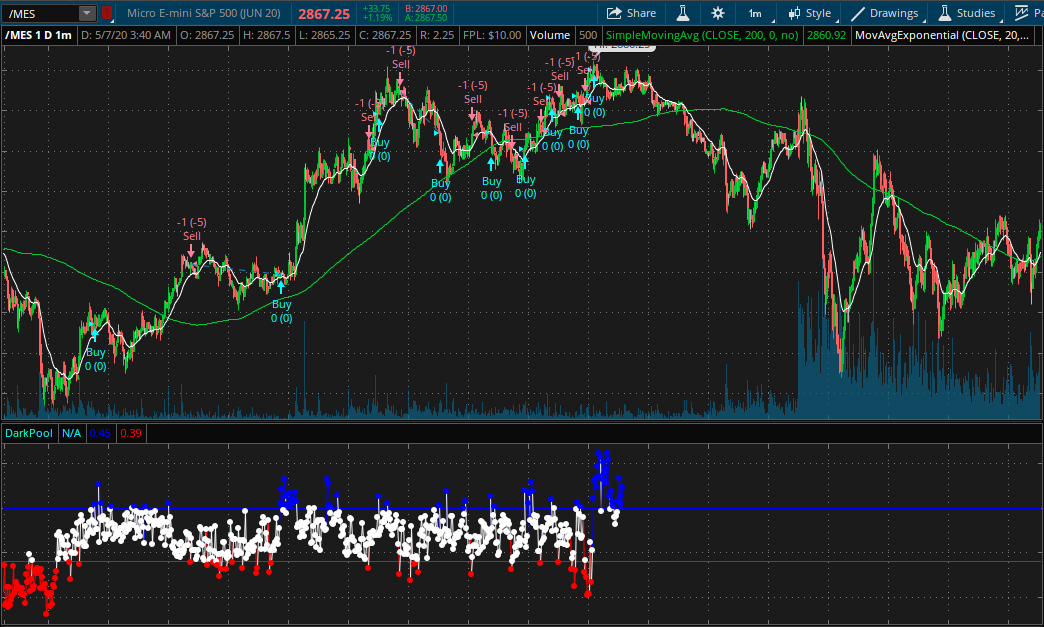

The colored lines above represent: Gamma Flip - Red & Green w/yellow, Gamma P&L (Cyan) and Gamma volatility (Plum). You'll notice those levels are usually the hard stops on price reversals (not anything else, not breakout, not VWAP, not moving averages etc.)

Market makers try to keep Delta neutral throughout each week, balanced at market open and market close. They hedge using futures and inverse indexes, plus buying and selling premium on option chains as the Gamma is the most important stat as option chain weeklies near expiration Friday.

Market structure is setup each week, each month, each quarter. This has to do with money managers needing to fill quotas and their bonuses come end of quarter/end of year. MMs like to sell volatility as a means to generate additional cash flow, as well as selling premium on options (calls and puts). This is all based on heavy duty Quant research done by PhDs at major universities CalTech, Yale, Oxford, Penn, and many many others.

The daily volatility is measured as a variance from the past, calculated in 5m intervals or 30m intervals and re-arranged at market open and close usually every day, and certainly on Fridays/Mondays.

I have found it's best to trade stocks that have great Gamma profiles through lots of dynamic hedging, highly liquid, good spreads, good volatility with low-medium IV (20%-50%).