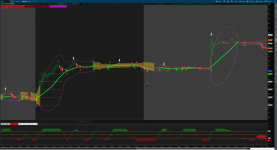

This Squeeze Strategy incorporates RSI for momentum confirmation, volume analysis, and a signal line to identify potential breakout opportunities.

Squeeze condition occurs when Bollinger Bands are inside Keltner Channels

Bollinger Bands: Measure volatility and identify overbought/oversold conditions

Keltner Channels: Provide a trend-following envelope

HOW TO USE

Look for Squeeze Condition: When the "Bollinger Band Squeeze" label appears, it indicates a potential buildup of volatility

Monitor Squeeze Intensity: Lower intensity suggests a stronger potential breakout

Confirm Direction:

Watch for Breakouts:

Use the Signal Line:

Consider Volume: High volume (1.5x average) during a breakout suggests stronger conviction

Interpretation:

- Squeeze + High Intensity + Strong Directional Bias + High Volume Breakout = High Probability Trade

Setup

# Note: This indicator is for informational purposes only. Always conduct your own analysis and manage your risk appropriately.

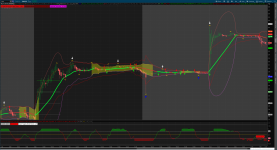

Squeeze condition occurs when Bollinger Bands are inside Keltner Channels

Bollinger Bands: Measure volatility and identify overbought/oversold conditions

Keltner Channels: Provide a trend-following envelope

- RSI: Confirms momentum direction

- Volume Analysis: Helps confirm potential breakouts

- Linear Regression Slope: Indicates overall trend direction

- Squeeze Intensity: Measures how tight the squeeze is

- Signal Line: 9-period moving average for additional trend confirmation

HOW TO USE

Look for Squeeze Condition: When the "Bollinger Band Squeeze" label appears, it indicates a potential buildup of volatility

Monitor Squeeze Intensity: Lower intensity suggests a stronger potential breakout

Confirm Direction:

- Use the "Direction" label to identify the overall trend

- Strong trends are indicated when slope and RSI agree (e.g., "Strong Upward Trend")

Watch for Breakouts:

- When the squeeze ends (Bollinger Bands move outside Keltner Channels)

- Confirm with the "Potential Breakout" label, which also considers volume

Use the Signal Line:

- Price crossing above the signal line may indicate a bullish move

- Price crossing below may indicate a bearish move

Consider Volume: High volume (1.5x average) during a breakout suggests stronger conviction

Interpretation:

- Squeeze + High Intensity + Strong Directional Bias + High Volume Breakout = High Probability Trade

Setup

- Always use in conjunction with other analysis and risk management techniques

- Adjust input parameters to fit your specific trading timeframe and style

# Note: This indicator is for informational purposes only. Always conduct your own analysis and manage your risk appropriately.

Ruby:

# Bollinger Band Squeeze Strategy using Keltner Channels

# Define input series

input length = 20;

input numDevDn = 2.0;

input numDevUp = 2.0;

input atrLength = 10;

input cloudOpacity = 50; # Adjust this value to control cloud opacity (0 to 100)

input rsiLength = 14; # RSI length for momentum confirmation

# Calculate Bollinger Bands

def middleBB = Average(close, length);

def stDev = StDev(close, length);

def lowerBB = middleBB - numDevDn * stDev;

def upperBB = middleBB + numDevUp * stDev;

# Calculate Keltner Channels (using EMA and ATR)

def emaLength = 20;

def keltnerMiddle = ExpAverage(close, emaLength);

def keltnerATR = MovingAverage(AverageType.EXPONENTIAL, TrueRange(high, close, low), atrLength);

def keltnerUpper = keltnerMiddle + numDevUp * keltnerATR;

def keltnerLower = keltnerMiddle - numDevDn * keltnerATR;

# Check for Bollinger Band squeeze condition

def bollingerSqueeze = lowerBB > keltnerLower and upperBB < keltnerUpper;

# Calculate the slope of the linear regression line of closing prices

def regressionLength = 20; # You can adjust this period for the regression calculation

def priceChange = close - close[regressionLength];

def sumX = Sum(1, regressionLength);

def sumXY = Sum(priceChange * BarNumber(), regressionLength);

def sumX2 = Sum(Sqr(BarNumber()), regressionLength);

def slope = (regressionLength * sumXY - sumX * Sum(priceChange, regressionLength)) / (regressionLength * sumX2 - Sqr(sumX));

# Calculate RSI for momentum confirmation

def rsi = RSI(length = rsiLength);

# Calculate squeeze intensity

def squeezeIntensity = AbsValue((upperBB - lowerBB) / (keltnerUpper - keltnerLower));

# Create plot for Bollinger Bands and Keltner Channels

plot bollingerUpper = if bollingerSqueeze then upperBB else Double.NaN;

plot bollingerLower = if bollingerSqueeze then lowerBB else Double.NaN;

plot keltnerUpperPlot = keltnerUpper;

plot keltnerLowerPlot = keltnerLower;

# Color customization

bollingerUpper.SetDefaultColor(Color.GREEN);

bollingerLower.SetDefaultColor(Color.GREEN);

keltnerUpperPlot.SetDefaultColor(Color.RED);

keltnerLowerPlot.SetDefaultColor(Color.RED);

# Add label for Bollinger Band squeeze condition

AddLabel(bollingerSqueeze, "Bollinger Band Squeeze", Color.CYAN);

# Create colored rectangles for Bollinger Bands and Keltner Channels with adjustable opacity

AddCloud(bollingerUpper, bollingerLower, Color.YELLOW, Color.YELLOW, cloudOpacity);

# Alert indicating the direction of the stock with RSI confirmation

AddLabel(yes, "Direction: " +

if slope > 0 and rsi > 50 then "Strong Upward Trend BB KC"

else if slope > 0 and rsi <= 50 then "Weak Upward Trend BB KC"

else if slope < 0 and rsi < 50 then "Strong Downward Trend BB KC"

else if slope < 0 and rsi >= 50 then "Weak Downward Trend BB KC"

else "Sideways Trend",

if slope > 0 and rsi > 50 then Color.DARK_GREEN

else if slope > 0 and rsi <= 50 then Color.GREEN

else if slope < 0 and rsi < 50 then Color.DARK_RED

else if slope < 0 and rsi >= 50 then Color.RED

else Color.GRAY);

# Add squeeze intensity label

AddLabel(yes, "Squeeze Intensity: " + AsPercent(squeezeIntensity), Color.MAGENTA);

# Add volume analysis

def volumeAvg = Average(volume, 20);

def highVolume = volume > 1.5 * volumeAvg;

# Signal line (simple moving average of close price)

def signalLine = Average(close, 9);

plot SignalLinePlot = signalLine;

SignalLinePlot.SetDefaultColor(Color.WHITE);

# Potential breakout signal

def potentialBreakout = bollingerSqueeze[1] and !bollingerSqueeze and highVolume;

AddLabel(potentialBreakout, "Potential Breakout", Color.YELLOW);Attachments

Last edited: