Futures_Beginner

Member

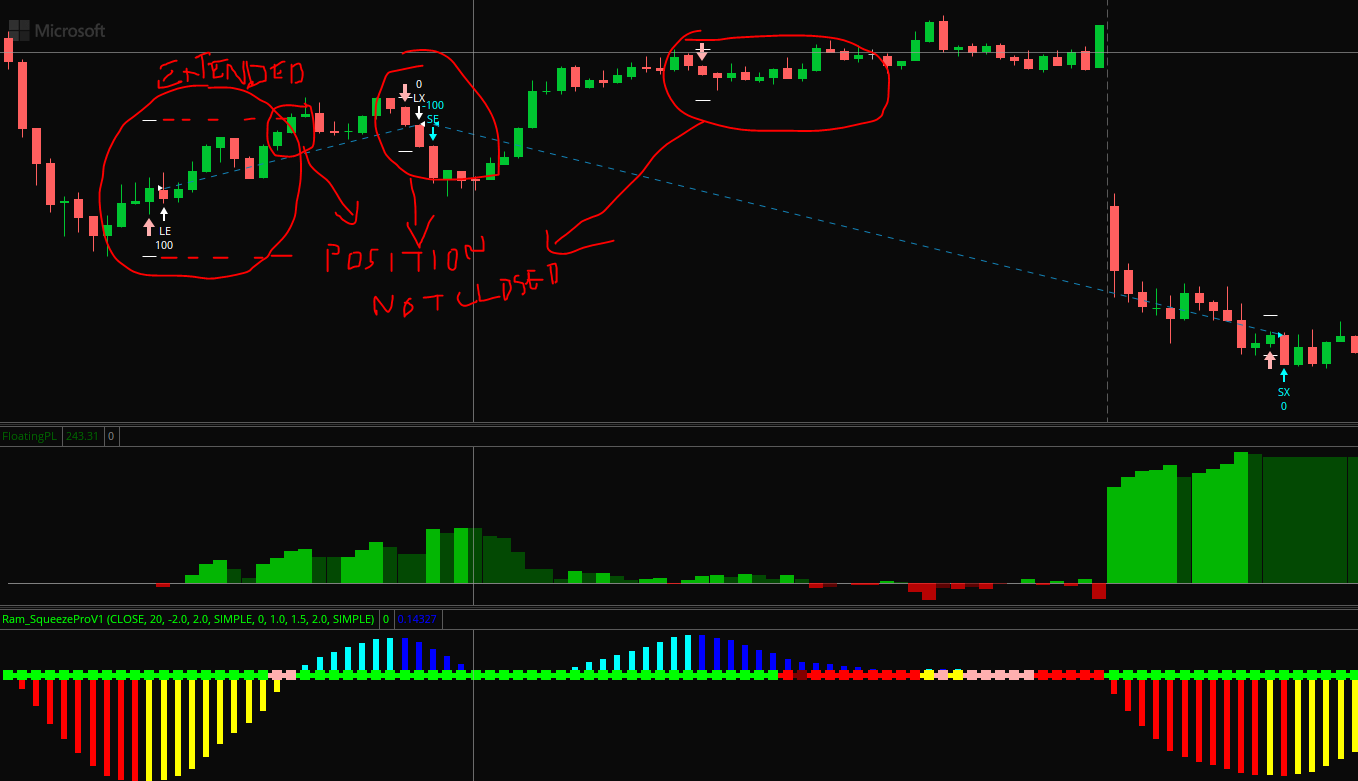

All experts out there,

Whatta great community. Really helpful for newbies like me.

I just picked up this Squeeze pro from one of the communities here and thought of backtesting with defined target and stop loss. But not getting what I am looking for.

While the code works as expected....want a little tweaks on the below

1. Stop loss and target line upon signal be extended till price closes above/below the SL/target

2. LE "Buy_T pen" or SE "Sell_T

pen" or SE "Sell_T pen" do not get closed upon meeting target/stop loss

pen" do not get closed upon meeting target/stop loss

3. How to close the position at the end of the day if no sl/target it met

Really appreciate your support

Code

Whatta great community. Really helpful for newbies like me.

I just picked up this Squeeze pro from one of the communities here and thought of backtesting with defined target and stop loss. But not getting what I am looking for.

While the code works as expected....want a little tweaks on the below

1. Stop loss and target line upon signal be extended till price closes above/below the SL/target

2. LE "Buy_T

3. How to close the position at the end of the day if no sl/target it met

Really appreciate your support

Code

Code:

# SqueezePro ##Assembled by TheBewb using existing Mobius Squeeze Momentum coding and "squeeze" concept made popular by John Carter.

input consecutiveHistogramBars = 5;

input price = close;

input length = 20;

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

input averageType = AverageType.SIMPLE;

input displace = 0;

def sDev = StDev(data = price[-displace], length = length);

def MidLineBB = MovingAverage(averageType, data = price[-displace], length = length);

def LowerBandBB = MidLineBB + Num_Dev_Dn * sDev;

def UpperBandBB = MidLineBB + Num_Dev_up * sDev;

input factorhigh = 1.0;

input factormid = 1.5;

input factorlow = 2.0;

input trueRangeAverageType = AverageType.SIMPLE;

def shifthigh = factorhigh * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), length);

def shiftMid = factormid * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), length);

def shiftlow = factorlow * MovingAverage(trueRangeAverageType, TrueRange(high, close, low), length);

def average = MovingAverage(averageType, price, length);

def Avg = average[-displace];

def UpperBandKCLow = average[-displace] + shiftlow[-displace];

def LowerBandKCLow = average[-displace] - shiftlow[-displace];

def UpperBandKCMid = average[-displace] + shiftMid[-displace];

def LowerBandKCMid = average[-displace] - shiftMid[-displace];

def UpperBandKCHigh = average[-displace] + shifthigh[-displace];

def LowerBandKCHigh = average[-displace] - shifthigh[-displace];

def K = (Highest(high, length) + Lowest(low, length)) /

2 + ExpAverage(close, length);

def momo = Inertia(price - K / 2, length);

def pos = momo >= 0;

def neg = momo < 0;

def up = momo >= momo[1];

def dn = momo < momo[1];

def presqueeze = LowerBandBB > LowerBandKCLow and UpperBandBB < UpperBandKCLow;

def presqueezein = LowerBandBB > LowerBandKCLow and UpperBandBB < UpperBandKCLow and LowerBandBB > LowerBandBB[1];

def presqueezeout = LowerBandBB > LowerBandKCLow and UpperBandBB < UpperBandKCLow and LowerBandBB < LowerBandBB[1];

def originalSqueeze = LowerBandBB > LowerBandKCMid and UpperBandBB < UpperBandKCMid;

def originalSqueezein = LowerBandBB > LowerBandKCMid and UpperBandBB < UpperBandKCMid and LowerBandBB > LowerBandBB[1];

def originalSqueezeout = LowerBandBB > LowerBandKCMid and UpperBandBB < UpperBandKCMid and LowerBandBB < LowerBandBB[1];

def ExtrSqueeze = LowerBandBB > LowerBandKCHigh and UpperBandBB < UpperBandKCHigh;

def ExtrSqueezein = LowerBandBB > LowerBandKCHigh and UpperBandBB < UpperBandKCHigh and LowerBandBB > LowerBandBB[1];

def ExtrSqueezeout = LowerBandBB > LowerBandKCHigh and UpperBandBB < UpperBandKCHigh and LowerBandBB < LowerBandBB[1];

def PosUp = pos and up;

def PosDn = pos and dn;

def NegDn = neg and dn;

def NegUp = neg and up;

def minUpBars = Sum(PosUp, consecutiveHistogramBars) >= consecutiveHistogramBars;

def minDownBars = Sum(NegDn, consecutiveHistogramBars) >= consecutiveHistogramBars;

def Cyan = if PosDn and minUpBars[1] then high else Double.NaN;

def yellow = if NegUp and minDownBars[1] then low else Double.NaN;

def SqueezeLineGreen = !ExtrSqueezein and !ExtrSqueezeout and !originalSqueezein and !originalSqueezeout and !presqueezein and !presqueezeout;

def ReleaseUp = NegDn[1] and NegUp ;

def ReleaseDown = PosUp[1] and PosDn ;

plot UpSignal = if SqueezeLineGreen and ReleaseUp and

yellow then low else Double.NaN;

UpSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

UpSignal.SetDefaultColor(Color.PINK);

UpSignal.SetLineWeight(3);

plot DownSignal = if SqueezeLineGreen and ReleaseDown and

Cyan then high else Double.NaN;

DownSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

DownSignal.SetDefaultColor(Color.PINK);

DownSignal.SetLineWeight(3);

#==== code for backtest

input Limit = 1.0;

input SL_Lookback = 5;

input lot_Size = 100;

def EP = EntryPrice();

def SL_Long = Lowest(low, SL_Lookback);

def SL_Short = Highest(high, SL_Lookback);

def target_Long = close + ((close - SL_Long) * Limit);

def target_Short = close - ((SL_Short - close) * Limit);

plot slbar_Long = if UpSignal then SL_Long else Double.NaN;

slbar_Long.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

slbar_Long.SetDefaultColor(Color.WHITE);

plot slbar_Short = if DownSignal then SL_Short else Double.NaN;

slbar_Short.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

slbar_Short.SetDefaultColor(Color.WHITE);

plot Limitbar_Long = if UpSignal then target_Long else Double.NaN;

Limitbar_Long.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Limitbar_Long.SetDefaultColor(Color.WHITE);

plot Limitbar_Short = if DownSignal then target_Short else Double.NaN;

Limitbar_Short.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Limitbar_Short.SetDefaultColor(Color.WHITE);

AddOrder(OrderType.BUY_TO_OPEN, UpSignal, close, lot_Size, Color.WHITE, Color.WHITE, "LE");

AddOrder(OrderType.SELL_To_Close, if DownSignal then close else high >= target_Long, close, 1, Color.WHITE, Color.WHITE, "LX");

AddOrder(OrderType.SELL_TO_OPEN, DownSignal[1], close[1], lot_Size, Color.CYAN, Color.CYAN, "SE");

AddOrder(OrderType.BUY_to_close, if UpSignal then close else low<= target_Short, close, 1, Color.CYAN, Color.CYAN, "SX" );