Prologue: My ambition is to create a scanner that finds stocks that match the picture of what a good chart should look like. I have created multiple scanners for this reason on this site. This scanner is my most ambitious attempt at accomplishing that goal.

What this scanner aims to accomplish:

This scanner is designed to detect stocks that have shown a persistent and strong bullish trend over the past 22 bars. This is based on an amalgamation of three separate indicators that take into account price direction, strength of movement, and trading volume:

The final scan condition is that the lowest value of the Scoresum in the past 22 bars must be at least 2. This means that the scanner will only identify stocks that have been consistently exhibiting strong bullish trends, both in terms of price movement and trading volume.

What is so great about this scanner:

This scanner is a scoring framework that can be used for many metrics. Also by using scoring the stocks dont have to match a specific metric 100% by our logic. By introducing a closeness effect, we match more real world scenarios and hopefully getting stocks that are more natural looking. Here are a few pluses:

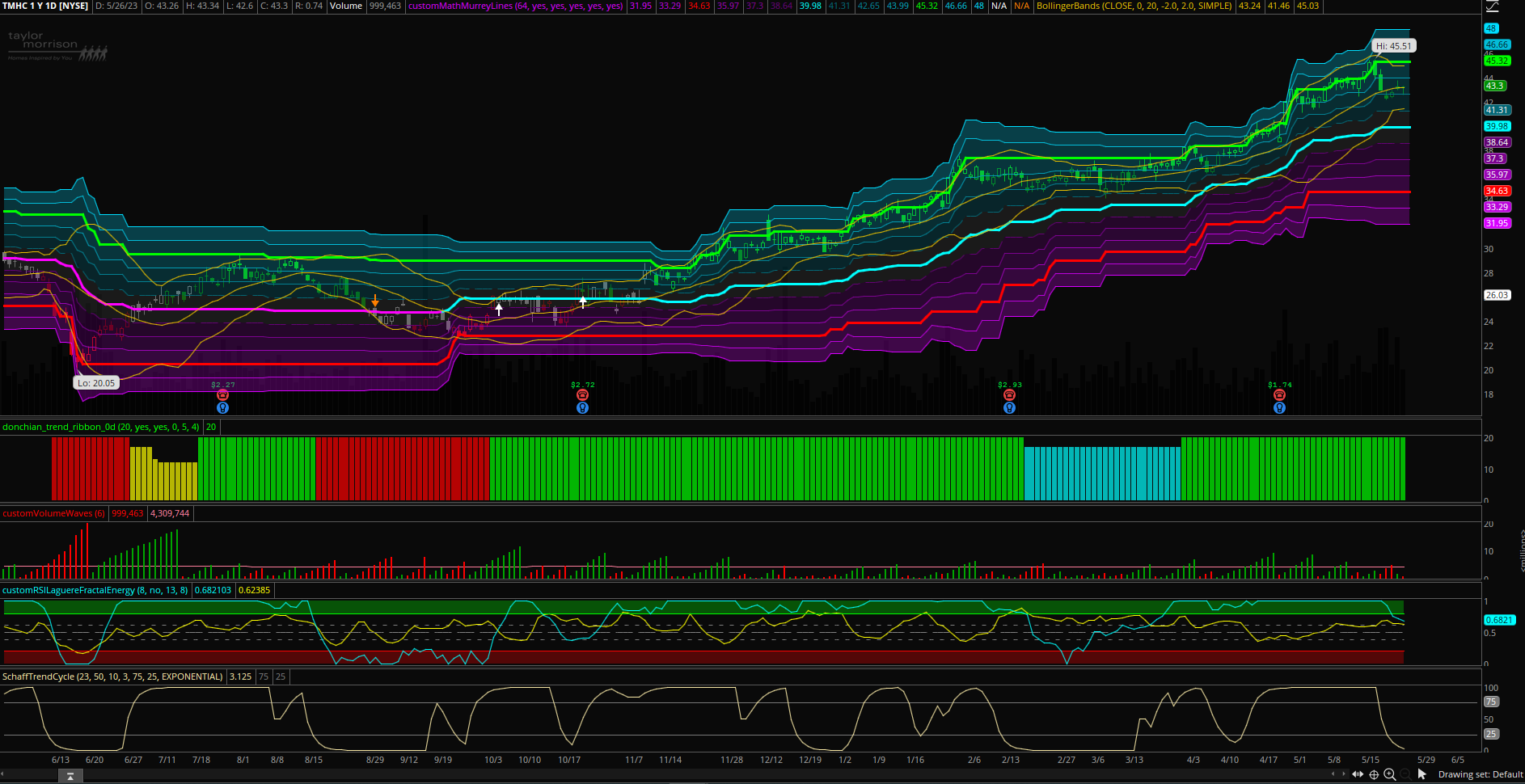

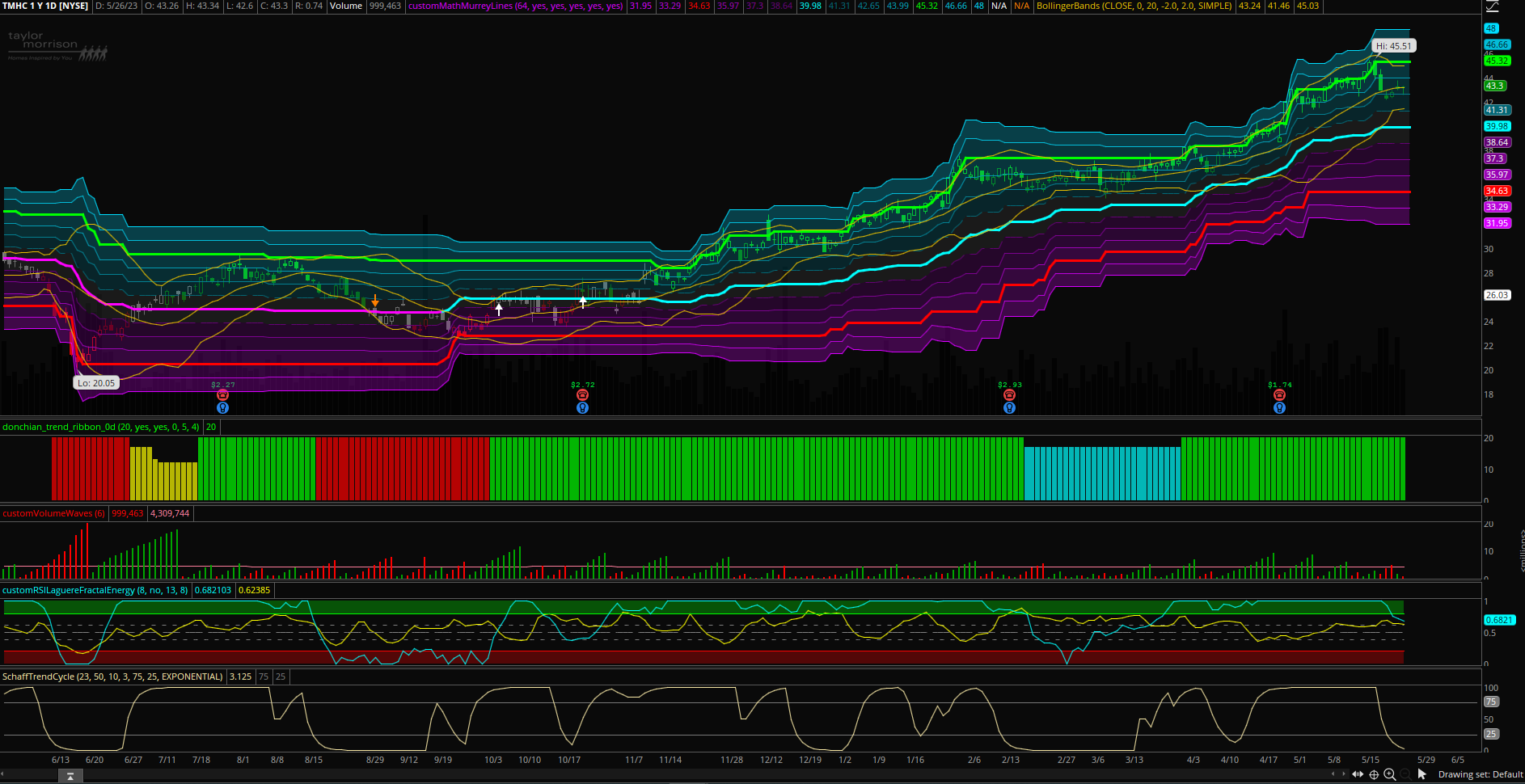

An Example: I ran this scan with the current settings and it returned only 9 stocks. Each one had a chart that I would consider in an uptrend. Consider TMHC, not only is this stock is a strong uptrend, but its also recently pulled back to a local support level:

My additional filters for the scanner:

What this scanner aims to accomplish:

This scanner is designed to detect stocks that have shown a persistent and strong bullish trend over the past 22 bars. This is based on an amalgamation of three separate indicators that take into account price direction, strength of movement, and trading volume:

- Price Direction (Score ID): The scanner first determines whether the closing price has increased or decreased relative to the high or low price from the previous trend period (highest high and lowest low). It gives a score of 1 if the closing price is greater than the previous high and a score of -1 if it's less than the previous low. If the price has not made a significant move, no score is assigned.

- Strength of Movement (Score ATR): The scanner considers the strength of the price movement by comparing it to the Average True Range (ATR). If the closing price is higher than the previous high plus the ATR, it assigns a score of 1. Conversely, if the closing price is lower than the previous low minus the ATR, it assigns a score of -1. This scoring system essentially rewards strong moves, either upwards or downwards.

- Trading Volume (Score Vol): The third factor the scanner considers is trading volume. It compares the current volume with the average volume over the trend period. If the volume exceeds this average and the closing price is greater than the previous high, the scanner assigns a score of 1. Conversely, if the volume exceeds the average and the closing price is less than the previous low, it assigns a score of -1. No score is assigned if the volume is less than the average.

The final scan condition is that the lowest value of the Scoresum in the past 22 bars must be at least 2. This means that the scanner will only identify stocks that have been consistently exhibiting strong bullish trends, both in terms of price movement and trading volume.

What is so great about this scanner:

This scanner is a scoring framework that can be used for many metrics. Also by using scoring the stocks dont have to match a specific metric 100% by our logic. By introducing a closeness effect, we match more real world scenarios and hopefully getting stocks that are more natural looking. Here are a few pluses:

- The three here, Direction, Strength, and Volume, are just the base 3.

- We can add scoring on multiple metrics, for instance a score for outperforming a benchmark index, a score for close relative to the 200 sma etc.

- We can add weights to each score, maybe we care more about bigger moves on bigger volume then we do direction.

- It can be adjusted for down trending stocks

- and much more im sure I havent thought about

An Example: I ran this scan with the current settings and it returned only 9 stocks. Each one had a chart that I would consider in an uptrend. Consider TMHC, not only is this stock is a strong uptrend, but its also recently pulled back to a local support level:

My additional filters for the scanner:

- Price above $10

- Average Volume over 1million

Code:

# Define your inputs

input trendPeriod = 20;

def tlen = if trendPeriod < 10 then 10 else trendPeriod;

# Score condition based on Increasing Deacreasing (scoreID)

def highestHigh = Highest(high, tlen);

def lowestLow = Lowest(low, tlen);

# Calculate ID Score

def scoreID = if close > highestHigh[1] then 1 else if close < lowestLow[1] then -1 else 0;

# Score condition based on strong move days scoreATR

def ATR = Average(TrueRange(high, close, low), 14);

def scoreATR = if close > highestHigh[1] + ATR then 1 else if close < lowestLow[1] - ATR then -1 else 0;

# Score condition based on volume scoreVol

def avgVol = Average(volume, trendPeriod);

def scoreVol = if close > highestHigh[1] and volume > avgVol then 1 else if close < lowestLow[1] and volume > avgVol then -1 else 0;

def trend = scoreID + scoreATR + scoreVol;

# Calculate simplified colorsum by summing up the trends

def Scoresum = Sum(trend, 10);

# The scanning condition

def scanCondition = Lowest(Scoresum[1], 22) >= 2;

# plot the condition to visualize it

plot scan = scanCondition;

Last edited: