Hi there, need some help to configure the Options Screen to perform the condition stated below.

These are the few steps that I hope the scanner can perform but I like to request for assistance if any customise script can be configured.

With my little knowledge, what i hope the scanner can do

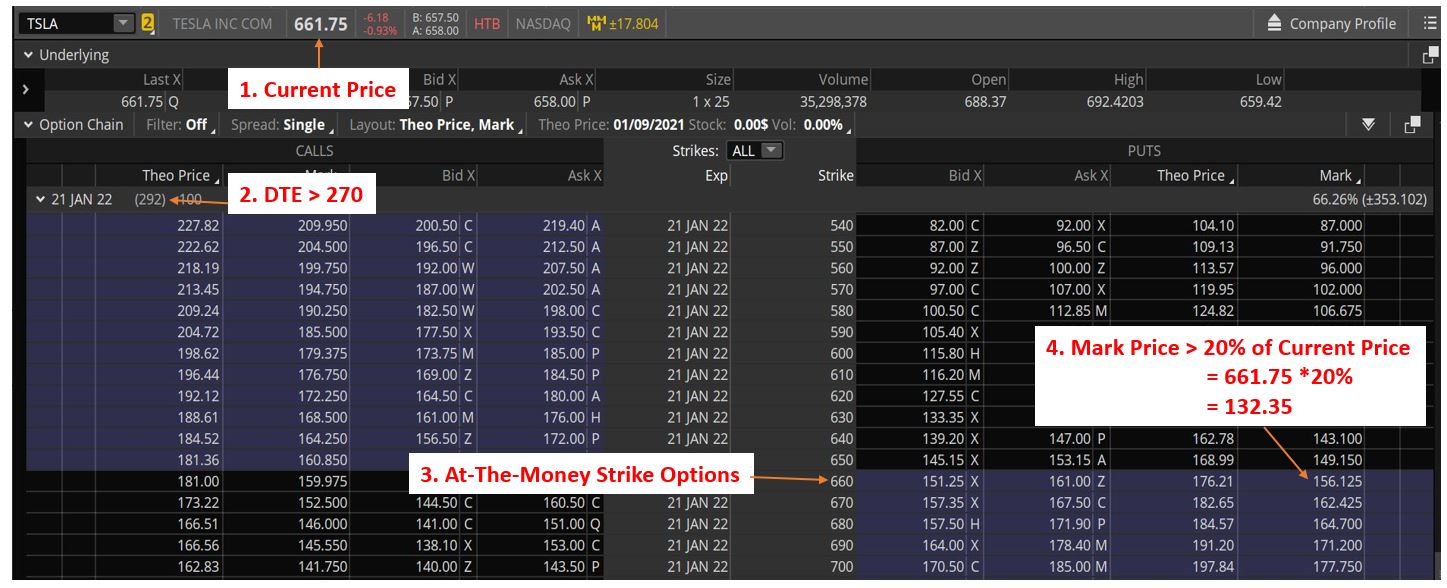

Objective : To scan for list of stocks when the ATM strike has Mark Price is 20% more than current price with at least 270 DTE

1. Find Stock Price >$200 and DTE > 270, then

2. Get CURRENT stock price

3. Find stocks with DTE greater than 270

3. Use DTE > 270, get the AT-THE-MONEY (ATM) STRIKE Options, "Mark Price". It is impossible to get exact ATM STRIKE, so the desired ATM strike can be within 5% greater than the current price

4. Compare ATM Strike "Mark Price", if "Mark Price" greater than 20% of the current stock price - Pass

5. Generate list of stock that are passed.

Thanks

These are the few steps that I hope the scanner can perform but I like to request for assistance if any customise script can be configured.

With my little knowledge, what i hope the scanner can do

Objective : To scan for list of stocks when the ATM strike has Mark Price is 20% more than current price with at least 270 DTE

1. Find Stock Price >$200 and DTE > 270, then

2. Get CURRENT stock price

3. Find stocks with DTE greater than 270

3. Use DTE > 270, get the AT-THE-MONEY (ATM) STRIKE Options, "Mark Price". It is impossible to get exact ATM STRIKE, so the desired ATM strike can be within 5% greater than the current price

4. Compare ATM Strike "Mark Price", if "Mark Price" greater than 20% of the current stock price - Pass

5. Generate list of stock that are passed.

Thanks

Last edited by a moderator: