RickK

Active member

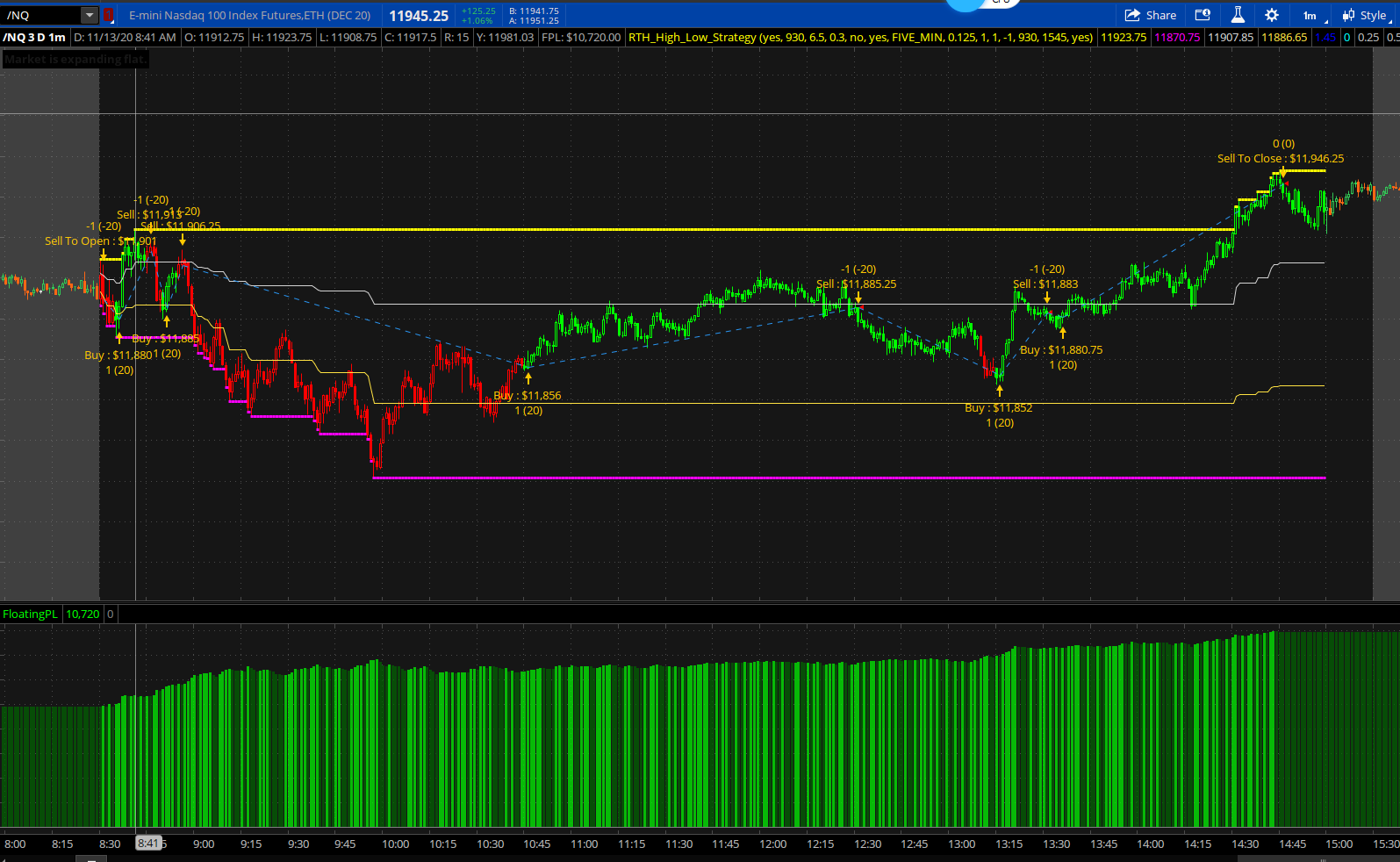

Here's a promising looking strategy that I found on thinkScript_Cloud. (I hope I'm allowed to post it here. ) It seems to be quite profitable with very manageable losses on small timeframes. Futures trading mostly, I think. There was no discussion where I found it, so I was hoping to get some going here. Apparently it has to do with Murrey Math / Donchian .... the former of which I know absolutely nothing about; the latter of which has not been kind to me in the past.

If you like it, can explain it, and/or find potential, please post back how you've used it. Specifically, with what other non-correlated confirming indicators have you used it, thoughts for improvements and possibly any rules you may come up with. I have not tested it in real-time yet, but I suspect that there might have some repainting as there is a higher time frame aggregation component.

BTW, apparently it has had the name "RSI_MultiAggregationStrat_DMonkey" in the past.

Oh, I made one small edit. I added an input for tradesize, since the original script limited it to 1 in the AddOrder command. After doing so, I tried it on $UPRO and $AAPL, modifying the tradesize input to 200...but it didn't really like that much.

If you like it, can explain it, and/or find potential, please post back how you've used it. Specifically, with what other non-correlated confirming indicators have you used it, thoughts for improvements and possibly any rules you may come up with. I have not tested it in real-time yet, but I suspect that there might have some repainting as there is a higher time frame aggregation component.

BTW, apparently it has had the name "RSI_MultiAggregationStrat_DMonkey" in the past.

Oh, I made one small edit. I added an input for tradesize, since the original script limited it to 1 in the AddOrder command. After doing so, I tried it on $UPRO and $AAPL, modifying the tradesize input to 200...but it didn't really like that much.

Code:

#StudyName: RTH // High // Low

#Description: Plots developing intraday high and low

#Author: DMonkey

#Requested By: ActiveTrader

# Ver 2 Up:Date 12/20/2017 : updated bubbles

# TOS.mx Link:

# Trading Notes:

# Added an input for tradesize, since the AddOrder had previously fixed it at 1. @Rick_Kennedy, member, usethinkscript.com

input bubbleson = yes;

input market_open = 0930;

input Duration_In_Hours = 6.5;

input Fraction = .3;

input range_picker =yes;

input Paint_Bars = yes;

input tradesize = 1;

def h = high;

def l = low;

def na = double.nan;

def Market_Duration = Duration_In_Hours * 60 * 60;

def Go_Time = secondsFromTime(market_open);

def openhigh = if Go_Time ==0

then h

else if h > openhigh[1]

then h

else openhigh[1];

plot data =

if Go_Time >= 0

&& go_Time < Market_Duration

then openhigh

else na

;

data.setpaintingStrategy(PaintingStrategy.DASHES);

data.setdefaultColor(Color.YELLOW);

data.setlineWeight(3);

def openlow = if Go_Time == 0

then l

else if l < openlow[1]

then l

else openlow[1];

plot data2 =

if Go_Time >= 0

&& go_Time < Market_Duration

then openlow

else na

;

data2.setpaintingStrategy(PaintingStrategy.DASHES);

data2.setdefaultColor(Color.MAGENTA);

data2.setlineWeight(3);

def RTH_High_bubble =

if Go_Time >= 0

then highestall(data)

else na;

def RTH_Low_bubble =

if Go_Time >= 0

then lowestall(data2)

else na;

AddChartBubble("time condition" = bubbleson == yes

&& if isnan(close[-1]) && !isnan(close)

then (RTH_High_bubble)

else na ,

"price location" = (RTH_High_bubble),

text = "RTH High : " + asdollars(round((RTH_High_bubble)/ ticksize(),0)* ticksize()),

color = Color.BLUE);

AddChartBubble("time condition" = bubbleson == yes

&& if isnan(close[-1]) && !isnan(close)

then RTH_Low_bubble

else na ,

"price location" = RTH_Low_bubble,

text = "RTH Low : " + asdollars(round((RTH_Low_bubble)/ ticksize(),0)* ticksize()),

color = Color.GRAY,

up = No);

# End Code

def range = Fraction *(data - data2);

plot se = data - range;

plot le = data2 + range;

def expansion_direction = if se > se[1] then 1 else if se < se[1] then 2 else expansion_direction[1];

addlabel(1,"Market is expanding " + if expansion_direction == 1 then "up." else if expansion_direction == 2 then "down." else "flat.",

if expansion_direction == 1 then color.green else if expansion_direction == 2 then color.red else color.orange);

input agg = aggregationPeriod.FOUR_MIN;

#input length = 100; # minval = 10

input mult1 = 0.125; # title = "Mutiplier; Only Supports 0.125 = 1/8");

input lines = 1; # true title= "Show Murrey Math Fractals");

input bc = 1; # (true, title = "Show Bar Colors Based On Oscillator");

# Donchanin Channel

def hi = data;

def lo = data2;

def range2 = hi - lo;

def multiplier = (range2) * mult1;

def midline = lo + multiplier * 4;

plot oscillator = ExpAverage((close(period = agg) - midline) / (if range_picker then range2 / 2 else range / 2), 1);

oscillator.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

def a = oscillator > 0 and oscillator < mult1 * 2;

def b = oscillator > 0 and oscillator < mult1 * 4;

def c = oscillator > 0 and oscillator < mult1 * 6;

def d = oscillator > 0 and oscillator < mult1 * 8;

def z = oscillator < 0 and oscillator > -mult1 * 2;

def y = oscillator < 0 and oscillator > -mult1 * 4;

def x = oscillator < 0 and oscillator > -mult1 * 6;

def w = oscillator < 0 and oscillator > -mult1 * 8;

oscillator.AssignValueColor( if a == 1

then Color.ORANGE

else if b == 1 then Color.ORANGE

else if c == 1 then Color.ORANGE

else if d == 1 then Color.GREEN

else if z == 1 then Color.ORANGE

else if y == 1 then Color.ORANGE

else if x == 1 then Color.ORANGE

else if w == 1 then Color.RED

else Color.BLUE);

plot L0 = 0;

L0.AssignValueColor(Color.CYAN);

plot PositiveQuadrant1 = if lines == 1 then mult1 * 2 else Double.NaN;

plot PositiveQuadrant2 = if lines == 1 then mult1 * 4 else Double.NaN;

plot PositiveQuadrant3 = if lines == 1 then mult1 * 6 else Double.NaN;

plot PositiveQuadrant4 = if lines == 1 then mult1 * 8 else Double.NaN;

plot NegativeQuadrant1 = if lines == 1 then -mult1 * 2 else Double.NaN;

plot NegativeQuadrant2 = if lines == 1 then -mult1 * 4 else Double.NaN;

plot NegativeQuadrant3 = if lines == 1 then -mult1 * 6 else Double.NaN;

plot NegativeQuadrant4 = if lines == 1 then -mult1 * 8 else Double.NaN;

PositiveQuadrant1.AssignValueColor(Color.LIGHT_GRAY);

PositiveQuadrant2.AssignValueColor(Color.LIGHT_GRAY);

PositiveQuadrant3.AssignValueColor(Color.LIGHT_GRAY);

PositiveQuadrant4.AssignValueColor(Color.LIGHT_GRAY);

NegativeQuadrant1.AssignValueColor(Color.LIGHT_GRAY);

NegativeQuadrant2.AssignValueColor(Color.LIGHT_GRAY);

NegativeQuadrant3.AssignValueColor(Color.LIGHT_GRAY);

NegativeQuadrant4.AssignValueColor(Color.LIGHT_GRAY);

assignPriceColor(if Paint_Bars

then if oscillator > 0 then color.green else color.red

else color.current);

input offset = -1;

def buy_condition = oscillator crosses above 0 or oscillator crosses above w or oscillator crosses above d;

def sell_condition = oscillator crosses below 0 or oscillator crosses below d or oscillator crosses below w;

input trade_time_Start = 0906;

input trade_time_end = 1410;

input Use_RTH = yes;

def active2 = if SecondsFromTime(trade_time_Start) >= 0 && SecondsTillTime(trade_time_end) >= 0 then 1 else 0;

def buy_at_open = oscillator > 0;

def sell_at_open =oscillator < 0;

AddOrder(OrderType.BUY_TO_OPEN, if SecondsFromTime(trade_time_Start) == 0 then buy_at_open else Double.NaN, open(priceType = PriceType.ASK)[-1], tradeSize, name = "Buy To Open : $" + open(priceType = PriceType.ASK)[-1] , tickColor = Color.GREEN, arrowColor = Color.ORANGE);

AddOrder(OrderType.SELL_TO_OPEN, if SecondsFromTime(trade_time_Start) == 0 then sell_at_open else Double.NaN, open(priceType = PriceType.BID)[0], tradeSize, name = "Sell To Open : $" + open(priceType = PriceType.BID)[-1], tickColor = Color.RED, arrowColor = Color.ORANGE);

def EOD = SecondsFromTime(trade_time_end) == 0;

AddOrder(type = OrderType.SELL_TO_CLOSE, condition = if Use_RTH && active2 then EOD else Double.NaN, price = close(priceType = PriceType.BID), tradeSize, name = "Sell To Close : $" + close(priceType = PriceType.BID), tickColor = Color.RED, arrowColor = Color.ORANGE);

AddOrder(type = OrderType.BUY_TO_CLOSE, condition = if Use_RTH && active2 then EOD else Double.NaN, price = close(priceType = PriceType.ASK), tradeSize, name = "Buy To Close : $" + close(priceType = PriceType.ASK), tickColor = Color.GREEN, arrowColor = Color.ORANGE);

AddOrder(OrderType.BUY_AUTO, if Use_RTH

then active2 && buy_condition

else buy_condition,

tradeSize = 1,

price = open(priceType = PriceType.ASK)[offset],

name = "Buy : $" + open(priceType = PriceType.ASK)[offset],

tickColor = Color.GREEN,

arrowColor = Color.ORANGE);

AddOrder(type = OrderType.SELL_AUTO, condition = if Use_RTH

then active2 && sell_condition

else sell_condition,

tradeSize = 1,

price = open(priceType = PriceType.BID)[offset],

name = "Sell : $" + open(priceType = PriceType.BID)[offset],

tickColor = Color.RED,

arrowColor = Color.ORANGE);

### end of code

Last edited: