I use a Trade Setup that I learned from a YouTuber called the "Back Burner" Trade.

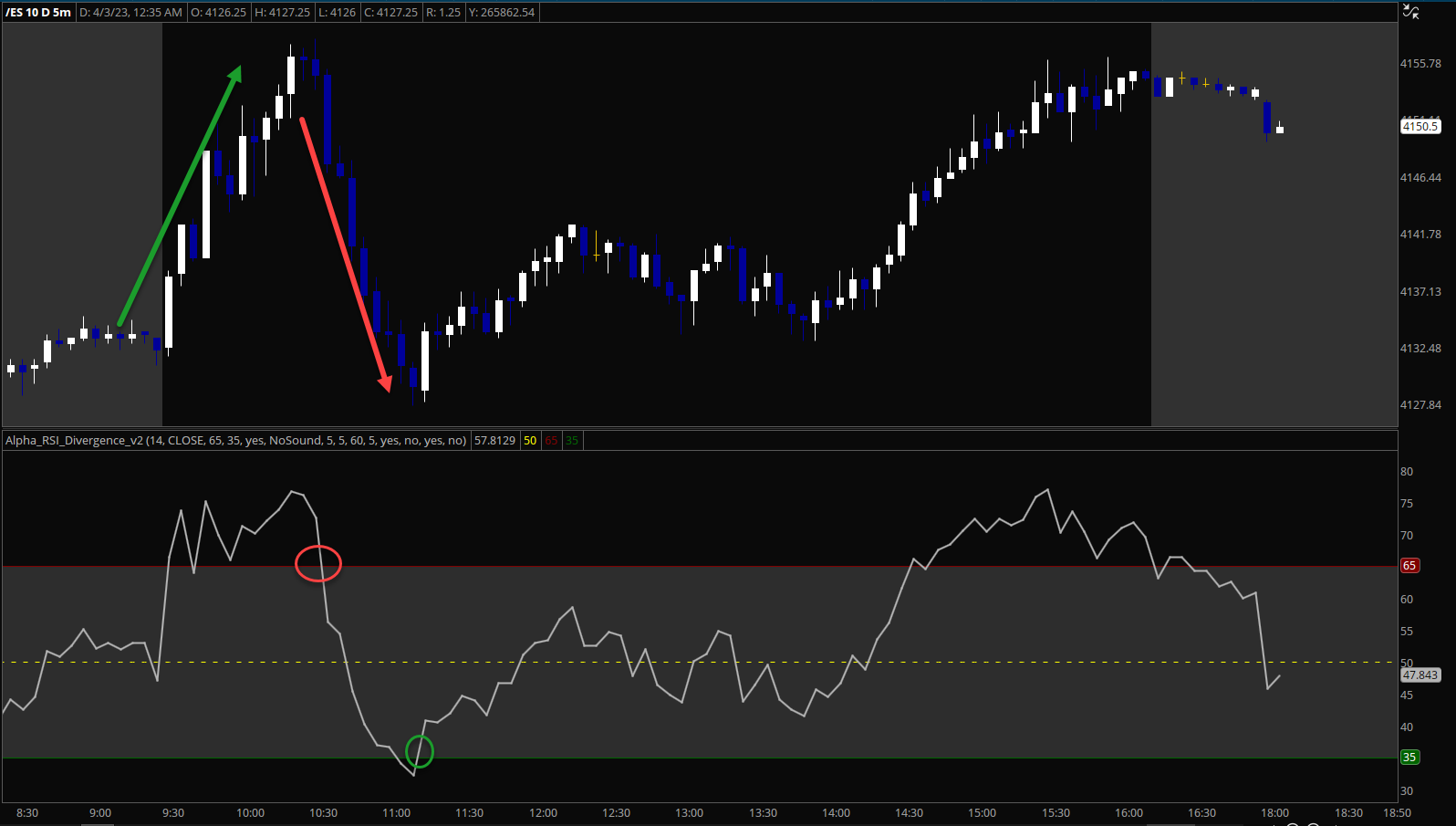

It is taking an oversold or overbought RSI condition on an impulsive move. When it come back into the zone out of the Oversold or Overbought typically the 20 and 80 level on the Oscillator that is the trigger signal. I scouted the Forums however didn't see a TOS indicator that does this. I typically use this when looking for a "V" Shape Bounce or Retrace.

Can someone point me to one if this already exists? or help with coding it please?

Here is an illustration of the setup:

It is taking an oversold or overbought RSI condition on an impulsive move. When it come back into the zone out of the Oversold or Overbought typically the 20 and 80 level on the Oscillator that is the trigger signal. I scouted the Forums however didn't see a TOS indicator that does this. I typically use this when looking for a "V" Shape Bounce or Retrace.

Can someone point me to one if this already exists? or help with coding it please?

Here is an illustration of the setup:

Last edited: