What Is This?

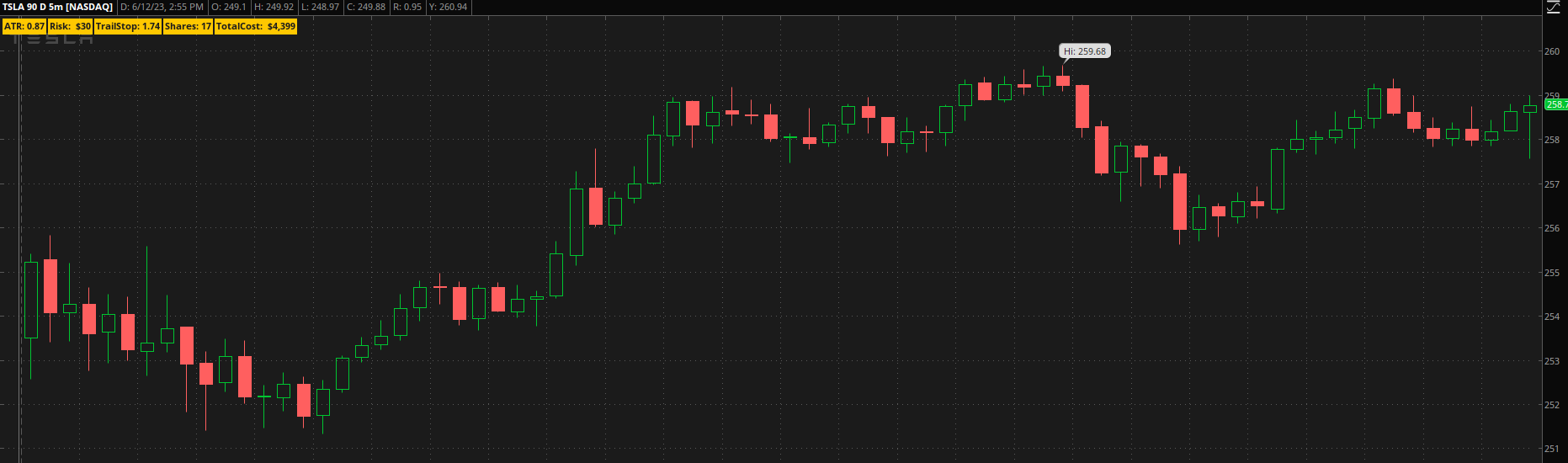

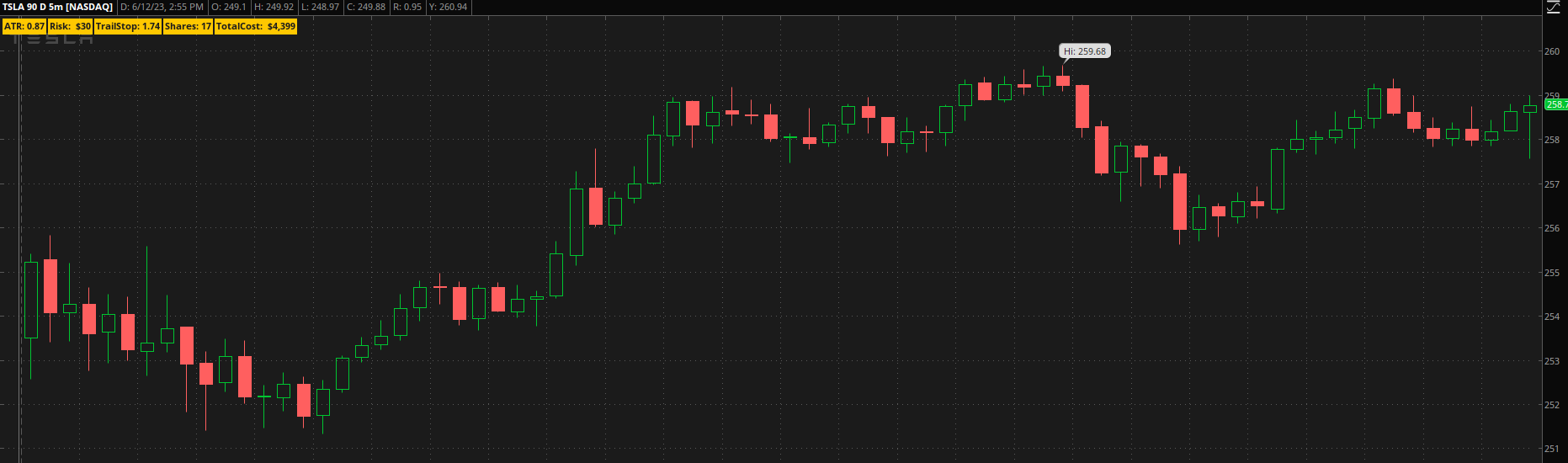

When day-trading speed is important, but risk management is even more important. I think the reason most accounts blow-up is because they have no idea how to choose size and stops so they "all-in" on hunches. These labels aim to prevent that and protect our money from emotionally charged decisions. The goal is to add a stop and choose a size that reflects the volatility of the instrument you are trading. For that I picked the ATR, because that is what I use.

What It Is Not

These labels should not be a buy or sell signal, there are plenty of indicators and strategies on usethinkscript for that. These are simply a quick and easy risk management tool.

Why They Are Useful:

They do the simple math of telling you where you should place your stop and the amount of shares you should consider based off the risk tolerance you decide.

User Options:

When day-trading speed is important, but risk management is even more important. I think the reason most accounts blow-up is because they have no idea how to choose size and stops so they "all-in" on hunches. These labels aim to prevent that and protect our money from emotionally charged decisions. The goal is to add a stop and choose a size that reflects the volatility of the instrument you are trading. For that I picked the ATR, because that is what I use.

What It Is Not

These labels should not be a buy or sell signal, there are plenty of indicators and strategies on usethinkscript for that. These are simply a quick and easy risk management tool.

Why They Are Useful:

They do the simple math of telling you where you should place your stop and the amount of shares you should consider based off the risk tolerance you decide.

User Options:

- Risk Size in Dollars - Default = $50

- Risk Multiplier - Default = 2x (The amount of volatility you are willing to risk)

Code:

declare upper;

input length = 14;

input averageType = AverageType.WILDERS;

input risk = 50;

input riskMult = 2;

def ATR = Round(MovingAverage(averageType, TrueRange(high, close, low), length), 2);

def trailStop = Round(riskMult * ATR, 2);

def shares = Round(risk / trailStop, 0);

AddLabel(yes, "ATR: " + ATR, Color.ORANGE);

AddLabel(yes, "Risk: " + " $"+ risk, Color.ORANGE);

AddLabel(yes, "TrailStop: " + trailStop, Color.ORANGE);

AddLabel(yes, "Shares: " + shares, Color.ORANGE);

AddLabel(yes, "TotalCost: " + " $" + Round(shares*close,0), Color.ORANGE);