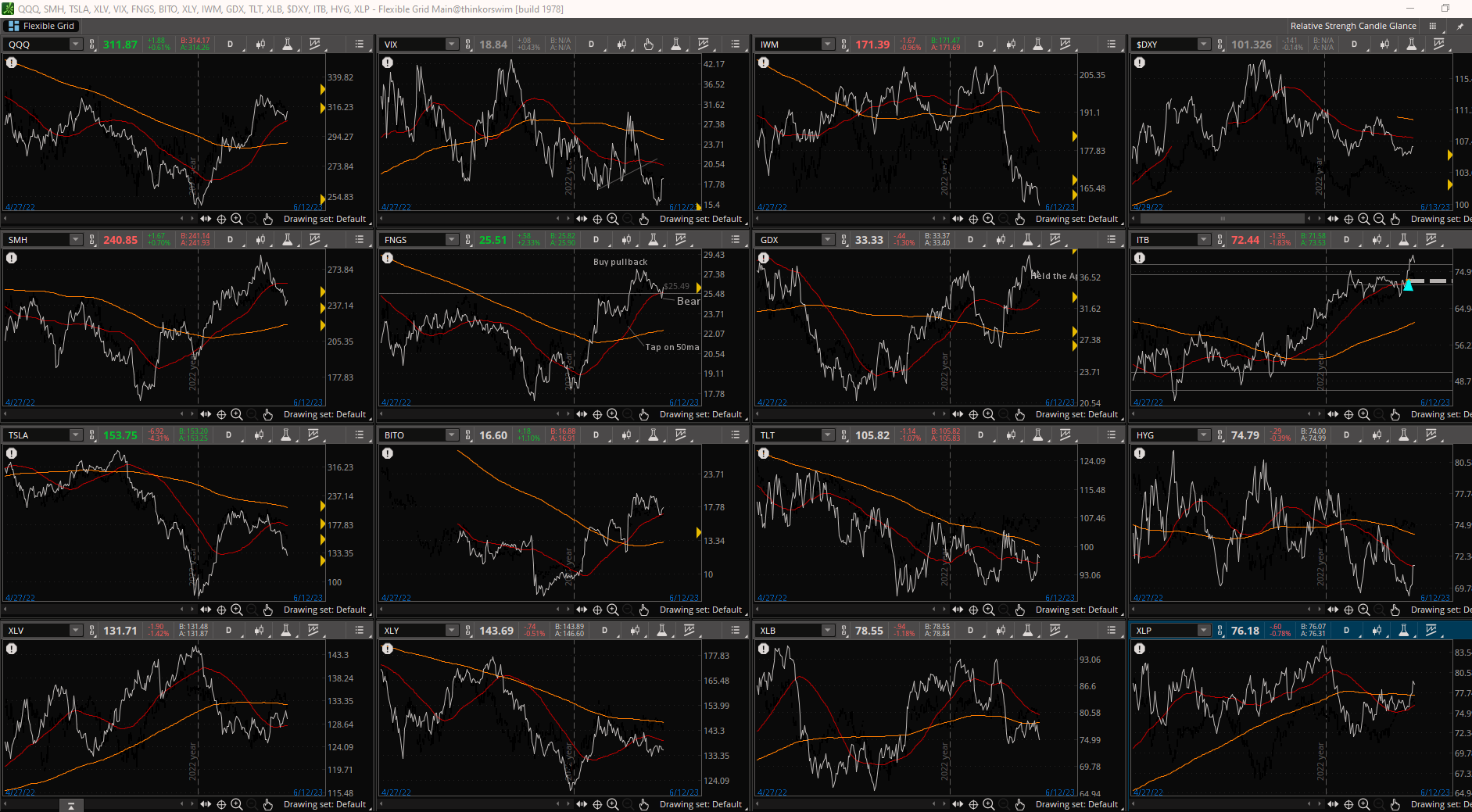

# Multiple symbol EMA status and relative strength analysis

# Created by @tony_futures

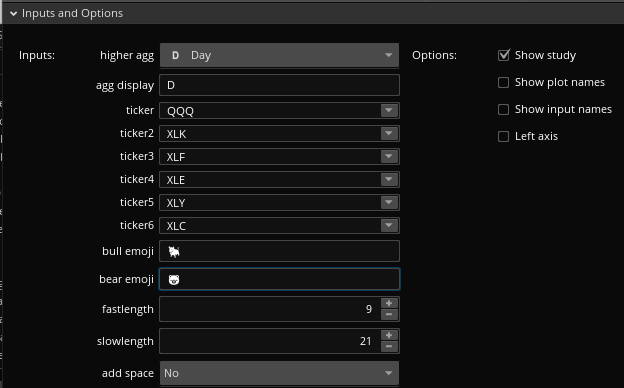

input higherAgg = AggregationPeriod.DAY;

input aggDisplay = "Daily";

input ticker = "QQQ";

input ticker2 = "XLK";

input ticker3 = "XLF";

input ticker4 = "XLE";

input ticker5 = "XLY";

input ticker6 = "XLC";

input bullEmoji = "";

input bearEmoji = "";

input fastlength = 9;

input slowlength = 21;

DefineGlobalColor("green", CreateColor(94, 110, 59));

DefineGlobalColor("red", CreateColor(136, 93, 100));

DefineGlobalColor("darkgreen", Color.DARK_GREEN);

DefineGlobalColor("darkred", Color.DARK_RED);

# Daily Avg

def dailyPrice = close(symbol = ticker, period=higherAgg);

def DailyFastAvg = ExpAverage(dailyPrice, fastlength);

def DailySlowAvg = ExpAverage(dailyPrice, slowlength);

def dailyPrice2 = close(symbol = ticker2, period=higherAgg);

def DailyFastAvg2 = ExpAverage(dailyPrice2, fastlength);

def DailySlowAvg2 = ExpAverage(dailyPrice2, slowlength);

def dailyPrice3 = close(symbol = ticker3, period=higherAgg);

def DailyFastAvg3 = ExpAverage(dailyPrice3, fastlength);

def DailySlowAvg3 = ExpAverage(dailyPrice3, slowlength);

def dailyPrice4 = close(symbol = ticker4, period=higherAgg);

def DailyFastAvg4 = ExpAverage(dailyPrice4, fastlength);

def DailySlowAvg4 = ExpAverage(dailyPrice4, slowlength);

def dailyPrice5 = close(symbol = ticker5, period=higherAgg);

def DailyFastAvg5 = ExpAverage(dailyPrice5, fastlength);

def DailySlowAvg5 = ExpAverage(dailyPrice5, slowlength);

def dailyPrice6 = close(symbol = ticker6, period=higherAgg);

def DailyFastAvg6 = ExpAverage(dailyPrice6, fastlength);

def DailySlowAvg6 = ExpAverage(dailyPrice6, slowlength);

# Relative Strength

def RS = if dailyPrice == 0 then 0 else close(period=higherAgg)/dailyPrice;

def sr = CompoundValue("historical data" = RS, "visible data" = if isNaN(sr[1]) then RS else sr[1]);

def strong = RS > SR;

def weak = RS < SR;

def RS1 = if dailyPrice2 == 0 then 0 else close(period=higherAgg)/dailyPrice2;

def sr1 = CompoundValue("historical data" = RS1, "visible data" = if isNaN(sr1[1]) then RS1 else sr1[1]);

def strong1 = RS1 > SR1;

def weak1 = RS1 < SR1;

def RS2 = if dailyPrice3 == 0 then 0 else close(period=higherAgg)/dailyPrice3;

def sr2 = CompoundValue("historical data" = RS2, "visible data" = if isNaN(sr2[1]) then RS2 else sr2[1]);

def strong2 = RS2 > SR2;

def weak2 = RS2 < SR2;

def RS3 = if dailyPrice4 == 0 then 0 else close(period=higherAgg)/dailyPrice4;

def SR3 = CompoundValue("historical data" = RS3, "visible data" = if isNaN(SR3[1]) then RS3 else SR3[1]);

def strong3 = RS3 > SR3;

def weak3 = RS3 < SR3;

def RS4 = if dailyPrice5 == 0 then 0 else close(period=higherAgg)/dailyPrice5;

def SR4 = CompoundValue("historical data" = RS4, "visible data" = if isNaN(SR4[1]) then RS4 else SR4[1]);

def strong4 = RS4 > SR4;

def weak4 = RS4 < SR4;

def RS5 = if dailyPrice6 == 0 then 0 else close(period=higherAgg)/dailyPrice6;

def SR5 = CompoundValue("historical data" = RS5, "visible data" = if isNaN(SR5[1]) then RS5 else SR5[1]);

def strong5 = RS5 > SR5;

def weak5 = RS5 < SR5;

input addSpace = no;

AddLabel(addSpace," ", Color.CURRENT);

AddLabel(DailyFastAvg > DailySlowAvg,ticker + " " + aggDisplay + bullEmoji,if strong then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg < DailySlowAvg,ticker + " " + aggDisplay + bearEmoji,if weak then GlobalColor("darkred") else GlobalColor("red"));

AddLabel(DailyFastAvg2 > DailySlowAvg2,ticker2 + " " + aggDisplay + bullEmoji,if strong1 then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg2 < DailySlowAvg2,ticker2 + " " + aggDisplay + bearEmoji,if weak1 then GlobalColor("darkred") else GlobalColor("red"));

AddLabel(DailyFastAvg3 > DailySlowAvg3,ticker3 + " " + aggDisplay + bullEmoji,if strong2 then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg3 < DailySlowAvg3,ticker3 + " " + aggDisplay + bearEmoji,if weak2 then GlobalColor("darkred") else GlobalColor("red"));

AddLabel(DailyFastAvg4 > DailySlowAvg4,ticker4 + " " + aggDisplay + bullEmoji,if strong3 then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg4 < DailySlowAvg4,ticker4 + " " + aggDisplay + bearEmoji,if weak3 then GlobalColor("darkred") else GlobalColor("red"));

AddLabel(DailyFastAvg5 > DailySlowAvg5,ticker5 + " " + aggDisplay + bullEmoji,if strong4 then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg5 < DailySlowAvg5,ticker5 + " " + aggDisplay + bearEmoji,if weak4 then GlobalColor("darkred") else GlobalColor("red"));

AddLabel(DailyFastAvg6 > DailySlowAvg6,ticker6 + " " + aggDisplay + bullEmoji,if strong5 then GlobalColor("darkgreen") else GlobalColor("green"));

AddLabel(DailyFastAvg6 < DailySlowAvg6,ticker6 + " " + aggDisplay + bearEmoji,if weak5 then GlobalColor("darkred") else GlobalColor("red"));