Hi, new here!

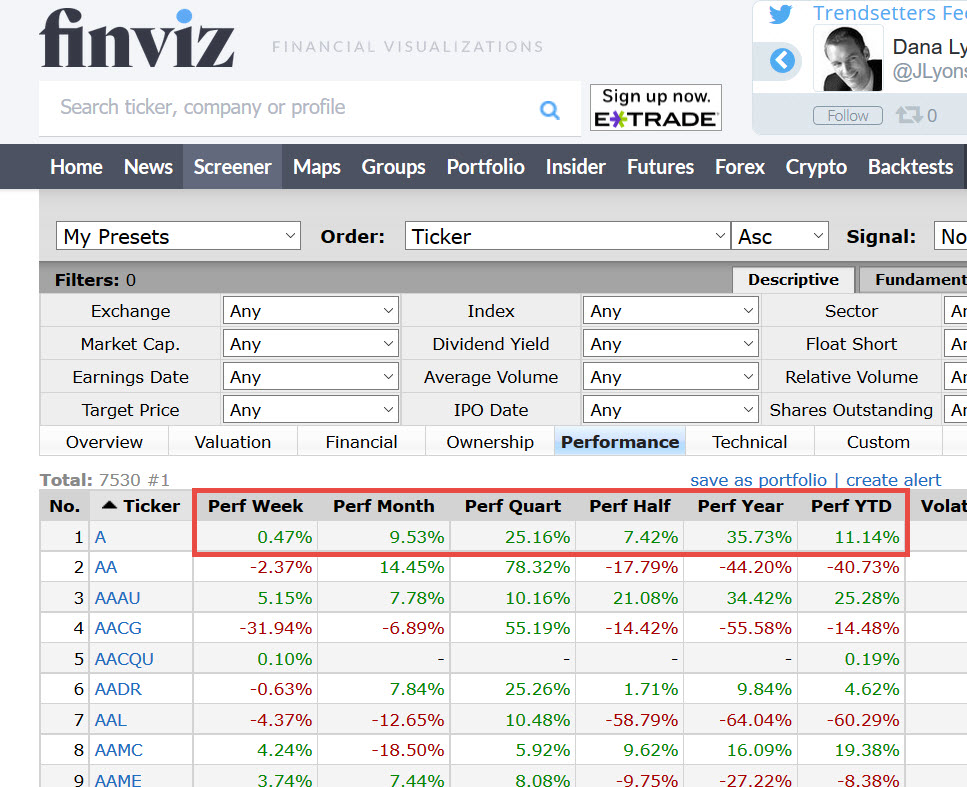

Unfortunately I am new in ThinkScripts and really hopping someone can help me build this. Finviz.com (https://finviz.com/screener.ashx?v=141) has column for each stocks indicating relative performance to SPX for each stocks for various time frames (one day, one week, one month etc...) I believe the calculation for daily for example is closing price of a stock / closing price of SPX. This is extremely useful to stop stocks/sectors with better performance than SPX (or any market) for different time periods, this is specially useful during market pull backs.

I know we can currently chart this with TOS but I would like to have these as columns on my watch list, is this possible or already exist? If not, can anyone help me build this for various time frames?

Any help will be greatly appreciated. thank you

Unfortunately I am new in ThinkScripts and really hopping someone can help me build this. Finviz.com (https://finviz.com/screener.ashx?v=141) has column for each stocks indicating relative performance to SPX for each stocks for various time frames (one day, one week, one month etc...) I believe the calculation for daily for example is closing price of a stock / closing price of SPX. This is extremely useful to stop stocks/sectors with better performance than SPX (or any market) for different time periods, this is specially useful during market pull backs.

I know we can currently chart this with TOS but I would like to have these as columns on my watch list, is this possible or already exist? If not, can anyone help me build this for various time frames?

Any help will be greatly appreciated. thank you

Last edited by a moderator: