#strat_jackson2

#https://usethinkscript.com/threads/randy-jackson-bullish-bearish-scan.20756/

#Randy Jackson Bullish/Bearish Scan

#cashfolder78 Apr 2, 2025

#1

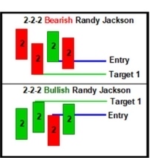

# I am currently learning "the strat" and searched around to see if anyone may have created a tos scan for "Randy Jackson Bullish/Bearish yet.

# Attached is a img of what I am looking to create a scan for.

# my interpretation of the rules, from pic

# bull

#.. bar1 , green 2

#.. bar2 , green 2. high > bar1 high. low > bar1 low. high is target

#.. bar3 , red 2. high < bar2 high. low < bar2 low. high is entry. close ?

#.. bar4 , green 2. bar4 high > bar3 high. low > bar3 low.

# make up a loss exit rule

# bar4 close < bar3 low

# no , if bar4 high < bar3 high * x% , then sell (approx midpoint of bar3)

# redo to mirror bull

# bear

#.. bar1 , red 2

#.. bar2 , red 2. low < bar1 low. high < bar1 high. low is target

#.. bar3 , green 2. high > bar high. low > bar2 low. low is entry

#.. bar4 , red 2. low < bar3 low. high < bar3 high

# make up a loss exit rule

# bar4 close > bar3 high

# no , if bar4 low > bar3 low * x% , then sell (approx midpoint of bar3)

def na = double.nan;

def bn = barnumber();

#------------------------------

# https://usethinkscript.com/threads/indicator-for-think-or-swim-based-on-rob-smiths-the-strat.3312/

# Indicator for Think or Swim based on Rob Smith's The STRAT

# Pelonsax Aug 1, 2020

#------------------------------

# S T R A T N U M B E R S

# A study by Ramon DV. aka Pelonsax

#------------------------------

def H = high;

def L = low;

def C = close;

def O = open;

def insidebar = (H < H[1] and L > L[1]) or (H == H[1] and L > L[1]) or (H < H[1] and L == L[1]) or (H == H[1] and L == L[1]);

def outsidebar = H > H[1] and L < L[1];

def twoup = H > H[1] and L >= L[1];

def twodown = H <= H[1] and L < L[1];

#-----------------------------

# STRAT NUMBERS

#-----------------------------

input Show_Strat_Numbers = yes;

input Show_Twos = yes;

plot barType = if Show_Strat_Numbers and insidebar then 1

else if Show_Strat_Numbers and outsidebar then 3

else Double.NaN;

barType.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

barType.AssignValueColor(color.WHITE);

plot barTypeDN = if Show_Strat_Numbers and !insidebar and !outsidebar and Show_Twos and twodown then 2 else Double.NaN;

barTypeDN.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

barTypeDN.AssignValueColor(color.DOWNTICK);

plot barTypeUP = if Show_Strat_Numbers and !insidebar and !outsidebar and Show_Twos and twoup then 2 else Double.NaN;

barTypeUP.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

barTypeUP.AssignValueColor(color.UPTICK);

#---------------------------

def bdn = if !insidebar and !outsidebar and twodown then 2 else 0;

def bup = if !insidebar and !outsidebar and twoup then 2 else 0;

# bull

#.. bar1 , green 2

#.. bar2 , green 2. high > bar1 high. low > bar1 low. high is target

#.. bar3 , red 2. high < bar2 high. low < bar2 low. high is entry. close ?

#.. bar4 , green 2. bar4 high > bar3 high. low > bar3 low.

# make up a loss exit rule

# bar4 close < bar3 low

#def bull1 = (barTypeUP == 2 and barTypeUP[-1] == 2 and barTypeDN[-2] == 2 and barTypeUP[-3] == 2)

def bull1 = (bup == 2 and bup[-1] == 2 and bdn[-2] == 2 and bup[-3] == 2)

and high[-1] > high and low[-1] > low

and high[-2] < high[-1] and low[-2] < low[-1]

and high[-3] > high[-2] and low[-3] > low[-2];

#addverticalline(bull1, "bull 1", color.green);

plot zup = if bull1 then low*0.9999 else na;

zup.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

zup.SetDefaultColor(Color.cyan);

zup.setlineweight(3);

zup.hidebubble();

#-----------------------

# cloud levels

def big = 99999;

def upcldtop;

if bn == 1 then {

upcldtop = 0;

} else if bull1 then {

upcldtop = fold a = 0 to 3

with b

do max(b,getvalue(high,-a));

} else if bull1[1] or bull1[2] or bull1[3] then {

upcldtop = upcldtop[1];

} else {

upcldtop = 0;

}

def upcldbot;

if bn == 1 then {

upcldbot = 0;

} else if bull1 then {

upcldbot = fold e = 0 to 3

with f = big

do min(f,getvalue(low,-e));

} else if bull1[1] or bull1[2] or bull1[3] then {

upcldbot = upcldbot[1];

} else {

upcldbot = 0;

}

def cut = if upcldtop > 0 then upcldtop else na;

def cub = if upcldbot > 0 then upcldbot else na;

addcloud(cut,cub,color.light_green);

#--------------------

def uptarget = if bn == 1 then 0

else if !bull1[1] and !bull1[0] and close[1] > uptarget[1] then 0

else if bull1[1] then high

else uptarget[1];

plot zuptgt = if uptarget > 0 then uptarget else na;

zuptgt.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

zuptgt.SetDefaultColor(Color.green);

zuptgt.setlineweight(2);

zuptgt.hidebubble();

def uploss = if bn == 1 then 0

else if uptarget == 0 then 0

else if close[1] < uploss[1] then 0

else if bull1[2] then low

else uploss[1];

plot zuploss = if uploss > 0 then uploss else na;

zuploss.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

zuploss.SetDefaultColor(Color.red);

zuploss.setlineweight(2);

zuploss.hidebubble();

def upentry = if bn == 1 then 0

else if uptarget == 0 then 0

else if bull1[2] then high

else upentry[1];

plot zupen = if upentry > 0 then upentry else na;

zupen.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

zupen.SetDefaultColor(Color.blue);

zupen.setlineweight(2);

zupen.hidebubble();

addchartbubble(0, low*0.997,

#bull1[2] + " B2\n" +

bull1[0] + " B\n" +

bup + "\n" +

bdn + "\n" +

upentry + " En"

, (if bull1 then color.yellow else color.gray), no);

#