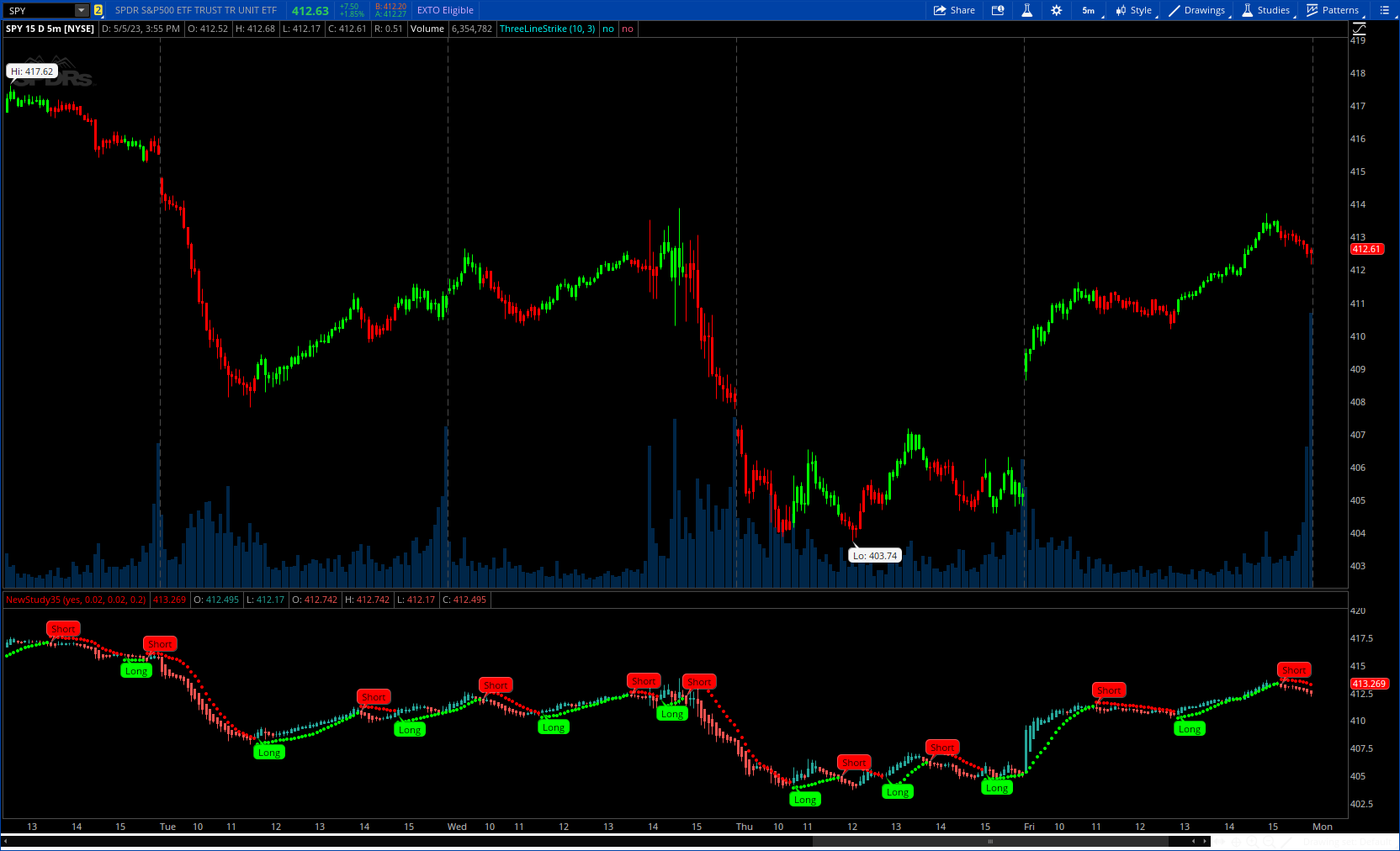

Heikin-Ashi PSAR Strategy

CODE:

CSS:

#https://www.tradingview.com/v/OBOvLOxW/

#study("QuantNomad - Heikin-Ashi PSAR Alerts", shorttitle = "HA-PSAR[QN]", overlay = false)

# Converted and mod by Sam4Cok@Samer800 - 05/2023

declare lower;

input BarColors = yes;

input start = 0.02;#, title = "PSAR Start")

input increment = 0.02;#, title = "PSAR Increment")

input maximum = 0.2;#, title = "PSAR Max")

def na = Double.NaN;

#// Calculation HA Values

#def haOpen;# = 0.0

def haclose = (open + high + low + close) / 4;

def haOpen = if (IsNaN(haOpen[1]) or haOpen[1] == 0) then (open + close) / 2 else (haOpen[1] + haclose[1]) / 2;

def hahigh = Max(high, Max(haOpen, haclose));

def halow = Min(low, Min(haOpen, haclose));

#// HA colors

def up = haclose > haOpen;

def upOp; def dnOp;

if up {

upOp = haOpen;

} else {

upOp = na;

}

if !up {

dnOp = haOpen;

} else {

dnOp = na;

}

def psar; # // PSAR

def af; # // Acceleration Factor

def trend_dir; # // Current direction of PSAR

def ep; # // Extreme point

def trend_bars;

def sar_long_to_short = trend_dir[1] == 1 and haclose <= psar[1]; #// PSAR switches from long to short

def sar_short_to_long = trend_dir[1] == -1 and haclose >= psar[1]; #// PSAR switches from short to long

def trend_change = IsNaN(psar[2]) or sar_long_to_short or sar_short_to_long;

##// Calculate trend direction

trend_dir = if (IsNaN(psar[2]) or psar[2] == 0) and haclose[1] > haOpen[1] then 1 else

if (IsNaN(psar[2]) or psar[2] == 0) and haclose[1] <= haOpen[1] then -1 else

if sar_long_to_short then -1 else

if sar_short_to_long then 1 else trend_dir[1];

trend_bars = if sar_long_to_short then -1 else

if sar_short_to_long then 1 else

if trend_dir == 1 then trend_bars[1] + 1 else

if trend_dir == -1 then trend_bars[1] - 1 else trend_bars[1];

#// Calculate Acceleration Factor

af = if trend_change then start else

if (trend_dir == 1 and hahigh > ep[1]) or (trend_dir == -1 and low < ep[1]) then

Min(maximum, af[1] + increment) else af[1];

#// Calculate extreme point

ep = if trend_change and trend_dir == 1 then hahigh else

if trend_change and trend_dir == -1 then halow else

if trend_dir == 1 then Max(ep[1], hahigh) else Min(ep[1], halow);

#// Calculate PSAR

psar = if (IsNaN(psar[2]) or psar[2] == 0) and haclose[1] > haOpen[1] then halow[1] else

if (IsNaN(psar[2]) or psar[2] == 0) and haclose[1] <= haOpen[1] then hahigh[1] else

if trend_change then ep[1] else

if trend_dir == 1 then psar[1] + af * (ep - psar[1]) else psar[1] - af * (psar[1] - ep);

# Plot the new Chart

AddChart(high = if up then hahigh else na, low = halow , open = haclose, close = upOp,

type = ChartType.CANDLE, growcolor = CreateColor(38, 166, 154));

AddChart(high = if up then na else hahigh , low = halow , open = dnOp, close = haclose,

type = ChartType.CANDLE, growcolor = CreateColor(239, 83, 80));

plot parSar = psar;

parSar.AssignValueColor(if trend_dir == 1 then Color.GREEN else Color.RED);

parSar.SetPaintingStrategy(PaintingStrategy.POINTS);

AddChartBubble(sar_short_to_long, halow, "Long", Color.GREEN, no);

AddChartBubble(sar_long_to_short, hahigh, "Short", Color.RED, yes);

AssignPriceColor(if !BarColors then Color.CURRENT else

if trend_dir>0 then Color.GREEN else

if trend_dir<0 then Color.RED else Color.GRAY);

#--- END of CODE