@$Jdoc member request:

https://usethinkscript.com/threads/convert-tradingview-qqe-mt4-glaz-modified-by-justunclel.13338/

below is the QQE suite has all options with additional RSI types and bar color. Try it!

https://usethinkscript.com/threads/convert-tradingview-qqe-mt4-glaz-modified-by-justunclel.13338/

below is the QQE suite has all options with additional RSI types and bar color. Try it!

CSS:

# QQE Suite - QQE mod and QQE MT4 with different RSI Types

# Created by Sam4Cok@Samer800 - 11/2022

declare lower;

input ShowLabel = yes;

input BarColor = yes;

input SignalBarColor = yes;

input qqeType = {default "QQE Mod1", "QQE Mod2", "QQE MT4-1", "QQE MT4-2"};

input ShowRSILine = yes;

input QqeStyle = {default Histogram, Line, Both};

input RsiMaType = AverageType.EXPONENTIAL;

input RSI_Type = {default RSI, RSX, AdaptiveRSI};

input RSICrossQQE = no;

input RSICrossZero = no;

input mt4Source = close;

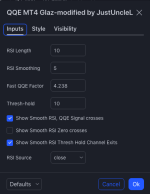

input mt4Length = 14;

input mt4Threshold = 10;

input mt4Smoothing = 5;

input mt4QqeFactor = 4.238;

input RSI_Source = close;

input RSI_Length = 6;

input RSI_Smoothing = 5;

input Fast_QQE_Factor = 3.0;

input RSI_Source2 = close;

input RSI_Length2 = 6;

input RSI_Smoothing2 = 5;

input Fast_QQE_Factor2 = 1.61;

input qqeModThreshold = 3;

input BandType = {Sticky,default NonSticky};

input BbMaType = AverageType.SIMPLE;

input BandLength = 50;

input BandMultiplier = 0.35;

#### Color

DefineGlobalColor("UP", CreateColor(51, 207, 255));

DefineGlobalColor("UP Weak", CreateColor(0, 117, 153));

DefineGlobalColor("DN", CreateColor(255, 0, 98));

DefineGlobalColor("DN Weak", CreateColor(204, 0, 78));

DefineGlobalColor("UpMT", CreateColor(76, 175, 80));

DefineGlobalColor("UpWeakMT", Color.DARK_GREEN);

DefineGlobalColor("DnMT", Color.RED);

DefineGlobalColor("DnWeakMT", CreateColor(163, 0, 0));

DefineGlobalColor("NeutralMT", CreateColor(255, 127, 0));

def na = Double.NaN;

def qqType = if qqeType == qqeType."QQE Mod1" then 1 else

if qqeType == qqeType."QQE Mod2" then 2 else

if qqeType == qqeType."QQE MT4-1" then -1 else -2;

def Style = if QqeStyle == QqeStyle.Histogram then 1 else

if QqeStyle == QqeStyle.Line then -1 else 0;

def sticky = if BandType == BandType.Sticky then 1 else 0;

##### Script

script nz {

input data = 0;

input replacement = 0;

def ret_val = if IsNaN(data) then replacement else data;

plot return = ret_val;

}

script rsx {

input src = close;

input rsxLength = 7;

def f8 = 100 * src;

def f10 = nz(f8[1], f8);

def v8 = f8 - f10;

def f18 = 3 / (rsxLength + 2);

def f20 = 1 - f18;

def f28 = f20 * nz(f28[1]) + f18 * v8;

def f30 = f18 * f28 + f20 * nz(f30[1]);

def vC = f28 * 1.5 - f30 * 0.5;

def f38 = f20 * nz(f38[1]) + f18 * vC;

def f40 = f18 * f38 + f20 * nz(f40[1]);

def v10 = f38 * 1.5 - f40 * 0.5;

def f48 = f20 * nz(f48[1]) + f18 * v10;

def f50 = f18 * f48 + f20 * nz(f50[1]);

def v14 = f48 * 1.5 - f50 * 0.5;

def f58 = f20 * nz(f58[1]) + f18 * AbsValue(v8);

def f60 = f18 * f58 + f20 * nz(f60[1]);

def v18 = f58 * 1.5 - f60 * 0.5;

def f68 = f20 * nz(f68[1]) + f18 * v18;

def f70 = f18 * f68 + f20 * nz(f70[1]);

def v1C = f68 * 1.5 - f70 * 0.5;

def f78 = f20 * nz(f78[1]) + f18 * v1C;

def f80 = f18 * f78 + f20 * nz(f80[1]);

def v20 = f78 * 1.5 - f80 * 0.5;

def f88;

def f90_ = if nz(f90_[1]) == 0 then 1 else

if nz(f88[1]) <= nz(f90_[1]) then nz(f88[1]) + 1 else nz(f90_[1]) + 1;

f88 = if nz(f90_[1]) == 0 and (rsxLength - 1 >= 5) then rsxLength - 1 else 5;

def f0 = if f88 >= f90_ and f8 != f10 then 1 else 0;

def f90 = if f88 == f90_ and f0 == 0 then 0 else f90_;

def v4_ = if f88 < f90 and v20 > 0 then (v14 / v20 + 1) * 50 else 50;

def rsx = if v4_ > 100 then 100 else if v4_ < 0 then 0 else v4_;

plot return = rsx;

}

script AdpRSI {

input src = close;

input length = 20;

def ama;

def alpha = AbsValue(RSI(Price = src - ama[1], Length = length) / 100 - 0.5);

ama = nz(ama[1] + Power(alpha, 1) * (src - ama[1]), src);

def trigger = ExpAverage(RSI(Price = ExpAverage(src, length / 2), Length = length), length / 2);

plot retrun = trigger;

}

#getStickyRange(highsource, lowsource, upper, lower, sticky=false)=>

script getStickyRange {

input highsource = high;

input lowsource = low;

input upper = high;

input lower = low;

input sticky = no;

def newUpper;

def newLower;

newUpper = if IsNaN(newUpper[1]) then upper else

if highsource[1] >= newUpper[1] or lowsource[1] <= newLower[1] or !sticky

then upper else nz(newUpper[1], upper);

newLower = if IsNaN(newLower[1]) then lower else

if highsource[1] >= newUpper[1] or lowsource[1] <= newLower[1] or !sticky

then lower else nz(newLower[1], lower);

plot UpBand = newUpper;

plot LoBand = newLower;

}

#qqeLine(matype, src, len, qqe) =>

script qqe1 {

input matype = yes;

input _Rsi = 50;

input RSI_Length = 6;

input qqe = 4.236;

def RsiMa = _Rsi;

def Wilders_period = RSI_Length * 2 - 1;

def AtrRsi = AbsValue(RsiMa[1] - RsiMa);

def MaAtrRsi = MovingAverage(matype, AtrRsi, Wilders_period);

def dar = MovingAverage(matype, MaAtrRsi, Wilders_period) * qqe;

def longband; def shortband; def trend;

def DeltaFastAtrRsi = dar;

def newshortband = RsiMa + DeltaFastAtrRsi;

def newlongband = RsiMa - DeltaFastAtrRsi;

longband = if RsiMa[1] > longband[1] and RsiMa > longband[1] then

Max(longband[1], newlongband) else newlongband;

shortband = if RsiMa[1] < shortband[1] and RsiMa < shortband[1] then

Min(shortband[1], newshortband) else newshortband;

def cross_1 = (RsiMa Crosses shortband[1]);

def cross_11 = (longband[1] Crosses RsiMa);

trend = if cross_1 then 1 else if cross_11 then -1 else If(IsNaN(trend[1]), 1, trend[1]);

def FastAtrRsiTL = if trend == 1 then longband else shortband;

plot return = FastAtrRsiTL;

}

#qqeLine(src, len, sf, qqe) =>

script qqe2 {

input matype = yes;

input _Rsi = 50;

input RSI_Length = 6;

input qqe = 4.236;

def RsiMa = _Rsi;

def Wilders_period = RSI_Length * 2 - 1;

def AtrRsi = AbsValue(RsiMa - RsiMa[1]);

def MaAtrRsi = MovingAverage(matype, AtrRsi, Wilders_period);

def dar = MovingAverage(matype, MaAtrRsi, Wilders_period) * qqe;

def DeltaRsi = dar;

def shortband = RsiMa + DeltaRsi;

def longband = RsiMa - DeltaRsi;

def trend;

trend = if RsiMa > nz(trend[1]) then

If(longband < trend[1], trend[1], longband) else

If(shortband > trend[1], trend[1], shortband);

plot retun = trend;

}

#-- RSI Calc

def RsiMod = RSI(PRICE = RSI_Source, LENGTH = RSI_Length);

def RsiMT = RSI(PRICE = mt4Source, LENGTH = mt4Length);

def rsxMod = rsx(RSI_Source, RSI_Length);

def rsxMT = rsx(mt4Source, mt4Length);

def cRSIMod = AdpRSI(RSI_Source, RSI_Length);

def cRSIMt = AdpRSI(mt4Source, mt4Length);

#--- QQE 1

def Rsi1 = If(qqType > 0, RsiMod, RsiMT);

def rsx1 = If(qqType > 0, rsxMod, rsxMT);

def cRS1 = If(qqType > 0, cRSIMod, cRSIMt);

def rsiSmoothing = If(qqType > 0, RSI_Smoothing, mt4Smoothing);

def rsiType = if RSI_Type == RSI_Type.RSI then Rsi1 else

if RSI_Type == RSI_Type.RSX then rsx1 else cRS1;

def MaRsi = MovingAverage(RsiMaType, rsiType, rsiSmoothing);

def AtrFastRsiTL = if qqType == 1 then

qqe1(RsiMaType, MaRsi, RSI_Length, Fast_QQE_Factor) else

if qqType == 2 then

qqe2(RsiMaType, MaRsi, RSI_Length, Fast_QQE_Factor) else

if qqType == -1 then

qqe1(RsiMaType, MaRsi, mt4Length, mt4QqeFactor) else

qqe2(RsiMaType, MaRsi, mt4Length, mt4QqeFactor);

def RsiMa = MaRsi;

def FastAtrRsiTL = AtrFastRsiTL;

# QQE 2

def cRSI2 = AdpRSI(RSI_Source2, RSI_Length2);

def Rsi2 = RSI(PRICE = RSI_Source2, LENGTH = RSI_Length2);

def rsx2 = rsx(RSI_Source2, RSI_Length2);

def rsiType2 = if RSI_Type == RSI_Type.RSI then Rsi2 else

if RSI_Type == RSI_Type.RSX then rsx2 else cRSI2;

def MaRsi2 = MovingAverage(RsiMaType, rsiType2, RSI_Smoothing2);

def AtrFastRsiTL2 = if qqType < 0 then na else

if qqType == 1 then qqe1(RsiMaType, MaRsi2, RSI_Length2, Fast_QQE_Factor2) else

qqe2(RsiMaType, MaRsi2, RSI_Length2, Fast_QQE_Factor2);

def RsiMa2 = MaRsi2;

def FastAtrRsiTL2 = AtrFastRsiTL2;

# Bands Cals

#--- BB

def lsrc = FastAtrRsiTL - 50;

def basis = MovingAverage(BbMaType, lsrc, BandLength);

def dev = BandMultiplier * StDev(lsrc, BandLength);

def BbUp = basis + dev;

def BbLo = basis - dev;

def BBupper = getStickyRange(basis, basis, BbUp, BbLo, sticky).Upband;

def BBlower = getStickyRange(basis, basis, BbUp, BbLo, sticky).Loband;

def upper = BBupper;

def lower = BBlower;

# Plots

plot Zero = if IsNaN(close) then na else 0;

Zero.SetDefaultColor(Color.GRAY);

#// Find all the QQE Crosses

# Ups and Downs

def maMOD = RsiMa2 - 50;

def maMT4 = RsiMa - 50;

def FastRsiMOD = FastAtrRsiTL2 - 50;

def FaastRsiMT4 = FastAtrRsiTL - 50;

def RSIndex = If(qqType > 0, RsiMa2, RsiMa);

def QqeRsi = If(qqType > 0, FastRsiMOD, FaastRsiMT4);

def QqeMa = If(qqType > 0, maMOD, maMT4);

def Threshold = If(qqType > 0, qqeModThreshold, mt4Threshold);

#def color22 = if QqeMa > Threshold then 1 else if QqeMa < -Threshold then -1 else 0;

def Greenbar1 = QqeMa > Threshold;

def Greenbar2 = maMT4 > upper;

def Redbar1 = QqeMa < -Threshold;

def Redbar2 = maMT4 < lower;

def UpStrong = Greenbar1 and Greenbar2;

def DnStrong = Redbar1 and Redbar2;

def UnDecided = (Greenbar1 and !UpStrong) or (Redbar1 and !DnStrong);

def MTNormal = Greenbar1 or Redbar1;

#---- RSI Plots

plot ATRLine = if !ShowRSILine then na else QqeRsi;

ATRLine.AssignValueColor(Color.WHITE);

ATRLine.SetLineWeight(3);

plot RsiLine = QqeMa;

RsiLine.AssignValueColor(CreateColor(0, 101, 255));

RsiLine.SetLineWeight(2);

RsiLine.SetHiding(if Style <= 0 then no else yes);

#--- OB/OS Levels

def hUpper = if IsNaN(close) then na else If(qqType > 0, 30, Threshold);

def hLower = if IsNaN(close) then na else If(qqType > 0, -30, -Threshold);

AddCloud(If(qqType > 0, na, hUpper), hLower, Color.DARK_GRAY, Color.DARK_GRAY, yes);

AddCloud(If(qqType < 0, na, Double.POSITIVE_INFINITY), hUpper, Color.DARK_GRAY, Color.DARK_GRAY, yes);

AddCloud(If(qqType < 0, na, hLower), Double.NEGATIVE_INFINITY, Color.DARK_GRAY, Color.DARK_GRAY, yes);

#-- PLot

def Hist1 = if !UpStrong or !Greenbar1 then 0 else QqeMa;

def Hist2 = if !DnStrong or !Redbar1 then 0 else QqeMa;

def Hist3 = if qqType > 0 then if !UnDecided then 0 else QqeMa else

if MTNormal then 0 else QqeMa;

#--- Candles

def Updir = QqeMa > QqeMa[1];

def Dndir = QqeMa < QqeMa[1];

plot UpCandle = Hist1;

UpCandle.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

UpCandle.SetLineWeight(4);

UpCandle.SetDefaultColor(GlobalColor("UP"));

UpCandle.AssignValueColor(if qqType > 0 then

if Updir then GlobalColor("UP") else GlobalColor("UP Weak") else

if Updir then GlobalColor("UpMT") else GlobalColor("UpWeakMT"));

UpCandle.SetHiding(if Style >= 0 then no else yes);

plot DnCandle = Hist2;

DnCandle.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

DnCandle.SetLineWeight(4);

DnCandle.SetDefaultColor(GlobalColor("DN"));

DnCandle.AssignValueColor(if qqType > 0 then

if Dndir then GlobalColor("DN") else GlobalColor("DN Weak") else

if Dndir then GlobalColor("DnMT") else GlobalColor("DNWeakMT"));

DnCandle.SetHiding(if Style >= 0 then no else yes);

plot NoCandle = Hist3;

NoCandle.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

NoCandle.SetLineWeight(4);

NoCandle.AssignValueColor(if qqType > 0 then Color.DARK_GRAY else GlobalColor("NeutralMT"));

NoCandle.SetHiding(if Style >= 0 then no else yes);

#----- Crosses -----------------------

#def QQExlong = if FastAtrRsiTL crosses above RSIndex then QQExlong[1] + 1 else 0;

#def QQExshort = if FastAtrRsiTL crosses below RSIndex then QQExshort[1] + 1 else 0;

def QQExlong = if FastAtrRsiTL < RSIndex then QQExlong[1] + 1 else 0;

def QQExshort = if FastAtrRsiTL > RSIndex then QQExshort[1] + 1 else 0;

#// Zero cross

def QQEzlong = if RSIndex >= 50 then QQEzlong[1] + 1 else 0;

def QQEzshort = if RSIndex < 50 then QQEzshort[1] + 1 else 0;

#// Thresh Hold channel Crosses give the BUY/SELL alerts.

def QQEclong = if RSIndex>(50+Threshold) then QQEclong[1]+1 else 0;

def QQEcshort = if RSIndex<(50-Threshold) then QQEcshort[1]+1 else 0;

#// QQE crosses

plot QQE_CrossUP = if !RSICrossQQE then na else If(QQExlong == 1, FastAtrRsiTL[1] - 50, na);# "QQE XQ Cross Over"

QQE_CrossUP.SetPaintingStrategy(PaintingStrategy.POINTS);

QQE_CrossUP.SetDefaultColor(Color.BLUE);

QQE_CrossUP.SetLineWeight(4);

plot QQE_CrossDN = if !RSICrossQQE then na else If(QQExshort == 1, FastAtrRsiTL[1] - 50, na); # "QQE XQ Cross Under"

QQE_CrossDN.SetPaintingStrategy(PaintingStrategy.POINTS);

QQE_CrossDN.SetDefaultColor(Color.MAGENTA);

QQE_CrossDN.SetLineWeight(4);

#// Signal crosses zero line

plot QQE_ZeroUP = if !RSICrossZero then na else If(QQEzlong == 1, 0, na); # "QQE XZ Zero Cross Over"

QQE_ZeroUP.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

QQE_ZeroUP.SetDefaultColor(Color.GREEN);

QQE_ZeroUP.SetLineWeight(2);

plot QQE_ZeroDN = if !RSICrossZero then na else If(QQEzshort == 1, 0, na);# "QQE XZ Zero Cross Under"

QQE_ZeroDN.SetPaintingStrategy(PaintingStrategy.TRIANGLES);

QQE_ZeroDN.SetDefaultColor(Color.RED);

QQE_ZeroDN.SetLineWeight(2);

#-- Label

def ExUp = Hist1 and Updir;

def Up = Hist1 and Dndir;

def ExDn = Hist2 and Dndir;

def Dn = Hist2 and Updir;

def Nu = Hist3;

AddLabel(ShowLabel and ExUp, qqeType + "(" + RSI_Type + ")" + "-Up Trending", Color.GREEN);

AddLabel(ShowLabel and Up, qqeType + "(" + RSI_Type + ")" + "-Weak Up", Color.DARK_GREEN);

AddLabel(ShowLabel and ExDn, qqeType + "(" + RSI_Type + ")" + "-Down Trending", Color.RED);

AddLabel(ShowLabel and Dn, qqeType + "(" + RSI_Type + ")" + "-Weak Down", Color.DARK_RED);

AddLabel(ShowLabel and Nu, qqeType + "(" + RSI_Type + ")" + "-Neutral", Color.GRAY);

#--- Price Color

AssignPriceColor(

if (!BarColor and !SignalBarColor) then Color.CURRENT else

if (BarColor and SignalBarColor) then

if QQEclong == 2 then Color.BLUE else if QQEcshort == 2 then Color.MAGENTA else

if ExUp then Color.GREEN else

if Up then Color.DARK_GREEN else

if ExDn then Color.RED else

if Dn then Color.DARK_RED else Color.GRAY else

if (BarColor and !SignalBarColor) then

if ExUp then Color.GREEN else

if Up then Color.DARK_GREEN else

if ExDn then Color.RED else

if Dn then Color.DARK_RED else Color.GRAY else

if QQEclong == 2 then Color.BLUE else

if QQEcshort == 2 then Color.MAGENTA else Color.CURRENT);

#--- END CODE

Last edited by a moderator: