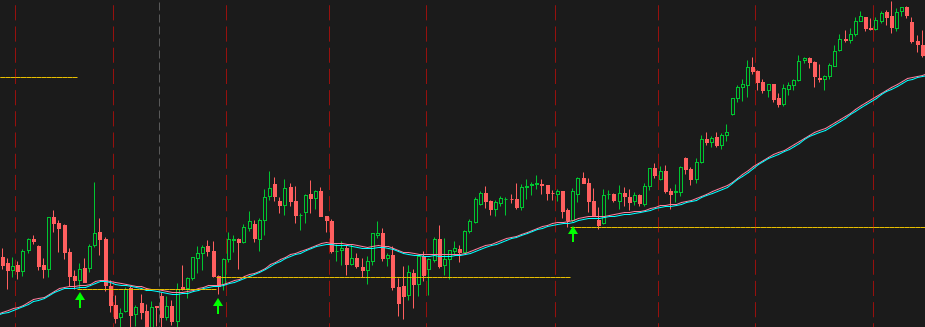

What I am trying to achieve, is when price crosses ema and then pulls back to within a certain range and then continues in the direction of the original cross. I would like an alarm and an arrow at this point.

Here is what I have started. It isn't working though.

also would like a stop low or high of last bar.

Here is what I have started. It isn't working though.

also would like a stop low or high of last bar.

Code:

# Define inputs for the EMA period, pullback range, and candle criteria

input emaLength = 20;

input pullbackRange = 0.1; # Adjust this value as needed for your criteria

input candleCriteria = 2; # Number of candles to check after the pullback

# Calculate the EMA

def ema = ExpAverage(close, emaLength);

# Calculate the pullback level

def pullbackLevel = ema * (1 - pullbackRange);

# Define a condition for the crossover and pullback

def crossoverAndPullback = close crosses above ema and low <= pullbackLevel;

# Initialize a counter to track candles after pullback

def candlesAfterPullback = if crossoverAndPullback then 1 else candlesAfterPullback[1] + 1;

# Create a signal when the pullback condition is met for the specified number of candles

def signal = candlesAfterPullback >= candleCriteria;

# Plot arrows on the chart when the signal occurs

plot bullishSignal = signal;

bullishSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

bullishSignal.SetDefaultColor(Color.GREEN);

bullishSignal.SetLineWeight(2);

# Add an alert when the signal occurs

alert(signal, "Bullish Pullback Signal", Alert.BAR, Sound.Bell);