May you please help me and tell me if the following script will allow me to create a study that generates a sell order after the stock price has increased 10% from the market open at 9:30:00 a.m.?

Is "aggregationperiod.day" the best way to specify the market open at 9:30:00 a.m.? Thank you very much for your time and your help.

Is "aggregationperiod.day" the best way to specify the market open at 9:30:00 a.m.? Thank you very much for your time and your help.

Code:

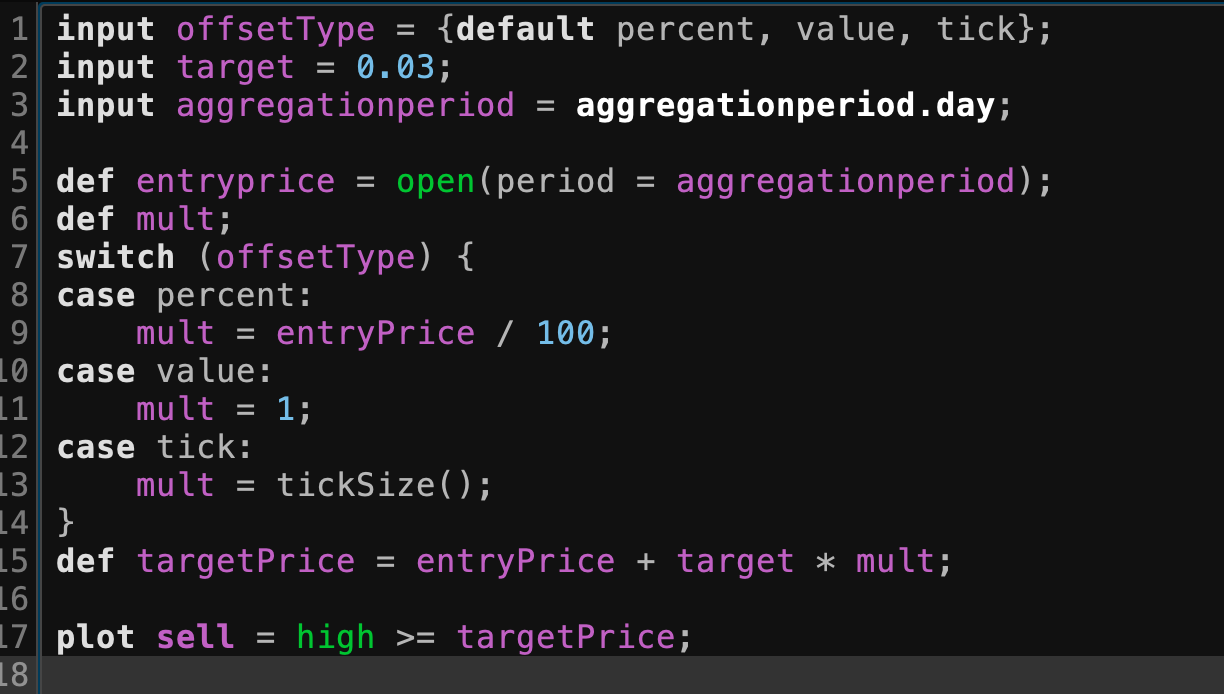

input offsetType = {default percent, value, tick};

input target = 0.1;

input aggregationperiod = aggregationperiod.day;

def entryprice = open(period = aggregationperiod);

def mult;

switch (offsetType) {

case percent:

mult = entryPrice / 100;

case value:

mult = 1;

case tick:

mult = tickSize();

}

def targetPrice = entryPrice + target * mult;

plot sell = high >= targetPrice;