WbKiki

New member

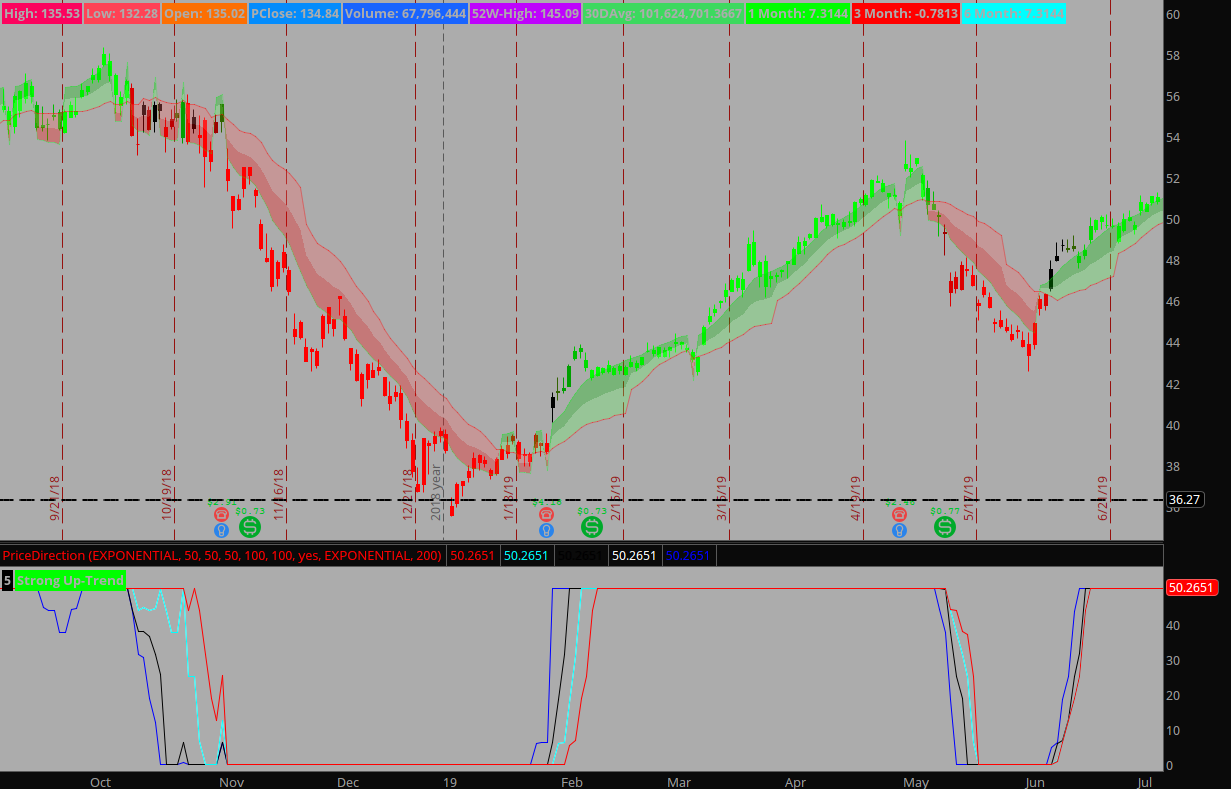

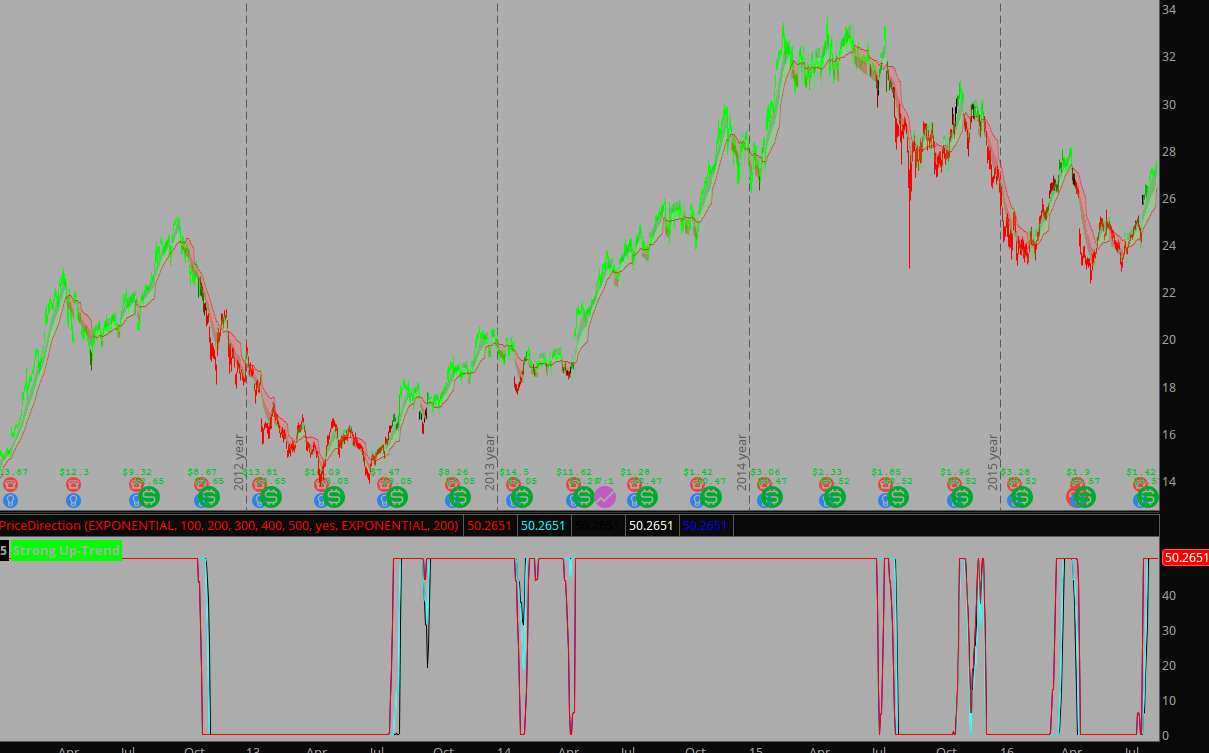

I tried to make a staircase-esque MA, it didn't quite turn out. This was done using some other price direction indicator I made.

Anyways, here's what I came up with, if you want to help and fix the MA to work on lower time frames, it would be much appreciated.

Upper Indicator - MA

Lower Indicator - Price Direction

Anyways, here's what I came up with, if you want to help and fix the MA to work on lower time frames, it would be much appreciated.

Upper Indicator - MA

Ruby:

# Price Direction AVG indicator - does not look well on larger time frames

declare upper;

def price = close;

input averagetype = averagetype.exponential;

input length = 15;

def close = movingaverage(averagetype, price, length);

def simp = .975+(.05*((close - Lowest(close, 2)) / (Highest(close, 2) - Lowest(close, 2)))); # This is where the problem lies - could be changed to closer represent price change and not just a percentage

plot main = simp*close;

input weight_length = 15;

def l = lowest(main,weight_length);

def h = highest(main,weight_length);

input avg_weight = 20;

plot avg = (main+((avg_weight/2)*l)+((avg_weight/2)*h))/(avg_weight+1);

plot m = (avg+main)/2;

m.hide();

AddCloud(m,avg,createcolor(102,255,102),createcolor(255,102,102));

AddCloud(main,m, createcolor(0,200,0),createcolor(255,0,0));Lower Indicator - Price Direction

Ruby:

# Trend Direction Indicator

# Colors explained:

# Green - the brighter this is, the stronger the uptrend

# Red - the brighter this is, the stronger the downtrend

# Cyan - if this appears there is a possibility of a stronger uptrend in the near future

declare lower;

input averagetype = AverageType.EXPONENTIAL;

input length1 = 150;

input length2 = 125;

input length3 = 100;

input length4 = 75;

input length5 = 50;

input displace = 0;

input averagetype2 = averagetype.exponential;

input l2 = 200;

input ColorBars = yes;

def price_avg1 = MovingAverage(averagetype, close, length1);

def price_avg2 = MovingAverage(averagetype, close, length2 * .8);

def price_avg3 = MovingAverage(averagetype, close, length3 * .6);

def price_avg4 = MovingAverage(averagetype, close, length4 * .4);

def price_avg5 = MovingAverage(averagetype, close, length5 * .2);

def st1 = 50 * (price_avg1 - (Lowest(price_avg1))) / (Highest(price_avg1) - Lowest(price_avg1));

def st2 = 50 * (price_avg2 - (Lowest(price_avg2))) / (Highest(price_avg2) - Lowest(price_avg2));

def st3 = 50 * (price_avg3 - (Lowest(price_avg3))) / (Highest(price_avg3) - Lowest(price_avg3));

def st4 = 50 * (price_avg4 - (Lowest(price_avg4))) / (Highest(price_avg4) - Lowest(price_avg4));

def st5 = 50 * (price_avg5 - (Lowest(price_avg5))) / (Highest(price_avg5) - Lowest(price_avg5));

def p1 = (st1 - Sin(st1));

def p2 = (p1 - Sin(p1));

def p3 = (p2 - Sin(p2));

def p4 = (p3 - Sin(p3));

def p5 = (p4 - Sin(p4));

def p6 = (p5 - Sin(p5));

def p7 = (p6 - Sin(p6));

def p8 = (p7 - Sin(p7));

def p9 = (p8 - Sin(p8));

def j1 = (st2 - Sin(st2));

def j2 = (j1 - Sin(j1));

def j3 = (j2 - Sin(j2));

def j4 = (j3 - Sin(j3));

def j5 = (j4 - Sin(j4));

def j6 = (j5 - Sin(j5));

def j7 = (j6 - Sin(j6));

def j8 = (j7 - Sin(j7));

def j9 = (j8 - Sin(j8));

def g1 = (st3 - Sin(st3));

def g2 = (g1 - Sin(g1));

def g3 = (g2 - Sin(g2));

def g4 = (g3 - Sin(g3));

def g5 = (g4 - Sin(g4));

def g6 = (g5 - Sin(g5));

def g7 = (g6 - Sin(g6));

def g8 = (g7 - Sin(g7));

def g9 = (g8 - Sin(g8));

def wm1 = (st4 - Sin(st4));

def wm2 = (wm1 - Sin(wm1));

def wm3 = (wm2 - Sin(wm2));

def wm4 = (wm3 - Sin(wm3));

def wm5 = (wm4 - Sin(wm4));

def wm6 = (wm5 - Sin(wm5));

def wm7 = (wm6 - Sin(wm6));

def wm8 = (wm7 - Sin(wm7));

def wm9 = (wm8 - Sin(wm8));

def pd1 = (st5 - Sin(st5));

def pd2 = (pd1 - Sin(pd1));

def pd3 = (pd2 - Sin(pd2));

def pd4 = (pd3 - Sin(pd3));

def pd5 = (pd4 - Sin(pd4));

def pd6 = (pd5 - Sin(pd5));

def pd7 = (pd6 - Sin(pd6));

def pd8 = (pd7 - Sin(pd7));

def pd9 = (pd8 - Sin(pd8));

plot main1 = (p1 + p2 + p3 + p4 + p5 + p6 + p7 + p8 + p9) / 9;

main1.AssignValueColor(Color.RED);

main1.SetLineWeight(1);

plot main2 = (j1 + j2 + j3 + j4 + j5 + j6 + j7 + j8 + j9) / 9;

main2.AssignValueColor(Color.CYAN);

main2.SetLineWeight(1);

plot main3 = (g1 + g2 + g3 + g4 + g5 + g6 + g7 + g8 + g9) / 9;

main3.AssignValueColor(Color.BLACK);

main3.SetLineWeight(1);

plot main4 = (wm1 + wm2 + wm3 + wm4 + wm5 + wm6 + wm7 + wm8 + wm9) / 9;

main4.AssignValueColor(Color.WHITE);

main4.SetLineWeight(1);

plot main5 = (pd1 + pd2 + pd3 + pd4 + pd5 + pd6 + pd7 + pd8 + pd9) / 9;

main5.AssignValueColor(Color.BLUE);

main5.SetLineWeight(1);

plot midline = (highestall(main1)+lowestall(main1))/2;

midline.assignvaluecolor(color.black);

def up1 = main1[1] < main1 or main1==highestall(main1);

def d1 = main1[1] > main1 or main1<=midline;

def up2 = main2[1] < main2 or main2==highestall(main2);

def d2 = main2[1] < main2 or main2<=midline;

def up3 = main3[1] < main3 or main3==highestall(main3);

def d3 = main3[1] > main3 or main3<=midline;

def up4 = main4[1] < main4 or main4==highestall(main4);

def d4 = main4[1] > main4 or main4<=midline;

def up5 = main5[1] < main5 or main5==highestall(main5);

def d5 = main5[1] > main5 or main5<=midline;

def uval = up1 + up2 + up3 + up4 + up5;

def dval = -1*(d1 + d2 + d3 + d4 + d5);

def t = uval+dval;

def tval = t[displace];

Addlabel (yes, tval, color.black);

AddLabel( tval==5, "Strong Up-Trend" , Color.GREEN);

AddLabel(tval==4,"Good Up-Trend", color.light_green);

addlabel(tval==3, "Trending Up", color.yellow);

addlabel(tval==2, "Weak Trend Up", color.blue);

addlabel(tval==1, "Bad Trend Up", color.red);

addlabel(tval==0, "No Trend", color.light_red);

addlabel(tval==-1, "Bad Trend Down", color.red);

addlabel(tval==-2, "Weak Trend Down", color.blue);

addlabel(tval==-3, "Trending Down", color.yellow);

addlabel(tval==-4, "Good Down Trend", color.light_green);

addlabel(tval==-5, "Strong Trend Down", Color.GREEN);

assignpricecolor(if tval==5 and ColorBars then createcolor(0,255,0) else if tval==4 and ColorBars then createcolor(0,220,0) else if tval==3 and ColorBars then createcolor(0,190,0) else if tval==2 and ColorBars then createcolor(0,160,0) else if tval==1 and ColorBars then createcolor(51,100,0) else if tval==0 and movingaverage(averagetype.exponential, close, 9)[5] < close then color.cyan else if tval==0 and ColorBars then color.black else if tval==-1 and ColorBars then createcolor(100,51,0) else if tval==-2 and ColorBars then createcolor(160,0,0) else if tval==-3 and ColorBars then createcolor(190,0,0) else if tval==-4 and ColorBars then createcolor(220,0,0) else if tval==-5 and ColorBars then createcolor(255,0,0) else color.CURRENT);

def PrimaryAverage = movingaverage(averagetype2, (main1+main2+main3+main4+main5)/5, l2);

def PrimaryDerivative = (midline+(50*(primaryaverage[0]-primaryaverage[1])/2));

plot primavg = (primaryaverage+primaryderivative)/2;

primavg.assignvaluecolor(color.black); primavg.setlineweight(1);

plot trail2 = movingaverage(averagetype.exponential, primavg, 100);

plot trail = movingaverage(averagetype.exponential, primavg, 200);

trail.hide();trail2.hide();primavg.hide();midline.hide();

plot quality = tval; quality.hide();